Summary:

- In this article, I am assessing one major reason that could get me to sell my Exxon position, despite having a bullish view of the stock.

- The company is generating much more cash than anyone expected, leading to high pressure on a major M&A deal and higher buybacks.

- The company has made clear that it will not significantly boost its dividend to protect the long-term sustainability of its direct shareholder payout.

- While I believe that Exxon remains a terrific dividend stock, I believe that income-oriented investors might be better off buying stocks with special dividends.

Bet_Noire

Introduction

While this title might seem bearish, I’m NOT implying that:

- Oil prices are about to fall.

- Exxon Mobil (NYSE:XOM) is doing something stupid.

- Every bullish article on XOM I have written so far is BS.

No, in this article, I want to shed some light on the other side of my bullish Exxon thesis. Just last month, I wrote a big piece on my long-term Exxon Mobil bull case, especially in light of an increasingly tight oil market.

I stand by every single bullish word I have written about Exxon Mobil this year.

What I want to achieve in this article is to give you the one big reason that could trigger me to sell Exxon Mobil this year.

Believe it or not, that reason is that Exxon could end up with too much cash.

As bullish as that might be, it might not be the best thing for Exxon shareholders who want to benefit from it through dividends. Exxon is likely to spend a big part of it on buybacks and M&A, as it does not want to hike its dividend too much. That’s because of its dividend strategy.

In this deep dive, we’ll discuss all of this as I walk you through my thoughts, assessing my largest energy holding.

So, let’s get to it!

So Much Cash

Exxon Is A Cash Cow

Initially, I wanted to go with a different title, something like 40 Billion Reasons To Sell Exxon – referring to its cash, but more on that later. Needless to say, that would have been a bit over the top. After all, I’m not trying to get people to sell Exxon. I’m just providing food for thought and an update on my own decisions.

After writing so many bullish articles on energy that I lost count, I want to highlight energy from a few different angles. In this article, I’ll assess my largest energy holding and most successful investment of my career – so far.

For that, I will use its just-released earnings, the company’s view on shareholder distributions, and the bigger picture.

I initially bought Exxon at $33.37 in 2020. While I have my fair share of mistakes, I can call this one of my most successful long-term investments.

It’s also the reason why Exxon is my largest energy holding. Not only that, but Exxon is also my second-largest dividend investment.

With that in mind, Exxon is in the best spot it has been in for many years. Thanks to high oil prices, it is printing cash like there’s no tomorrow.

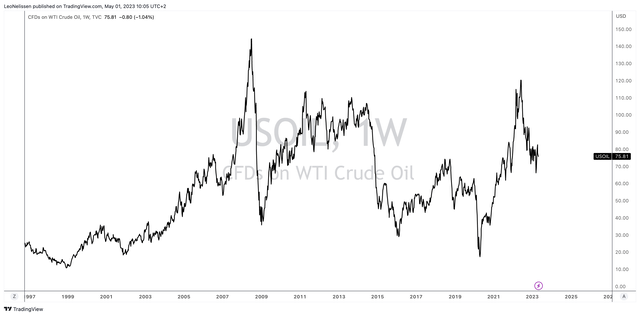

While demand fears have caused oil prices to retreat from last year’s highs, prices are still elevated compared to what we saw between the commodity peak of 2011 and the pandemic. This is caused by constrained supply growth and long-term demand growth, as oil demand is not declining.

Thanks to increasingly efficient operations (last year, the company guided to an average breakeven point of $35 Brent by 2027), the company is generating loads of cash.

In the first quarter of this year, the company generated $16.3 billion in operating cash flow. After accounting for $5.8 billion in cash spending on projects and $8.1 billion in dividends and buybacks, the company was able to reduce debt a bit and add $3 billion to its savings.

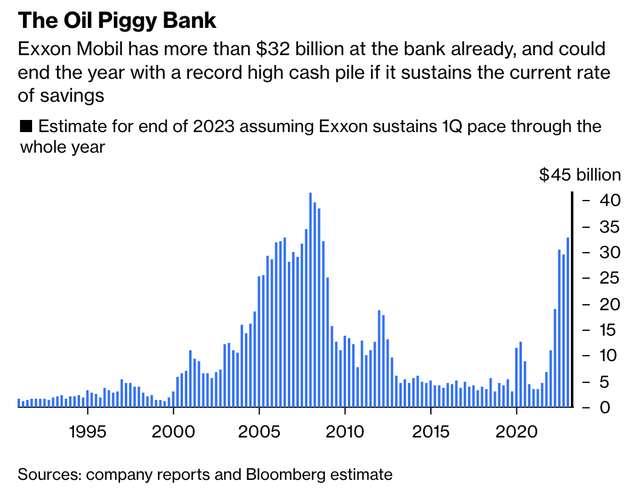

Exxon is now sitting on $32.7 billion in the bank, which is projected to reach $45 by the end of this year if it sustains the current savings rate.

