Summary:

- Pfizer reported its Q1 2023 earnings today.

- The company beat expectations of revenues and EPS as its COVID Franchise outperformed.

- Inevitably, COVID revenues will shrink over time but management has been spending big on M&A.

- Management is promising some $45bn in new revenues by the end of the decade – but the market seems to want another COVID franchise.

- That won’t happen, but for those prepared to be patient, today’s earnings and the company’s growth potential encourage a mild “BUY” opportunity.

JHVEPhoto

Investment Overview

New York headquartered Pfizer (NYSE:PFE) reported its Q1’23 earnings earlier today. The company outperformed analysts’ estimates in terms of both revenue – which came in at $18.3bn – and Earnings Per Share (“EPS”) – $1.23 on an adjusted basis – thanks to a less than expected fall in revenues from its COVID vaccine Comirnaty, and COVID antiviral, Paxlovid.

This being Pfizer however – a healthcare behemoth whose share price has delivered just 17% growth across the past 5 years – from ~$33 per share, to ~$39 per share – the company’s stock did not respond to the positive news in any meaningful way.

Perhaps it is Pfizer’s monumental share count – with 5.6bn shares. Of listed companies only Apple (AAPL), Alphabet (GOOG), Amazon (AMZN), Bank of America (BAC) and AT&T (T) have issued more – but this company has traditionally been more about the dividend than the stock from an investment perspective.

On Sunday, Pfizer announced an increase in the dividend payout to $0.41 per quarter, for an annual yield of >4%, which is competitive and a good selling point, but if you are looking for a Pharma company whose share price can deliver a strong, near-term bull run, you are probably looking in the wrong place with Pfizer.

Consider the past few years the Pharma giant has had. Its development of the world’s most widely used COVID vaccine, Comirnaty, alongside partner BioNTech (BNTX), saw Pfizer finally deliver some top line revenue growth after it had slipped from $52bn in 2013 to $42bn by 2020. This growth, it has to be said, was spectacular, not steady.

Comirnaty sales in FY21 and FY22 were $36.7bn, and $36.8bn respectively, whilst in 2021 Pfizer developed the COVID antiviral therapy Paxlovid, the safest and most effective to date against the effects of the virus – and in 2022, the company earned $18.93bn from this drug. Granted, 50% of revenues from Comirnaty went to BioNTech, but nevertheless, Pfizer drove incredible top line growth to $82bn in 2021, and $100.3bn in 2022 – more than doubling its revenues in less than 3 years.

Net income has also climbed – from $6.6bn in 2020, to $22.4bn in 2021, and $31.4bn in 2022. Pfizer’s EPS has risen from $1.65 in 2020, to $5.6 last year.

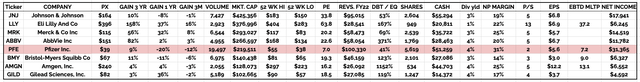

Big 8 US Pharma firms compared (data sourced from Google Finance / TradingView)

If we compare Pfizer to its US Big Pharma rivals – Johnson & Johnson (JNJ), Eli Lilly (LLY), Merck & Co (MRK), AbbVie (ABBV), Bristol Myers Squibb (BMY), Amgen (AMGN) and Gilead Sciences (GILD) – as per the table above we can see that Pfizer stock looks drastically undervalued by some measures – i.e. price to sales ratio, price to earnings ratio – revenue generation and net profit margin.

Pfizer generated 3.5x more revenue than Eli Lilly in 2022, yet its market cap is $150bn lower than Lilly’s. Pfizer drove close to 2x the revenues of Merck and AbbVie, and achieved a substantially higher profit margin, yet its market cap of $220bn at the time of writing is nearly $50bn lower than AbbVie’s, and ~$70bn lower than Merck’s.

By these measures Pfizer’s stock price looks anomalously low and set for growth, but the market has come to a different conclusion – that since the additional revenues earned from COVID by Paxlovid and Comirnaty are not set to be a permanent fixture – i.e. demand for both will fall significantly as fewer people get vaccinated for COVID and fewer require antiviral treatment – Pfizer’s growth is compromised and therefore its valuation also.

