Summary:

- AOS is a global leader in manufacturing residential and commercial water heating equipment, boilers and water treatment products.

- With the stable business model, potential catalysts, healthy balance sheet and solid dividend grades, AOS can be labeled as a high-quality dividend growth stock.

- Based on my own discounted cash flow analysis, the fair value of AOS stock is $62.88 per share, which is 8.4% overvalued.

- Turbulence in the US housing market, limited growth in China and volatile steel prices can create some better buying opportunities compared to the current share price.

DKosig

Investment thesis

As a dividend growth investor I tend to look at companies that pay a reliable growing dividend. A. O. Smith Corporation (NYSE:AOS) is a darling in the dividend growth community because of its dividend aristocrat status. AOS pays a dividend every year since 1940 and has managed to grow its dividend for 30 consecutive years. In my opinion AOS has the capability to be a cornerstone in a high-quality dividend growth stock portfolio. AOS is one of my largest holdings and I am going to explain why you need to consider AOS as a holding in your own dividend portfolio. We’re going to take a deep dive into the financials and dividend metrics. And last but not least, we’re going to determine the fair value of AOS with discounted cash flow analysis, which shows that the current share price is on the expensive side.

Company overview

AOS is a global leader in manufacturing residential and commercial water heating equipment and boilers. They’re also a manufacturer of water treatment products for residential and light commercial applications. The company has its headquarters in Milwaukee (USA) and has approximately 12000 employees in the US, Canada, China, India, Mexico, the Netherlands, Turkey, the UK and Vietnam.

AOS is involved in a variety of end-markets:

- Water heaters: electric and natural gas, heat pump and solar tank units.

- Boilers.

- Water treatment products.

- Expansion tanks, commercial solar water heating systems, swimming pool and spa heaters, related products and parts.

The company states that they are the largest manufacturer of water heaters in North America in the residential and commercial segment of the market. In 2022, 74% of the total revenue came from the US. What I really like as an investor is that 80-85% of the sales is derived from the replacement of existing products, which creates a lot of stability. The sales in the rest of the world accounts for 26% of the total sales. The majority comes from China. Also Europe, middle east, Hong Kong and Vietnam accounts for 13% of total sales.

There are some potential catalysts for AOS to mention. The increased focus on energy efficiency and decarbonisation as a part of the “Green deal” can provide additional growth opportunities in both boilers and water heaters, especially if AOS keeps developing new and innovative products. Also their presence in India can be a main growth driver in the coming years. In 2022 AOS had a 28% growth in local currency in India from both water heating- and water treatment products.

2023 plans and capital allocation priorities

In the AOS Q4’2022 earnings presentation the company has described their path to further growth:

- Further expansion of their energy-efficient product portfolio, such as a new residential pump water heater (VOLTEX). This is in line with the megatrend to reduce our carbon footprint and movement towards “clean and green”.

- Global expansion of their water treatment business. Consumers tend to be more focused towards clean drinking water and AOS wants to increase market share in this segment as well.

- AOS has a lot of cash on hand, so there is always a possibility to do an acquisition in times of economic uncertainties, which can lead to excellent opportunities and possible favourable shareholder returns.

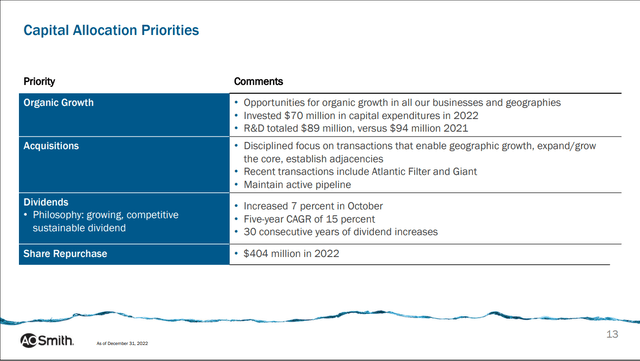

In the Q4-2022 investor presentation, AOS showed a summary of their capital allocation priorities.

