Summary:

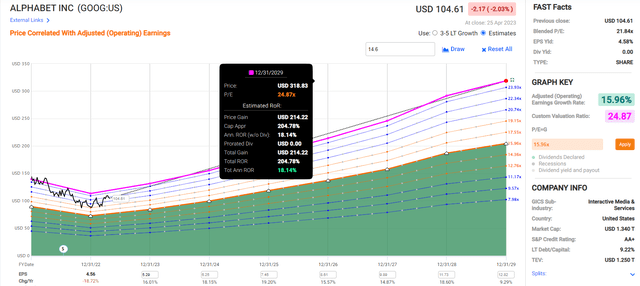

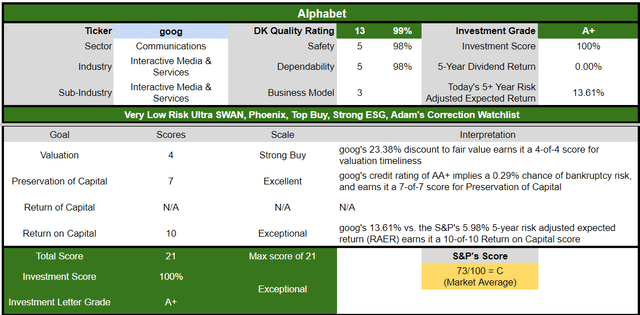

- Fears of recession and AI disruption have left Google/Alphabet Inc. stock 25% undervalued, one of the best growth tech titan bargains on Wall Street.

- The mildest recession in history is not a threat to Google’s long-term prospects.

- Microsoft Corporation’s attempts to gain search market share have thus far been a complete failure. Google has actually gained market share in the past year.

- Google’s latest earnings prove it’s executing well on its growth prospects, including generating $74 billion in free cash flow this year and buying back almost $500 billion in stock by 2028.

- Google’s 25% discount and 14.6% long-term growth rate mean 205% total return potential through 2028, 4X the S&P consensus. 9.8 cash-adjusted P/E and 0.75 PEG ratio make it as close to a perfect Ultra SWAN growth investment as exists today.

hynci

This article was published on Dividend Kings on Wed, April 26th.

—————————————————————————————

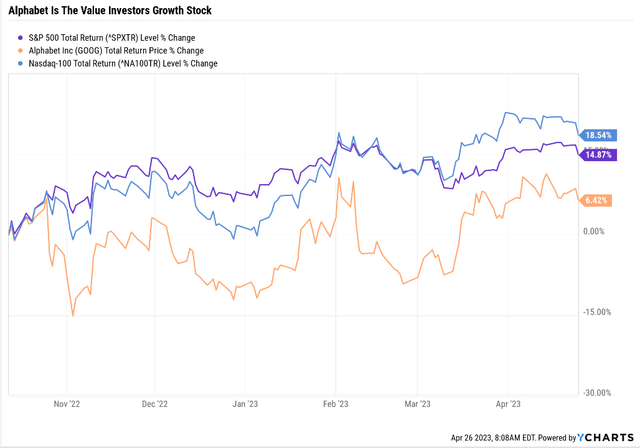

Since the October lows (so far), stocks have staged a nice rally, with tech stocks soaring even more, almost 20%.

But it’s always a market of stocks, not a stock market, and Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) aka Google has significantly lagged the S&P 500 (SP500) and Nasdaq (COMP.IND).

That’s due to several factors, including concerns about the 2023 recession and worries that ChatGPT, which Microsoft Corporation (MSFT) is integrating into Bing, could disrupt Google’s dominance in search.

Let’s take a look at the three reasons bears are wrong on Google, and why its latest earnings report proves that Alphabet remains a potentially X buy with Y% upside in the next few years.

Recession Fears On Alphabet Are Overblown

Given that 90% of Google’s sales come from search-based advertising, it’s understandable that investors might be worried about the likely coming recession.

