Summary:

- Q1 Earnings were good enough – there’re no signs of business degradation and competitiveness loss.

- Cost structure remains rather stable and the inflation peaks are already behind.

- AT&T’s bottleneck is a cash generation, which was the reason why shares fell after earnings release. The company is likely to not achieve management FCF guidance this year.

- Even despite FCF problems, AT&T has an ability to cover both dividends and debt obligations this year and even raise dividends next year.

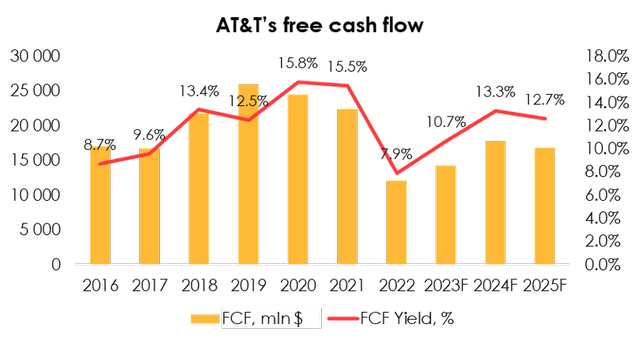

- At current prices, AT&T seems to be very cheap with >10% FCF yield, >6% dividend yield and a significant multiples upside. BUY at current prices.

Brandon Bell

Investment Thesis

AT&T (NYSE:T) shares have sharply fell after latest earnings and now create an interesting investment opportunity in low-volatile stock with a decent dividend yield. Despite cash generation will remain problematic for company this year and it is likely AT&T won’t reach management guidance, current yields are already attractive. We believe that latest sell-off was an overreaction and it’s time to buy T stock.

Q1 FY2023 Earnings summary

The 1Q 2023 report is in line with our expectations, as AT&T’s business continues to be stable and the company maintains its leading position in the US market of mobile providers.

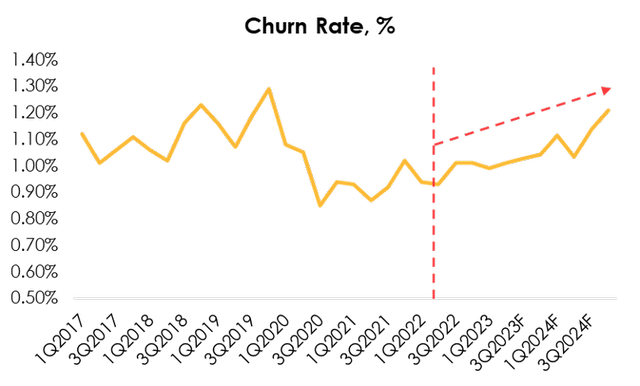

Churn in the wireless communications segment remains low: It was 0.99% in 1Q, compared with our forecast for 1.03%. We’re expecting churns to get higher due to WM spin-off, which used to be an additional factor of customer retention (Promo HBO Max subscription.)

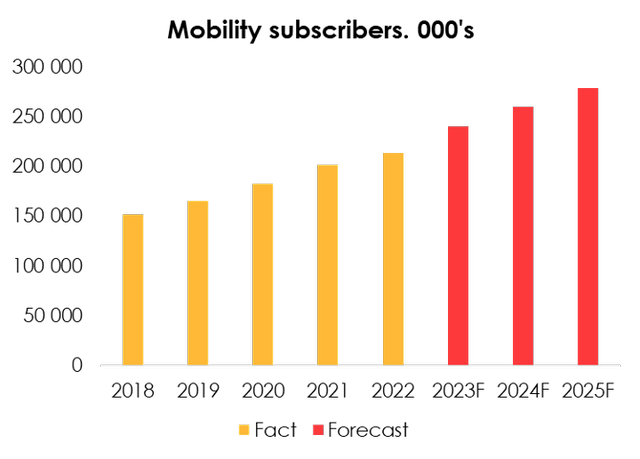

The number of users jumped to 222.8 mln (+13.3% y/y). The segment of IoT devices continues to be the main driver of the subscriber count. As we mentioned in our previous article, IoT market will persist a strong driver in the middle term due to rising connected devices penetration.

