Summary:

- AbbVie’s revenue amounted to $12,225 million in the first three months of 2023, 9.7% less than the previous year.

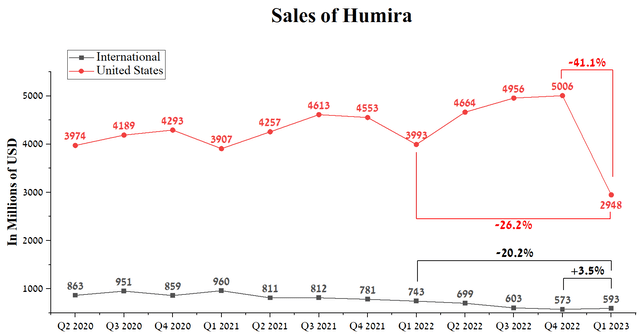

- US sales of Humira were $2,948 million, down 41.1% quarter-on-quarter and 26.2% year-over-year.

- In addition to unsuccessful drug sales, AbbVie announced suspending the development of ABBV-154, an anti-TNF steroid conjugate.

- Combined sales of Skyrizi and Rinvoq were $2,046 million in Q1 2023, down $300 million quarter-on-quarter.

- As a result, we continue to believe that the business model built under the leadership of Richard Gonzalez is losing its former effectiveness and becoming non-viable in an increasingly competitive environment in immunology and neuroscience, which could ultimately lead to increased downward pressure on AbbVie’s share price in 2023.

AntonioGuillem/iStock via Getty Images

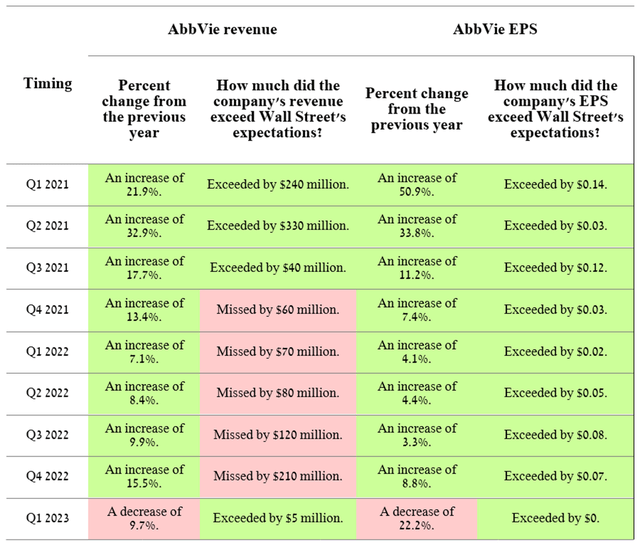

On April 27, 2023, AbbVie (NYSE:ABBV) released its Q1 2023 financial results. In recent quarters, sales of the company’s products have shown mixed dynamics, which led to falling short of Wall Street analysts’ expectations. So, AbbVie’s revenue amounted to $12,225 million in the first three months of 2023, 9.7% less than the previous year. In addition, net income attributable to AbbVie has been declining year-on-year and quarterly to $239 million, one of the lowest in the company’s history. As a result, we continue to believe that the business model built under the leadership of Richard Gonzalez is losing its former effectiveness and becoming non-viable in an increasingly competitive environment in immunology and neuroscience, which could ultimately lead to increased downward pressure on AbbVie’s share price in 2023.

Source: Author’s elaboration, based on Investing.com

The sharp drop in sales of Humira

Humira (adalimumab) is a drug in the class of biological response modifiers (BRMs). Its mechanism of action is based on the inhibition of TNF-α, which leads to a decrease in the magnitude of the innate immune response and the level of pro-inflammatory cytokines.

At one time, this medicine revolutionized the treatment of various autoimmune diseases, including plaque psoriasis, ulcerative colitis, rheumatoid arthritis, psoriatic arthritis, axial spondyloarthropathy, Crohn’s disease, and ankylosing spondylitis. Thanks to its innovative mechanism of action, Humira has become the gold standard in the market in a relatively short period of time, resulting in double-digit sales growth from its first approval until 2022.

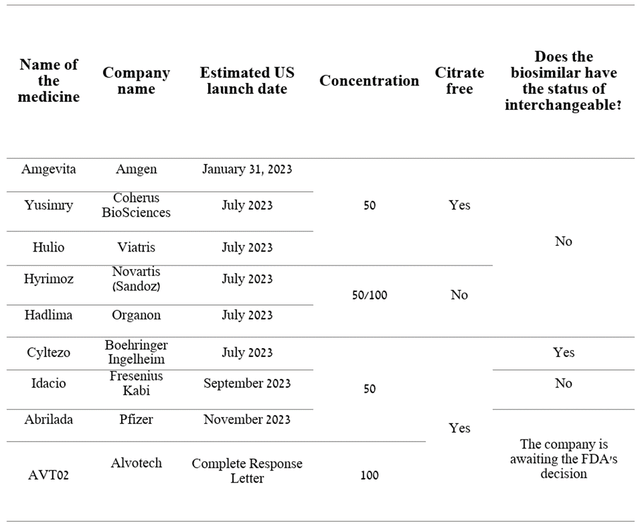

However, the launch of Amjevita, Amgen’s (AMGN) first FDA-approved Humira biosimilar at the end of January 2023, crippled this trend more than many expected, even though it does not have the status of interchangeable and was only approved in the lowest concentration of the active substance equal to 50 mg/mL. US sales of Humira were $2,948 million, down 41.1% quarter-on-quarter and 26.2% year-over-year.