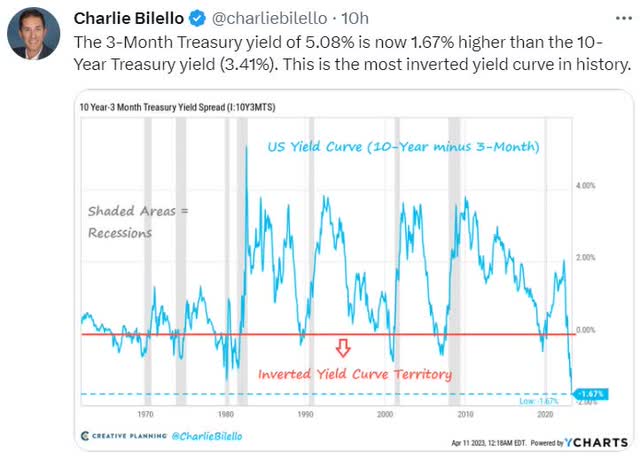

The yield curve, the best historical recession forecasting tool, keeps hitting new record inversions.

The bond market is pricing in a 100% risk of recession by October 2024, and the bond market is “the smart money” on Wall Street.

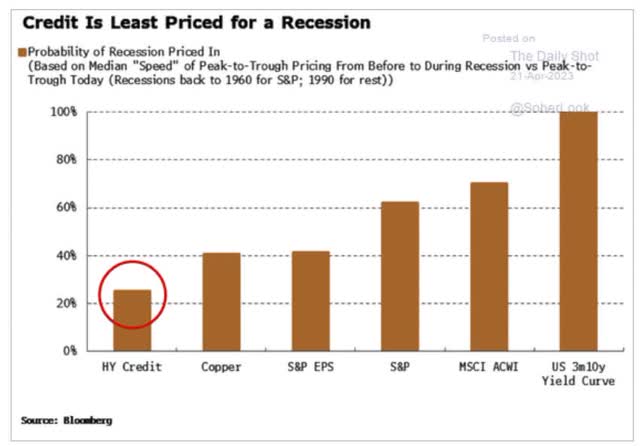

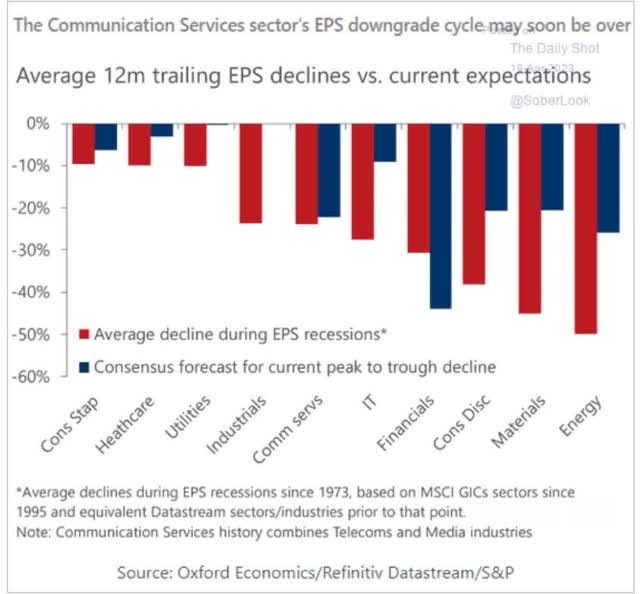

Communications companies average a 20% earnings decline during recessions, which is pretty much what the analyst consensus has priced in.

- and thus likely so has the stock price.

