Summary:

- NVIDIA AI Foundations is a new set of cloud services that advance enterprise-level generative AI and enable customization across use cases in areas such as text, visual content, and biology.

- NVIDIA’s NeMo Guardrails is a new open-source toolkit for easily developing trustworthy large language model-based conversational applications.

- NVDA stock is trading at its 52-week high at nearly $290 a share with a P/E of 166, but there is a reason 66% of institutions are holding shares.

- NVIDIA has created an ecosystem that powers AI from a software and hardware perspective for organizations of all types.

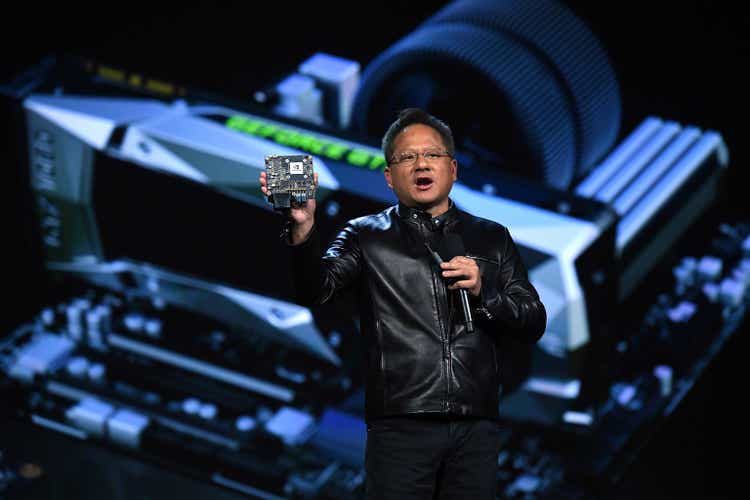

Ethan Miller/Getty Images News

What is the Goal of this Article?

My largest holding in my stock portfolio is NVIDIA (NASDAQ:NVDA) and many of my readers know it currently consists of nearly 30% of my overall holdings. I say this upfront because many critics may call my perspective very biased as I am extremely bullish on the company. So yes, I do want to see this company succeed and I have strong conviction in its’ future success. However, I am not oblivious to the high price that it is trading at, the volatility of the stock, and potential geo-political headwinds it could face. I have been a holder of this stock since February 2019 and have been gradually adding consistently to the position until it reached 25% of my overall holdings, due to my conviction in the company.

This article has a sole purpose of educating readers about the potential revenue impact and growth that can be created by the company’s new AI cloud services called AI Foundations and its’ recent open-source safety measure for generative AI called Nemo Guardrails. NVIDIA is known as a semiconductor giant and global leader in GPU technology and artificial intelligence.

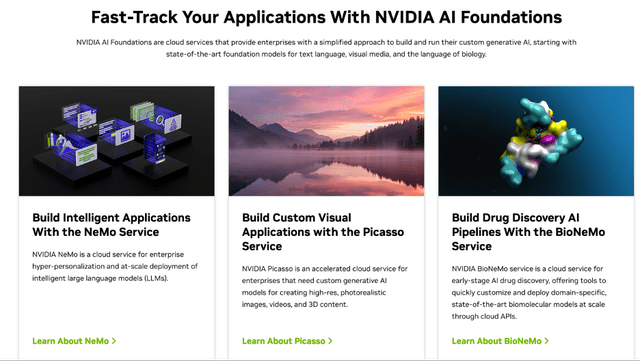

Images on AI Foundations Services (NVIDIA Website)

As mentioned earlier, they have recently launched AI Foundation Services and NeMo Guardrails, two groundbreaking software AI service offerings that will help organizations of all types arrive at better business outcomes. As the demand for AI applications continues to surge, these innovative tools are poised to drive NVIDIA’s stock price and revenue growth. In this article, we will examine how these new offerings can contribute to the company’s financial success for their datacenter and professional visualization parts of the business. However, let’s begin with identifying the potential risks involved for new potential shareholders if they buy this stock at these prices and are not willing to hold for five or more years.

What Risks are there in Buying NVIDIA Stock?