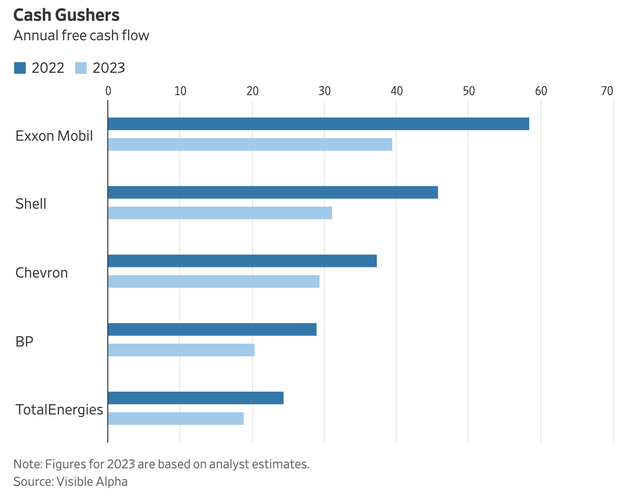

On a full-year basis, Exxon is expected to generate close to $40 billion in free cash flow. Again, bear in mind that this is after it has taken care of capital expenditures. While this is down from almost $60 billion in 2022, it still implies a free cash flow yield of 8.3%. What this means is that the company could pay an 8.3% dividend without having to borrow or sacrifice its operations. Or, it could repurchase 8.3% of its outstanding shares. That won’t happen, but it explains why this free cash flow yield is so impressive.

In this case, Exxon stands out among its integrated peers (as seen in the chart above) because of its significant footprint in the Permian basin and exposure to fast-growing production in offshore Guyana. Those two assets helped Exxon to increase production by nearly 300,000 BOE (barrels of oil equivalent) a day in the first quarter, compared with the same period the previous year.

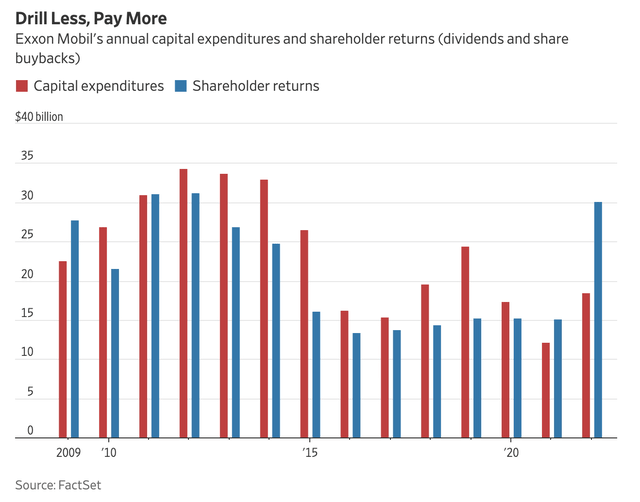

Moreover, for two consecutive years, the company’s shareholder distributions have surpassed capital investments, a trend that has become prevalent in the industry. I cannot emphasize the significance of this development enough, as many producers have chosen to prioritize the protection of their balance sheets, rewarding investors, and ensuring that oil markets do not encounter severe supply/demand imbalances similar to the ones witnessed in 2015 and 2020, by refraining from increasing production.

It also needs to be said that Exxon has an extremely healthy balance sheet. If the company continues to stick to its capital plan, its balance sheet is on track to turn net cash positive in 2024, according to analyst estimates. This means that Exxon is about to have more cash than gross debt on its balance sheet.

So Much Cash – Now What?

This is the part where I get to complain

So far, so good.

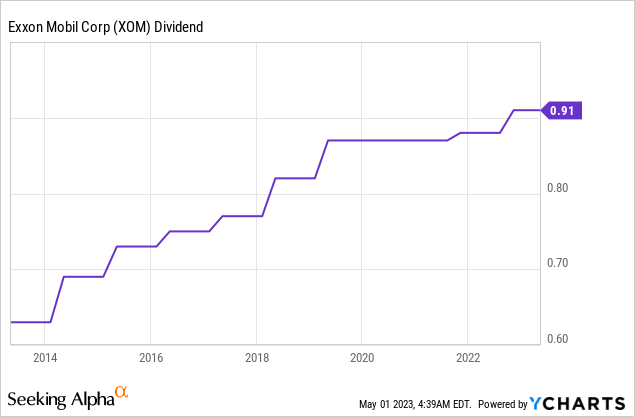

Every investor is now asking when Exxon is going to boost its dividend. After all, dividend growth has been subdued so far. While Exxon needs to get credit for not cutting the dividend during the pandemic, it has refrained from significantly boosting its dividend in recent years. These are the most recent hikes:

- October 2022: 3.4%.

