Elliott Management is preparing to appoint Rothschild to act as an independent adviser on its options to take its bookstore chain assets public, according to Sky News. An IPO of the company that owns the UK-based Waterstones bookstore chain and the U.S.-based Barnes & Noble is reported to be likely to take place as soon as the second quarter of this year.

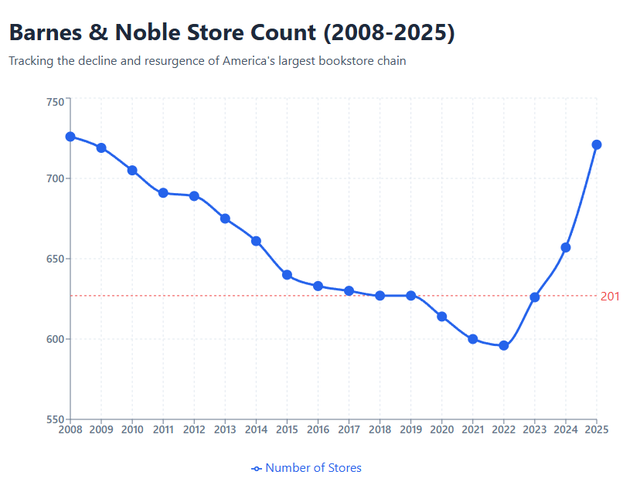

Looking back, Elliott Management acquired Waterstones in 2018 and then bought Barnes & Noble in 2019, with both operating independently but under common ownership and leadership by James Daunt. Notably, Barnes & Noble has made a roaring comeback in the U.S. and is opening stores as its strategy of getting back to the basics pays off. After bottoming out around 600 stores, Barnes & Noble opened approximately 30 new stores in 2023, 61 in 2024, and 67 in 2025. As of November 25, there were 721 Barnes & Noble locations. The company plans to open 60 additional stores in 2026.

Seeking Alpha

For its part, Waterstones operates roughly 300 physical bookshops, with most in the UK and Ireland and a small presence in Amsterdam and Brussels. Similar to Barnes & Noble, the chain is generally popular with consumers and scores high on loyalty due to its in-store experience.

The return to prominence or survival of both bookstore chains is satisfying to some consumers who did not buy into the “Death by Amazon” thesis that was once popular.

The Barnes & Noble bookstore chain is no longer related to Barnes & Noble Education (BNED), which is a college bookstore business and education solutions provider only.