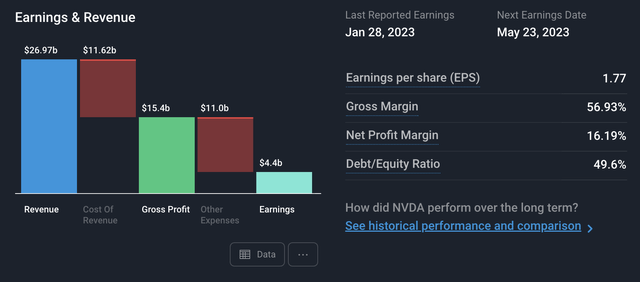

As of today, NVIDIA stock is trading at nearly $290 a share, which is its’ 52-week high. The company has grown to a market cap of $715 billion with an eye-bleeding P/E ratio of 166 and P/S ratio of almost 27. Then when we look at a DCF analysis of 10 years at a 9.6% discount rate we get a valuation of $100 per share opposed to the $290 it is trading at today. WOW!

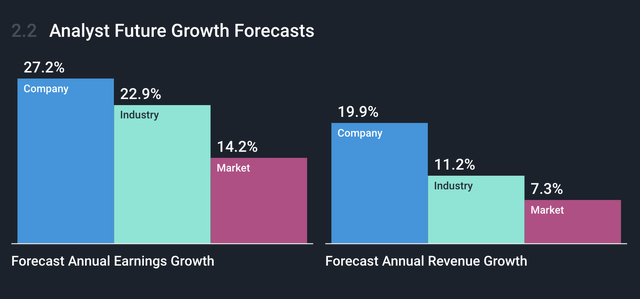

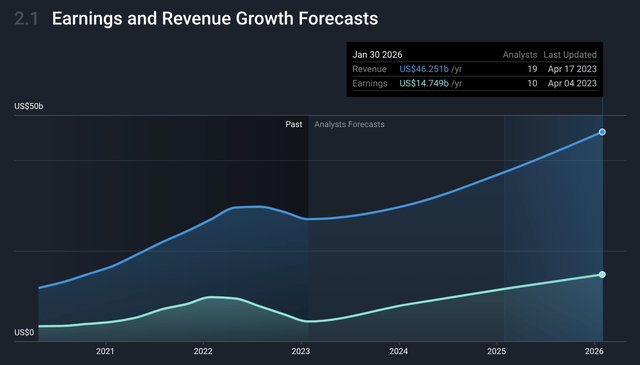

Now NVIDIA does have a strong cash balance of $13 billion and can cover all their debt with their cash and then some, so they are fiscally strong and responsible. They are projected to grow their revenues annually over the next 3 years at 20% and their earnings at 27%, which are both faster than their industry averages.

Earnings and Revenue of 2022 (Simply Wall St. App)

Now many value investors and just more conservative investors or investors with a short timeframe of holding a stock would definitely say “No way am I buying this stock!” or “Too overvalued and rich for my blood”. That is the beautiful thing of investing is that it is a personal decision as every single investor has a different need and perspective for their investments. Some investors want an immediate return in the next month, maybe year to three years and then utilize those funds. Other investors may be just saving for retirement and have a span of 10 to 20 years to hold on to a stock and can be less risk averse. So, it is important to know what you are comfortable with, what your goals are for your investments, and why you are doing individual stocks over putting your money in the indexes or bonds.

Now there is one other big risk which is the geo-political risk of China invading Taiwan and takeover Taiwan Semiconductor Manufacturing (TSM) which is the main producer of NVIDIA chips and other main semiconductor companies. If this happens this would impact the stock significantly in my opinion, but more importantly put the safety of many countries in jeopardy. This is a risk to be aware of but for me personally, I believe the other global powers understand the seriousness of this threat and will prevent this at all costs. I could be wrong though, I am not a fortune-teller, so you have to make your own investing decisions on what risk you are willing to take on.

