Summary:

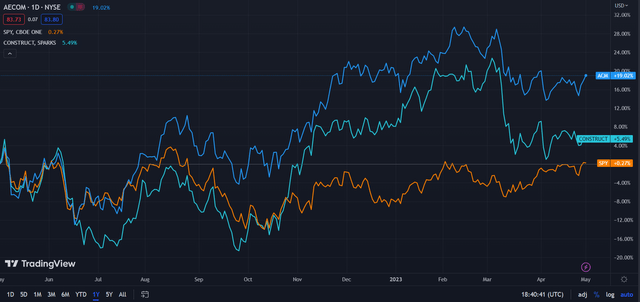

- In the past year, AECOM has experienced 19.12% share price growth, in contrast to SPY (+0.46%) and the general construction industry (+6.02%).

- This occurred in spite of macroeconomic challenges, such as inflation, rising interest rates, etc. with high impact on the construction industry.

- While the company’s net revenues have declined in the trailing 5 years, its net income has grown substantially, and free cash flow has remained stable.

- AECOM’s lean infrastructure consultancy strategy, alongside superior talent attraction and a strong relationship with the government, has contributed to this success.

- As such, despite the rally of the past year, the market’s chronic inability to adequately price AECOM’s operation success leads me to rate the company a ‘buy’.

JHVEPhoto/iStock Editorial via Getty Images

AECOM (NYSE:ACM) is a multinational infrastructure consultancy company with operations focused on North America.

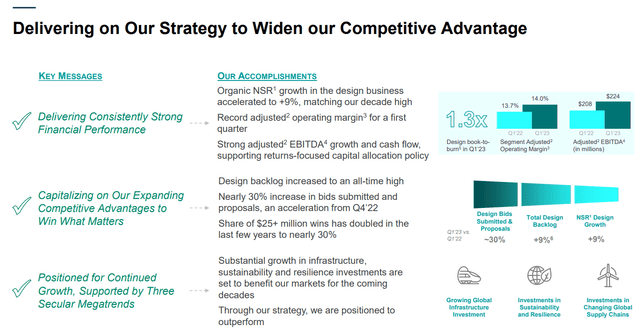

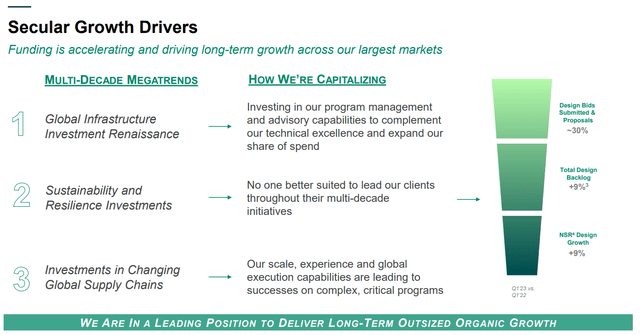

The company maintains a three-pronged approach to providing value; consistent financial performance, capitalizing on competitive advantages, and leveraging secular megatrends for growth.

AECOM Q1 Investor Presentation

On all three fronts, the company has proven itself successful; on financials, the firm has consistently experienced margin growth alongside stable free cash flow; on competitive advantage, the company has both expanded employee programs to retain best-in-class talent while sustaining a record high design backlog; on secular growth, the company has developed expertise in climate and supply chain while learning how to navigate increased global infrastructure investment best.

Through these activities, AECOM has seen TTM revenues approach $13.26bn, alongside a net income of $337.01mn.