Capital allocation strategy (Q4-2022 investor presentation)

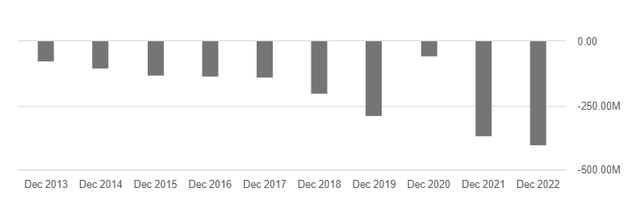

It’s good to see that the company gave us a clear overview of their strategy. At the moment I see AOS more as a dividend growth stock that learns more towards growth. They clearly priorities organic growth in all their business segments and growth as a result of acquisitions. This should result in rising profits, resulting in a growing dividend. They also do share repurchases over time. In 2013 AOS had a total amount of 182.5 million outstanding. The total amount of shares decreased to 151.2 million in FY 2022 at an accelerating pace.

Capital allocated to share repurchases (Seeking Alpha )

Especially the last 2 years they did a large amount of buybacks ($770 million). Year 2020 was an outlier. The main reason for that was a debt repayment.

Financials

Income statement

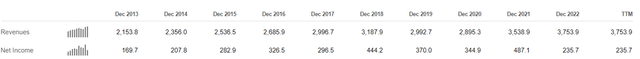

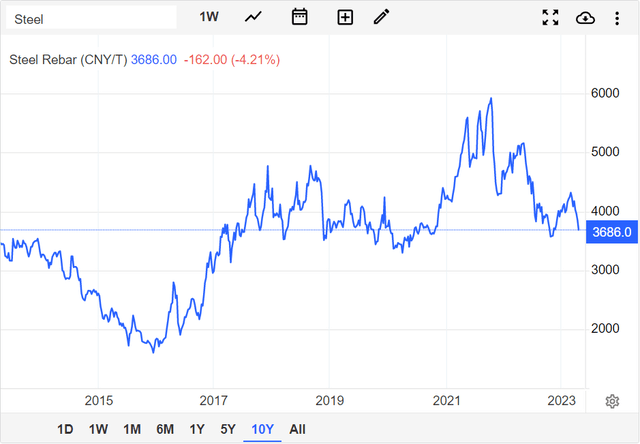

From the last 10 years AOS has managed to grow its revenue at a steady pace from $2153.8 million to $3753.9 million (Dec 2013 to Dec 2022). Also the net income is growing nicely over time. There is a big difference between FY 2021 and FY 2022, where the net income almost halved. This is mainly because there was an increase in raw material (especially steel) and transportation costs and challenges in the supply chain. This had a large impact on their profitability. At the moment AOS has a EBITDA margin of 7.75%, which is way lower than their own 5-year average of 18.71%.However, I think this effect is temporary. The company itself also sees improvement in supply chain and a decrease in steel prices.

Revenue vs Net income (Seeking Alpha)

Balance Sheet

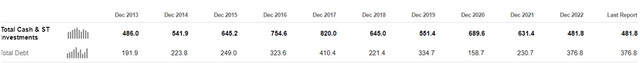

I like the balance sheet of AOS a lot. In FY 2022 they had a total of $391.2 million in cash on hand and a total of $90.6 million in short term investments, which also can be turned into cash in the short-term (3 months to 1 year). AOS has a total debt of $376.8 million and a net debt of minus $105 million. To have more cash than debt is a very good situation to be in. It provides a safety cushion for potential economic headwinds and also fits their goal to do acquisitions when they see an opportunity. This FY is no exception, because in the last 10 years AOS always had a healthy amount of cash on their side compared to their debt. AOS doesn’t have a Moody’s or S&P credit rating, but I think it’s safe to say that the company is in a healthy financial condition.

Total cash vs total Debt (Seeking Alpha)

Outlook & latest quarterly report

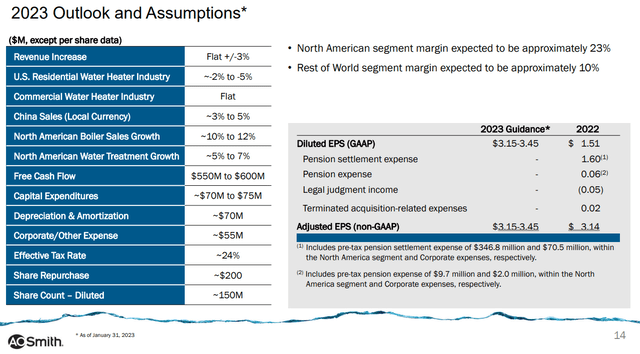

For FY 2023 AOS expects their revenue to be flat to +/- 3% compared to FY 2022. They also expect significant growth in boiler sales (10-12%) and water treatment products (5-7%).The estimated amount of free cash flow ($550-$600 million) is also way higher compared to the previous FY. This should be a result from enhanced margins. So a significant increase in profitability can be expected in FY 2023.

