Summary:

- The solid financials of NextEra Energy allowed the company to extend its forecasts for EPS growth in the mid-term.

- NEE has the potential to provide stable, inflationary- and recessionary-resilient fundamentals.

- The investment ambitions and clean energy rush provide a predictable line of sight for the company’s business in the long term.

- The valuation premium on NEE stock appears justified through the profitability prism, while fundamentals offer some 20% on top of that.

pidjoe

NextEra Energy (NYSE:NEE) appears to be the main beneficiary of the green transition in the U.S., where the extension of tax incentives for renewable energy through the IRA package could have a positive impact on the company’s long-term growth prospects. At the same time, NextEra manages a strong regulated business in Florida, one of the most favorable states in terms of conditions for the utility sector. The latter, along with a leading renewable energy company, in combined effect, generate steady earnings, backed by government-regulated rates and long-term supply contracts. I believe that NextEra Energy’s unique blend of stable dividends from its utility and the growth potential of its renewable energy makes it an attractive investment opportunity. The solid financial performance in both LOB, along with the growing demand for clean energy solutions, positions NEE well to generate consistent earnings through a recession.

Overview and recent earnings highlights

NextEra Energy is the largest U.S. utility by market value and one of the world’s leading renewable energy operators. The company includes two main units: Florida Power & Light (FPL), a regulated utility company in Florida, and NextEra Energy Resources (NEER), which operates a clean power fleet. NEE operates a total of up to 60 GW of generating capacity, of which 54% is managed by FPL and 46% by NEER.

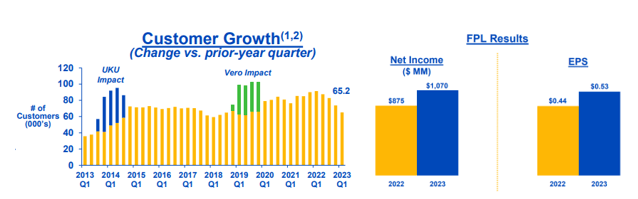

The company successfully completed the first quarter of 2023 in terms of adjusted EPS, which rose to $0.84 (+13.5% YoY) and outperformed significantly the market expectations mainly due to the new commissioning of renewable energy in the green segment of NEEP and the continuing trend towards growth in the consumer base in Florida. At the same time, the company’s revenue went up by 2.3x to $6.7 billion.

Favorable positioning

The regulated segment in Florida, the main driver of the company’s total revenue, is positioned for further growth. In particular, the economic and regulatory climate in Florida is favorable for the FPL as the state ranks 8th in the U.S. in terms of economic prospects. Florida recorded the highest net population influx in 2022 of 417k, extending a trend that had accelerated during the COVID-19 pandemic. Such trends are positive for the utility business, which provides an opportunity to increase the consumer base.

Florida economy and customer profile (company presentation)

Thus, retail sales in Florida grew by 0.4% YoY, underpinned by sustainable customer base growth (+65k during the quarter) and despite the abnormally warm weather in the state during January and February. In addition, FPL’s tariff structure stands out in comparison to other industry players. The average rate of return on equity in FPL tariffs was 10.80%, on top of the US average of around 9.50%. The flexible system of regulation of the tariff rate of return, which is tied to the 30-year Treasury bonds, allows to reduce the negative effects of pro-inflationary processes and interest rates volatility.

Green megatrend

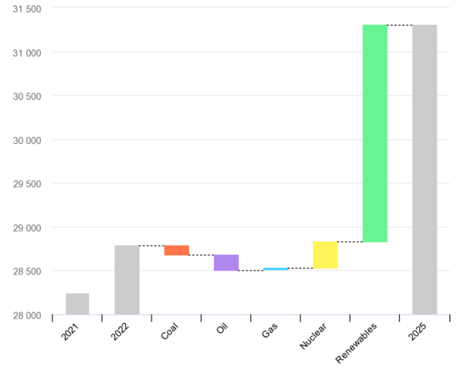

Renewables and nuclear energy are forecasted to dominate the growth of global electricity supply in the mid-term while meeting on average more than 90% of the additional demand.

