Summary:

- Unlike China and Europe, the U.S. is a growth market for battery electric vehicles, or BEVs, with a very small number of significantly over-catered segments.

- Vehicle sales statistics indicate very strong trends by Tesla’s BEV rivals: predominantly Lucid, Rivian and German carmakers.

- Breakthroughs in sodium-ion battery solutions should enhance affordability in more ways than one.

- Unevenly distributed charging infrastructure hampers widespread adoption. This is another factor on top of existing affordability issues.

- Tesla’s stock price can be expected to increasingly normalize in line with other carmakers.

Marcus Lindstrom

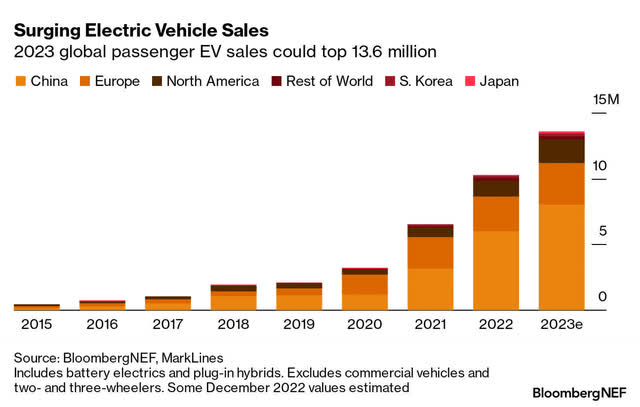

New vehicle sales in the U.S. have been in a steady decline for nearly a decade now, with 2022 being the lowest since 2011. With estimates at around 13.7-13.9 million, this metric represents an 8-9% decline from the previous year. However, electric vehicles (“EVs”) accounted for 5.8% of all new cars sold, representing a solid increase from the 3.1% share in the previous year.

However, it bears to keep in mind that China and Europe have collectively represented the majority of EV sales in the world for well over 5 years now – with the former being a massive market.

The Chinese government’s newspaper of record confirmed on the 15th of March – backed by data from both global EV sales trackers and domestic associations – that EVs accounted for 19% and 11% of all car sales in China and Europe, respectively. 5.2 million Battery Electric Vehicles (“BEVs”) were sold in China, while 807,180 EVs were sold in the U.S.

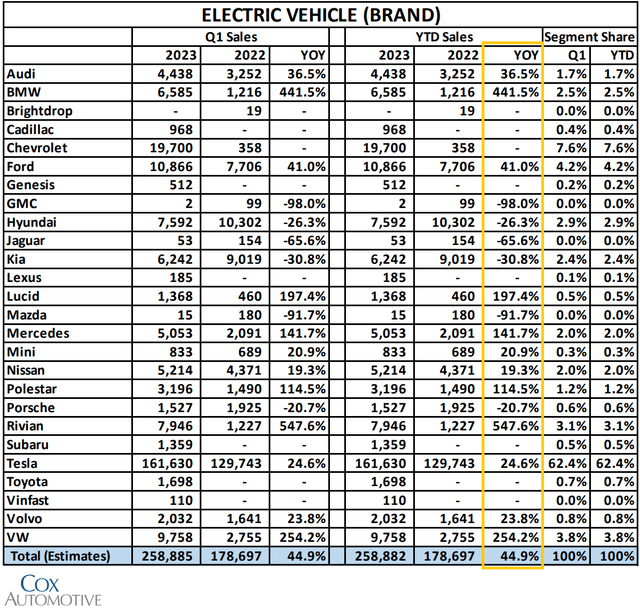

The landscape that dogs Tesla, Inc. (NASDAQ:TSLA) in its native homeland of America is the advent of an increasing range of new entrants and historically-significant carmakers. Mercedes-Benz (OTCPK:MBGAF, OTCPK:MBGYY), BMW (OTCPK:BMWYY), Ford Motor Company (F), Cadillac (owned by General Motors (GM)), Hyundai (OTCPK:HYMPY, OTCPK:HYMLF), Kia (OTCPK:KIMTF) and Nissan (OTCPK:NSANY, OTCPK:NSANF) – among others – all launched their EVs in the U.S. in recent years and have been eating into Tesla’s company’s market share, which dropped from 72% in 2021 to 65% in 2022. China displays a similar but a much vaster landscape: more than 94 brands collectively offer over 300 models – ranging from just $5,000 to over $90,000 – with local brands commanding 81% of the EV market. Tesla held an approximate 14% market share here in the United States during 2021, which slipped to the 8.8% mark in 2022.

