Summary:

- Intel suffered its worst-ever quarterly loss in the first quarter.

- Moderating growth in the PC market continues to have an outsized influence on Intel’s consumer-facing CCG group. The Data Center/AI business now also experiences a dramatic downturn.

- Intel’s valuation and risk profile remain unattractive to investors.

Justin Sullivan

Intel’s (NASDAQ:INTC) revenues continued to crash in the first-quarter as the chip maker contends with a major slowdown in demand, excess inventory and falling chip sales. Intel reported its largest-ever quarterly loss in the first-quarter as well and saw steep revenue declines in its Data Center business which until recently has proven to be more resilient and less exposed to the cyclicality inherent in the consumer-focused processor business. I believe the slowdown in Intel’s business could get worse before it gets better and Intel’s guidance for the second-quarter indicates that the chip maker doesn’t have much hope either that the situation is going to improve in the short term. For those reasons, I am reiterating my sell recommendation for Intel and believe that Intel might have to suspend its dividend entirely.

Massive slowdown in Intel’s core CCG unit, Data Center/AI units now also seeing growing business pressures

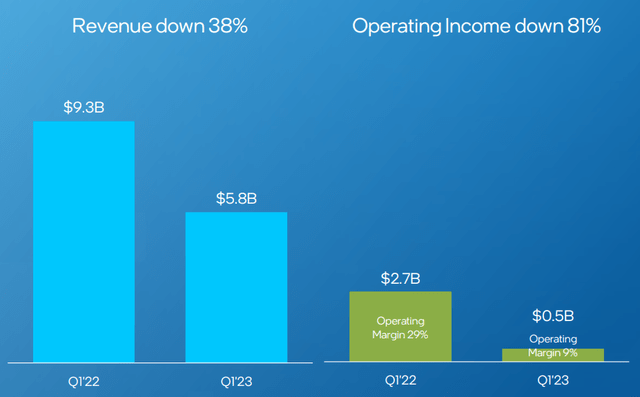

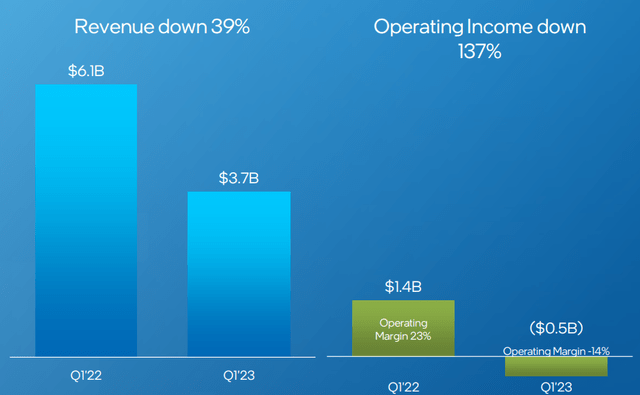

The Client Computing Group is Intel’s largest business unit, responsible for approximately 50% of revenues. The segment revenues declined 38% in Q1’23 due to a slowdown in consumer demand for new PCs and laptops, but weakness is also spreading to the more corporate-focused Data Center and AI business. This segment saw a revenue drop of 39% in the first-quarter and a huge contraction in its operating income margin. Overall, Intel’s total revenues fell 36% year over year to $11.7B as the industry continues to suffer both from weak demand as well as excess inventories. Consequently, with the two biggest business segments under growing pressure, Intel reported its largest-ever quarterly loss of $2.8B in Q1’23.

Intel’s commercial performance chiefly depends on the CCG business due to its large size. As I indicated in my work “Intel: Brace For More Pain After IDC Report“, PC shipments continued to decelerate sharply in the first-quarter. According to Gartner, global PC shipments declined 29% year over year in Q1’23 which continued to hurt Intel’s key operating metrics such as top line growth, but also operating income margins.

Intel’s CCG unit performance in Q1’23 implied a huge drop-off in operating income profitability, suggesting that the company is not going to see any relief in the short term. In Q1’23, Intel’s operating margin in the CCG segment dropped to 9%, compared to 29% in the year-earlier period.

Intel’s Data Center/AI business is starting to show extreme weakness as well as corporations cut back on IT investments. Intel’s new server chip Sapphire Rapids, for example, is said to be facing weaker than expected demand as Microsoft reduced its order volume between 50-70% for the second half of FY 2023. Weakness in Data Center/AI compounds Intel’s existing problems in the consumer-facing processor business and I expect this to heavily weigh on investor sentiment.

Intel’s Data Center/AI segment’s operating income margins in the first-quarter were (14)%, compared to 23% in the year-earlier period. Weakness in Data Center/AI resulted in a total negative operating income margin, on a consolidated level, of 12.5% (GAAP metric), compared to 23.7% in Q1’22.