Electricity Market Report 2023 (IEA)

The transition to electricity from renewable sources is in the vanguard of the climate and economic doctrine of the United States. The bold goal of 80% renewable energy in the electricity mix by 2030 does not look feasible at the current rate of 21.5%. But even approaching such parameters will require large-scale buildups of new renewable capacities, as in order to replace coal-fired thermal power plants in the U.S. it is necessary to increase the generation of renewable energy by 90%.

NextEra, as the leading renewable energy operator in the country, could continue to expand its market share due to the above trends. Moreover, the company’s growth path is clearly foreseeable with approximately 20.4 GW backlog in NEER of signed wind, solar, and storage contracts. In fact, it anticipates to build about 33-42 GW of new renewables and storage projects by 2026. Already, the company controls more than 5% of the total capacity of the US energy system, and taking into account its investment ambitions, I expect the share could grow to 7-8% by 2026.

Perfect mix to exploit the long-term drivers

NEE is one of the main beneficiaries of the Inflation Reduction Act, which comprises $30 billion in targeted grant and loan programs for clean electricity investments. In addition to the immediate financial impact of the stimulus, NEE has a chance to boost non-tariff revenue by servicing Florida’s consumer solar panels, which the IRA has extended its installation tax subsidies through 2032.

Among other non-tariff possibilities of NextEra is the production of green hydrogen. The company is currently implementing a project for the production of green hydrogen for CF Industries (CF) with a total capacity enough to produce 100k tons per year of green ammonia. In addition, the fuel has great potential in the automotive, chemical, aerospace and utility industries as a clean alternative to natural gas.

In addition, the NEER continues to expand its transmission business to support the growth in renewables. FPL in turn, has filed a 10-year generation resource plan, which stipulates a 20 GW of new solar capacity expansion, and 2 GW of battery storage rollout over the next decade as well. This could increase the cost-effective solar generation up to 35% in the utility’s energy mix, from 5% in 2022.

In my view, NEE operates a perfect combination of utility and renewable energy businesses to feel comfortable in a recessionary environment. The former provides for a resilient, recession- and inflation-resistant operating cash flows, while the latter could contribute to a strong growth prospect due to the accumulated backlog and stellar development plans in the mid-term. The two business units could also exploit inner-group expertise to improve efficiency and benefit from the company’s favorable set of opportunities. Moreover, NEE commands the strongest balance sheet in the sector, which is a key factor in building, financing and operating with a cost superiority. The expansion of the cost-effective solar and storage capacity could be viewed as a prudent strategic move not only due to the decarbonization push, but for the reason that it could underpin the company’s energy offering in the event of volatile natural gas prices, thus supplying the customer base with a low-cost generation source.

Sustainable shareholder return

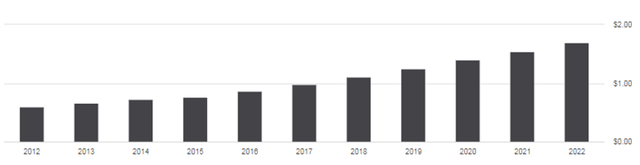

The dividend yield of NextEra Energy stands at 2.3%. In comparison to the sector, this level cannot be called high, as the industry offers investors a 3.4% on average. The lag is explained by the fact that NEE used to focus on investing the cash flows in the business.

Dividend growth history (Seeking Alpha)

However, the point is that NEE has a decades-long history of distributing dividends to shareholders going through every economic environment, and a solid track record of increasing its DPS since 2005. Moreover, the company looks like an even more valuable investment as the management intends to increase dividend payments by 10% on annum at least until 2024, which is higher than the rates offered by competition. Meanwhile, good financial performance could continue with adjusted EPS growth in the 6-8% range in the mid-term, reaching up to $4.00 in 2026 from $2.90 in 2022.

I believe NEE could achieve the growth expectations, as the company has demonstrated efficient operating cost management and an increase in profitability, which is generally unusual for the utilities sector in an inflationary environment. In particular, the EBITDA margin increased noticeably (both YoY and sequential) to 55% in the recent quarter.