Outlook and Assumptions 2023 (AOS investor presentation Q4-2022)

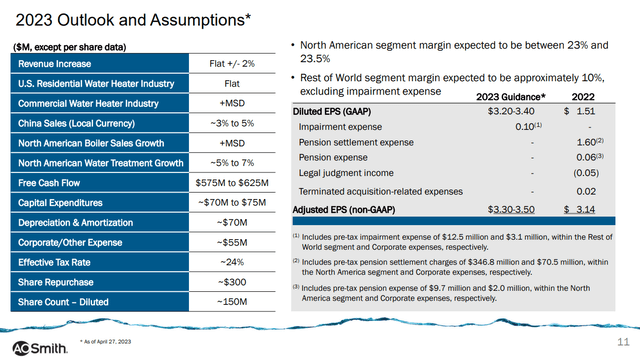

The increase in free cash flow is already visible in the Q1’23 report from AOS, as they beat analyst expectations once again (Non-GAAP EPS of $0.94 beats by $0.16). Compared to Q1’22 the free cash flow has increased from $4 million to $109 million. The results were driven by higher water heater volumes and lower steel costs in the North American segment. The results in “the rest of the world” segment were far worse due to lower consumer demand in China. Nonetheless, they expect that the situation there will improve in the second half of FY 2023. Sales in India grew 28%, which is a good thing to see.

Outlook and Assumptions 2023 (AOS investor presentation Q1-2023)

Comparing the two slides from above we can see that AOS also raises their 2023 outlook (Adjusted EPS non-GAAP $3.15-3.45 to $3.30-$3.50) . They expect even better margins in the North American segment. The expected free cash flow will be in a higher range, from $550-$600 million to $575-625 million, and AOS intends to increase their share buyback program from $200 million to $300 million. From an investor point of view it’s always nice to see an increase in returning cash to shareholders in the form of share buybacks. Especially when the company is undervalued, later in the article we will see if that’s actually the case.

Dividend

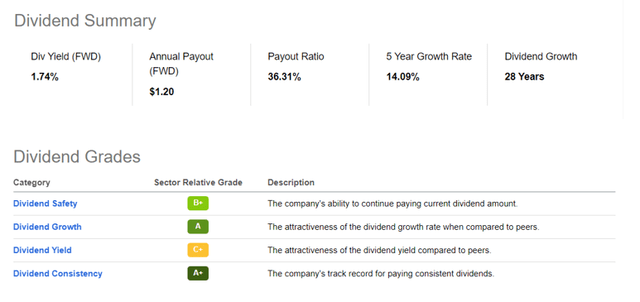

Analysing the dividend the categories from the Seeking Alpha dividend Scorecard were used.

Dividend Grades (Seeking Alpha)

Dividend yield and growth

At the current share price the dividend yield is 1.74%, which comes close to its own 5 year average of 1.78%. For the average income investor this is on the low side, but if we look at the dividend growth there is definitely more to like. AOS has a 10-year dividend growth rate (CAGR) of 19.83%, which is impressive. However, it seems like that the growth rate is in a decline, with a 5-year dividend CAGR of 14.09% and a 3-year dividend CAGR of 8.09%. I think this makes sense, because in the last three years their earnings weren’t growing as fast compared to the years before. Based on my own expectations I think the future dividend hikes will be in line with the 3-year CAGR and can be dependent on the possible headwinds, which will be discussed later in the article.

Dividend Safety and Consistency

The dividend of AOS is considered to be safe, with a dividend payout ratio of 36.31%. AOS is also well capable to pay the dividend from their free cash flow. If we divide the annual dividend payout in FY 2022 of ($1.14) to the free cash flow per share ($2.07), this comes down to 55.07%, which is still well covered. Especially if we consider 2022 is a relative weak FY from a free cash flow point of view. Based on the percentages and the outlook of the company it’s very likely that they are able to grow the dividend at a steady pace.

Valuation

Based on the potential catalysts , financial metrics and dividend grades there is a lot to like about AOS. But is the current share price a good reflection of the company’s value? To determine the value of the company discounted cash flow analysis has been used.