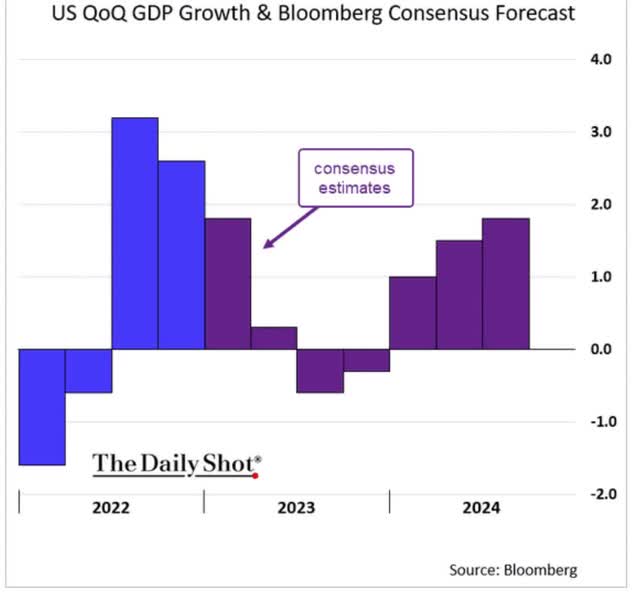

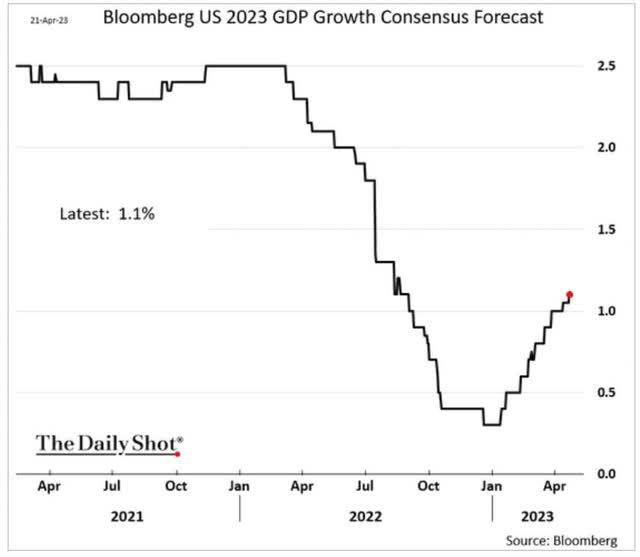

And this is the AVERAGE recession since 1973. What do economists currently expect from the 2023 recession?

Yes, they expect a short recession lasting two quarters. And a peak decline in GDP of about -0.8%.

But guess how that compares to the average recession’s -1.4% decline?

It’s the mildest recession in history, with positive 2023 growth.

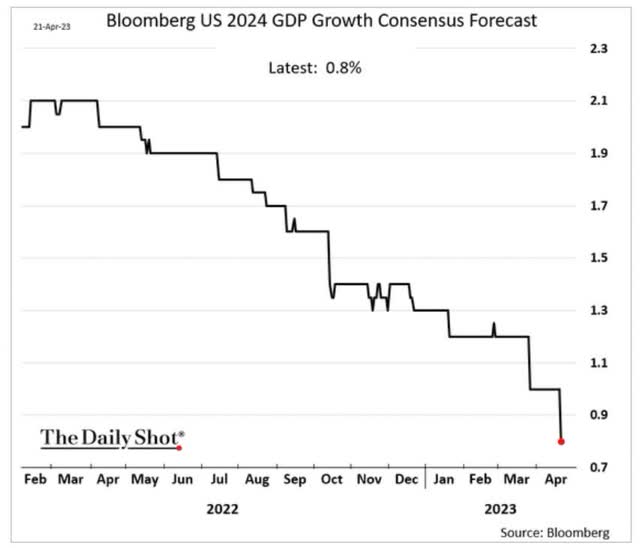

Yes, 2024 growth isn’t exactly looking great at the moment, but the point is that this is likely to be a very mild recession, nothing like the Pandemic or Great Recession.

- Pandemic: -2.8% (full-year growth)

- Great Recession: -4.6%

- Average recession: -1.4%

- the mildest recession in history (2001) -0.4% full-year growth.

