Summary:

- Intel remains on track to launch and ship its Clearwater Forest data center CPU by 2025. In addition, management is confident in process leadership with Intel 18A.

- However, it remains to be seen whether Intel could overcome AMD’s challenges with its Sapphire Rapids processor. Management’s commentary suggests further near-term share losses.

- INTC has recovered remarkably from its December 2022 and March 2023 lows. Sellers aptly rejected recent buyers in early April.

- While INTC’s valuation is not aggressive, its execution risks and weak growth factors could hamper further upward momentum from here.

JHVEPhoto

Intel Corporation (NASDAQ:INTC) stock has underperformed the S&P 500 (SPY) since our previous update, as we downgraded INTC following its remarkable recovery.

The iShares Semiconductor ETF (SOXX) also underperformed the SPX since late March, as market operators took the opportunity to take profits/exposure off outperforming semi-stocks recently.

As such, keen INTC investors should not be surprised by the pullback.

Intel’s earnings release wasn’t that bad, although its adjusted gross margin fell to 38.4% from last quarter’s 43.8%. In addition, the company’s guidance for Q2 suggests that the pain is not over yet, as Intel communicated an adjusted gross margin outlook of 37.5%.

Despite that, management’s commentary suggests that the worst could be over for Intel in H1FY2023, with significant improvement in its profitability in H2.

Accordingly, CFO Dave Zinsner assured investors that Intel expects “to comfortably be in the 40s from a gross margin perspective in the back half of the year.”

As such, Intel expects the worst of the recent headwinds to take a positive turn, even though it remains “cautious about the macroeconomic outlook.”

Notably, Intel expects the recently elevated costs of product qualification, factory underloading, and inventory adjustments to subside moving forward. Hence, these are expected to provide a meaningful bolster to help Intel recover its near-term gross margin.

Furthermore, supply chain sources suggest that the inventory adjustment at its downstream customers has improved significantly. However, the “lack of new product plans for the second half of 2023″ has worried downstream players about a sustainable demand recovery in H2.

Intel management’s commentary indicates that the company sees a “stronger second half,” as its customers are expected to end H1 with a “healthy inventory position.”

As such, the company highlighted its confidence in meeting its outlook of a “270 million unit sell-through TAM for the year.” CEO Pat Gelsinger reminded investors that it’s broadly in line with the “240 million or 250 million units sell-in TAM from industry analysts.”

As such, the expected H2 recovery needs to be closely followed, as INTC’s recovery and price action suggest that investors have likely reflected the optimism.

AMD’s (AMD) challenge against Intel’s ability to improve shipments of Sapphire Rapids is expected to intensify in 2023. As such, management highlighted that “server and networking markets remain weak as cloud and enterprise have yet to reach their bottoms.”

Therefore, Intel’s guidance has likely contemplated the near-term headwinds against further market share losses against AMD. Investors will need to critically assess whether the shipments cadence in Sapphire Rapids could improve in H2, helping Intel compete more effectively against AMD.

Therefore, we assessed that investors need to account for more significant execution challenges, even as Intel said it remains on track with its data center product launch and shipment cadence through 2025 with Clearwater Forest.

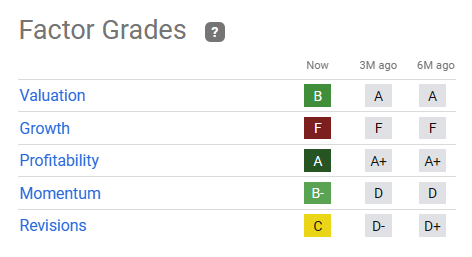

INTC quant factor ratings (Seeking Alpha)

INTC’s valuation remains unaggressive, according to Seeking Alpha’s Quant rating. Accordingly, INTC is given a “B” valuation grade, lower than the “A” grade it received three months and six months ago.

We assessed that INTC’s “A” grade was in line with the bottoming process, attracting buyers in December 2022 and March 2023.

However, INTC’s “F” grade for growth suggests that execution headwinds to recover its mojo must be carefully considered as Intel continues on its “five nodes in four years” process roadmap.

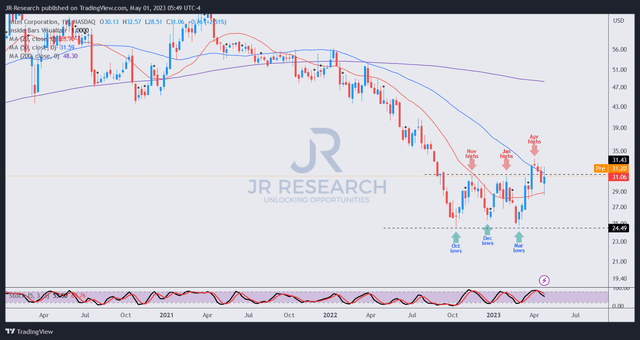

INTC price chart (weekly) (TradingView)

INTC buyers attempted to break through its $31 resistance level in early April. However, their valiant attempt was decisively rejected by sellers, as INTC fell back below those levels.

INTC’s pullback is consistent with the topping signals we saw in the SOXX in March, which suggests caution.

We assessed that there isn’t an optimal entry zone for buyers who missed INTC’s lows in March to hop on board. Our assessment of its growth and valuation factors suggests that it’s important to remain cautious unless we observe significant pessimism in INTC.

Those signals were observed in October and December 2022, which we highlighted here and here. Such signals were also seen in late February/March, which we also presented here.

With that in mind, investors should stay on the sidelines and bide their time.

Rating: Hold (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!