Summary:

- Amazon’s Q1 reporting was solid, but AWS commentary clearly disappointed, challenging the growth narrative.

- Accumulating $4.8 billion of operating income vs a ~$1.1 trillion market cap, Amazon lacks the attraction of a value stock.

- Reflecting on Q1, I see sharply slowing growth across segments, a lack of profitability on a group level, and a still clouded macroeconomic outlook.

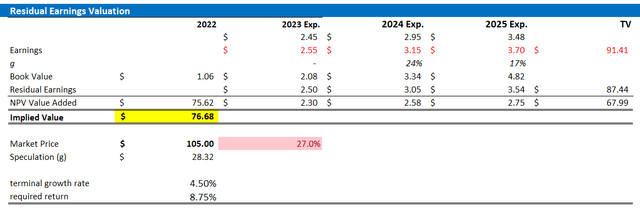

- I reiterate a “Sell” rating for Amazon stock, although I raise my base case target price to $76.68/ share.

HJBC

Amazon (NASDAQ:AMZN) posted a solid Q1 performance that initially prompted the stock to jump as much as 12% in afterhours trading. However, as expected, investors eventually turned bearish following management commentary on a softer than expected environment for cloud computing, implying that the AWS business’ growth could slow to 16% YoY growth rates in Q2. With AWS growth slowing, paired with lack of group profitability and broader macroeconomic concerns, the e-commerce giant’s equity is a super difficult investment pitch.

I remain bearish on Amazon and continue to assign a ‘Sell’ recommendation. However, reflecting on Amazon’s incremental shift towards a more reasonable growth strategy that is also anchored on profitability considerations, I raise my EPS expectations for AMZN through 2025; and I update my target price to $76.68/ share.

Amazon’s Q1 2023 Results

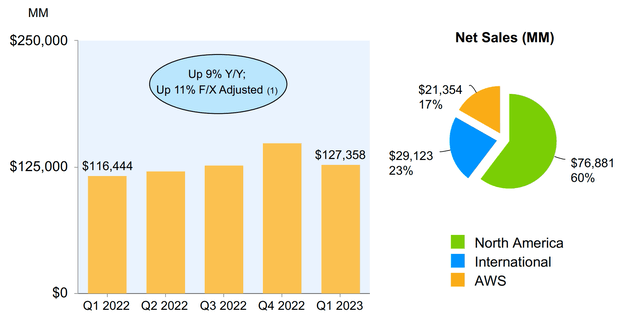

On Thursday 27th after market close, Amazon reported results for the Q1 2023 period, outperforming analyst expectations with regards to both topline and earnings. During the period from January to end of March, Amazon generate group revenues of $127.4 billion, up 9% YoY as compared to $116.4 billion in first quarter 2022, and topping analyst consensus estimates by close to $2.75 billion. Excluding the unfavorable impact of approximately $2.4 billion as a consequence of foreign exchange rate fluctuations, net sales would have increased by ~11% YoY.

With regards to profitability, Amazon’s operating income, which includes about $500 million of severance costs, came in at about $4.8 billion, versus $3.7 billion for the same period one year prior (up about 30% YoY); net income came in at $3.2 billion ($0.31/share), beating estimates by ~$800 million.

According to management commentary provided in the earnings call, Amazon executive have seen a stabilization in international markets, particularly in Europe, where inflation pressures have eased and the economy has started to grow again. In the U.S., however, both e-commerce and AWS customers are increasingly focusing on attractive value-for-price opportunities, pressuring profit margins. With regards to potential cost efficiency, and in addition to the layoffs already announced, Amazon highlighted increased profitability anchored on the introduction of a decentralized fulfillment model, which has eight interconnected regions across the U.S., resulting in faster and more cost-effective delivery services for customers.

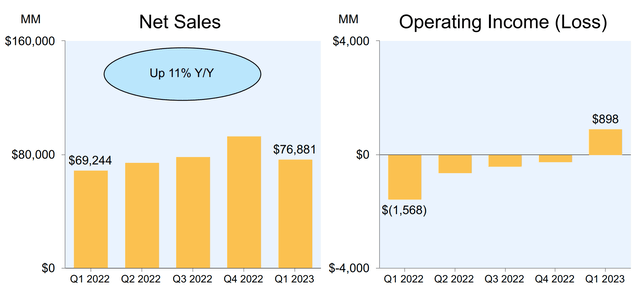

Zooming into Amazon’s operating segments, the North America segment increased sales by about 11% YoY, to $76.9 billion. Operating income was $0.9 billion (finally green numbers), versus an operating loss of $1.6 billion for the same period in 2022.

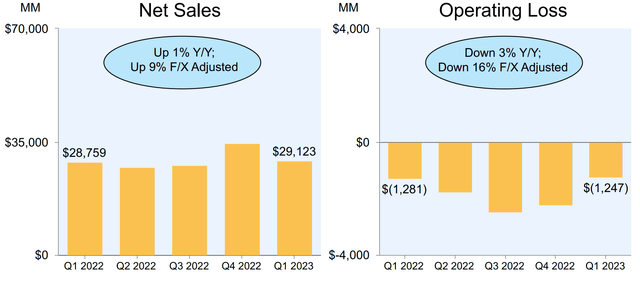

The International segment increased sales by only 1% YoY, to $ 29.1 billion, while the segment’s operating loss only narrowed slightly, to a loss of 1.3 billion in the first quarter 2023.