The wireline unit also showed steady growth as the number of fiber connections reached 7.49 mln (+19.2% y/y) by the end of 1Q, which was also in line with our forecast for 7.41 mln, while the proportion of high-speed connections reached 53.7%. Thanks to the price increase, the average revenue per connection climbed to $96.2 (+3.56% y/y).

We’re not seeing any significant risks for AT&T to lose its market share or subscribers count and forecasting an increase of user base to 240.2 mln in 2023 and then to 260.3 mln in 2024.

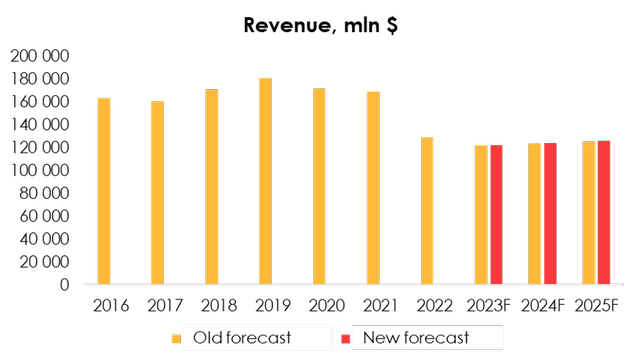

Despite falling ARPU’s which is general for the telecom sector, steadily increasing number of subscribers will support organic revenue growth. We’re also pleased with AT&T’s pricing power in internet connections due to revenue per connection dynamics.

We are raising the revenue forecast from $121 971 mln (+1.0% y/y) to $122 132 mln (+1.2% y/y) for 2023 and from $123 356 mln (+2.3% y/y) to $123 990 mln (+1.5% y/y) for 2024 due to slight adjustments to the outlook for ARPU and the number of subscribers.

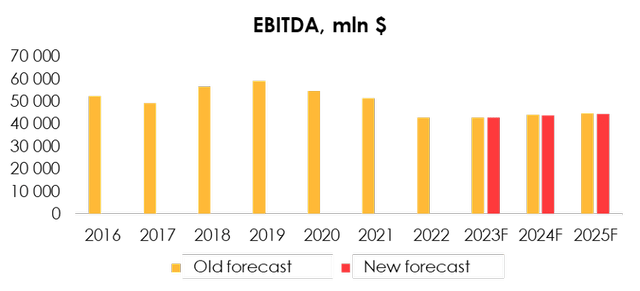

Margin’s at the same time remain consistent with market expectations and our forecast. The company’s adjusted EBITDA totaled $10 589 mln (+3.9% y/y), also in line with our forecast for $10 838 mln. The y/y change is exclusive of the EBITDA of WarnerMedia.

AT&T’s cost structure remains stable: No substantial deviations were spotted in terms of quarterly EBITDA margin, so we made only minor adjustments to the outlook for the operating income of the segments.

We are lowering the adjusted EBITDA forecast from $43 051 mln (+3.8% y/y) to $43 042 mln (+3.8% y/y) for 2023 and from $44 022 mln (+2.3% y/y) to $43 926 mln (+2.1% y/y) for 2024.

Why T stock fell after earnings and is there an issue?

Despite quite good Q1 earnings, AT&T stock significantly decreased after the release. Cash generation remains the main bottleneck for the company: Q1 Free Cash Flow totaled $1 004 mln only, but management guidance remained unchanged – $16 bn total for the year. The market seems to disbelieve management guidance and sees dividend’s risk.

