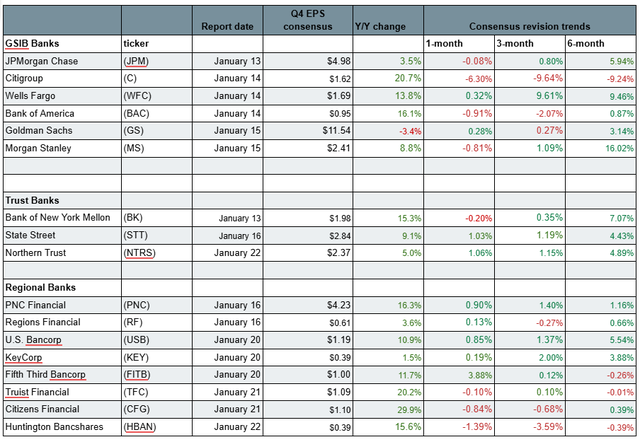

Bank earnings start rolling in on Tuesday, with JPMorgan Chase (JPM) and Bank of New York Mellon (BK) leading off, followed by Citigroup (C), Wells Fargo (WFC) and Bank of America (BAC) on Wednesday, and Goldman Sachs (GS) and Morgan Stanley on Thursday.

Investment banking revenue is expected to help drive Q4 earnings as deal activity accelerates. Global investment banking revenue increased 15% to $103B for all of 2025, according to Dealogic data cited by Reuters. M&A volume jumped 42% Y/Y to $5.1T.

Q4 EPS consensus estimates expect the strongest Y/Y growth from Citigroup (C) (+21%) among the global systemically important banks; Bank of New York Mellon (BK), also called BNY (+15%), in the trust bank category; and Citizens Financial Group (CFG) (+30%) in the large regional bank group.

The biggest upward earnings consensus revisions in the past six months are at Morgan Stanley (MS) (+16%) for the GSIBs, BK (+7.1%) for the trust banks, and U.S. Bancorp (USB) for the large regionals.

While Q4 earnings matter, “coming guidance and additional affirmation of the broadening capital markets rebound will matter more,” Morgan Stanley analysts, led by Betsy Graseck wrote in a note to clients.

M&A volume surged 65% Y/Y in Q4 2025, but deal completions are expected to flow through next year as well. Last month, Goldman Sachs (GS) Chief Financial Officer Denis Coleman said the bank’s sponsor-led deal volumes rose 40% in 2025.

Overall, Morgan Stanley models Q4 investment banking fees rising 9% Y/Y, slightly lower than the consensus’s 11% increase. M&A fees are estimated to rise 15% Y/Y vs. the +14% consensus.

Markets revenues are poised to rise 8% Y/Y in Q4 vs. +7% consensus, the Morgan Stanley analysts said. Equities trading revenue (+12%) is expected to outpace FICC trading revenue (+5%).

The MS analysts’ EPS estimates for PNC Financial (PNC), Northern Trust (NTRS), and State Street (STT) are most above consensus, while their estimate for Citi (C) is most below the average analyst estimate.

Their most preferred names for positive guidance include BNY (BK) on a potential upward revision to return on tangible common equity and State Street (STT) on a more detailed roadmap to achieving operating leverage durability.

One note on Bank of America’s (BAC) Q4 results. On Tuesday, the bank announced that it’s changing its accounting method related to its tax-related affordable housing, eligible wind renewable energy and solar renewable energy equity investments to better align its financial statement presentation with the economic impact of the equity investments. The changes have an insignificant impact on net income on an annualized basis, the company said.

With the accounting change, Bank of America’s (BAC) retained earnings as of Sept. 30, 2025, decreased $1.7B from the previously reported amount, reflecting the cumulative impact of the timing difference in expense recognition under the new accounting methods.

Looking ahead to 2026, trading, wealth management, and investment banking operations should drive growth, while net interest income will grow at a slower pace on a softer rate backdrop, Evercore ISI analyst Glenn Schorr said in a note to clients.

His top picks for NII growth for the coming year are Bank of America (BAC), JPMorgan Chase (JPM), and BNY (BK). In trading, Morgan Stanley (MS) and JPMorgan (JPM) top his list, and in investment banking, Morgan Stanley (MS) stands out, but Citi (C) screens the cheapest and should benefit from a rising tide, Schorr said. In M&A, he likes Morgan Stanley (MS), Goldman Sachs (GS), and JPMorgan (JPM).

Q4 2025 Bank Earnings Estimates, Revisions (S&P CapIQ)