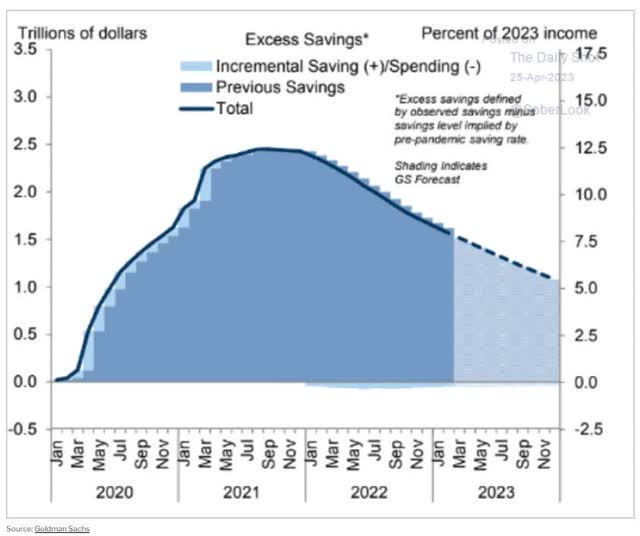

With consumers still sitting on $1.5 trillion in excess savings, which Goldman thinks won’t dry up until the end of 2025, we’re unlikely to see a massive falloff in consumer spending and, thus advertising.

And let’s not forget that Google isn’t just any advertising company. It’s THE advertising company.

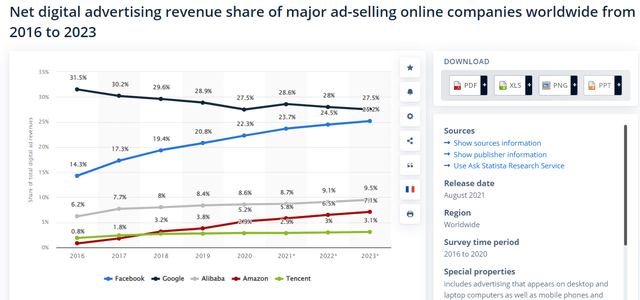

Google’s market share in digital advertising is 28%. Yes, that’s been falling over time, but not because Google’s ad revenue is falling, but because the industry is growing rapidly.

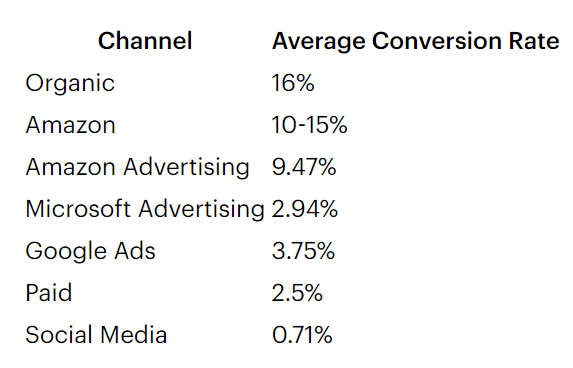

Popupsmart

The average online ad has a 2.86% conversion rate. Microsoft’s Bing ads are slightly better than that but far behind Google’s 3.75%.

Amazon can only boast more effective ads than GOOG because its customers are on its site looking to buy something already.

And Social Media? Thanks to Apple’s new privacy settings, the effectiveness of that has crashed to 0.7%, 5X worse than GOOG’s ads.

The point is that with a 92% search market share and the 2nd most effective ads, GOOG’s business model isn’t at high-risk today.

What about future business model disruption risk?

AI-Disruption Risk Are Greatly Exaggerated

See this article for an in-depth look at why the hype around Bing-integrating ChatGPT 4 is just hype.

What’s the latest data? Is there any evidence that Microsoft is on track to dethrone Google as the king of search?