Introduction

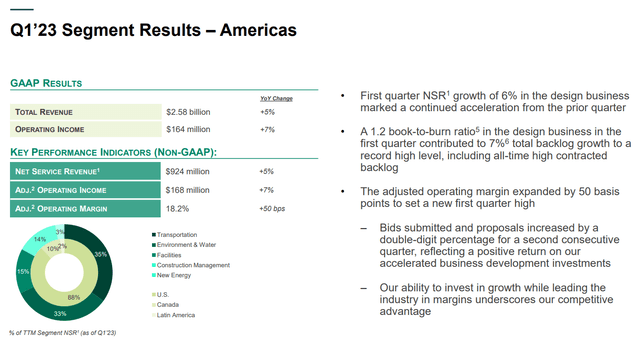

Although AECOM operates across many infrastructure latitudes, the company chiefly segments its activities geographically; in the Americas, in Q1 of this year, the company has generated $2.58bn in total revenue, alongside an operating income of $164mn, with respective YoY changes being +5% and +7%. On the flip side, internationally, the company has experienced $803mn in Q1 revenues alongside a $55mn operating income, an increase of 0% and +4% respectively.

AECOM Q1 Investor Presentation

Although the company maintains a significantly larger presence in the Americas, its international operations involve greater margins. In both arenas, however, the company has experienced superior net income growth to revenue growth, emphasizing AECOM’s recent focus on margin expansion.

Valuation & Financials

General Overview

Relative to both the broad market (SPY) and the general construction industry index- as aggregated by TradingView- AECOM has experienced superior price action.

AECOM (Dark Blue) vs Market & Industry (TradingView)

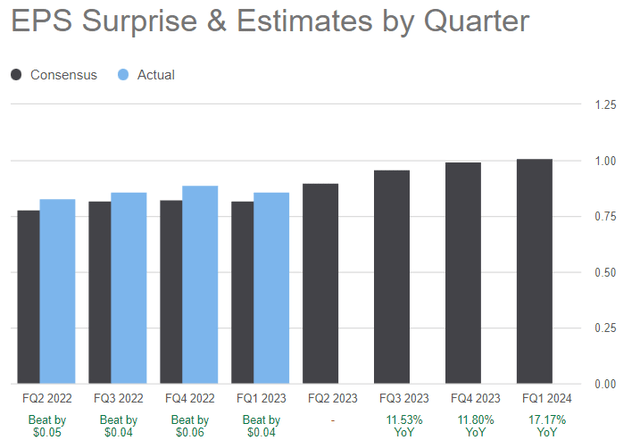

This growth, however, is merely a product of AECOM’s recurring financial success, consistently outperforming analyst expectations, and does not price in the long-term scale and margin growth I expect the company will experience.

AECOM Earnings Surprise (Seeking Alpha)

Comparable Companies

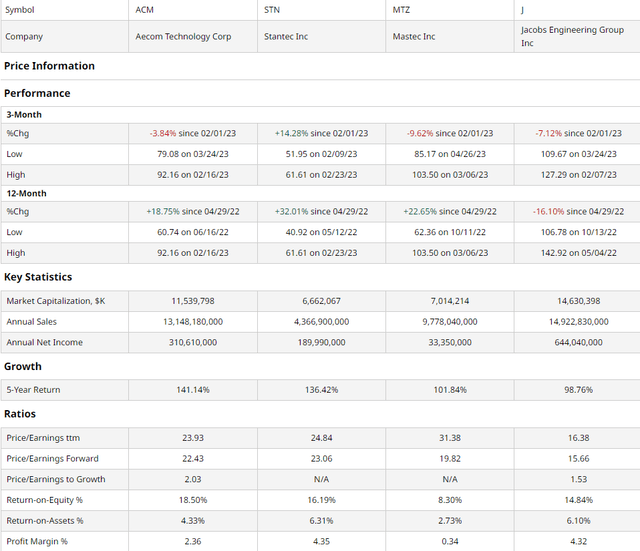

The complex and localized nature of construction lends itself to an inherently fragmented market; as such, AECOM has few direct infrastructure consultancy rivals. However, while not direct competitors on all fronts, construction and engineering firms such as Stantec (STN), MasTec (MTZ), and Jacobs Solutions (J) are adequately comparable peers.