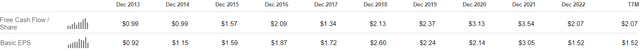

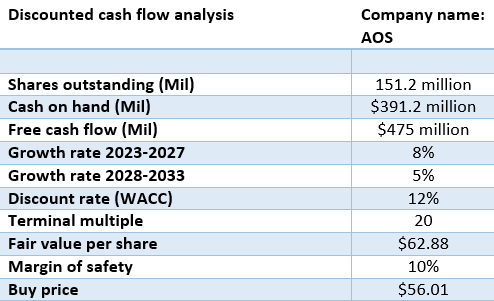

2022 FY free cash flow is $321.1 million I think it’s not fair to use this number because it’s way too low compared to the previous two years and to their own 2023 FY outlook of $550-$600m in free cash flow. Due to the fact that I see some possible headwinds for the short- term I did my calculations with a free cash flow of $475 million.

The 10- year free cash flow growth rate (CAGR) of AOS was 7.65%. This is based on the free cash flow per share of $0.99 in FY 2013 to $2.07 per share in FY 2022.

Free cash flow growth vs basic EPS growth (Seeking Alpha)

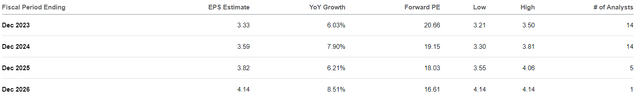

As you can see, the free cash flow growth over the years is choppy, AOS is a cyclical company after all. So we can say that the 7.65% is a quite conservative number, because the 9-year free cash flow CAGR (dec 2013 – dec 2021) would be 15.21%. Based on analysts’ expectations the future EPS growth for the coming years will be in the 6-8.51% range.

For my own analysis I used a 5- year growth rate of 8% and for the 5 years thereafter I used a growth rate of 5% because it’s harder to make accurate assumptions over longer periods of time. I used a terminal multiple of 20 because AOS is a high quality company and has a 5-Year average PE of 25.60. I used a discount rate of 12%, because I want a return on my investment around 12% per year. This comes to a fair value of $62.88 per share. If we subtract a margin of safety of 10% the buy price will be $56.59 per share. At the moment the share price of AOS Is $68.15. Compared to my fair value it is 8.4% overvalued.

Discounted cash flow analysis (My own Google spread sheet)

Short-term risks

There are some potential risks to consider before investing in AOS.

A possible recession or further decline of the global economy, especially in the US, will affect consumer spending and can have a significant impact on the earnings of AOS. Buying a new water heater can be a large investment in times of economic uncertainty. In that case it is likely that consumers will postpone their purchases. AOS is also dependent on residential and commercial construction. New residential housing will be in further decline in 2023 compared to 2022, so they really have to rely on replacements of existing products. I think if the housing market is getting weaker over time this leads to a decrease in share price. AOS is exposed to the Chinese housing market as well, because 22% of total sales came from China in 2022. The sales were negatively impacted related to Covid-19 disruptions. This isn’t really the case anymore so this could lead to an increase in demand in the second half of 2023. However the Chinese housing market isn’t at its best either, it could go either way.

Volatility in raw material costs can also be a risk and can have a major impact on profitability. From the start of 2021 to around May 2022 the steel prices were really high and volatile. At the moment the price of steel is much lower compared to 2021 and 2022 standards. In the Q1 2023 earnings call the CFO ,Chuck Lauber, said that steel prices are likely to be about 20% higher in the second half of the year. The North American Segment margin was 25.1% this quarter, because of the increase in steel costs they expect margins to be less and end up in the 23-23.5% range.

Steel price chart (Tradingeconomics.com)

Conclusion

AOS definitely deserves a place in a high-quality dividend growth portfolio. The stable business model, potential catalysts, healthy balance sheet and solid dividend grades should provide investors with plenty of dividend increases. It’s far from a high yielder, but if you have the time on your side you will be rewarded with a growing dividend and share buybacks. Based on my own discounted cash flow analysis AOS is 8.4% overvalued. With the potential short-term risks in mind, it’s likely better buying opportunities will occur.

Personally I am Bullish for the long term. At the moment AOS my 2nd largest holding and I am happy that I took the opportunity to buy some shares around the $50 dollar range. If the stock is trading between the $56-$62 range I will consider buying more. With my own fair value in mind, I will give AOS a HOLD rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AOS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.