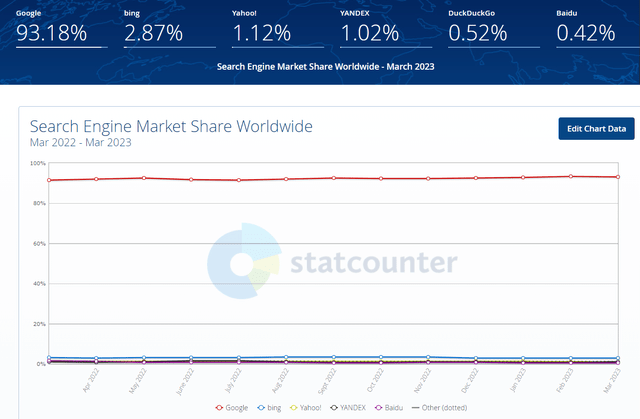

In March 2022, long before ChatGPT’s public launch, Google’s global market share in search was a Standard Oil/ASML-like 91.56%.

In March 2023, after MSFT integrated ChatGPT into Bing? 93.17%.

Bing went from 3.1% pre-Chat GPT to 2.88% after.

Let’s also not forget that GOOG has its own AI chatbot, Bard.

In March, we introduced our experimental conversational AI service called Bard. We have since added our PaLM model to make it even more powerful and Bard can now help people with programming and software development tasks, including code generation, lots more to come. For developers, we have released our PaLM API alongside our new MakerSuite tool. It provides a simple way to access our large language models and begin building new generative AI applications quickly.” – CEO, Q1 conference call.

Google spent almost $40 billion on R&D last year and is expected to spend $44 billion in 2023. By 2028 it’s R&D spending is expected to be $57 billion.

For context, the U.S. government spends $170 billion annually on R&D and the entire US $608 billion.

- in 2022 GOOG’s R&D spending made up 7% of all US R&D spending

- it’s growing at 6.4% annually

- doubling every 11 years.

What do you think Google is spending $43 billion in R&D on? Most of it is focused on AI and how to improve it, and integrate it into their core business.

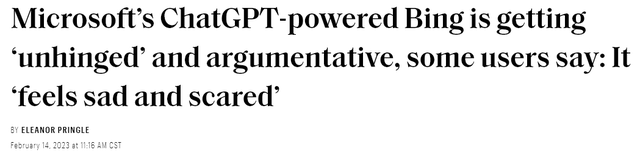

And yes, Bard made a factual mistake in its demo, but guess what? Bing running on ChatGPT is also making hilarious mistakes.

Ultimately, whether or not MSFT can use AI to become the new king of search comes down to whether or not users find its chatbot superior to GOOG’s search offering.

Thus far, there is zero evidence that they are. In fact, Bing losing market share after integrating ChatGPT indicates that the “GOOG is doomed because of AI” crowd is dead wrong.

And do you know what else proves the Google bears wrong? GOOG’s latest earnings.

Google’s Earnings Prove Bears Wrong

Stock prices move daily, usually for no good fundamental reason.

| Time Frame (Years) |

Total Returns Explained By Fundamentals/Valuations |

| 1 Day | 0.02% |

| 1 month | 0.33% |

| 3 month | 1.0% |

| 6 months | 2.0% |

| 1 | 4% |

| 2 | 12% |

| 3 | 20% |

| 4 | 28% |

| 5 | 36% |

| 6 | 47% |

| 7 | 58% |

| 8 | 68% |

| 9 | 79% |

| 10+ | 90% |

| 20+ | 91% |

| 30+ | 97% |

(Sources: JPMorgan, Fidelity, Princeton, RIA, Bank of America.)

The daily moves in stock prices are truly meaningless. Once per quarter, we find out actual hard facts, true fundamentals.

Everything else is speculation about breaking news and changing analyst estimates.

Here are the latest facts about Google.

