Summary:

- Microsoft communicated a strong start into 2023, beating analyst consensus estimates with regard to both revenue and earnings.

- The better-than-expected earnings numbers were driven mostly by cost rationalization but also a recovering ad market.

- MSFT will likely continue to enjoy the tailwind of a strengthening AI and cloud business outlook going into Q2 and beyond.

- Reflecting on a rich valuation of close to x30 FWD P/E, I reiterate a “Hold” rating for Microsoft Corporation; I raise my TP to $290.20/ share.

FinkAvenue

Microsoft (NASDAQ:MSFT) delivered a stronger than expected FY23 Q3 report, easily topping analyst estimates with regards to both topline and earnings. In my opinion, MSFT’s earnings beat highlights the company’s business model resilience amidst a challenging macro, while strong early metrics relating to MSFT AI adoption point to evident leadership in a vertical that is very likely to become the key growth tailwind for the coming decade(s). Accordingly, it is very easy to pitch the MSFT bull case on a long-term basis. But a x25 P/E, x11 P/B and x11 P/S valuation might suggest that tactical patience could be a sensible investment strategy.

Reflecting on Microsoft’s strong earnings report, paired with a commitment to OPEX discipline, investment in AI, as well as an accelerating cloud business, I revise my EPS projections for MSFT until 2025; and I now calculate a fair implied target price of $290.2/ share.

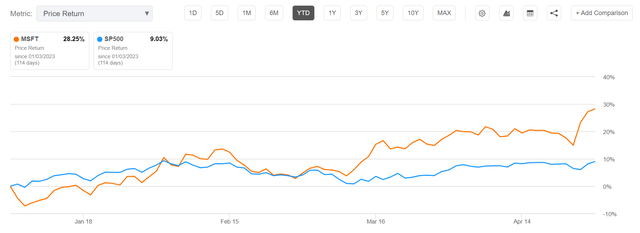

For reference, Microsoft stock is nicely outperforming the broader market YTD by a factor of almost x3. Since the start of 2023, MSFT shares are up close to 30%, versus a gain of less than 10% for the S&P 500 (SPY).

MSFT’s Q3 2023 Performance

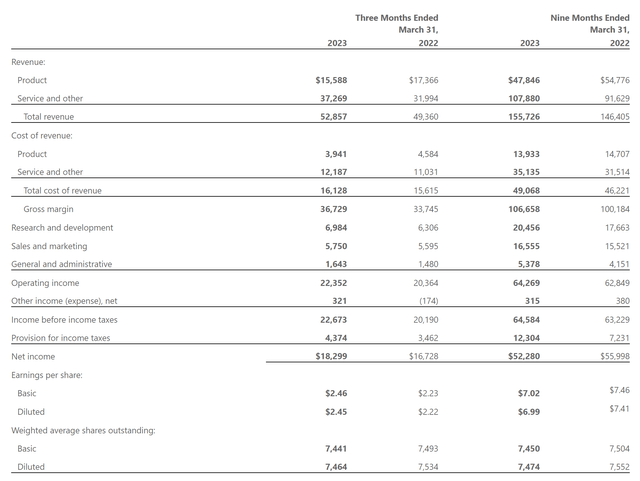

On Tuesday 25th after market close, Microsoft opened its books for the FY23 Q3 period, and communicated a resilient start into 2023, beating analyst consensus estimates with regards to both revenue and earnings. During the period from January to end of March, the software/ tech giant generated revenues of $52.9 billion, up from $49.36 billion for the same period in 2022 (~3% YoY growth), and materially above the $51.8 billion expected by analysts (~$1.8 billion beat).

With regards to profitability, Microsoft’s operating profit was reported at $22.4 billion, increasing about 10% YoY; Post-tax net income came in at $18.3 billion ($2.46/ share), up about 10% YoY, and beating analysts’ estimates by close to ~$2 billion.

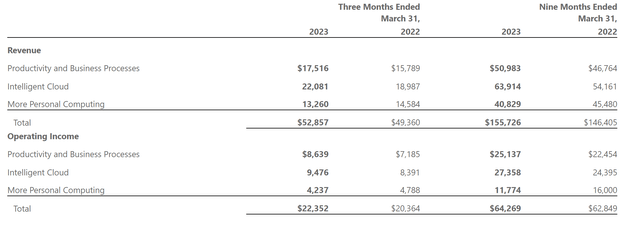

Microsoft’s earnings beat was supported by a solid performance across all the company’s operating segments:

- Microsoft’s revenue in ‘Productivity and Business Processes’ was $17.5 billion, an increase of 11% YoY. Office 365 Commercial revenue grew by 14% YoY, while Dynamics 365 revenue increased by 25%.