The overall sales statistics also indicate a key point: while China and Europe are relatively more mature markets for BEVs, the U.S. (and Canada) can relatively be considered a growth market.

Industry Developments

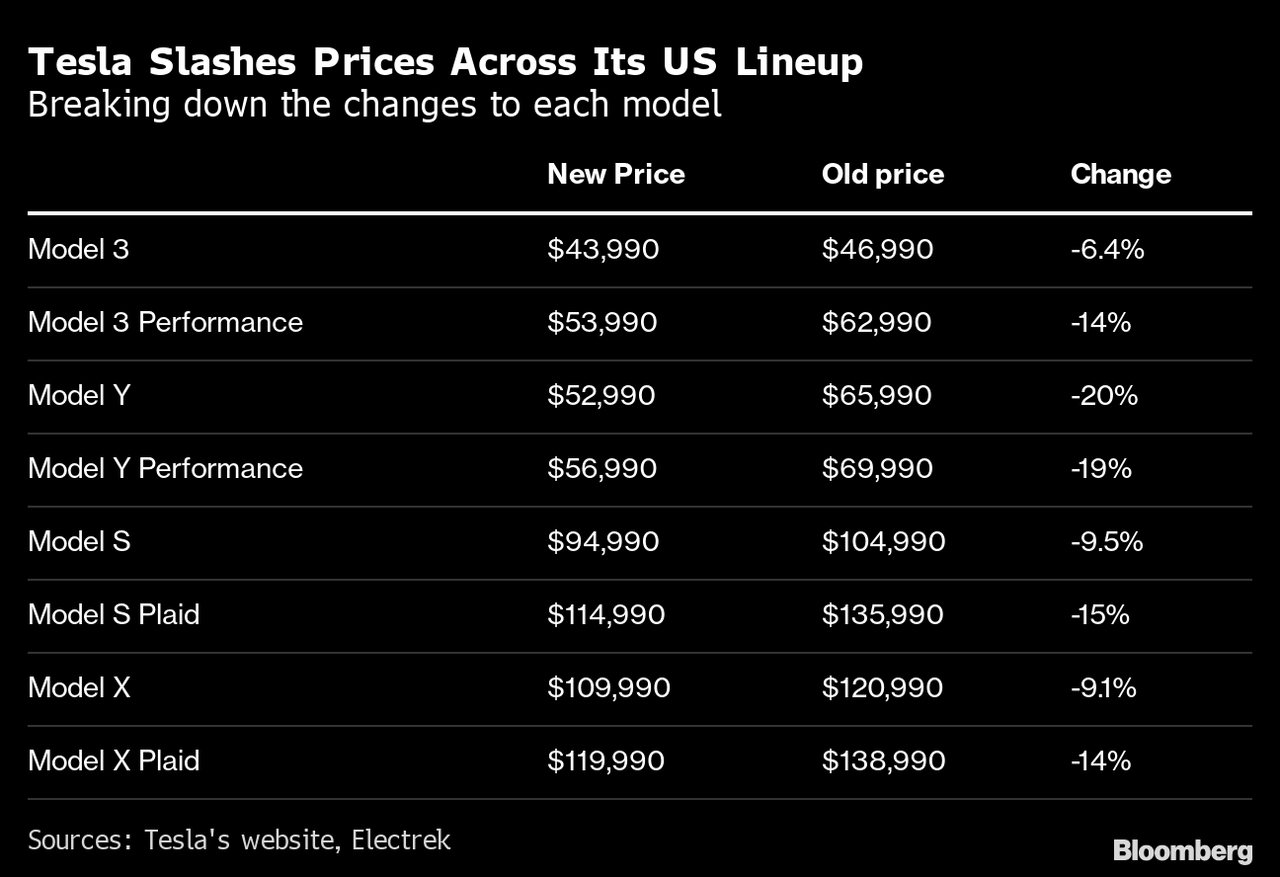

Tesla’s margins have been considered to be even more fraught after a wave of price cuts were announced in recent times:

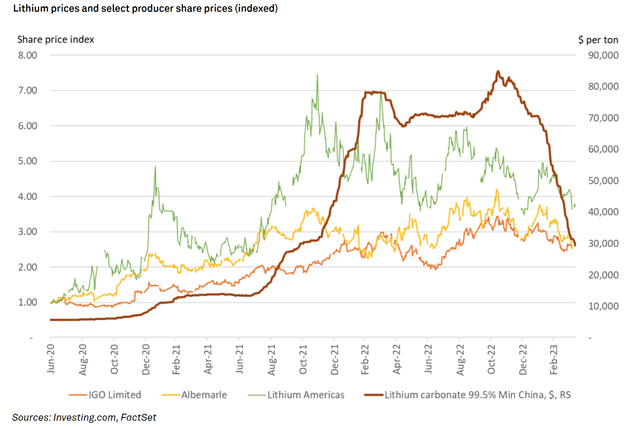

Now, like most carmakers, the company locks prices via mid- to long-term supplier contracts so the concerns over Tesla’s margins are valid. However, over a longer term, this might not be a pressing issue. A key cost component in a BEV is the Lithium-ion battery. Lithium prices have seen a precipitous fall over the YTD:

This has been attributed to two dominant factors: softer demand for BEVs in China as well as larger inventories of vehicles worldwide. Softer demand for BEVs in China, a market that has shown a year-on-year increase in overall car sales, indicates its relative maturity. The larger inventories of vehicles paired with lowering overall sales in the U.S., however, indicate buyer constraints and affordability issues. This is an issue for U.S. carmakers: foreign markets have a deep bench of legacy and upstart competitors while customers in its home turf are increasingly reduced to a “creamy layer” user segment that is over-catered.

In that regard, the decision by Tesla to take a margin hit in order to maintain market share is entirely logical. In future production runs, the present-day depression of battery raw material will likely prove to generate higher margins, depending on how it negotiates with its suppliers. The price cut also had an “electrifying” effect (pun coincidental) on used BEV sales in the U.S. over the course of Q1 this year: a 32% Year-on-Year (YoY) jump in sale volumes are estimated to have been due to falling prices because of these cuts. These figures also lend support to what user segment drives U.S. BEV sales as well as the affordability issue.

Also depressing the long-term outlook for lithium prices is the increasing viability for sodium batteries as an alternative to those made from lithium, with sodium estimated to being 1,000 times more abundant than lithium. One company is already moving to take advantage of this breakthrough: JAC Group – jointly held by a Chinese provincial government and Volkswagen (OTCPK:VWAGY) – announced the launch of the compact 5-door sedan “Hua Xianzi” powered by a sodium-ion battery. The battery solution is developed in association with HiNa Battery, a company affiliated with the state-run Chinese Academy of Sciences.

Putting aside the aspect of lowering U.S. dominance in technology, increasing adoption of sodium-ion batteries by carmakers will likely serve to propel sales: lithium battery packs will continue to become cheaper since sodium-ion battery packs come with price advantages built in.

However, another limitation to BEV sales in the U.S. is the charging infrastructure availability: as of 2022, China had nearly 1.8 million chargers installed. Guangdong Province alone has 383,000 – more than double the number of public chargers in the entire United States. This is yet another factor that limits BEV adoption: “commuter” drivers and large corporate fleet owners might have the flexibility to switch to BEVs. Other segments are less incentivized to.

Performance Trends in the YTD

In terms of U.S. electric vehicle sales, there’s no doubt that Tesla maintains the lion’s share of sales in pure numerical terms. In terms of trends over the year as of Q1 of this year, however, the results are very interesting:

While Ford and General Motors have been racking up a strong increase in sales, American upstarts Lucid and Rivian as well as German legacy houses BMW, VW and Mercedes have shown very strong upticks. While the latter certainly do benefit from having a low numerical base in the prior year, the strong numbers indicate that their offerings are finding strong traction among the addressable market segment in the U.S.