Source: Author’s elaboration, based on quarterly securities reports

It should be noted that a biosimilar with the status of an interchangeable has advantages over a regular one since, depending on the legislation of a particular state, a pharmacist can automatically offer the patient a cheaper biosimilar version instead of Humira prescribed by a doctor. If the biosimilar does not have the status of interchangeable, then the attending physician is obliged to send the patient a prescription for it. The first interchangeable medicine with Humira was Boehringer Ingelheim’s Cyltezo, which scored FDA’s green light in October 2021.

From the beginning of July 2023, competition is expected to increase in the market for tumor necrosis factor (‘TNF’) inhibitors, which, according to our estimates, will not only lead to a more significant drop in demand for Humira but also lead to a decrease in prices for its biosimilars, since each of these companies will strive to win as much market share as possible.

Source: Author’s elaboration, based on quarterly securities reports

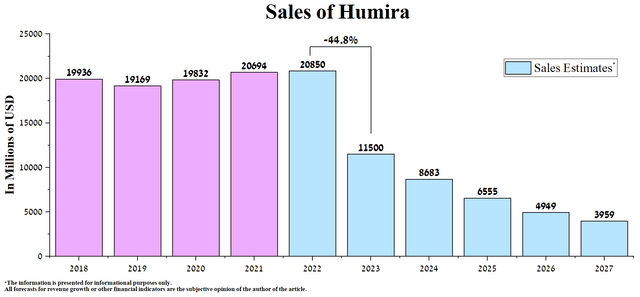

With upcoming launches of interchangeable versions of Humira and our expectation that Pharmacy Benefits Managers (PBMs) will strive to prescribe them to use the lowest cost medicines to reduce healthcare expenses in the US, we expect Humira’s subsequent sales in the next five years to decrease. Thus, according to our estimates, sales of AbbVie’s product will amount to $11.5 billion in 2023, having decreased by 44.8% compared to the previous year, and at the same time, this figure will be slightly less than $4 billion by 2027.

Conclusion

On April 27, 2023, AbbVie released financial results for the first three months of 2023, disappointing many of the company’s investors due to a sharp drop in net income and revenue year-on-year and quarterly. Many of the financial key performance indicators fell short of ours and Wall Street analysts’ expectations, resulting in a 7.99% decline in AbbVie’s share price from the previous trading day.

The launch of Amjevita, Amgen’s first FDA-approved Humira biosimilar, drastically dragged down sales of the AbbVie blockbuster that revolutionized medicine in the early 21st century. This happened although Amjevita has no interchangeable status and was only approved at the end of January. Also, the combined sales of Skyrizi and Rinvoq, which the company has high hopes for, amounted to $2,046 million in Q1 2023, an increase of 45.6%. At first glance, these are excellent results, but this is far from the case. Revenue for both products fell quarter-on-quarter by double-digit percentages for the first time since they were approved. In our estimation, this is due to the launch of Humira’s biosimilar, which has a significantly lower price than the branded version and has generated significant demand from patients and doctors. In addition, we believe that sales of Skyrizi and Rinvoq will slow down due to increased competition in the immunology drugs market, including from Johnson & Johnson’s (JNJ) Tremfya and Bristol-Myers Squibb’s (BMY) Sotyktu, which are either more effective or more convenient to use.

In addition to unsuccessful drug sales, AbbVie announced it was suspending the development of ABBV-154, an anti-TNF steroid conjugate. This asset was studied in polymyalgia rheumatica and Crohn’s disease and had the prerequisites to become a product capable of restoring the company’s lost position in this market. Another disappointment was the complete suspension of the cystic fibrosis program, thereby ending AbbVie scientists’ efforts to develop a competitor to Vertex’s (VRTX) Trikafta.

In conclusion, we want to note that we continue to remain conservative regarding the future of the company for the coming year, and this is due not only to the dismal sales of AbbVie’s essential medicines but also to the fact that Richard Gonzalez announced that he would remain as CEO in 2023. We believe that the management of any company has the primary responsibility in its development, and in the absence of effective and efficient strategies to move the business forward, this becomes the first serious signal that the asset is beginning to wither. The business model built by Richard Gonzalez is losing its former efficiency and becoming unviable in the face of increased competition in neurology and immunology, and relatively low R&D costs do not allow the production of revolutionary products that could dramatically improve the company’s financial position in a short time. We believe AbbVie stock is entering a period of high volatility, and its price could drop as low as $124 per share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.