NVIDIA earnings and revenue forecasted growth (Simply Wall St. App)

So, if this stock has potential geo-political risk, is at its’ 52-week high and getting close to its’ most expensive price which previously was a 36 p/s ratio, why would anyone buy now? You must decide when it is right for you and what your time horizon is going to be. I am holding my stocks for at least the next fifteen to twenty years so my key tenants on companies I purchase are more around their anti-fragility and continued compounded annual growth. My readers should know I have made my fair share of investment mistakes which do make for good learning lessons, and now I am really focused on reliable companies that could have the potential for hyper growth ahead of them or at least a consistent 15%-20% year over year growth for some-time. I also like when my companies are misunderstood by the market yet riding secular trends, founder-led, have reoccurring revenue, can cover their debt and have cash afterwards, and are free-cashflow positive. I believe NVIDIA checks all these boxes, and you can read my previous articles on the company to hear my perspective on this, but in this article let’s talk about the expansion of opportunity and revenue NVIDIA’s AI Foundation Services and NeMo guardrails will bring to the company.

AI Foundation Services: Unlocking the Potential of Custom AI Models

NVIDIA AI Foundation Services is a family of cloud services designed for businesses to create and run custom generative AI models based on their proprietary datasets and domain knowledge. This service provides companies with a comprehensive platform for training, tuning, and deploying AI models, catering to a wide range of industries and applications.

The AI Foundation Services consists of three main cloud services NVIDIA NeMo, Picasso, and BioNeMo that help organizations utilize and customize enterprise-level generative AI across text (NeMo), visual content (Picasso), and biology (BioNeMo). These services are powered by NVIDIA’s DGX Cloud which consists of their AI Supercomputers. There are many use cases that these cloud services can create such as the following below.

NeMo Use Cases:

- Text generation – for storyline creation or global translations in many languages.

- Summarization – for news, email, meeting minutes, etc.

- Chatbots – for intelligent Q&A and real-time customer support

NVIDIA NeMo Use Cases (NVIDIA Website)

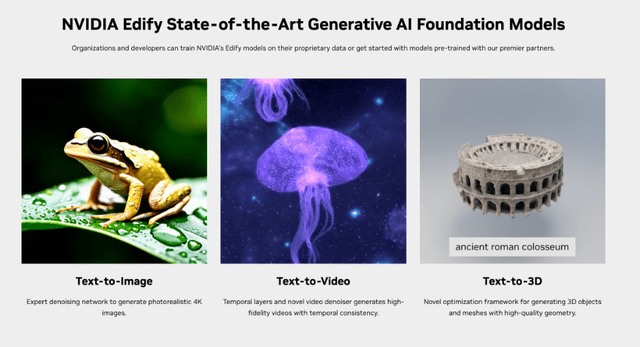

Picasso Use Cases:

- Image Generation – for creating high resolution images for product design.

- Video Generation – for creating videos with high fidelity for advertising and marketing.

- 3D Content Generation – for creating 3D assets with detailed geometry for character creation.

NVIDIA Picasso Use Cases (NVIDIA Website)

BioNeMo Use Cases:

- Protein Prediction – for 3D protein structure and property predictions.

- Biomolecular Generation – for novel protein sequences and small molecule generation.

- Molecular Docking – for modeling interactions between small molecules and target proteins.

NVIDIA BioNeMo Use Cases (NVIDIA Website)

The increasing demand for AI solutions is driving businesses to seek tailored models that can address specific challenges and requirements. NVIDIA AI Foundation Service offers an end-to-end solution, enabling organizations to harness the power of AI to boost efficiency, innovation, and profitability. As a result, this offering is likely to attract more clients and increase the company’s market share in the AI sector, contributing to NVIDIA’s stock price and revenue growth.

