Summary:

- Thermo Fisher Scientific has experienced significant revenue growth over the last decade.

- Since 2018, they have been steadily buying back shares and raising their dividend.

- With a forward P/E of 29.09, a PEG of 1.54, and a forward Price/Cash Flow of 22.84, the company currently appears overvalued.

- Thermo Fisher Scientific is a Hold.

jetcityimage/iStock Editorial via Getty Images

Thesis

With the Fed fighting inflation and the “R” word on everyone’s lips, this potential upcoming economic slowdown could produce a buying opportunity for manufacturing companies. While it’s hard to tell by how much any given company will be affected, now is the time to begin looking for gems to buy later.

Thermo Fisher Scientific Inc. (NYSE:TMO) is one of many manufacturing companies I am looking into. After looking over their financials, the company is healthy. However, after looking over their valuations, the company also appears overvalued. Currently, Thermo Fisher Scientific is a Hold.

Company Background

Thermo Fisher Scientific Inc. is a supplier of medical equipment, analytical instruments, reagents and consumables, and software services. The company is headquartered in Waltham, Massachusetts, and was formed as a result of a 2006 merger between Thermo Electron Corporation and Fisher Scientific International, Inc.

I grew up within a few miles of one of their manufacturing facilities and still live in the area. The company has developed a reputation for treating its employees well. I have known several fabricators who worked there for multiple decades; they all had positive things to say about the company. When the pandemic broke out, demand for their products skyrocketed and the company increased its output to match. Their demand has since abated; a couple of days ago I bumped into another local engineer who informed me he was laid off the previous week.

Statements made during the most recent earnings call indicate the company repurchased $3B worth of shares and increased their dividend by 17%. They also expect full year revenue will be around $45.3 billion, with adjusted EPS of $23.70 per share. Their growth estimates are that Q2 core organic growth is expected to be mid-single digits.

Long-Term Trends

The global scientific instrument market is expected to expand at a CAGR of 4.99% through 2028. Analytical instrumentation is projected to have a CAGR of 4% until 2028. Medical devices are projected to have a CAGR of 3% through 2028. The molecular biology enzymes, kits, and reagents market has a projected CAGR of 17.8% until 2028. The life science software market is expected to have a CAGR of 8.1% through 2027.

Financials

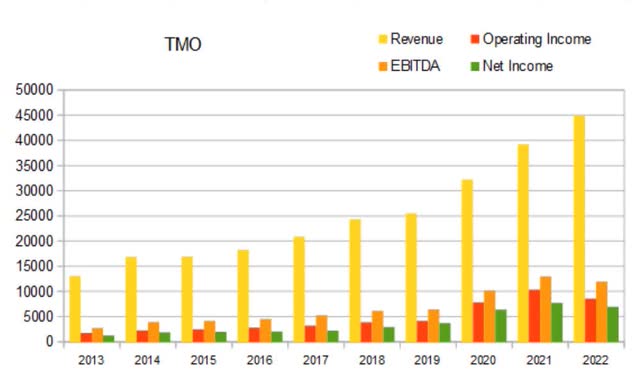

Thermo Fisher Scientific has experienced significant revenue growth over the last decade. That growth also came with cash flow improvements.

TMO Annual Revenue (By Author)

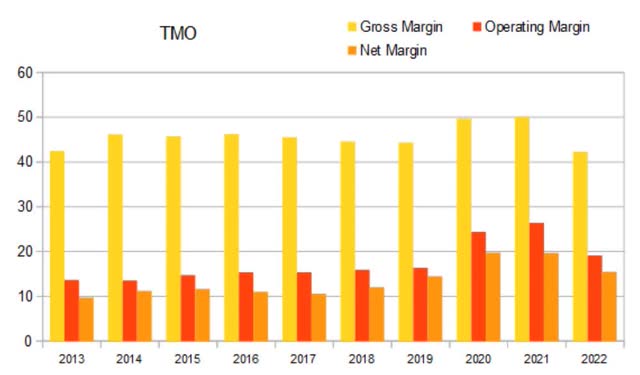

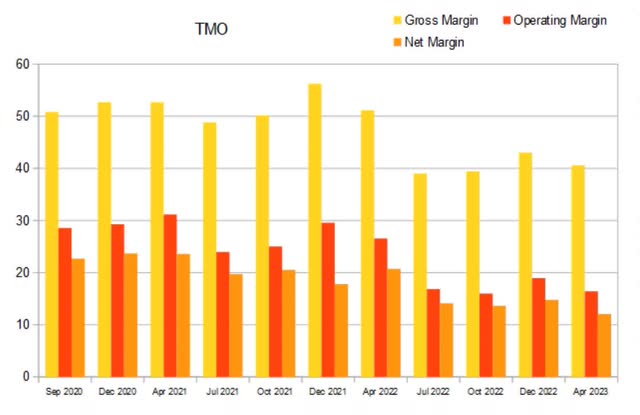

Gross margins are consistently above 40%. Operating margins experienced an improvement in 2020 and 2021. Operating margins reached as high as 26.45%, but have since retracted back under 20%.

