Summary:

- Meta Platforms communicated a strong start into 2023, beating analyst consensus estimates with regard to both revenue and earnings.

- The better-than-expected earnings numbers were driven mostly by cost rationalization, but also a recovering ad market.

- Meta will likely continue to enjoy the tailwind of a strengthening advertising business going into Q2 and beyond.

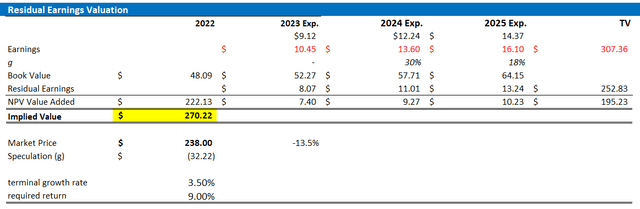

- I update my EPS expectations for Meta through 2025, and I now calculate a fair implied target price of $270.22/ share.

Justin Sullivan

I previously assigned a Buy rating to Meta Platforms (NASDAQ:META) going into Q1 2023 reporting, as I argued that the market may be too pessimistic about the social media giant’s earnings power. Now, after Meta reported stronger-than-expected results, the stock jumped as much as 15%. In line with my fundamental long-term thesis that Meta operates one of the most sticky and profitable business model in the tech/ communication sector, I believe Meta stock has more room to run–despite a >100% share price appreciation YTD. In fact, reflecting on a strong earnings report, paired with continued OPEX discipline and strategic investments in AI, I update my EPS expectations for Meta through 2025; and I now calculate a fair implied target price of $270.22/ share.

Meta’s Q1 Results

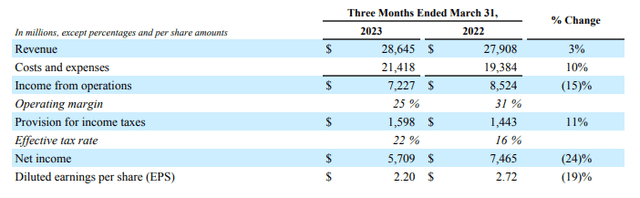

On Wednesday 26th, Meta Platforms communicated a strong start into 2023, beating analyst consensus estimates with regards to both revenue and earnings. During the period from January to end of March, the social media giant generated revenues of $28.65 billion, as compared to $27.1 billion for the same period in 2022 (3% YoY growth), and compared to about $27.7 billion estimated by analysts (~$950 million beat).

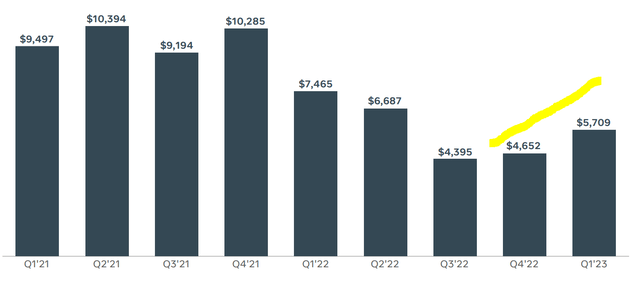

With regards to profitability, Meta’s profit from operations came in at $7.23 billion, falling 10% versus Q1 2022; Post-tax net income came in at $5.7 billion ($2.2/ share), falling 24% YoY, but beating analysts’ estimates by close to ~500 million

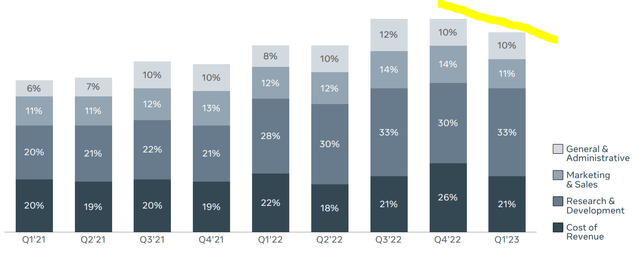

The better than expected earnings numbers were driven mostly by cost rationalization. And as Meta’s operating cost base is coming down (ex-R&D costs)…

… earnings are picking up again.

Although Meta’s Q1 results came in slightly lower than my personal expectations (see here), estimating $29.3 billion of revenues and $2.35 of EPS, I view Meta’s performance in the first quarter of 2023 as a strong confirmation that the social media giant operates a highly sticky and profitable business.

Reflecting on solid Q1 results, Mark Zuckerberg, Meta founder and CEO commented:

We had a good quarter and our community continues to grow…

… Our AI work is driving good results across our apps and business. We’re also becoming more efficient so we can build better products faster and put ourselves in a stronger position to deliver our long term vision.

