Summary:

- The banking crisis seems to be coming to an end after news broke that JPMorgan Chase & Co agreed to absorb First Republic Bank.

- This move will be a significant loss for shareholders of First Republic Bank, but it is a boon for JPMorgan Chase and its shareholders.

- This continues a long history of the company stepping in to support the economy, both for society’s interests and its own.

Drew Angerer/Getty Images News

May 1st was a dark day for shareholders of First Republic Bank (NYSE:FRC). After a couple of months of struggling following the start of the banking crisis in early March of this year, news broke that, following being taken into receivership by the FDIC, the beleaguered institution is essentially being absorbed by JPMorgan Chase & Co. (NYSE:JPM) in an attempt to further contain the contagion that has caused so much havoc in the banking sector. Although painful for shareholders of First Republic Bank, this should prove to be a boon for its acquirer. Furthermore, this will very likely put the final nail in the coffin of the banking crisis, hopefully allowing the economy to get back on track with business as usual.

One winner and one loser

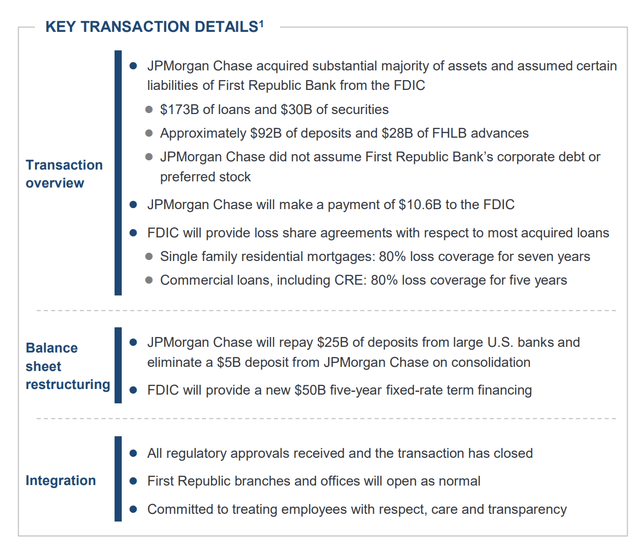

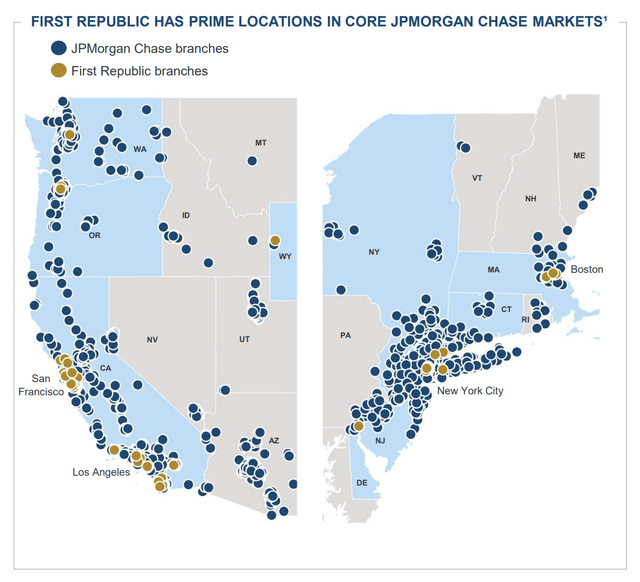

Whether or not you are happy about the news regarding First Republic Bank will likely be based on which side of the deal you find yourself. Based on what we know, for instance, common shareholders of First Republic Bank are essentially being wiped out. But for investors in megabank JPMorgan Chase, this development is a massive win. According to the news as it broke on May 1st, JPMorgan Chase agreed to acquire the substantial majority of the assets owned by First Republic Bank from the FDIC. As part of this, they have also agreed to take on the deposits, and some other liabilities, associated with the bank.