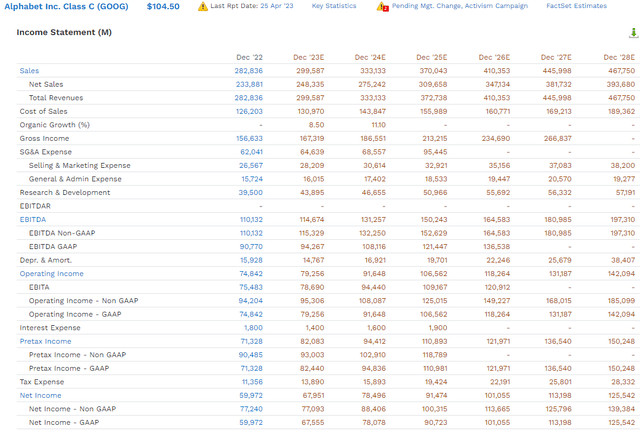

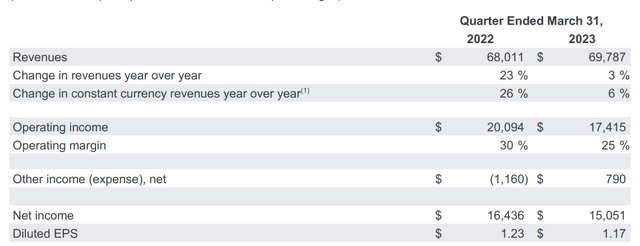

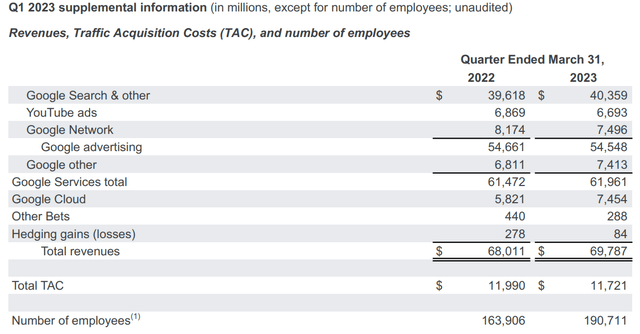

Sales were up 6% in constant currency, with EPS declining or 5%.

Search revenue grew 2%, with modest declines in YouTube ad revenue. Overall, ad sales were flat.

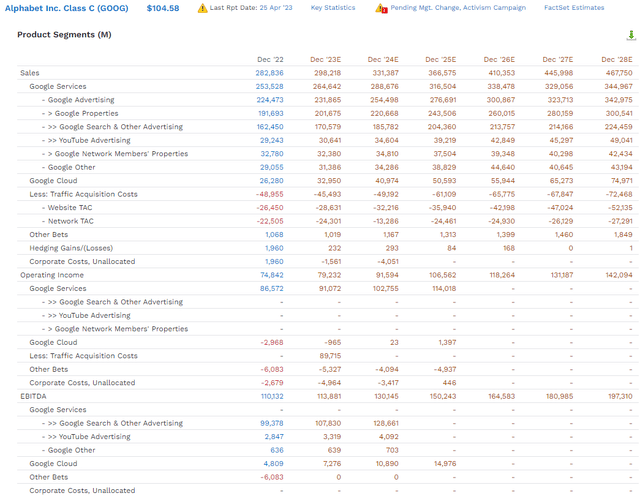

Google cloud grew 28%, faster than MSFT’s cloud sales.

Google Cloud has finally turned a profit, ahead of schedule.

Cloud is expected to grow at 19% annually through 2028, achieving $75 billion in sales, or 200% more than last year.

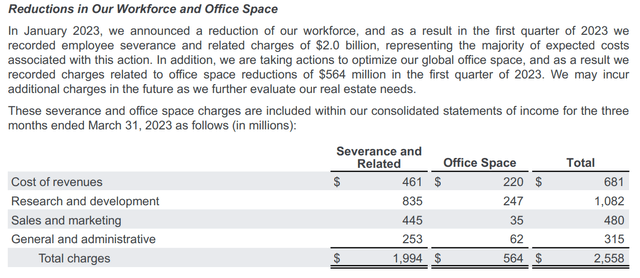

While Google’s headcount rose by 27,000 over the last year, they took a $2 billion charge for severance as they laid off 10,000 workers in January.

That $2 billion severance accounted for 75% of the decline in operating income in Q1.

In fact, the entire decline in operating income was due to costs related to the layoffs.