NeMo Guardrails: Ensuring Safety and Security for Large Language Models

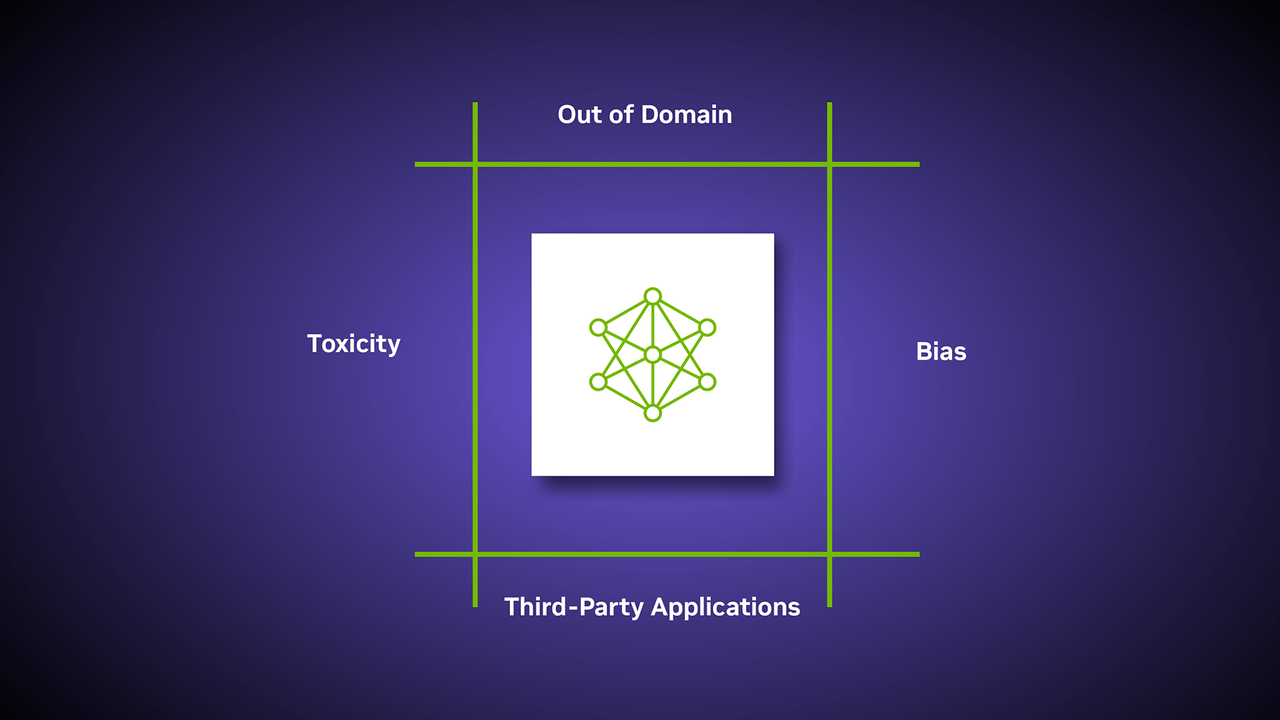

In addition to AI Foundation Service, NVIDIA has introduced NeMo Guardrails, an open-source toolkit designed to enable safety and security for Large Language Models (LLMs). NeMo Guardrails empowers developers to build safe and secure LLM-powered conversational systems while addressing the challenges and risks associated with such models.

NeMo Guardrails features a range of programmable constraints, or “guardrails,” which monitor and influence user interactions with LLMs, ensuring that conversations remain within the intended domain. By providing topical, safety, and security guardrails, the toolkit ensures that interactions with LLMs are focused, non-toxic, and free of cybersecurity risks.

This offering is especially timely as LLMs, like OpenAI’s ChatGPT, gain traction in various applications, from customer support to content generation. By providing a reliable solution to ensure the safety and security of LLMs, NVIDIA is positioning itself as a leader in this growing market segment.

NVIDIA NeMo Guardrails (NVIDIA Website)

Market Potential and Growth Drivers

The market potential for AI solutions and LLMs is vast and continues to expand rapidly. As businesses across various industries recognize the benefits of AI and LLM applications, the demand for NVIDIA’s AI Foundation Service and NeMo Guardrails is expected to rise.

Some key growth drivers for these offerings include:

Increased Adoption of AI Solutions: As more organizations adopt AI technologies to enhance their operations and decision-making processes, the need for custom AI models and secure LLM applications will grow. NVIDIA’s offerings cater to this demand, creating opportunities for revenue growth. The current revenue share of NVIDIA’s professional visualization business last quarter was only 4% of its’ revenue, at $226M so it has much more room for growth. This part of the business did grow sequentially at 13% and I believe will take on more growth as more organizations understand the impact of NVIDIA AI Solutions and their Omniverse platform. I also believe AI Foundation Services will integrate more and more with NVIDIA’s Omniverse platform for an end to end offering for customers, and already NVIDIA Omniverse has 300,000 downloads so far, and 185 connectors to third–party design applications.