- October 2021: 1.1%.

The company currently yields 3.1%, which isn’t something to get excited about.

While the low dividend yield can be explained by the massive stock price return since the pandemic, the dividend growth rates are slow and expected to remain somewhat low.

So, why is that?

Roughly 40% of its shareholders are retail shareholders. The company mentioned this in its earnings call. Hence, the company wants to deliver stability and predictable income for its investors.

[…] as we think about the dividend, we try to keep the long-term in mind and also be extremely conscious of the commodity cycles and the variability and the volatility that we see in the marketplace and making sure that we establish a level of dividends that are reliable, sustainable, and I’d like to see those grow with time.

What Exxon is telling us is that it will refrain from big dividend hikes as it doesn’t know what the future looks like. If Exxon were to hike its dividend too aggressively, it could be forced to cut its dividend during the next oil price bear market. The company wants to avoid being put in a spot like that. Gradual hikes still benefit investors while also allowing the company to improve its balance sheet and engage in buybacks.

Also, Exxon does NOT pay a special dividend, which I would prefer over buybacks.

With that in mind, the company already has a healthy balance sheet. Its balance sheet is so healthy that it is paying just 3% on debt, which is 200 basis points below the rate on short-term government bonds.

While the company is expected to spend roughly $17.5 billion on buybacks this year, investors are afraid that Exxon might waste some of its cash.

The last time Exxon was net cash positive was in 2009. Back then, Exxon – under Rex Tillerson – decided to use its strong balance sheet position to buy natural gas producer XTO Energy. Unfortunately, it overpaid and eventually took a big write-down.

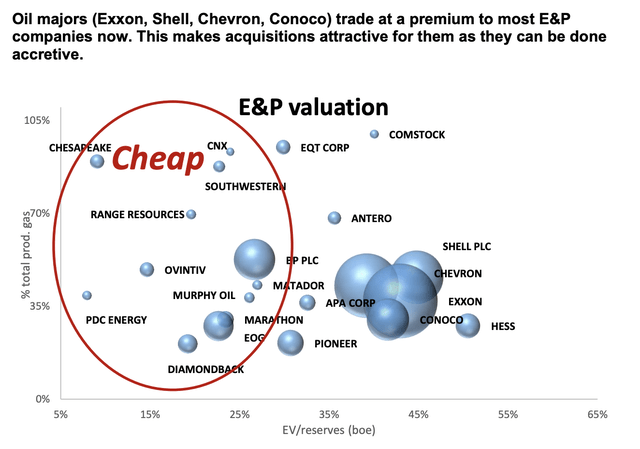

Now, Exxon is expected to make another move. In this case, rumors are that it will buy Pioneer Natural Resources (PXD). While I am not in favor of speculating on who Exxon might buy, I do have a chart that shows that Exxon is trading at a premium compared to its smaller peers. Peers with high inventories are especially attractive targets for Exxon currently.

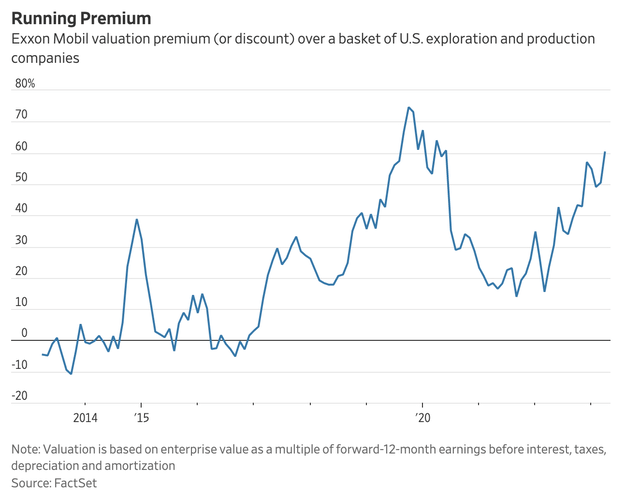

This is what Exxon’s valuation premium looks like on an NTM EBITDA basis.

With that in mind, it’s not very likely that I will sell Exxon. However, it’s also not impossible.

We’re at a point in the oil price cycle where I’m somewhat shifting my priorities. As most of my readers know, I am a long-term oil price bull. I believe that constrained supply growth will be an issue for a very long time, which will likely lead to triple-digit oil prices the moment economic demand bottoms.

While I believe that I’m more bullish than most, we’re not dealing with a hidden bull case anymore. Back in 2020 and 2021, this was different. Some thought oil was done for good, which offered great prices. Now, that has changed. The bull case for oil is much more obvious now, which leads me to believe that I want to shift my focus from high capital gains to income. I still pick stocks that will likely outperform their peers. I just want stocks that let shareholders benefit from long-term elevated oil prices.