Strong User Growth and Engagement

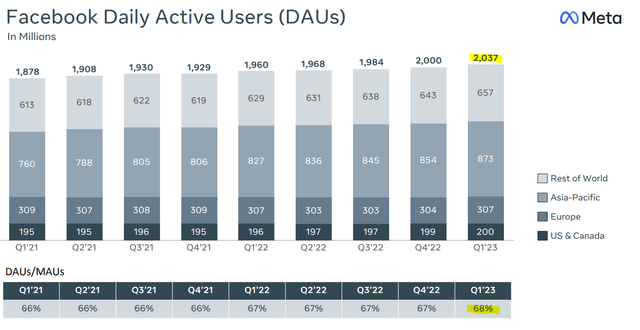

Another highlight in Meta’s Q1 reporting was, for me, the company’s communication with regards to the user base. In March 2023, Meta’s Family daily active user base jumped to 3.02 billion people, an increase of 5% YoY. Notably Facebook Blue’s daily active user base continues to record steady growth, adding about 37 million of new users (4% YoY growth) and recording gains in all reporting regions including the US & Canada. Moreover, Meta disclosed that Facebook’s engagement has pushed to a record level as the DAU/MAU ratio expanded to 68%.

Share Repurchases Remain Strong

Investors will likely appreciate that, on the backdrop of strong results, Meta repurchased $9.22 billion stock in the first quarter of 2023. And given that Meta closed Q1 2023 with $37.44 billion of cash and cash equivalents, including marketable securities, the company will likely materialize the still outstanding additional $41.73 billion worth of shares available and authorized for repurchases.

Outlook Implies Confidence

According to Meta’s guidance and management commentary, the social media giant will likely continue to enjoy the tailwind of a strengthening advertising business going into Q2 and beyond. While management has not provided FY 2023 topline projections, for Q2 2023, Meta expects revenues to fall between $29.5-32 billion. With regards to costs, Meta said that it now expects FY 2023 expenses to fall between $86 billion and $90 billion, significantly below the previously guided range of $89 billion to 95 billion. Notably, this projection encompasses expenses of $3-5 billion associated with consolidating facilities, severance payouts, and other expenditures related to personnel. CAPEX is likely to be anchored around $30 billion, reflecting ongoing investments in AI for advertising and recommendation algorithms, generative AI, Reels, as well as Reality Labs.

Valuation Update – Raise Target Price

Accounting for Meta’s Q1 earnings beat and strong management commentary somewhat, I update my EPS expectations for Meta through 2025: I now estimate that the social media giant’s EPS in 2023 will likely end up somewhere between $10.05 and $10.9, as compared to $9.12 prior. Moreover, I also adjust and raise my EPS expectations for 2024 and 2025, to $13.6 and $16.1, respectively.

I continue to anchor on a 3.5% terminal growth rate (one percentage point higher than estimated nominal global GDP growth), as well as on a 9% cost of equity.

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price for Meta Platforms equal to $270.22/ share.

Author’s EPS Estimates; Author’s Calculations

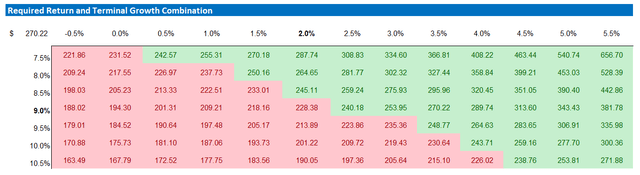

Below is the updated sensitivity table.

Author’s EPS Estimates; Author’s Calculations

Conclusion

Meta shares rose sharply after the company announced stronger than expected Q1 2023 results and communicated to markets that the advertising business may be recovering. But investors should note that the social media giant may still deliver further upside in 2023 anchored on exciting business initiatives. Specifically: 1) Meta has lately been demonstrating an unwavering commitment to cost management, which could be a sign that profitability is stabilizing, if not expanding again; 2) Meta is making progress with its AI and Reels technology, potentially improving both engagement and monetization of the social media ecosystem; 3) Meta is expanding efforts to monetize its messaging platforms, which could represent a significant revenue opportunity that markets may have yet to correctly price.

Post Q1-2023 reporting, I update my EPS expectations for Meta through 2025; and I now calculate a fair implied target price of $270.22/ share. For me, Meta remains a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice; this article reflects market commentary and the author's opinion only

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.