As demonstrated above, while AECOM has undergone a substantial rally in the TTM, it is not out of the ordinary among peers. In the trailing 5 years, though, the company has sustained superior returns to all peers, likely owing to the delivery and reception of large projects and financial results isolated from macroeconomic concerns.

AECOM continues to, on a multiples basis, be priced similarly to its peers.

Despite all this, I believe that the relatively lower profit margin of the company to its peers indicates potential for even greater margin growth. This is further justified by AECOM’s operational tendencies heading into the future, for instance, the company experienced significant net service revenue growth owing to their existing backlog, enabling the company to demand greater fees and creating a virtuous cycle of scale and margin expansion.

Valuation

According to my discounted cash flow model, AECOM stock is undervalued by nearly 31%, with its fair value being $122.12, up from $83.91 today.

The model assumes a discount rate of 8%, a hurdle rate calculated through AECOM’s relatively low equity risk premium and debt-centric cap structure.

To adequately project future value, I estimated a net margin in line with the industry average of ~4%. The model was calculated over 5 years without perpetual growth.

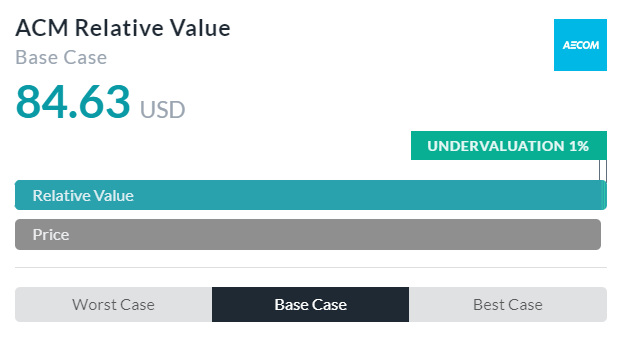

Alpha Spread

While Alpha Spread’s relative valuation tool does not pronounce AECOM’s undervaluation as resoundingly as my DCF, reiterating that AECOM is valued at parity with competitors and peers.

As aforementioned, I believe this approach neglects AECOM’s operational and strategic superiority across its suite of solutions.

Strategy Optimized to Capitalize on Megatrends

AECOM Q1 Investor Presentation

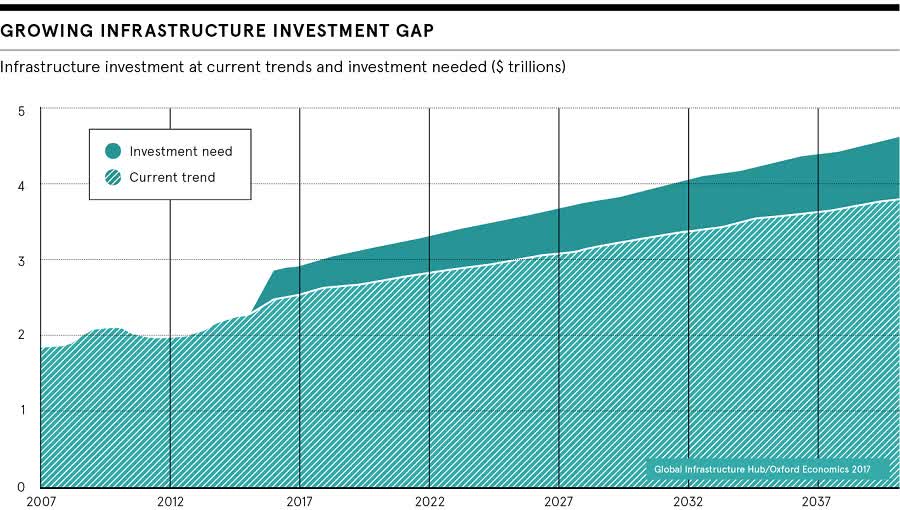

Over the coming years, infrastructure investment is expected to continue being a growing asset class, due to the increasing investment need for this product; this remains consistent when considering public investment in addition to private, financial investment. Even more so, many of these investments are expected to be in response to the growing climate and sustainability themes. By investing in employees through expanded benefit programs, in addition to holistically developing expertise in these areas through Technical Practice Networks and Digital AECOM, AECOM is the best positioned to take advantage of these trends.