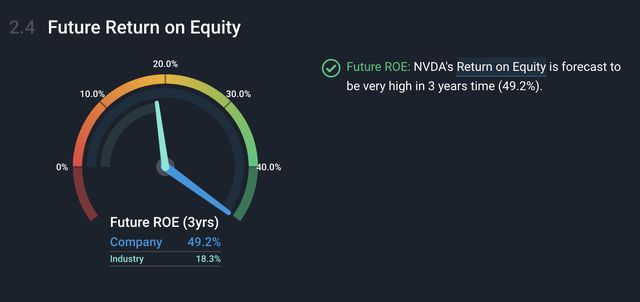

NVIDIA Future Return on Equity 3yr Average (Simply Wall St. App)

Safety and Security Concerns: With the increasing use of AI and LLMs comes the heightened need for safety and security measures. NeMo Guardrails addresses these concerns by providing developers with an effective solution to ensure the safety of LLM-powered applications. This offering can help NVIDIA capture a significant share of the growing LLM market.

Rapid Innovation in AI: The AI landscape is evolving rapidly, with new applications and use cases emerging continually. NVIDIA’s AI Foundation Service and NeMo Guardrails are designed to keep pace with this innovation, allowing businesses to harness the latest AI advancements effectively.

Expansion into New Industries: NVIDIA’s AI offerings have the potential to penetrate a wide range of industries, from healthcare and finance to automotive and retail. This broad applicability can drive adoption of the company’s AI Foundation Service and NeMo Guardrails, contributing to revenue growth.

Financial Implications and Stock Price Growth

The introduction of NVIDIA’s AI Foundation Services and NeMo Guardrails has the potential to significantly impact the company’s financial performance. As more businesses across various sectors adopt these offerings, NVIDIA can expect increased revenue, strengthening its position in the AI market.

Several factors may contribute to NVIDIA’s stock price growth, including:

Revenue Growth: As the adoption of AI Foundation Service and NeMo Guardrails increases, NVIDIA’s revenue from these services is expected to grow. This growth in revenue will likely have a positive impact on the company’s stock price, as investors recognize the potential for long-term profitability.

Competitive Advantage: By offering innovative and secure AI solutions, NVIDIA distinguishes itself from competitors in the AI market. This competitive advantage can attract new clients and drive increased adoption of the company’s offerings, resulting in higher stock prices.

Market Leadership: NVIDIA’s AI Foundation Service and NeMo Guardrails position the company as a leader in the AI and LLM markets. Market leadership often translates to increased investor confidence, which can drive stock prices upward.

Positive Market Sentiment: As AI and LLMs become more prevalent, public and investor sentiment around these technologies is likely to improve. Positive market sentiment can contribute to increased demand for NVIDIA’s stock, pushing prices higher.

NVIDIA Revenue and Earnings Growth (Simply Wall St. App)

Conclusion

NVIDIA’s AI Foundation Services and NeMo Guardrails represent a significant step forward in the company’s AI offerings. By catering to the growing demand for custom AI models and secure LLM applications, these services can drive revenue growth and contribute to an increase in the company’s stock price. Buying shares at current prices could be risky in the short term but for investors who plan on holding a position in NVIDIA for numerous years, should still receive compounded returns over time, in my opinion.

As the AI and LLM markets continue to expand, NVIDIA’s innovative solutions and market leadership are well-positioned to capitalize on this growth. By offering businesses a comprehensive suite of AI tools and services, NVIDIA stands to benefit from the increasing adoption of AI technologies across industries.

In conclusion, NVIDIA’s AI Foundation Service and NeMo Guardrails are likely to play a crucial role in the company’s financial success, as they address key market needs and trends. Investors should keep a close eye on the adoption and performance of these offerings, as they have the potential to significantly impact NVIDIA’s stock price and revenue growth in the coming years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.