Summary:

- There is always a bottom for Wall Street, and the “buy the dip” mentality remains intact.

- Intel rose sharply as Wall Street “hoped” the worst was behind.

- Near-term, they may be right, but longer-term they are dead wrong.

WilleeCole/iStock via Getty Images

Intel Corporation’s (NASDAQ:INTC) Q4-2022 results did turn out to be a kitchen sink quarter of sorts. After a painful dividend cut that most investors saw coming a mile away, and a realignment of expectations, Q1-2023 was greeted with a big rally. It appears that there is always a “bottom” for Wall Street, and the “buy the dip” mentality remains intact. We tell you what the cheerleaders are missing.

Q1-2023

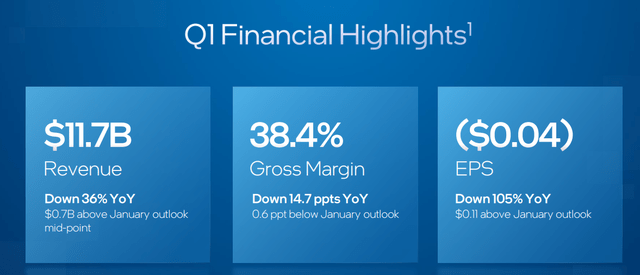

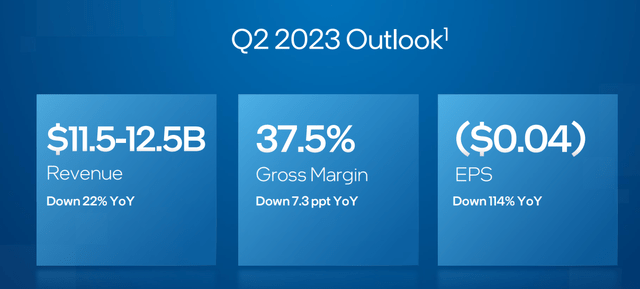

The game is played in finance by making sure you “beat expectations”. Analysts rush to reduce expectations and earnings estimates, and the company will try and oblige by guiding them so low that the actual results come in better. INTC’s Q4-2022 was a perfect setup for this. So here we are and this grotesque set of numbers with a loss of 4 cents a share and revenues of $11.7 billion.

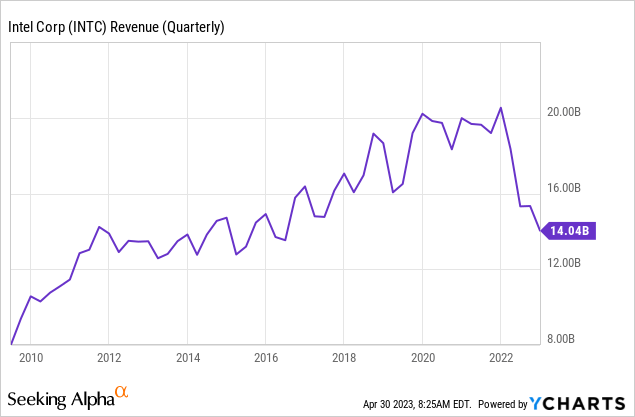

Y-charts has not been updated for this quarter, but you can visualize that you would have to go back to 2010-2011 to find a poorer comparative.

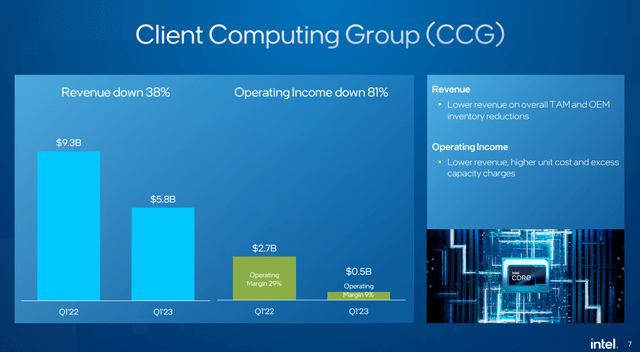

Declines were broad-based, with client computing group taking it on the chin and dropping 38%.

