Summary:

- Meta Platforms has seen a massive recovery in its share price not backed by fundamentals.

- The company continues to generate $16 billion in losses from Realty Labs and a 25x P/E ratio that doesn’t generate strong returns.

- The company’s margins have decreased in key markets, as the company’s growth no longer keeps up with inflation, showing its long-term weakness.

Derick Hudson

Meta Platforms (NASDAQ:META) has seen its share price rocket up. That’s a continuation of a strong recovery in the company’s share prices from lows of just over $90 per share. The company remains almost 40% below all-time highs, which is quite impressive overall. As we’ll see throughout this article, Meta is overvalued with a poor ability to drive shareholder returns.

Meta Platforms Financial Performance

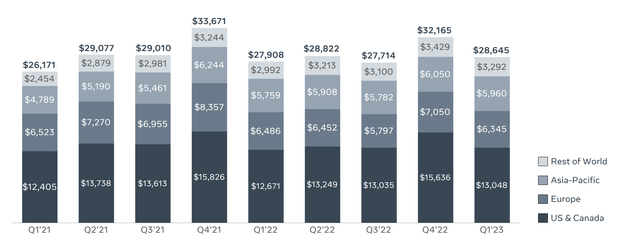

The company had reasonable financial performance for the quarter, with a 3% YoY revenue growth rate.

Meta Platforms Investor Presentation

However, that’s insufficient to line up with inflation growth. It also represents a substantial decline in the company’s prior YoY growth rate. The company’s Europe revenue decreased YoY and has remained weak, indicating to us that the company’s penetration and revenue from this market has capped out. We expect revenue here to remain volatile but low.

In the US & Canada the company managed to grow revenue, however, in other markets, the company’s revenue growth seems to have petered out especially in some growth markets. The company’s Asia-Pacific revenue increased by 3-4% while Rest of the World income increased by 9%. This indicates continued growth in the Rest of the World but weakness in the Asia Pacific market.

Still, there’s a benefit to the company’s revenue remaining relatively strong.

Meta Platforms Expenses

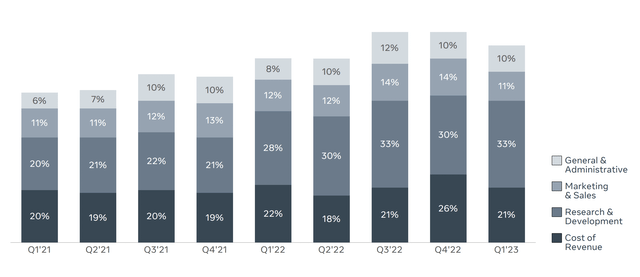

Meta Platforms expenses have continued to remain high. The company’s 1Q 23 revenue hit a massive 75% versus a more normal 1Q 21 level of 57%, that would be even lower without Reality Labs.

Meta Platforms Investor Presentation

The company’s Cost of Revenue and Marketing & Sales expenses have remained roughly constant. The company’s G&A expenses also remain higher versus 2 years, ago but remain fairly constant. Where the company’s costs have swelled is R&D revenue. That has gone from 20% of the company’s revenue to 33%, and shows no signs of slowing down.

Our view is that a true R&D focused revenue for the company not counting Reality Labs could be much closer to 15%.

Meta Platforms Active Users

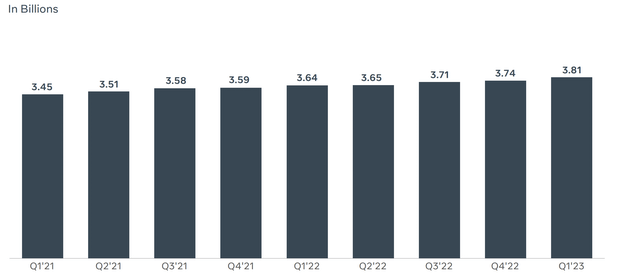

The company’s active users have continued to tick up, although the last quarter of the year is normally the company’s strongest.

Meta Platforms Investor Presentation

The company had 3.81 billion monthly active users across its properties. Daily active users remained strong as well across the portfolio, allowing the company to see growth on both segments. The company’s ARPP (average revenue per person) decreased slightly, partially due to a mixed diversification in users as the user count in Europe declined.

There is one concern here. Previously, the company had the benefits of lower fixed costs, increased user count, and increased revenue per user as a triple whammy to increase profits. With the loss of margin improvements and the loss of increased revenue per user, the company’s ability to continue improving revenues declines substantially.

Our View

At the end of the day, what matters for Meta Platforms investors is whether they can drive profits.

Meta Platforms Investor Presentation

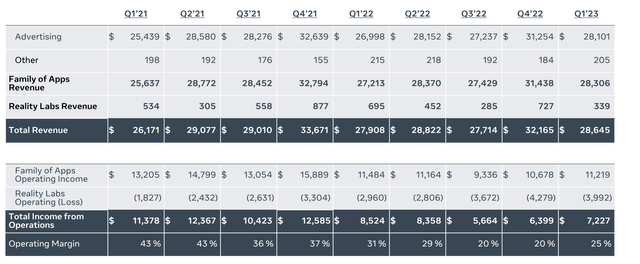

The company’s revenue did improve YoY, while the company’s operating income decreased slightly. The impact of Reality Labs decreased QoQ but was still up massively YoY, resulting in just over $7 billion in operating income. At the end of the day, the company earned just under $6 billion in net income, giving the company a P/E ratio in the mid-20s.

The company still has no indication to long-term profits from Reality Labs. Reality Labs revenue in the quarter was $339 million, down 50% YoY. Apple is rumored to be entering the market. That could continue to put pressure on the company’s future earnings. At this time we don’t see any reasonable way for Reality Labs to pay off despite its $16 billion annualized profit hit.

Mark Zuckerberg, with his strong ownership stake in Meta Platforms, isn’t interested in giving up on Reality Labs. More importantly, Meta Platforms anti-trust pressure means it’s much harder for the company to grow its business from something that it doesn’t create, from scratch on its own.

Thesis Risk

The largest risk to our thesis is a complete revamp in the company’s goals and a new focus on a project that has a much higher chance of increasing long-term earnings. The company’s core business is a massive profit machine generating billions in FCF. The company can aggressively repurchase shares and drive returns. If it doesn’t, however, we expect it to continue to suffer.

Conclusion

It’s tough to recommend against investing in Meta Platforms. The company has an incredibly strong core business with the ability to generate substantial profits. From that, the company has historic cash flow generation and it has set itself up to be able to drive substantial shareholder returns. However, instead it’s decided to use all that cash flow on a dream.

Reality Labs is costing the company $16 billion annualized. Revenue has declined substantially YoY from the division. Mark Zuckerberg’s control over the company means that investors can’t stop the investments in Reality Labs. Until that changes, we see the company’s valuation as having run away, making it a poor investment.

The company doesn’t have any other current alternatives to invest and handle anti-trust increasing the risk it waists its investments. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get one chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.