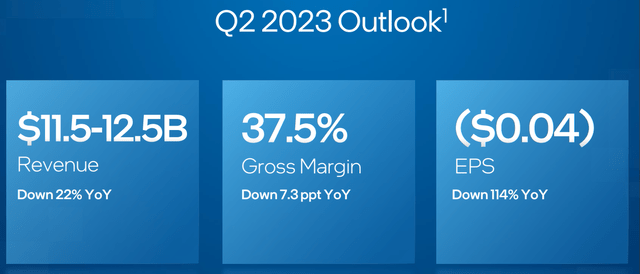

Light outlook for Q2’23

The outlook for Q2’23 is poor and Intel clearly has not seen the bottom yet regarding its top line contraction. For the second-quarter, Intel expects $11.5-12.5B in revenues, showing a decline of 22% year over year and the chip maker expects more losses as well.

Intel’s valuation

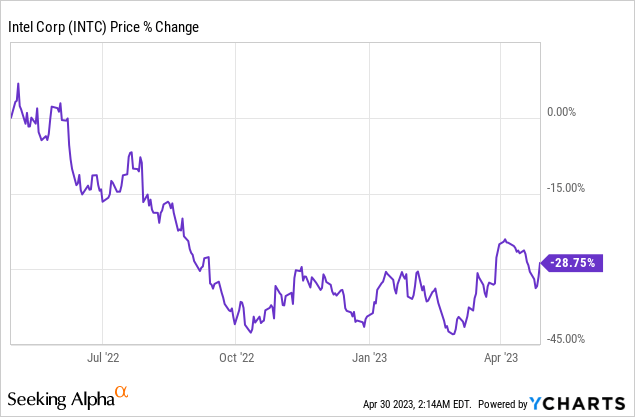

Shares of Intel have experienced a major revaluation to the down-side in the last year, declining 29% in the last twelve months. However, despite challenges in Intel’s core markets and a 66% dividend cut announced in the last quarter, Intel entered into a new up-leg lately that I believe is not sustainable… especially after Intel presented its first-quarter score card.

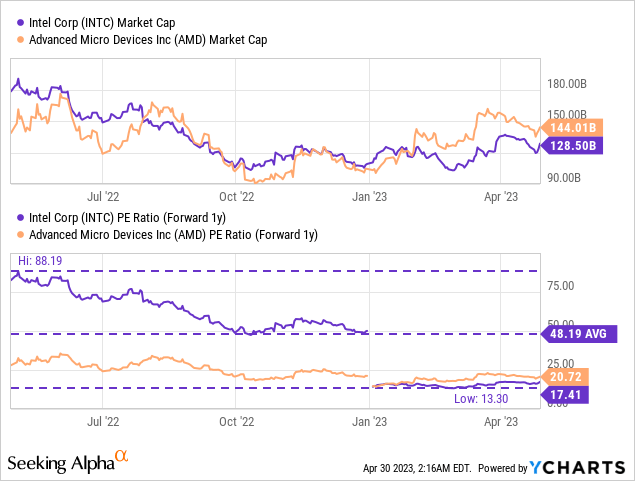

Intel currently presents a P/E ratio of 17.4X which is significantly below the 1-year average P/E ratio of 48.2X. Intel’s EPS estimates have also started to fall off dramatically as analysts don’t expect a fundamental improvement in operating metrics and performance in the near term. With shares trading at a 17.4X P/E ratio and EPS estimates continuing to trend down, I believe the risk profile remains highly unattractive.

Risks with Intel

The problem with Intel is that the company has exposure to the weak and cyclical consumer-facing processor business which is reeling from inventory build-ups. On top of that, Intel got some bad news from the server market which is where corporations cut back on spending, resulting in weaker than expected demand for core new server products, such as the Sapphire Rapids. Negative operating income margins in the Data Center/AI business are also concerning and they compound Intel’s existing problems in the Client Computing Group. In the worst-case, Intel may have to suspend its dividend altogether if it doesn’t get a grip on its profitability situation.

Final thoughts

Intel’s first-quarter performance was bad, but it may get worse for the chip maker as there are no signs in the consumer processor market that show that the situation is improving. The new headache is the Data Center business which is seeing weaker demand, steep revenue declines and negative operating income margins.

The guidance for Q2’23 also disappointed and showed that Intel’s operating performance is not set to improve in the current quarter either. Therefore, I believe that Intel’s share price hasn’t bottomed yet and that dividend risks remain high. If PC shipments continue to decelerate in the second-quarter, investors must expect new rounds of EPS down-ward revisions which could weigh on Intel’s valuation factor.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.