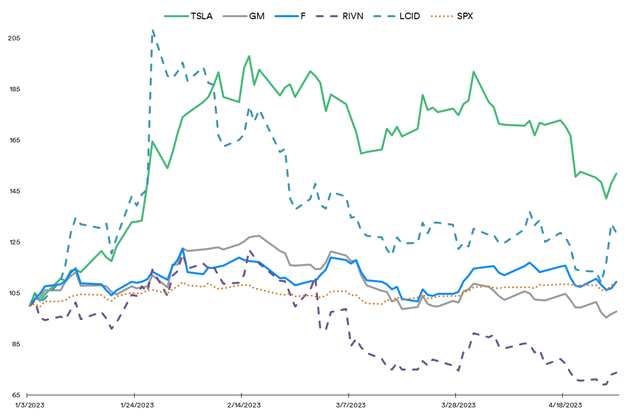

Stock price performance for the U.S. carmakers in the Year Till Date (YTD) graphically are decidedly mixed but do show some correlation with the broad-market S&P 500 (SPX in index form and SPY in ETF form) :

Source: Created by Sandeep G. Rao using data from Yahoo!

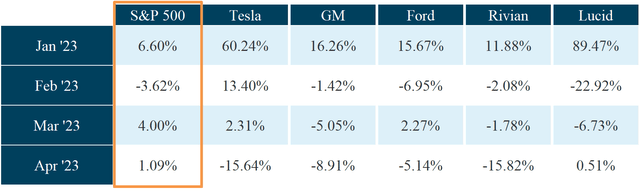

When laid out month-wise, however, there is evidence of some form of rationalization:

Source: Created by Sandeep G. Rao using data from Yahoo!

Data suggests that Tesla has been a strong directional outlier in the months leading up to April. However, April has been a depressor for 4 out of the 5 U.S. carmakers. Such a large proportion of this basket suffering a reversal is indicative of industry-wide gloom on the sales outlook: with price cuts being the way forward to keep short-term demand going, virtually every carmaker is expected to get hit on margins. However, relative to “pure play” carmakers, “diversified” legacy carmakers are tending to maintain a stronger and less volatile trajectory relative to the index.

Key Takeaways

Being in a growth market with an affordability crisis and a small number of controlling over-catered user segments is a highly tenuous situation for U.S. carmakers. Also increasingly obsolete – much like fossil fuel cars – is the argument that an investment in “pure play” EV carmakers is an investment in technological innovation. Outside of affordability, overall trends suggest that buyers are essentially only constrained from switching to BEVs along two lines:

- BEVs requiring long “down times” for charging when compared to either fossil fuel-driven cars or Plugin Hybrid Vehicles (PHEVs).

- Lack of quick-charging infrastructure outside of high-density charging clusters.

Not considering affordability or infrastructure in favor of arguing for technology is a simple case of missing the forest for the trees. In that regard, Tesla has long been overvalued for its technology. As BEVs are increasingly normalized, this argument for overvaluation grows weaker. Thus, Tesla, Inc. stock cannot be expected to forever maintain its high P/E Ratio, given that the average P/E Ratio for the domestic automotive industry lies at around the 11-12X mark. Further stock price rationalization cannot be ruled out.

The infrastructure impediment has a proven solution as seen in China and other countries: creating a universal charging standard across the United States – both “quick” and “slow” – would likely create the pathway for even higher BEV adoption. However, this would further normalize the likes of Tesla against legacy carmakers making an EV push. The latter is by no means a minority: virtually every major carmaker has committed to producing a stable of BEVs.

However, no stock exists in a vacuum. What does help the likes of Tesla, Inc. and large legacy carmakers to some extent was outlined in the previous article: given the macroeconomic outlook, size is driving a bias in investor choice. The larger the company, the higher its imputed survivability.

Balancing this versus the well-exhibited deflation of overvaluation in U.S. equities implies that the trajectories of carmaker stocks are bound to be volatile in the periods to come for at least the duration of the current year. Investors should keep this in consideration prior to exercising their choices.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I lead research at an ETP issuer that offers daily-rebalanced products in leveraged/unleveraged/inverse/inverse leveraged factors with various stocks, including some mentioned in this article, underlying them. As an issuer, we don't care how the market moves; our AUM is mostly driven by investor interest in our products.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.