- In the Intelligent Cloud segment, Microsoft’s revenue was $22.1 billion, up 16% YoY. Azure and other cloud services revenue grew by 27%.

- Revenue in Microsoft’s ‘More Personal Computing’ decreased (down 9% YoY), primarily due to lower sales in Windows OEM and Devices, which was partially offset by growth in Windows Commercial and Xbox content and services (up 14% YoY).

Specifically, I would like to direct your attention to MSFT’s cloud business, in more detail: Despite facing macro headwinds (referencing’s AWS’ sharp business slowdown), Microsoft’s topline from server products and cloud services grew by 17% YoY (or 21% in constant currency), and MSFT’s Azure business jumped 27 YoY (or 31% in constant currency).

Reflecting on a strong FY23 Q3 reporting, MSFT’S CEO and chairman Satya Nadella commented:

The world’s most advanced AI models are coming together with the world’s most universal user interface – natural language – to create a new era of computing …

Across the Microsoft Cloud, we are the platform of choice to help customers get the most value out of their digital spend and innovate for this next generation of AI.

A Look into FY23 Q4

Despite facing macro pressures, the company has provided guidance for the fourth quarter that surpasses expectations, and, in my opinion, the management’s outlook is generally more positive compared to the previous earnings call.

Much of MSFT’s earnings call with analysts centered around AI, with AI-related keywords and topics being reference more than 50 times. In general, Microsoft highlighted the positive impact of generative AI, expressing excitement about the early feedback and growing demand for the AI capabilities/ products and services the company has already introduced. In the Q3 quarter, for reference, Microsoft noted a surge in demand for its OpenAI Azure Services offering, which now serves approximately 2,500 customers, a tenfold increase from the Q2 quarter. Looking into FY23 Q4, while Azure’s growth rate is expected to slow down to 20% in the fourth quarter, the demand for AI infrastructure is proving to be a growth catalyst, as Azure AI Services alone is expected to contribute one percentage point to the company’s topline, which translates to approximately $150 million in revenue.

Microsoft guided FYQ4 revenues in the range of $54.9 billion to 55.9 billion, which would reflect a QoQ growth of approximately 4% to 6%. EPS are guided at around $2.56, which implies that Microsoft remains on track for a FY23 double-digit percentage earnings expansion.

Valuation Update – Raise Target Price

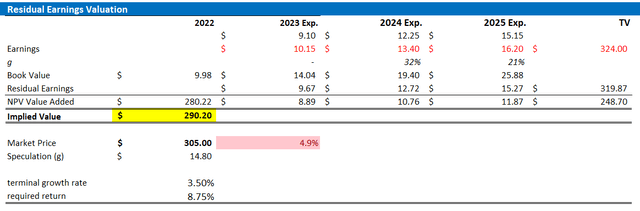

Accounting for Microsoft’s FY23 Q3 earnings beat and strong management commentary, I update my EPS expectations for MSFT through 2025: I now estimate that the tech giant’s EPS in 2023 will likely end up somewhere between $10.0 and $10.3, as compared to $9.1 prior. Moreover, I also adjust and raise my EPS expectations for 2024 and 2025, to $13.4 and $16.2, respectively.

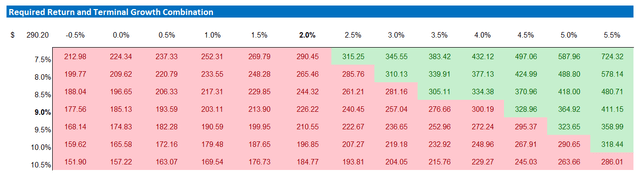

I continue to anchor on a 3.5% terminal growth rate (one percentage point higher than estimated nominal global GDP growth), as well as on a 8.75% cost of equity (discount to market).

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price for MSFT equal to $290.20/ share.

Author’s EPS Estimates; Author’s Calculations

Below is the updated sensitivity table.

Author’s EPS Estimates; Author’s Calculations

Conclusion

Microsoft’s stronger than expected FY23 Q3 report highlights that the diversified IT mega-vendor continues to be well positioned to capitalize on the favorable demand tailwind for digital transformation and cloud adoption, even amidst macroeconomic pressure. And reflecting on the emerging commercial opportunities for AI applications, I have little doubt that MSFT’s growth is poised to re-accelerate soon (double-digit topline and earnings expansion in FY2024 looks very achievable).

Post FY23 Q3, I update my EPS expectations for MSFT through 2025; and I now calculate a fair implied target price of $290.20/ share. As a function of valuation, I reiterate a ‘Hold’ recommendation. But I am advocating to ‘Buy’ MSFT on any reasonable dip.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advice; this article is market commentary and a reflection of the author's opinion only.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.