Summary:

- Reality Labs keeps burning cash while demand for its products remains weak. Ad impressions increased by 26% implying Meta is increasing ads on their products to the detriment of users.

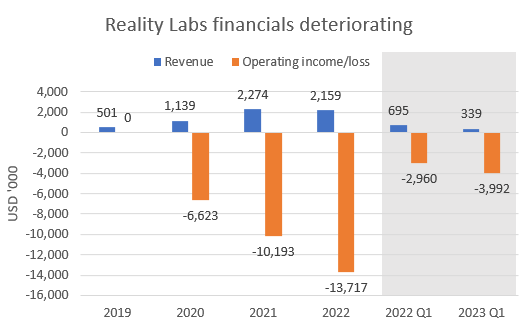

- The segment’s YoY topline decreased by 51% to $339 million, while operating income decreased by 35% to -$4.0 billion (operating margin -1,178%).

- Zuckerberg’s mid-range revenue outlook for Meta Platforms is ~$30.8 billion, implying about 7% growth YoY during Q2.

- Although a 7% growth rate sounds good in this environment, Meta is lapping a weak comparison period which saw revenues decline by 1% YoY (2022 Q2 vs 2021 Q2).

- The silver lining is that the balance sheet is still solid and Meta has no problem financing its capex and share repurchase program for the next 1-2 years.

photoschmidt/iStock via Getty Images

Investment Thesis

Meta Platforms (NASDAQ:META) reported earnings recently and while the market is celebrating it as the best thing since sliced bread, I see things differently. Here are my three points on why investors should stay clear of Meta at these prices:

- Reality Labs kept burning cash at an increasing rate. This would be fine and dandy for me as long as revenues would grow as well. This is however not the case. Topline for Reality Labs actually decreased by 51% YoY after decreasing 5% in 2022 vs 2021. This implies demand for Meta’s products in this segment is very weak.

- Meta’s financial position is strong. With that said, shareholders shouldn’t expect the generous share repurchase program to continue if Meta can’t improve Reality Labs’ economics

- Ad impressions grew by 26% YoY, while user growth came in at between 2% and 5% depending on which metric you look at. This implies Meta is pushing more ads on people, which should lead to a poorer user experience (assuming people don’t like to be spammed with ads). The increase can of course also reflect a change in product mix etc. but the company hasn’t provided any comments regarding this.

In this article, I will cover the first two points of this thesis in more detail, as they are the more significant items of the near to medium-term equity value story.

Reality Labs

Reality Labs is Meta’s start-up segment focusing on building an ecosystem in the metaverse. To my understanding, however, most of its revenue is generated from VR/AR goggles Meta Quest. Demand for the goggles has been weak during the last 15 months, as sales have decreased since 2021. In the 2023 Q1 earnings release, Zuckerberg also commented that the operating loss is expected to keep increasing in 2023 compared to 2022.

Reality Labs financial figures (Company financial statements, author)

While Meta’s social media empire is highly cash generative and produces very attractive returns on invested capital (check out my previous article where I go through Meta’s economics more thoroughly) it is subsidizing Reality Labs’ cash burn. It’s imperative for Meta investors that Reality Labs finds a pocket of value in the metaverse space in the near term. The first indication of it will be topline growth, which is nowhere to be seen currently. If not, I think management has to shut the project down which would, in turn, weaken Meta’s growth story as the social media business is already facing market saturation. While the current trajectory looks awful, it’s good to remember that Meta has a strong balance sheet and is able to keep up this pace of cash burn for several years.

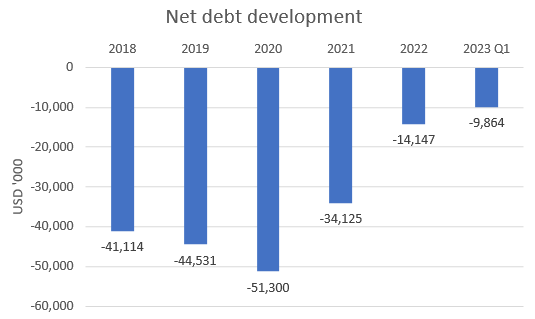

Meta Has A Solid But Deteriorating Balance Sheet

I’ve painted quite a bleak picture so far, but it’s not all bad. Due to Meta’s strong historical financial track, they have a strong balance sheet that is able to finance their heavy capex and share repurchase programs in addition to Reality Labs’ increasing losses for 1-2 years.

| Item (all figures in USD ‘000) | 2021 | 2022 | 2023 est. |

| Cash flow from operations | 57,683 | 50,475 | 51,000 |

| Capex (tangible and intangible) | -19,541 | -32,743 | -33,000 |

| Free cash flow | 38,142 | 17,732 | 18,000 |

| Share repurchases | -44,537 | -27,956 | -30,000 |

| Cash flow after repurchases | -6,395 | -10,224 | -12,000 |

As we can see from the table above, Meta’s free cash flow, although very strong, took a turn for the worse in 2022 due to its heavy capex program and to some extent its weaker business performance. Meta has also repurchased shares aggressively, which has led it to spend more cash than it has made during 2021-2022. In my opinion, this is fine, as the company has had excess cash for quite some time. I wanted to point out that Meta can’t keep this cash flow profile going for more than 1-2 years (depending on how strong they want their balance sheet to be). The balance sheet has taken a turn for the worse since 2020.

Net debt development (Company financial statements, author)

I have included operating finance lease liabilities in the net debt figures. If my 2023 estimate would prove somewhat correct, Meta would have more debt than cash on its balance sheet, which hasn’t happened since its founding in 2008. It’s not as worrying as it sounds, however, as Meta can simply reduce its share repurchase program, which would lead to excess cash on its balance sheet again. What investors should bear in mind, however, is that the share repurchase program will probably not continue on its current scale if Meta intends to keep a healthy balance sheet (assuming the capex program stays on the same level going forward and that operating cash flow does not improve significantly in the near term). As I’ve stated before, the success of Reality Labs is the critical factor in whether the company will thrive in the future or stagnate as a social media empire.

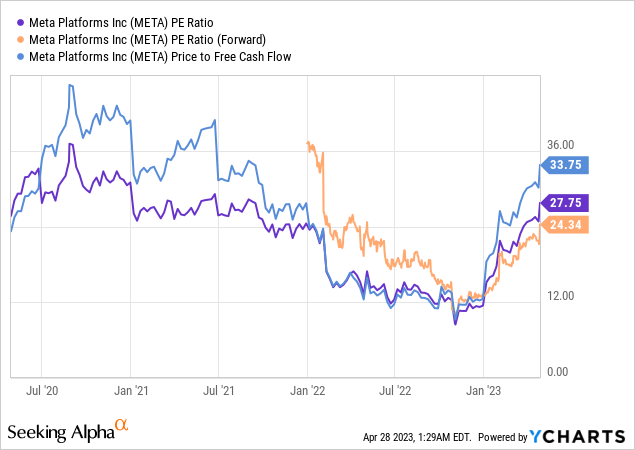

Valuation Is Rich

Meta’s valuation has increased meaningfully during 2023 and jumped higher with 2023 Q1 earnings as the market celebrated its earnings beat. The valuation looks rich in my eyes considering the points I have highlighted in this article. This is why I rate the company a sell. Although headline figures are important, investors should look at Reality Labs with a discerning eye during 2023 and hope for topline growth, as we already have heard from management that operating losses will increase.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.