Summary:

- Exxon Mobil reported very strong results in the first quarter of 2023.

- Crude oil prices were down year-over-year, but the company was able to make up for it with higher production.

- There are some signs that energy prices will rise over the remainder of the year due to declining supply.

- Exxon Mobil has one of the strongest balance sheets in the industry and a very sustainable dividend.

- XOM stock is currently trading at an attractive valuation.

imaginima

Earlier today, oil and gas supermajor Exxon Mobil Corporation (NYSE:XOM) announced its first-quarter 2023 earnings results. At first glance, these results were mixed as the company failed to meet the expectations of its analysts in terms of top-line revenue, but it did beat earnings estimates. A more in-depth look tells a different story, however, as this was one of the best quarters that Exxon Mobil has ever reported. The company delivered both the highest net income in its history and fairly significant year-over-year production growth. The company also managed to complete a project that should boost its output of refined products. When we combine this with the likelihood of rising energy prices as the year continues, there is a lot to like here. Overall, Exxon Mobil continues to be a solid investment prospect with a very reasonable valuation.

Results Analysis

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Exxon Mobil’s first-quarter 2023 earnings report:

- Exxon Mobil reported total revenue of $86.564 billion in the first quarter of 2023. This represents a 4.35% decline over the $90.500 billion that the company reported in the prior-year quarter.

- The company reported an operating cash flow of $16.341 billion in the most recent quarter. This compares rather favorably to the $14.788 billion that the company reported in the year-ago quarter.

- Exxon Mobil produced an average of 3.831 million barrels of oil equivalents per day in the reporting period. This represents a 4.24% increase over the 3.675 million barrels of oil equivalent per day that it produced on average during the equivalent quarter of last year.

- The company completed the ramp-up of the Beaumont Refinery expansion, demonstrating 250,000 barrels per day of crude oil distillation capacity.

- Exxon Mobil reported net income of $11.430 billion in the first quarter of 2023. This represents a 108.58% increase over the $5.480 billion that the company reported in the first quarter of 2022.

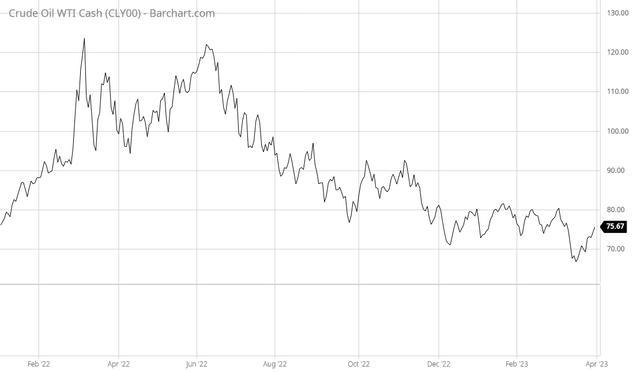

One of the first things that we notice is that Exxon Mobil’s revenue came down compared to the prior-year quarter. This is something that we also saw in the results of other traditional energy companies that have reported, such as Pioneer Natural Resources (PXD). The biggest reason for this is that crude oil and natural gas prices were both lower than they were at this time last year. This chart shows the price of West Texas Intermediate crude oil from January 1, 2022, until the end of the first quarter:

It should be fairly obvious that this will reduce Exxon Mobil’s financial performance. After all, lower energy prices mean that the company was forced to sell its products for less than it did during the prior-year quarter. This means that less money comes into the company and that less money is available to cover expenses and make its way down to the bottom line. Exxon Mobil pointed this out in its earnings press release, although the company was specifically referring to profits and not revenue:

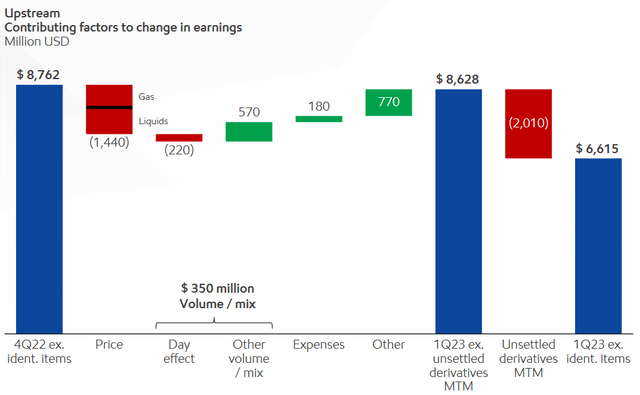

“Lower liquids and natural gas realizations coupled with the absence of favorable mark-to-market impacts on unsettled derivatives, fewer days in the quarter, and higher unscheduled maintenance negatively impacted results sequentially.”