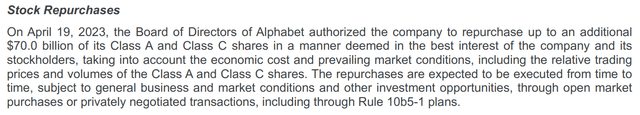

Another $70 billion was added to the buyback authorization.

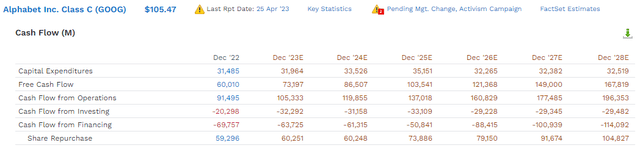

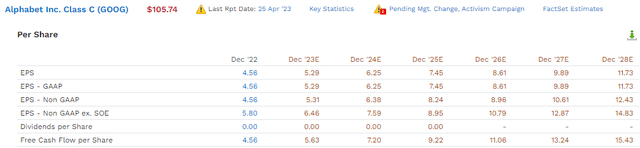

In 2022, Google generated $60 billion in free cash flow. This year, they are expected to generate $74 billion, or 23% more.

By 2028, it’s expected to be generating $168 billion in free cash flow, a growth rate of 18.7% annually.

And that’s on an absolute basis. Don’t forget about monster buybacks of $60 billion this year, growing to potentially over $100 billion by 2028.

- $470 billion in consensus buybacks

- enough for 35% of existing shares at current valuations.

What about on a per-share basis? What is the expected effect of half a trillion in buybacks?

While free cash flow is expected to grow 19% annually, free cash flow per share is expected to grow 23% annually, with approximately 4% net share reduction annually.

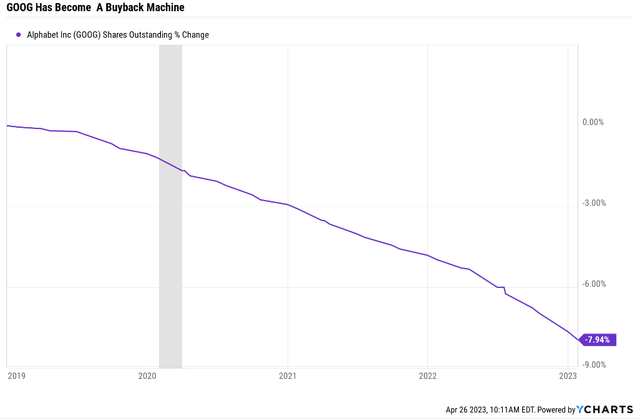

Since it began buying back stock just before the pandemic, Google has been accelerating buybacks while delivering some of the best growth in big tech.

And what about long-term growth? Beyond 2028?

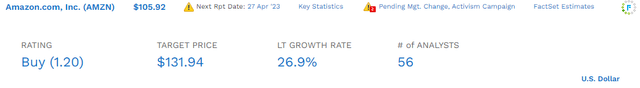

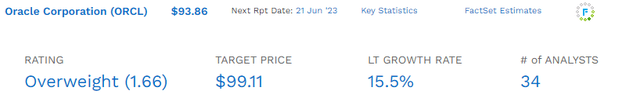

Cloud Computing Giants Growth Rates

FactSet Research Terminal FactSet Research Terminal FactSet Research Terminal FactSet Research Terminal FactSet Research Terminal

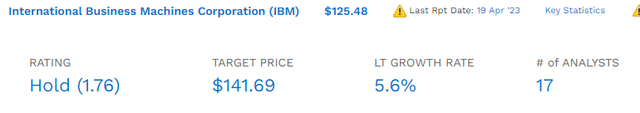

Google has the 3rd best growth rate among its large peers, above that of MSFT and 3X that of IBM.