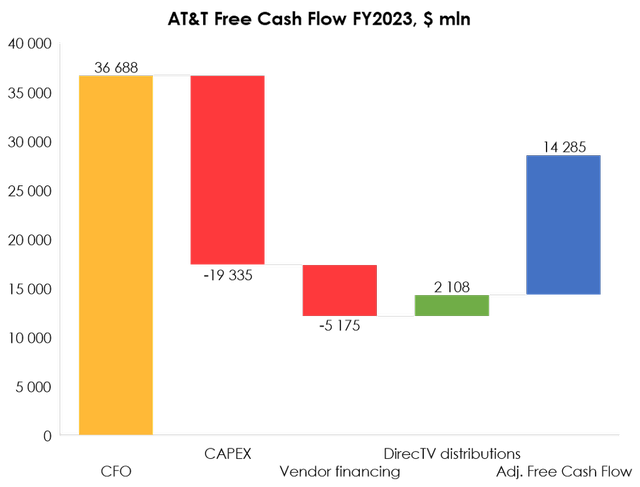

Generally, there was three reasons for the weak Q1 free cash flow:

- Higher net working capital investments (2.6 bn total)

- Poor DirecTV distributions (0.8 bn compared to 1.3 bn last year)

- High vendor financing, which totaled 2.1 bn compared to 1.6 bn last year

Generally, we don’t think that dividends or FY23 free cash flow is at serious risk. Vendor financing, according to management speech, is elevated in Q1 due to seasonal last quarter high devices sales. Hence, a significant part of AT&T’s obligations is already covered and we’re expecting that the rest payment will not exceed $3 bn.

At the same time, net working capital seem to be normalizing within the year. We expect that total investment will total $1.1 bn for the year.

And though DirecTV are assumed to be less this year due to general marketing budgets decrease and lower TV income, we think that $2.1 bn (-20% y/y) is a realistic number that company can get.

When we get to the free cash flow build, we’re also not sure that company will be able to reach its $16 bn target this year. Elevated CAPEX (consistent with 2022 will give us around $20 bn investment). We project $14,285 mln Free Cash Flow this year.

At the same time, with common & preferred stock dividends fixed at current rates, AT&T will have to pay $8.5 mln this year and will have to pay bond maturities of $0.5 bn in Q2 and $3.2 bn in Q3. Company has issued another $3.6 and $3.4 bn debts in Q1, so is currently at $2.8 bn cash position.

With total FY23 FCF of 14.3 bn, dividend payment of $8.5 bn and net debt outflow of $3.2 bn, excess cash will be around $2.6 bn, which leaves T in stable cash position by the end of the year, so we believe that this year dividend is completely secured.

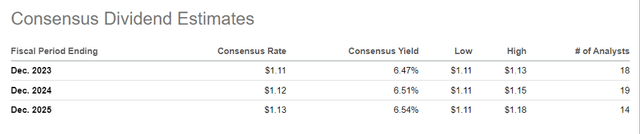

As we look through the next year, with an assumption of CAPEX moderation and NWC normalization, AT&T will have an ability to raise dividends to at least $1.16 per share, while the market doesn’t bet on this.

Though cash generation faces some troubles this year, we’re sure that these are not critical and company has an ability to pay and raise its dividends. After latest earnings sell-offs, even conservative FCF projection gives a significant yield for the current prices.

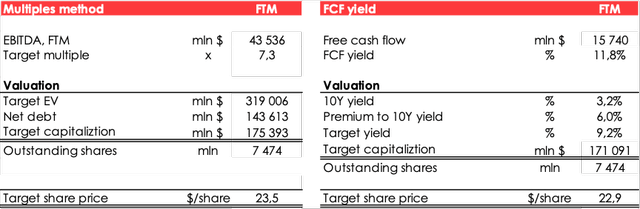

Valuation

We’re evaluating AT&T prices based on FTM EV/EBITDA multiples and FCF Yield. We are maintaining the fair value price for the shares at $23.2 (average price between EV/EBITDA and FCF Yield methods).

Conclusion

Though there’s not much to develop and AT&T business and generally it reached its “plateau”, it seems as the market overreacted after latest earnings release. AT&T is currently rather cheap and offers investor decent dividend and free cash flow yield. Though cash generation will face some problems this year, company will have an ability to pay both dividends and debt obligations and even increase shareholders reward next year. BUY.

To manage your positions, we recommend to follow both AT&T and peers (Verizon (VZ), T-Mobile (TMUS)) earnings releases and industry research (IBM, TelecomPaper, Deloitte, Fitch).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.