In many ways, Pfizer’s Q1’23 earnings were a perfect riposte to that conclusion, as I will explain in this post, as well as outlining in what other areas Pfizer can grow, what management’s plans are and whether Pfizer stock is worth owning, or buying, at the present time.

Pfizer Q1’23 Earnings Overview – A Better Than Expected Short Term Performance

Pfizer’s share price did hit the giddy heights of $60 per share in late 2021 when Comirnaty’s manufacturing and distribution was at its peak, and Paxlovid about to be rolled out – but has since retreated to trade lower than it did in 2016, and in the early years of the new millennium – which gives you a feel for how stagnant the share price has been.

If a company earns an additional ~$100bn of revenues in 2 years you would think its shareholders would be rewarded, but not in Pfizer’s case!

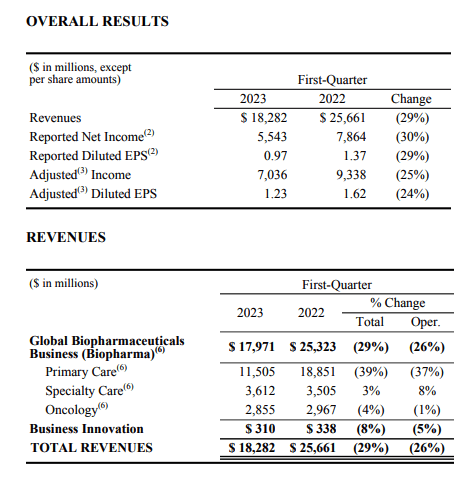

Pfizer Q123 performance top level (Pfizer press release)

As we can see above revenues fell by 26% year-on-year, from $25.7bn to $18.3bn, which is almost entirely due to the falling contributions from Comirnaty and Paxlovid, which drove $7.1bn between them for the quarter, versus $14.7bn in the prior year.

Comirnaty revenues decreased from $13.3bn in Q1’22, to just over $3bn, while Paxlovid revenues actually increased year-on-year, from $1.5bn, to >$4bn. Management may have been pleased with that performance, which shows that Paxlovid in particular still has a key role to play in treating COVID patients, but also cautioned on its earnings call with analysts that:

… we expect significantly lower sales contributions from our COVID products in the second-quarter versus the first-quarter.

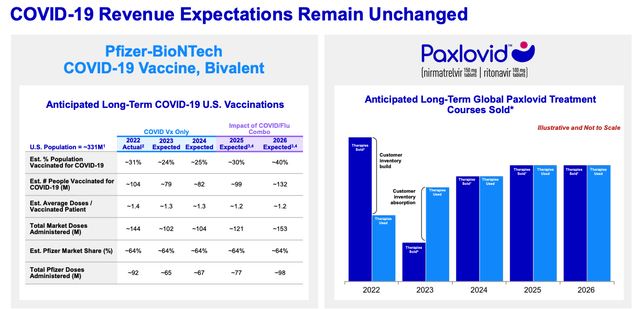

Pfizer COVID franchise revenue expectations (Pfizer earnings presentation)

Nevertheless, as shown in the slide above, Pfizer is not giving up on its COVID franchise, which after all, still accounted for 39% of the Pharma’s total revenues in Q1’23 – in FY22, that figure was 57%. Management continues to believe that a private – possibly reimbursable – market for COVID vaccinations will emerge, and also that it can deliver a combined COVID / Flu vaccine. It would not surprise me if the COVID franchise remained not far off a double-digit billion per annum revenue generating franchise for many years to come.

Leaving COVID aside, Pfizer also drove 5% year-on-year growth for its ex-COVID products, to $11.15bn. Pfizer has a large portfolio of drug products that numbers almost 50, but only 8 of these achieved blockbuster (>$1bn per annum) sales in 2022, and the biggest revenue generators were anticoagulant Eliquis, which loses its patent exclusivity in 2026, and the Prevnar family of Pneumococcal conjugate vaccines, which also faces patent cliffs from 2026. Both of these assets generated >$6bn of revenues in FY22, and saw sales grow by 5% and 2% respectively in Q1’23.