TMO Annual Margins (By Author)

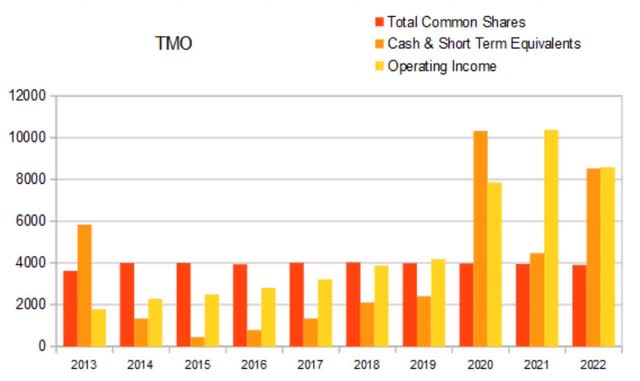

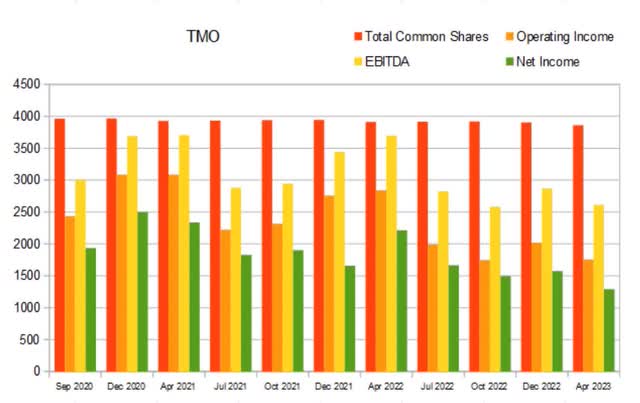

Taking a look over the relationship between share count, cash, and revenue shows that this company does not have a long history of buying back shares. The buybacks have been small enough that they are hard to see on the below chart, but the share count has been slowly dropping since 2018.

TMO Annual Share Count vs Cash vs Operating Income (By Author)

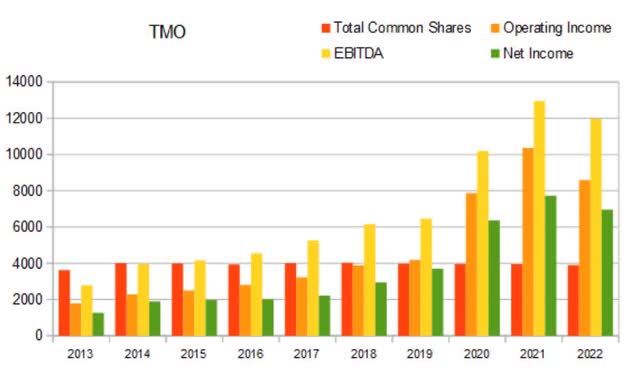

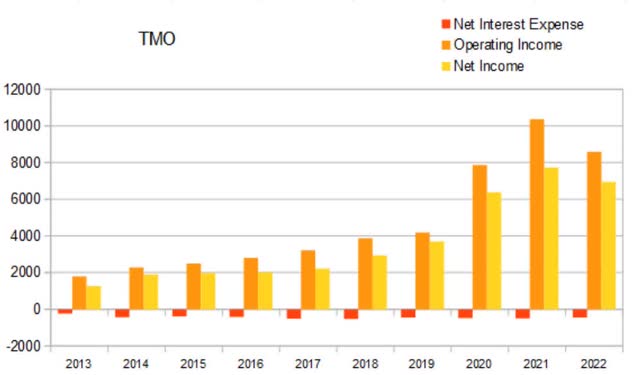

The company began experiencing improvements to its income for most of the last decade. The retraction that has been taking place since 2021 is likely due to a drawdown of the covid-related demand.

TMO Annual Share Count vs Incomes (By Author)

While the company has grown income significantly, their annual net interest expense has remained fairly stable.

TMO Annual Net Interest Expense (By Author)

Their annual equity curve has shown significant growth over the last decade. This is an indication of financial health and is very attractive for long-term investors.

TMO Annual Total Equity (By Author)

Return on capital was steadily ranging between 4.6% and 5.8% from 2013 until 2017, before experiencing an expansion in 2018. It reached a peak of 11.16% in 2020.