I don’t care much for buybacks in this space. I’m also not a big fan of the risks that come with big-scale M&A.

Don’t get me wrong. I think Exxon will likely make a smart move if it decides to pull the trigger. I’m just not a fan of its conservative dividend.

Hence, at this point, I am working to make adjustments to my portfolio. As long as I’m still a resident in the Netherlands, I can sell my investment tax-free. If I were to sell Exxon (if, not when), I would pick a producer with a number of benefits:

- High production inventories (to avoid forced M&A at some point).

- Efficient production with a low breakeven (I need high free cash flow).

- A plan to distribute most of it to shareholders.

- A healthy balance sheet.

In a recent article, I presented three viable options that I am considering buying.

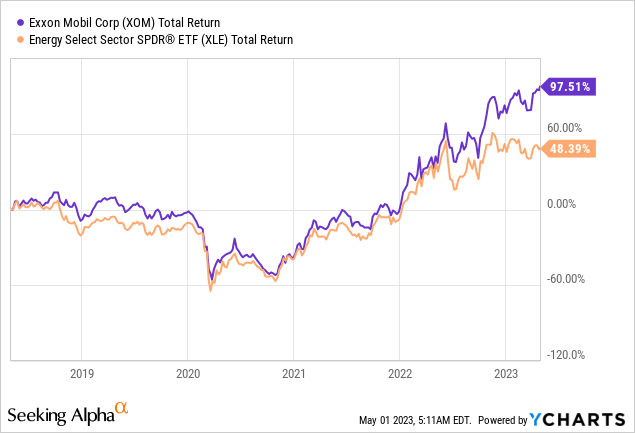

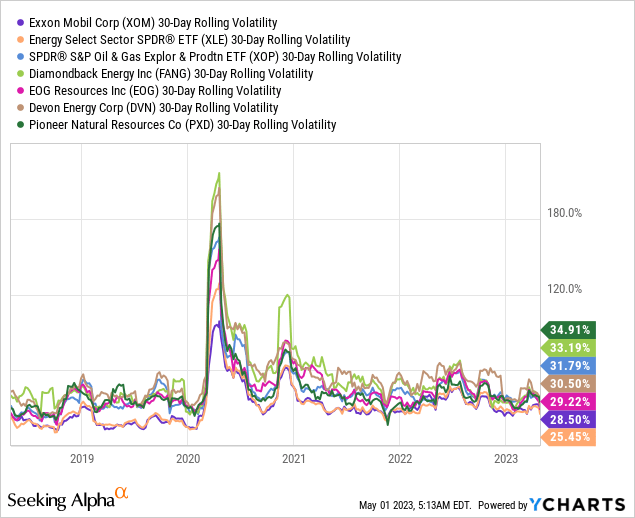

With that in mind, it needs to be said that sticking with Exxon has benefits too. It’s not just a rock-solid oil major with diversification through downstream operations, but it is also an outperformer with subdued volatility.

Over the past five years, XOM has returned almost 100%. This includes the pandemic. This performance is twice as good as the performance of the energy ETF (XLE).

While Exxon did not outperform all the stocks in the list below, it does come with lower volatility. Right now, the difference is somewhat limited (as overall volatility is down). However, when markets become nervous, Exxon tends to perform much better than its smaller peers.

In other words, I am fully aware that having close to 20% energy exposure makes my portfolio somewhat volatile. If I were to sell Exxon to buy one of its payout-focused peers, I would add volatility to my portfolio.

That’s a major tradeoff I need to keep in mind.

The Bottom Line

Without a doubt, Exxon is an exceptional dividend stock. Its balance sheet is the strongest it has been in over a decade, unaffected by the current high-rate environment, and continues to generate substantial cash flow even amidst the recent decline in oil prices.

The company will likely continue to hike its dividend at a slightly higher pace than we witnessed in 2022, backed by aggressive buybacks.

That said, Exxon is now at a point where it has too much cash. It needs to make a decision. While it will refrain from aggressive dividend growth or special dividends, it will likely have to go with an acquisition to add new high-quality inventory to its business and benefit from valuation opportunities.

While I don’t believe that Exxon will make another mistake like buying XTO in 2009, I believe that there are better stocks that also benefit from a wave of cash.

We’re at a point where income-oriented investors might have to go with a different stock that prioritizes cash distributions over indirect distributions via buybacks.

I haven’t made a decision, but I am considering making a move that could add more income to my portfolio – especially given my long-term bullish view on the oil industry.

Needless to say, I remain bullish on Exxon, and I stand behind everything I have said in recent articles. I expect Exxon to outperform, and I have not made the decision to sell.

Please let me know what you think of my view. I look forward to hearing from long-term investors who own Exxon because of its stable and consistent income.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM, PXD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.