The company showed in its earnings presentation that lower crude oil and natural gas prices reduced its net income by $1.440 billion in the first quarter compared to the fourth quarter of 2022:

Thus, the lower resource prices clearly were the biggest drag on the company’s financial performance during the quarter. The fact that derivatives also had a negative impact does not change this since these derivatives are priced based on energy prices, so the fact that both crude oil and natural gas prices declined quarter-over-quarter was the cause of the company’s unrealized mark-to-market losses. The fact that Exxon Mobil was able to largely offset the negative impact of these prices through strong performance in other areas of its business speaks well about the company.

Fortunately, there are some signs that energy prices could rise over the remainder of the year. As I discussed in a recent blog post, earlier this month the Organization of Petroleum Exporting Countries agreed to reduce its output by one million barrels per day in May, which comes on the heels of a two-million barrel per day cut back in October 2022. Overall, the multi-nation organization’s output will be 3.66 million barrels per day lower than in the summer of 2022. The United States is certainly not going to make up for this deficit as the U.S. Energy Information Administration states that total American output has only increased by 794,000 barrels per day over the last year. There is no other source of crude oil in the world that can make up for this excess production, short of a temporary increase if the Biden Administration decides to draw down the Strategic Petroleum Reserve. As the demand for crude oil typically surges during the summer months, we almost certainly have a situation in which near-term demand increases but supply declines. The laws of economics state that this should cause crude oil prices to go up. Indeed, that did happen following the announcement of the production cuts, but it did not last as recession fears continue to weigh on the market. If a recession does not hit though, it seems certain that energy prices will go up, which will be beneficial for Exxon Mobil over the remainder of this year.

As stated in the highlights, Exxon Mobil increased its production by 156,000 barrels of oil equivalents per day compared to the prior-year quarter. This helped to offset the impact of the lower energy prices on the company’s financial performance. After all, higher production means that the company had more products that it could sell in exchange for money. Thus, it received less for each unit of crude oil or natural gas that it sold, but it sold more of them. Unfortunately, this is not a trend that is likely to continue as Exxon Mobil stated during the earnings conference call that it will be performing scheduled maintenance activity at some of its production sites. This will lower its average daily production by 110,000 barrels of oil equivalents during the second quarter. That nearly completely offsets the year-over-year production increase that we saw here. This could very easily result in the company’s second quarter being weaker than the first unless we see a sharp uptick in energy prices.

Financial Considerations

It is always important to look at the way that a company finances itself before making an investment in it. This is because debt is a riskier way to value a company than equity because debt must be repaid at maturity. This can cause a company’s interest expenses to increase following the rollover in certain market conditions. As interest rates are currently at the highest level that we have seen in fifteen years, this is a very big risk today. In addition to this, a company must make regular payments on its debt if it is to remain solvent. Thus, any event that causes a company’s cash flows to decline could push it into financial distress if it has too much debt. As crude oil and natural gas prices can be volatile, this is something that can be a very big concern with companies like these.

One metric that we can use to evaluate an oil company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well a company’s equity will cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important.

As of March 31, 2023, Exxon Mobil had a net debt of $8.795 billion compared to $206.414 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 0.04 today. Here is how that compares to some of the company’s peers:

|

Company |

Net Debt-to-Equity Ratio |

|

Exxon Mobil Corporation |

0.04 |

|

Chevron (CVX) |

0.06 |

|

ConocoPhillips (COP) |

0.16 |

|

BP p.l.c. (BP) |

0.18 |

|

Shell plc (SHEL) |

0.23 |

|

TotalEnergies SE (TTE) |

0.22 |

(all data comes from the most recent financial reports as of the time of writing, which may not necessarily be the first-quarter 2023 earnings report)

As we can see, Exxon Mobil has almost no reliance on debt to finance its operations, and it has a much stronger balance sheet than the other supermajors. However, none of these companies has an especially high debt load. Overall, though, it does not appear that the company’s shareholders have anything to worry about with respect to its debt.

Dividend Analysis

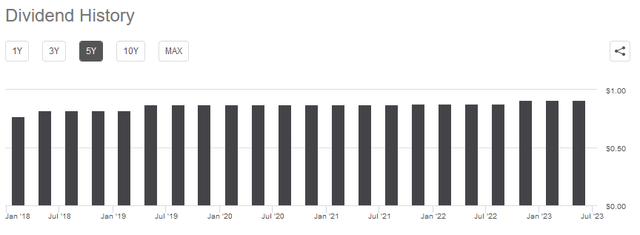

One of the things that investors have always liked about Exxon Mobil is that the company has a long history of paying relatively attractive dividends. In fact, I can recall some articles that have been published on Seeking Alpha stating that Exxon Mobil is “the best dividend stock in the market.” While we can certainly debate that claim all day, the fact is that the dividend is one of the things that a typical investor will have in their minds when purchasing shares of Exxon Mobil. As of the time of writing, the stock yields 3.08%, which is certainly higher than the paltry 1.55% yield currently being offered by the S&P 500 Index (SPY). Exxon Mobil’s current yield is not particularly impressive for the energy sector, however, as there are a number of shale companies and midstream partnerships offering yields that are double or even triple Exxon Mobil’s. The fact that Exxon Mobil has a history of raising its dividend over time helps to balance this out though since it means that someone buying today will have a much higher yield-on-cost after only a few years:

The fact that the company does generally increase its dividend over time is also nice during inflationary periods, such as the one that we are currently experiencing today. This is because inflation is constantly reducing the number of goods and services that we can purchase with the dividend that the company pays out. This may make it feel as though you are getting poorer and poorer with the passage of time, even if your portfolio does not actually go down in total value. The fact that Exxon Mobil increases its dividend helps to offset this effect and ensures that the dividend maintains its purchasing power over time. However, the company’s most recent increase was pretty paltry and failed to keep up with inflation despite the fact that soaring energy costs are one of the largest drivers of that inflation and Exxon Mobil has been consistently reporting some of the highest profits in the industry. This greatly reduces the appeal of the company as a dividend play in my eyes.

As is always the case though, it is critical that we ensure that the company can actually afford the dividend that it pays out. This is because we do not want to be the victims of holding stock when the company has to cut its dividend. After all, such a scenario would reduce our incomes and will almost certainly cause the stock price to decline.

The usual way that we analyze a company’s ability to afford its dividend is by looking at its free cash flow. Free cash flow is the amount of money that is generated by a company’s ordinary operations and is left over after the company pays all of its bills and makes all necessary capital expenditures. This is the amount of money that can be used for things such as reducing debt, buying back stock, or paying a dividend. In the first quarter of 2023, Exxon Mobil achieved a levered free cash flow of $8.7548 billion, which was unfortunately the lowest figure that it had since December 2021:

|

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

Q1 2022 |

Q4 2021 |

|

|

Levered Free Cash Flow |

$8,754.8 |

$11,465.4 |

$13,683.5 |

$11,154.3 |

$9,965.6 |

$8,341.9 |

|

Unlevered Free Cash Flow |

$8,854.1 |

$11,594.8 |

$13,814.1 |

$11,275.5 |

$10,083.1 |

$8,480.0 |

(all figures in millions of U.S. dollars)

The company’s dividends cost it $3.738 billion in the first quarter of 2023. Thus, it appears that the company is easily covering its dividend with a substantial amount of money left over that can be used for other purposes. Thus, at the present time, it does not appear that the current dividend is in any danger. Exxon Mobil should be able to maintain it and continue to deliver the regular increases that investors have come to expect from this company.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of an oil and gas supermajor like Exxon Mobil, we can value it using the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the company’s stock may be undervalued relative to its forward earnings per share growth and vice versa. However, as I have pointed out in various previous articles, right now just about everything in the traditional energy industry appears to be substantially undervalued based on this ratio. Thus, the best way to value a company like this today is to compare Exxon Mobil’s ratio to that of its peers in order to see which has the most attractive relative valuation.

According to Zacks Investment Research, Exxon Mobil will grow its earnings per share at a 21.38% rate over the next three to five years. That gives the company a price-to-earnings growth ratio of 0.55 at the current price. This certainly makes the company appear very undervalued at the current price. Here is how this compares to the company’s peers:

|

Company |

PEG Ratio |

|

Exxon Mobil |

0.55 |

|

Chevron |

0.82 |

|

ConocoPhillips |

0.56 |

|

BP plc |

0.96 |

|

Shell plc |

0.72 |

|

TotalEnergies SE |

0.64 |

As we can clearly see, all of these companies’ stocks appear quite cheap relative to their forward earnings per share growth. This is a clear sign that the recent market strength has not delivered any benefits to the energy sector, which has unfortunately been typical over the past several years. However, Exxon Mobil is the most undervalued of the whole group. Thus, the stock price today certainly appears reasonable.

Conclusion

In conclusion, Exxon Mobil’s results for the first quarter of this year were quite strong, although the second quarter may come in a bit weaker unless energy prices surge upward. Fortunately, it does appear that such an upward price swing is very possible due to supply-demand pressures. The company continues to maintain one of the strongest balance sheets in the industry, as the company has virtually no reliance on debt and has a strong enough free cash flow to effectively wipe out its debt very quickly. The dividend is not as high as some other energy companies, but it is sustainable and may be increased later this year. Finally, the stock appears to be very reasonably priced today. Overall, this company continues to be worth considering for your investment dollars.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long various energy-focused funds that may hold long positions in any stock mentioned in this article. I exercise no control over these funds and their positions may change at any time.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!