TMO Annual Return On Capital (By Author)

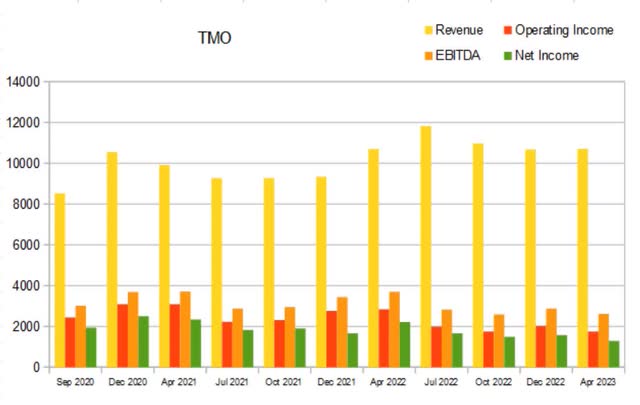

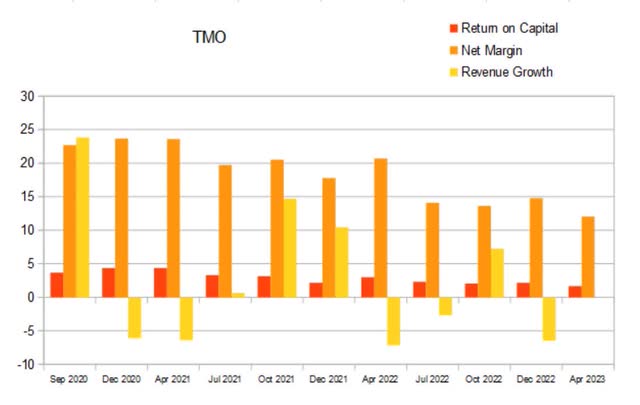

Looking over their quarterly numbers, we can see that revenue has been rising as their income has been slowly dropping.

TMO Quarterly Revenue (By Author)

The divergence between revenue and income on the above chart shows up on the chart below as a margin contraction.

TMO Quarterly Margins (By Author)

While share count does go up some quarters, over the long run it is trending down.

TMO Quarterly Share Count vs Incomes (By Author)

Quarterly return on capital declined from its peak of 4.37% in Dec 2020 to 2.14% in Dec 2021. It then became range-bound between 2.05% and 2.95% before falling to a new low of 1.64% this most recent quarter.

TMO Quarterly Return On Capital (By Author)

Valuation

As of April 27th, 2023, Thermo Fisher Scientific had a market cap of $205.63B and traded for $543.02 per share. The company has a forward P/E of 29.09, a PEG of 1.54, and a forward Price/Cash Flow of 22.84. According to its metrics, the company is currently overvalued.

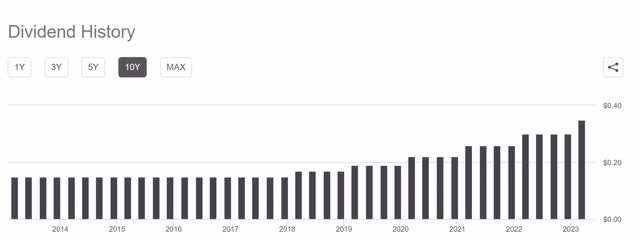

They first began offering a dividend in 2012 and have been increasing it since 2018. They currently pay a $0.35 per share quarterly dividend, totaling $1.40 per year.

TMO Dividend History (By Author)

Assuming the company continues increasing its dividend by 17% per year for the next 20 years and using a discount rate of 9%, a discounted cash flow calculator produces a fair value estimate of $128.07 per share. Using a more conservative 15% growth produces an estimate of $96.95 per share. This is an already mature company which only recently began steadily increasing its dividend, it may be many years before it is worth buying purely for its dividend value.

Risks

The recession we are facing may be deeper or last longer than we are presently expecting. Instead of a temporary decline, the company could experience a more sustained drawdown in overall demand for its products.

Catalysts

While unlikely to happen in any given year, our global air travel network makes the threat of another pandemic a real possibility. This company already experienced significant tailwinds during the last one and is likely to again during any future events of a similar nature.

Conclusion

Thermo Fisher Scientific has been steadily buying back shares and raising its dividend. With an annual return on capital below 10%, the pace of buybacks and dividend raises is unlikely to be as attractive as other choices. While it does have healthy, but not amazing financials, it does not currently have an attractive valuation.

The compounding effects of dividend raises and share buybacks work together to build outsized shareholder value over long time frames. If the share price of Thermo Fisher Scientific ever drops into a place where its PEG approaches a value of 1, I will consider becoming a long-term investor.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.