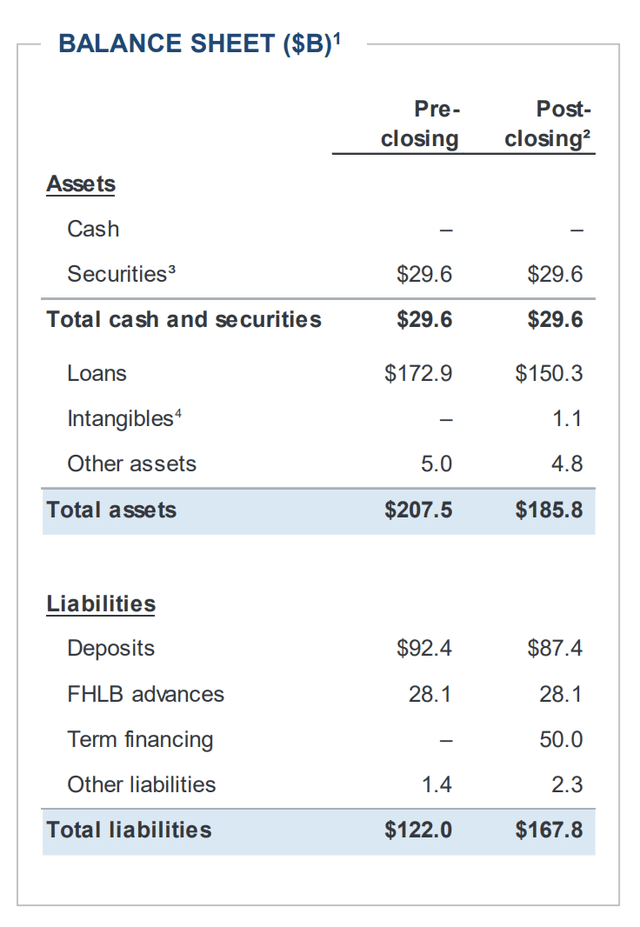

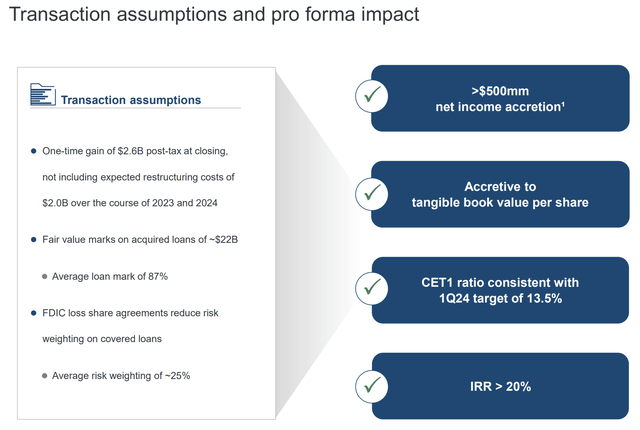

In exchange for the assets and assumed liabilities, JPMorgan Chase has agreed to pay the FDIC $10.6 billion. In exchange, they will receive $207.5 billion in assets and $122 billion in liabilities. This will consist of $29.6 billion in securities and $172.9 billion worth of loans. After certain closing adjustments, the balance sheet of First Republic Bank will look a bit different. This is due to a number of factors. For instance, earlier this year, First Republic Bank received $30 billion in uninsured deposits from a consortium of the largest banks. Immediately following the closing of this deal, JPMorgan Chase will be paying out $25 billion to those institutions, with the other $5 billion being eliminated in consolidation since that $5 billion initially came from JPMorgan Chase itself. JPMorgan Chase is also acknowledging a roughly $22.6 billion reduction in the value of the loans it is receiving.

There are some other interesting aspects to this transaction. For starters, the FDIC has agreed to provide JPMorgan Chase with $50 billion of fixed-rate term financing for the next five years. This is purely speculative on my part, since management refuses to disclose what the interest rate on the term loan is. But odds are, it’s a low rate. If so, this could be a big win for the company, since even saving 1% on rates for an amount that large could result in extra pretax profits of $500 million per year. On top of this, the management team at JPMorgan Chase negotiated significant loss sharing agreements with most of the loans that it is receiving from First Republic Bank. This includes 80% lost coverage for seven years for single family residential mortgages and 80% lost coverage for five years for commercial loans. This means that the FDIC has agreed to basically guarantee a sizable majority of those loans in the event that they don’t work out.

At present, 60% of the loans on First Republic Bank’s balance sheet by value or single family. 13% is classified as multifamily. Another 12% is in the form of capital call lines and business loans, while 6% is in the form of commercial real estate. All other miscellaneous loans comprise the remaining 8% of the company’s loan portfolio.