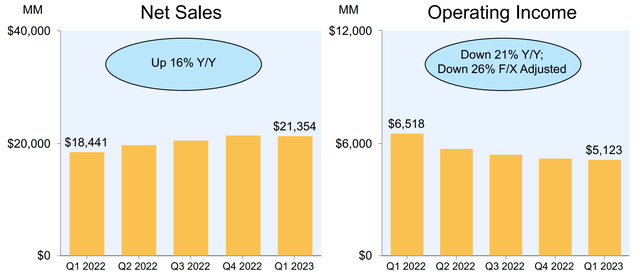

Growth for the AWS segment slowed sharply, as sales increased by only 16% YoY, to $21.4 billion. Likewise, also AWS segment operating income disappointed at $5.1 billion (mid-20% operating margin), compared to $6.5 billion in Q1 2022 (mid-30% operating margin). In the call with analysts, Amazon management highlighted that the company has been ‘supporting’ AWS customers in managing costs (which is fancy expression for Amazon saying that AWS offered discounts and incentives).

Not a growth company’s typical guidance

Amazon has provided guidance for the second quarter of 2023, which, although solid, clearly lacks growth or profitability expansion that a growth company should bring to the table. Amazon’s group net sales are expected to grow between 5% and 10% YoY only, to an estimated range of approximately $127 billion to $133 billion (with Q2 mid-point guidance projecting a flat quarter vs Q1). Operating income for the March quarter is expected to be somewhere between $2.0 billion and $5.5 billion, potentially losing profitability as compared to the $3.3 billion reported in the second quarter of 2022 and the $4.8 billion reported in Q1 2023.

Most disappointing are Amazon’s projections with regards to the AWS segment, where growth is expected to drop further, to 11% YoY. Amazon’s Brian Olsavsky commented that AWS ‘customers of all sizes in all industries’ are trying to save costs, and ‘these optimizations continuing into the second quarter’ could likely pressure both growth and profitability margins by 500 basis points.

Valuation Update: Raise TP

Amazon’s slowing growth is well noted; but so is the conglomerates ambition to cut costs across units. Reflecting on Amazon’s incremental shift towards a more reasonable growth strategy that is also anchored on profitability considerations, I raise my EPS expectations for AMZN through 2025: I now estimate that Amazon’s EPS in 2023 will likely expand to somewhere between $2.2 and $2.7. Likewise, I also raise my EPS expectations for 2024 and 2025, to $3.15 and $3.7, respectively.

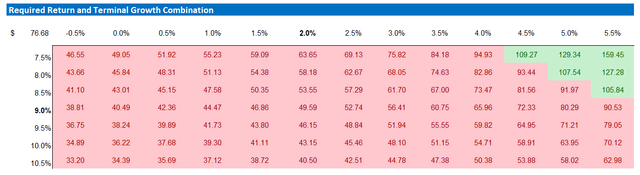

I continue to anchor on a 4.5% terminal growth rate (still giving Amazon a growth premium versus the broader economy), as well as an 8.75% cost of equity (risk discount versus the market)

Given the EPS updates as highlighted below, I now calculate a fair implied share price for Amazon of equal to $76.68, versus $70.65 previously.

Author’s EPS Estimates and Calculations

Below is also the updated sensitivity table.

Author’s EPS Estimates and Calculations

Risks

As a counter-thesis against my bearish arguments, I would like to highlight what I have written before:

There are two risks to point out. First, betting against Amazon is hardly ever a smart move – or at least it has not been in the past. Despite the short-term headwinds Amazon remains one of the best managed companies in the world, and the long-term outlook for the e-commerce giant remains bright. Second, investors should consider that Amazon frequently misses earnings estimates (less so revenues) and the market does not very much care. Arguably, Amazon has taught its investors to look past short-term accounting and profitability targets. And accordingly, the (expected) earnings miss may fail to materialize a stock sell-off.

Conclusion

Amazon reported better than expected Q1 2023 estimates, but clearly missed investors’ expectations for Q2, especially with regards to AWS topline and profitability. Accordingly, the Amazon equity story continues to be a difficult pitch, with the narrative being pressured by multiple headwinds, most notably: sharply slowing growth across business segments, lack of profitability on group level, and a still clouded macroeconomic outlook.

Personally, I estimate that Amazon stock should be priced at approximately $76.68/ share. I base my argument on a residual earnings framework, which is anchored on updated EPS estimates, an 8.75% cost of equity and a 4.5% terminal growth rate. Notably, as compared to my prior valuation, I have materially raised EPS expectations through 2025. But Amazon still looks overvalued, compared to reasonable growth and profitability estimates. Reiterate ‘Sell’ rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice; this article is market commentary and a reflection of the author's opinion only.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.