Valuation

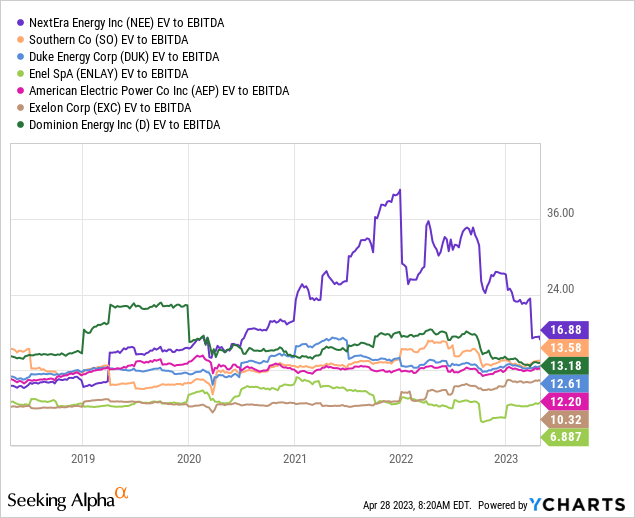

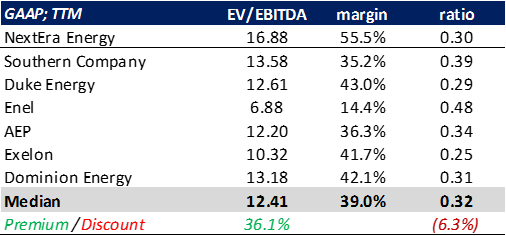

Looking at the valuation of the NEE stock in comparison to the peer group, the company is trading at the highest EV/EBITDA ratio of 16.9x.

The company is commanding leading profitability numbers on the EBITDA line (presented a bit later in the article) as well as has superior growth prospects, thanks to decent development and investment plans.

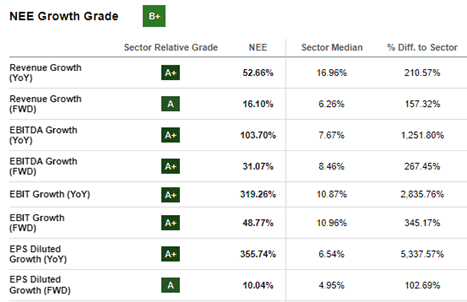

Growth profile (Seeking Alpha)

In my view, the EBITDA ratio is more suitable here than the Sales ratio, as a highly profitable business is a key feature in coping with a recessional environment. Indeed, NEE has a solid margin of safety in the event of a sales downturn due to a recession. Moreover, in the high-interest environment as well, the focus on growth instead of profitability may not work-out as it used to be with a low interest rate. In the meantime, the former (EBITDA ratio) provides a better reflection of the capital structure of a company, which matters in the case of a significant debt portion.

Now, the peer’s median EV/EBITDA multiple of 12.4x implies a 36% premium and could suggest a clear overvaluation of NEE stock. However, let’s take a look at the EBITDA ratio through the prism of profitability.

EV/EBITDA and EBITDA margin comparison (Seeking Alpha)

Summarizing the table above, NEE operates a 55% EBITDA margin, which is comfortably above the 39% level of the competition. Dividing the EV/EBITDA ratio on EBITDA margin, we may find an idea of how much you are paying for a unit of operating profitability. The result is a ratio of 0.30x which is even lower than the peer median level of 0.32x. This could suggest that NEE is trading at a 6.3% discount on EV/EBITDA compared to the selection when taking into account the profitability.

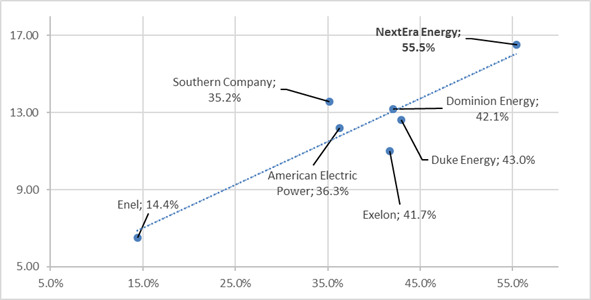

Let’s now put this on the scatter in order to get a more visual picture of how the NEE qualifies amid the peer selection.