Still, like the COVID drugs, the market expects that Eliquis and Prevnar sales may start shrinking when their patents expire, and this is likely being baked into the share price and preventing even positive short term performance from being rewarded.

Going through Pfizer’s latest 2022 10K submission (annual report), it seems that several other key drugs are threatened by patent expiries – including the Vyndaqel family of products – $686m of revenues in Q1’23, or 4% of total revenues, Xeljanz – $237m of sales, down 36% year-on-year, Ibrance – $1.14bn sales in Q1’23, or 6.3% of total revenues, plus Xtandi and Inlyta from the oncology division – >$500m sales in Q1’23, and Xalkori – >$100m sales in Q1’23.

Worries Persist About Pfizer’s Long Term Growth Plans

Many of the above mentioned drugs with patent expiries potentially looming are key to Pfizer’s core revenue generation, and not many products outside of this bunch are generating especially strong growth or making a key revenue contribution, which again underlines why analysts and the market are reluctant to buy the company’s stock.

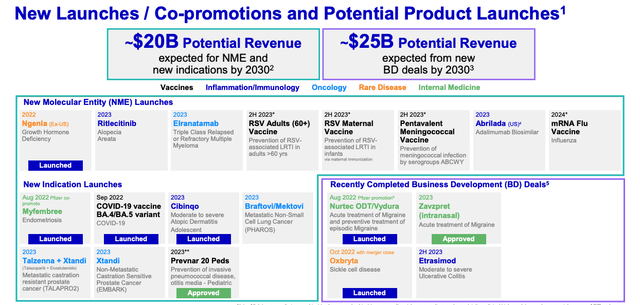

Nevertheless, Pfizer is promising faster ex-COVID product revenue growth in the second half of this year, buoyed by a number of key product launches, including Cibinqo for eczema, approved in January and forecast internally for peak sales of ~$3bn, and later in the year, potentially alopecia therapy Ritlecitinib, migraine therapy Zavzpret, approved in March, blood cancer therapy elranatamab – forecast for peak sales of $4bn per annum – a new RSV vaccine, label expansions for Xtandi and Braftovi, and a potential approval for blockbuster-in-waiting Etrasimod.

It is not a bad list of new product launches to be unveiling this year, by any means, although the Pharmaceutical industry is highly competitive and Pfizer will be desperate to avoid its revenues retreating too rapidly from COVID era highs, to the stagnant growth of the decade before, scaring off investors in the process. That is why the company has been busy spending the cash generated from COVID vaccine and antiviral sales on M&A. As I discussed in a recent note on Pfizer:

Since mid-2021 Pfizer has completed: a $2.3bn deal for Trillium Therapeutics and its 2 CD-47 targeting blood cancer drug candidates; a $7bn deal for Arena Pharmaceuticals and its late stage autoimmune candidate Etrasimod; an $11.6bn deal for Biohaven and its lead candidate Nurtec, indicated for migraine treatment; a $5.4bn deal for Global Blood Therapeutics and its ~$200m per annum commercial stage drug Oxbryta, indicated for Sickle Cell Disease (“SCD”), and lead candidate GBT601, which may offer a functional (permanent) cure for SCD; and, finally, a $525m deal for Reviral and its antiviral therapeutics targeting respiratory synctial virus (“RSV”).

And of course, in March Pfizer announced that it will be spending $43bn acquiring the antibody drug conjugate pioneer giant Seagen – Seagen markets and sells ADCETRIS, approved to treat Hodgkin’s Lymphoma and T-cell Lymphoma, PADCEV, approved for Urothelial (bladder) cancer, and TIVDAK, approved for Cervical Cancer. These 3 drugs earned, respectively, $839m – up 23% year-on-year – $451m – up 33% year-on-year – and $63m – up 923% yoy – in 2022.