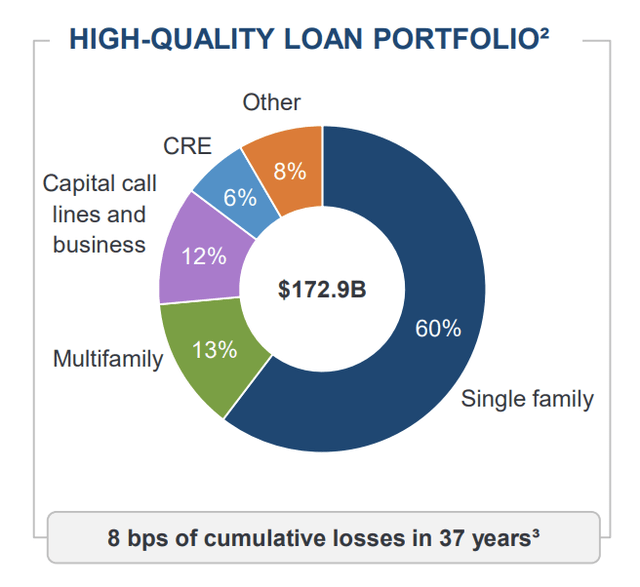

Ignoring all of these benefits, there are some other opportunities that JPMorgan can capitalize on here. Although JPMorgan Chase is substantially larger than First Republic Bank, they do have an overlapping physical footprint. In particular, this includes parts of the West Coast like San Francisco and Los Angeles, as well as Boston and New York City. In fact, of the 84 branches that First Republic Bank has open right now, 60, or roughly 71.4%, are located in these cities. Its greatest exposure is the San Francisco where it has 32 different branches. Presently, we don’t know how many of the branches that are out there will actually be closed. The management team at JPMorgan Chase did say that they view this as an opportunity to further grow into the US wealth management space. So it is possible then a sizable portion of these locations might still remain operational. But for now, that is all up in the air.

The reason why this is significant is that it will create an opportunity for material synergies between the two institutions. As of this writing, we do not yet know what these synergies might come out to be. But we do know that, all combined, this transaction should increase JPMorgan’s annual net income by $500 million or more. In 2022, the megabank generated profits of $37.68 billion.

Ignoring all of the other benefits that the bank is receiving from this transaction, using the data from 2022 and assuming that the price to earnings multiple that JPMorgan Chase was trading at immediately before the deal was announced is reflective of its true value, this increase in profitability should add about $5.38 billion to the company’s market capitalization. But seeing as how the stock shot up 2.1% for the day, adding $8.86 billion to its market capitalization, it’s obvious that the market is baking in the other aspects of the deal as well.

Of course, this transaction will not come without some significant restructuring costs. These are estimated to be about $2 billion split between this year and next. Fortunately, this is more than offset by the $2.6 billion post-tax gain that the company is booking on the deal and the assets it is receiving.

As for the financial stability of JPMorgan itself, investors need not worry. As I mentioned already, the company generated a significant amount of profits last year. Operating cash flow was even higher at $107.12 billion. The company has total assets of $3.67 trillion on its balance sheet, with a book value of equity of $292.33 billion. Even without the perks provided to it by the FDIC, JPMorgan Chase is large enough to absorb these assets and contain the contagion. I would also like to note something interesting from a historical perspective. This is not the company’s first rodeo in coming to the rescue.

Back in 2008, as it looked like the financial world was collapsing, JPMorgan Chase acquired Bear Stearns in a deal valued at roughly $1.4 billion. This marked a significant increase over the $270 million the company initially agreed to buy Bear Stearns for. For context, that bank’s headquarters building was worth around $1 billion at the time. But this is far and away from being the first example of the company stepping in.

One could argue that swooping in to help bail out the financial sector is in the company’s DNA. It dates back to the days when J.P. Morgan himself ran the show. During the Panic of 1907, the institution stepped in to back the economy. Similar events took place in 1895 and 1893. Also, in 2008, JPMorgan Chase acquired Washington Mutual Bank, the largest failed commercial bank in U.S. history, for $1.9 billion. That deal brought to the institution $307 billion in assets, with total deposits of $188 billion.

Of course, the company does not do this out of sheer goodwill. It is true that it is a positive development when it does take place. Rather, the main motivations for the company are the need to survive and the desire for additional profit. If one or both of these motivations were not on the table, it is all but certain the company would not step forward. This is not meant to be condemnation against the business. Rather, it is the cold but truthful observation of the facts. It is the same kind of observation that led the company to step in this time as well.

Takeaway

Based on the data provided, it seems to me as though JPMorgan Chase & Co. has continued a long tradition of serving a vital role in our nation’s economy. For better or worse, the company has agreed to absorb First Republic Bank, essentially using its massive assets to squash the contagion that was otherwise threatening to spread. Had they not stepped forward, there were other institutions that would have. Some of them even expressed an interest and made bids.

For shareholders of First Republic Bank, this marks a rather painful day. But at least it brings a conclusion to the troubles that they had dealt with over the past two months. Investors in JPMorgan Chase & Co., meanwhile, should view this as a win. The company immediately increases its asset base, paves the way for additional growth in the wealth management space, and is growing profitability, all in one fell swoop. Given these factors, I would argue that JPMorgan Chase & Co. stock warrants a “buy” rating this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!