EV/EBITDA scatter (Seeking Alpha; author’s estimates)

It is obvious that NextEra Energy is not so expensive. We could find the company’s spot in line with the trendline, which suggests that the 55% margin is justifying the company’s EV/EBITDA valuation at 17x. As a result, NEE appears to deserve at least a 30% premium to the competition.

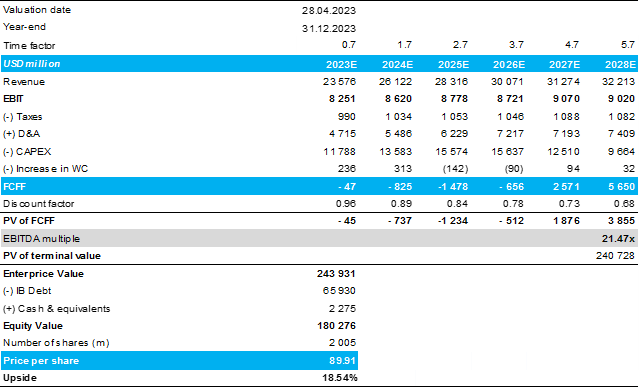

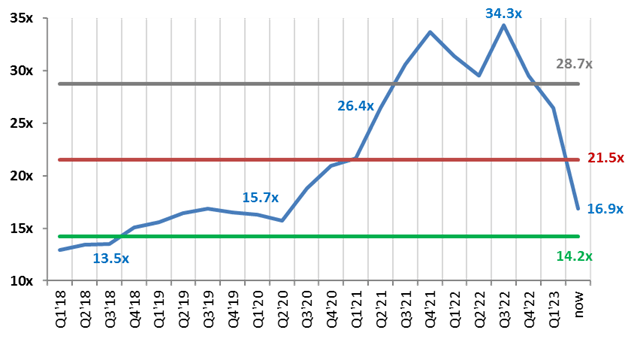

In terms of fair value determination, I decided to apply the DCF model with projections through FY2028 and incorporate a median EV/EBITDA over the last 5 years of 21.5x as the exit multiple. The model assumes a target capitalization of $180.3 billion, or $90 per share, which corresponds to an upside potential of 19% and a Buy rating.

DCF (author’s estimates)

Clearly, the model is highly sensitive to the terminal value, so let’s examine further. The current EV/EBITDA ratio of the company is well below the 5Y median level outlined in red in the following chart.

EV/EBITDA (Seeking Alpha)

The above line (gray line; one standard deviation above) stood at 28.7x level, and if incorporated as an exit multiple, the equity value should be $261.3 billion, or $130 per share, which implies a 71.8% upside potential. The green line is one standard deviation below the medium and represents the direction where NEE is clearly heading. However, in the future, I expect NextEra Energy to make a reversion to the median level, thanks to the favorable blend of utility and renewables prospects in between.

Risk factors

Although it is common for utilities to have high levels of debt due to infrastructure requirements, in the elevated interest rate environment, interest expense on this burden is increasing. The scenario of a deep recession in the US may also adversely affect the operating and financial results of NextEra Energy, as it could force the company to revise its ambitious plans for the introduction of renewable energy in the coming years.

Takeaway

I believe NextEra Energy stock is an attractive investment opportunity in the potential recession scenario as the company has the perfect combination of stable utility business to power the capital returns to shareholders, and prospective renewable energy operations to capitalize on clean energy initiatives. A sustainable growth in earnings and dividends could be a feature or a sample of predictability and quality that investors may want to lock in amid the recession. In the meantime, NEE’s renewables and storage backlog, along with a strong balance sheet to power further investments in a base rate expansion provides strong visibility of future growth. NEE is currently valued at a premium, which could be explained by high quality and stable earnings growth. But if we walk the valuation through the company’s profitability against the competition, a different story floats.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Investment Idea For A Potential Recession competition, which runs through April 28. This competition is open to all users and contributors; click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.