Why Alphabet Offers % Upside In The Coming Years

| Metric | Historical Fair Value Multiples (all years) | 2022 | 2023 | 2024 | 2025 | 2026 | 12-Month Forward Fair Value |

| Earnings | 24.87 | $113.41 | $131.81 | $155.44 | $181.80 | $208.66 | |

| Average | $113.41 | $131.81 | $155.44 | $181.80 | $208.66 | $139.54 | |

| Current Price | $105.19 | ||||||

|

Discount To Fair Value |

7.25% | 20.20% | 32.33% | 42.14% | 49.59% | 24.61% | |

| Upside To Fair Value | 7.81% | 25.31% | 47.77% | 72.83% | 98.36% | 32.65% | |

| 2023 EPS | 2024 EPS | 2023 Weighted EPS | 2024 Weighted EPS | 12-Month Forward PE | 12-Month Average Fair Value Forward PE | Current Forward PE |

Current Forward Cash-Adjusted PE |

| $5.30 | $6.25 | $3.57 | $2.04 | $5.61 | 24.9 | 18.7 | 10.8 |

Google is historically valued by billions of tech investors at 25X earnings, and today it trades at a 25% historical discount of 18.7.

- over the last 20 years, Google has had billions of cumulative shareholders

- and their average estimate of fair value is 25X earnings.

Adjusted for cash, it’s trading at a 10.8 P/E and a PEG of 0.74.

- growth at a good price.

| Rating | Margin Of Safety For Very Low-Risk 13/13 Ultra SWAN | 2023 Fair Value Price | 2024 Fair Value Price | 12-Month Forward Fair Value |

| Potentially Reasonable Buy | 0% | $131.81 | $155.44 | $139.54 |

| Potentially Good Buy | 5% | $125.22 | $147.67 | $132.56 |

| Potentially Strong Buy | 15% | $112.04 | $132.12 | $118.60 |

| Potentially Very Strong Buy | 25% | $93.92 | $116.58 | $104.65 |

| Potentially Ultra-Value Buy | 35% | $85.68 | $101.03 | $90.70 |

| Currently | $105.75 | 19.77% | 31.97% | 24.21% |

| Upside To Fair Value (Including Dividends) | 24.64% | 46.99% | 31.95% |

Google is a potential strong buy and just 1% above its very strong buy price of $104.65.

It offers a 32% upside to fair value right now, and its return potential for the next few years is excellent.

2029 Consensus Total Return Potential

If Google grows as expected for the next six years and returns to historical, market-determined fair value, it could deliver 205% returns, or 18% annually.

That’s Buffett-like return potential from a blue-chip bargain hiding in plain sight and 4X more than the S&P consensus.

Bottom Line: Google Proves The Bears Wrong And Could Triple From Here

Dividend Kings Automated Investment Decision Tool

Let me be clear: I’m NOT calling the bottom in Google stock (I’m not a market-timer).

Even Ultra SWAN kings can fall hard and fast in a bear market.

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck.

While I can’t predict the market in the short term, here’s what I can tell you about Google.

- the global leader in search (93% market share and growing)

- 14% to 16% long-term return potential vs. 10.2% S&P

- historically 25% undervalued

- 18X earnings vs 25X historical

- 10.8X cash-adjusted earnings, 0.75 PEG, growth at a good price

- 205% consensus return potential over the next six years, 18% annually, 4X more than the S&P 500

- 150% better risk-adjusted expected returns than the S&P 500 over the next five years.

If you want to buy one of the greatest companies on earth, with an AA+ rated balance sheet, consider buying Google today.

If you want to enjoy potentially life-changing long-term returns and triple your money in six years, Google is just what you’re looking for.

If you want to profit from the market’s mispricing of a tech giant that’s firing on all cylinders, Google/Alphabet Inc. is one of the best growth blue chips available today.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

DK owns GOOG in our portfolios.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

-

Access to our 13 model portfolios (all of which are beating the market in this correction)

-

my correction watchlist

- my $3 million family hedge fund

-

50% discount to iREIT (our REIT-focused sister service)

-

real-time chatroom support

-

real-time email notifications of all my retirement portfolio buys

-

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.