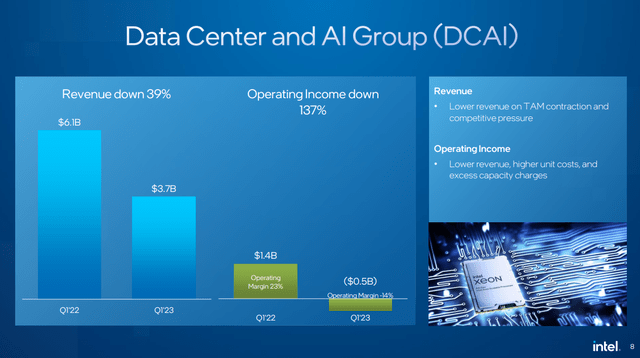

Data center, once mentioned as the centerpiece of INTC’s dominance, fell a shade more than that.

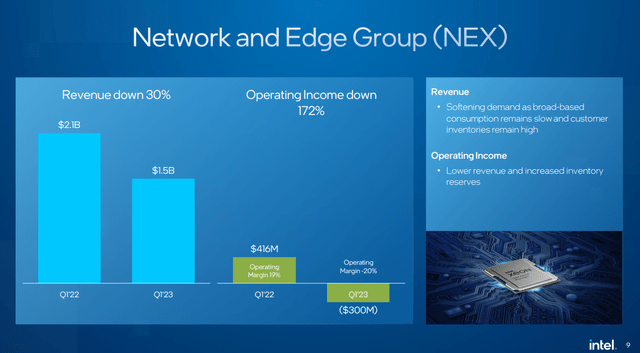

The NEX group was the least impacted on the revenue front, but still the worst operating margin of negative 20%.

So where does all the optimism come from. Perhaps from the Q2-2023 outlook, which shows a midpoint of a $12.0 billion revenue outlook. The chatter here is that we are seeing sequential revenue growth and hence the trough must be in.

There is a lot of wrong with that simple logic, and we tell you why you should be hesitant in jumping on the bandwagon.

2024 Estimates Still Falling

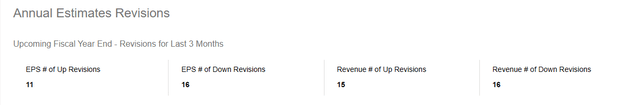

For 2023 the Wall Street crowd was a bit divided after the results. Revenue and earnings estimates received a boost from half the analysts, while the other half realized they were too optimistic.

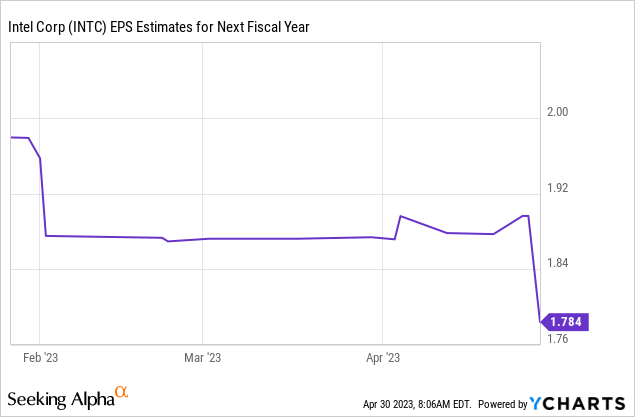

This is what we call a “churn” and it is often, though not always, seen when the company is making a notable turn. But when we move to the next fiscal year, the picture makes a notable change. After the results, almost all analysts cut their estimates. You can see that by the drop in the 2024 estimates, which fell about 6%.

Even These Numbers Assume Heroic Gross Margins

Wall Street still believes that we will have a recession and INTC will increase its revenues by over 15% into 2024. That will be quite the feat if both those scenarios come to pass. As we have previously shown, INTC has never increased its revenues during a recession. Semiconductors as a whole are the most cyclical of sectors, and forecasting an increase is about as logical as expecting real GDP to go up during a recession.

But the madness does not stop there. The expectations are that the $1.78 in earnings will be produced off just $58.0 billion in revenues.

What can we expect with a quarterly run rate of $14.5 billion? We don’t have to look very far for that. After Q3-2022 results, INTC guided for $14-$15 billion in revenues for Q4-2022 (midpoint $14.5 billion) and predicted a midpoint for non-GAAP earnings of $0.20. Let’s forget that INTC never came close to these numbers and just focus on the fact that $14.5 billion should produce 20 cents in earnings. Wall Street has expanded that to 45 cents a quarter. Each predicted event (revenue and earnings estimates) is individually highly improbable. Together, they become impossible.