Pfizer future revenue generation (Pfizer presentation)

As we can see above, Pfizer has some ambitious plans to generate $20bn from its product pipeline by 2030, and also add another $25bn to the top line thanks to its business development, through the likes of its new migraine franchise, Sickle Cell Disease drug Oxbryta, Etrasimod – with a potentially best in-class efficacy and safety profile – and there is no mention of the Seagen assets here, although management believes it can generate >$10bn in risk adjusted revenues by 2030 from this business.

Some $45bn – $50bn of new revenues by 2030 is a bold promise, although it is some $10bn less than the COVID franchise generated in 2022, which means that, despite all this progress, the market can still make a case the company is traveling in reverse. It seems hard on Pfizer, given the company generated substantial profits from its COVID drugs, which it has diverted into growing the business, but the reality is that the company is a little low on what we might call ‘mega-blockbuster” drugs.

What I mean by that is Merck has a >$15bn selling asset in Keytruda, which analysts believes could one day generate >$25bn in annual sales. Lilly’s valuation is higher than Pfizer’s mainly because analysts believe its new drug Tirzepatide could generate >$50bn per annum in peak sales – more even than Comirnaty.

AbbVie’s Humira has generated >$15bn per annum for many years – although it goes off patent this year, AbbVie has developed 2 new drugs that it says will generate >$25bn per annum between them – even Gilead Sciences has a double-digit billion selling asset in Biktarvy.

Frankly, Pfizer’s ex-COVID product portfolio and pipeline is large, and diverse, but lacking in genuinely stand out revenue generators of the type that can attract a lot of investment into the company that expects a good return.

Conclusion: Pfizer Can’t Quite Catch A Break – The Company Needs A Guidance Uplift To Reignite Share Price

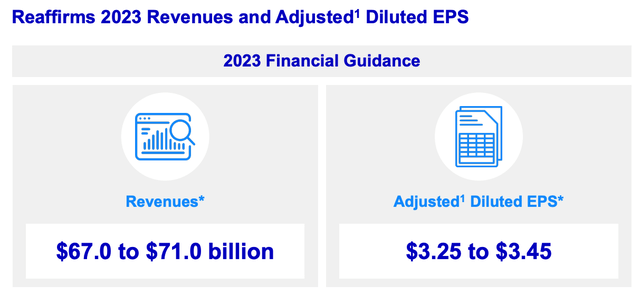

Pfizer 2023 Guidance (Pfizer presentation)

Ultimately, despite a solid set of earnings that exceeded expectations at the top and bottom line, Pfizer did not raise its FY23 guidance after reporting its latest quarters’ results, which stands at $67 – $71bn of revenues, and adjusted EPS of $3.25 – $3.45.

That gives us a forward P/E ratio of 11.5x, and a forward P/S ratio of ~3.2x. Once again I will emphasize how low these ratios are for a major pharma – much lower than any of its rivals, but will that translate to share price growth? I doubt it, in the short term at least.

Pfizer showed in 2021 that despite its monumental share count and prior stagnant growth, its shares do offer upside potential, but it has to be said that as the COVID opportunities narrow – likely into a private market and a flu / combo vaccine opportunity – the market has not continued to support Pfizer as management has funneled the COVID profits into new business acquisitions designed to future-proof the company.

Personally, I don’t think Pfizer has done much wrong – the M&A deals management has done seem relatively sensible – even if the $43bn paid for Seagen feels too high – and the promised new revenues, if achieved, could make Pfizer the world’s biggest Pharma by revenue long-term, now that JNJ plans to spin-out its consumer health business.

For the time being however, as the new businesses are embedded in and new products launched, the business is hard to value and the performance of newly launched drugs is uncertain. I hope to share some more detailed forward revenue guidance and a discounted cash flow analysis calculating a share price target in a future post.

The uncertainty makes Pfizer stock an intriguing play in my opinion. The company did not waste the additional $15bn and $25bn per annum of profits it received from COVID in 2021 and 2022, but it diverted them into new business opportunities.

It will take a long time for the market to judge how successful that process has been. Based on the current undervaluation of Pfizer stock, so long as you have confidence in management’s stated growth plans, buying Pfizer stock at the current price and holding long term is not necessarily a bad course of action in my view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, GILD, BMY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.