Wall Street Ignores The Balance Sheet Deterioration

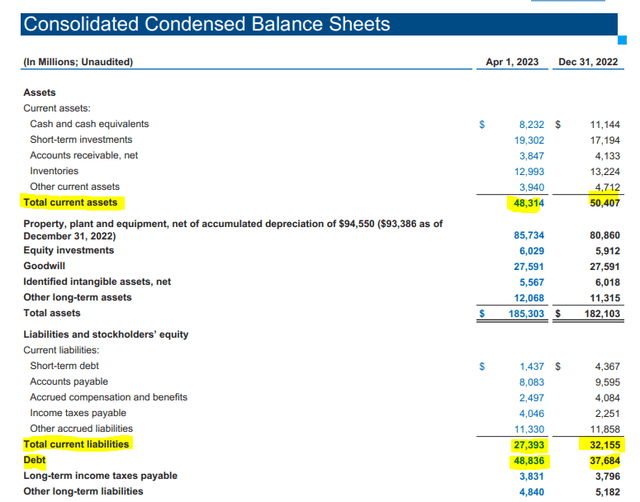

INTC tended to command a premium valuation at market turns because it had a great balance sheet. Assuming we do get a turn within 12–18 months and assuming that the earnings do come through, we believe that the market will not give it the valuation it got in the past. The reason is that the balance sheet is deteriorating rather quickly. Just in the last quarter, net debt, as defined by us as current liabilities plus debt and minus current assets, increased by $8.5 billion.

By the end of 2024, the picture here is going to look pretty ominous, even if all of Wall Street’s average projections on revenues actually materialize. So, a 12-15X earnings multiple is more probable than those lofty 25X numbers that the analysts are using in their targets.

Verdict

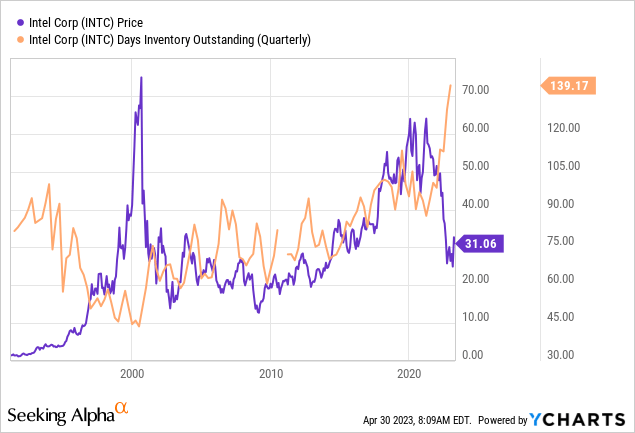

The bull case is made by assuming that the peak in days of inventory predicts the bottom in the stock price.

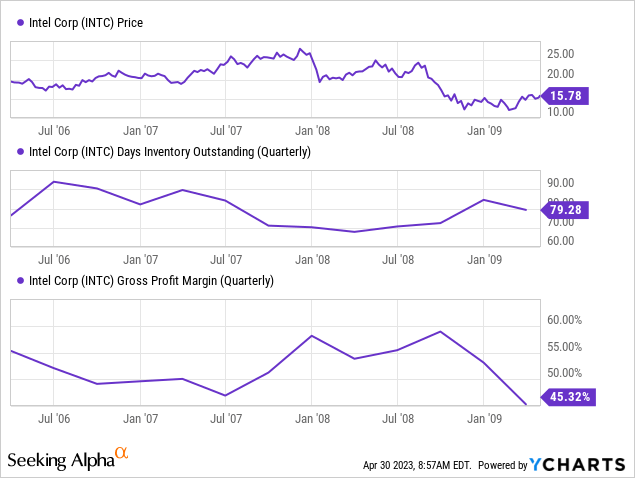

Certainly, the trough in this number predicted the absolute peak during the dotcom bubble. While that is a nice optimistic notion, we think the current levels of inventory are too high to make such an easy extrapolation. The current cycle likely plays out like the 2007-2009 timeframe. We will see some modest improvements in days of inventory and gross profit margins over 1-2 quarters. Then, when the recession actually hits, both these will reverse course again and INTC stock will go to new lows.

So that’s the second hit you have to be on the watch for. After months of actually having a Hold rating, we are actually now moving this to a Sell. As investors know, we use “Sell” generally only for a Short Selling, and we now have a small Short position coupled with $30 PUTs for September 2023. Obviously, that makes us biased, unlike the long positions who always analyze the facts in a cold, clinical fashion and have never “talked their book”.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.