Oxford Economics

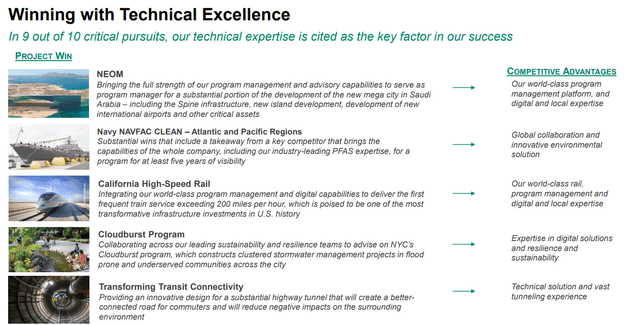

The company has already captured value through this strategy; AECOM was selected as a program manager for the Spine infrastructure, new islands, international airports, etc. for NEOM in Saudi Arabia, with their technical expertise being cited as a key factor for success. From a historic perspective, the marquee California High-Speed Rail project is a transformative infrastructure investment for which AECOM is taking the lead due to technical excellence.

AECOM Q1 Investor Presentation

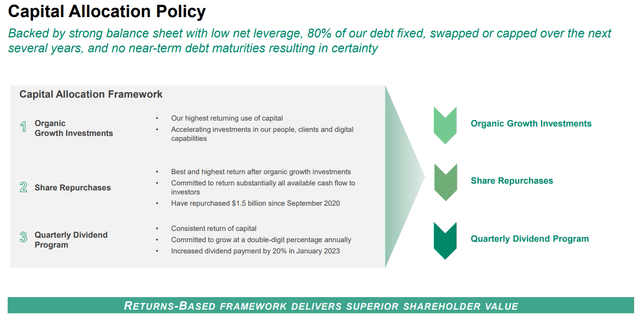

To best support future cash flows and return capital to investors, AECOM is committed to further organic growth investments- including constant retention of top talent as well as accelerated training and digital capabilities, share repurchase programs, with over $1.5bn repurchased since late 2020, and a quarterly dividend program, with dividend payments increased by 20% in January of this year.

AECOM Q1 Investor Presentation

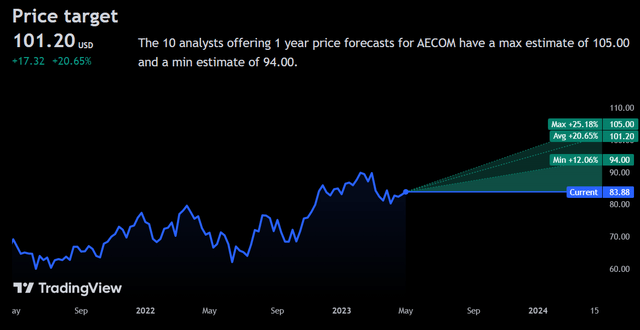

Wall Street Consensus

Analysts echo my highly positive sentiment surrounding the company, with an average 1Y price increase projected at 20.65%, to a value of $101.20.

Even at minimum projected price growth, analysts expect the company to grow 12.06%, to a price of $94.00.

This is likely due to further accelerated public infrastructure investments, the operational strengths of the company, and a large backlog which isolate the company from macro issues.

Risks

Fragmentation May Further Inhibit Scale

As aforementioned, the construction industry is highly fragmented, due mostly to localized demands, costs and regulatory structures. AECOM, which has already sustained downward pressure on its scale- or revenues, more simply- may not be able to sustain further pressures without materially affecting company performance.

Competitive Intensity Accelerates

Regional, national, and international competitors continue to agglomerate, and may both have greater financial resources or government support than AECOM can ascertain. As such, though AECOM has experienced margin expansion in the past few years, competition may restrict its ability to do so going into the future.

Employee Retention is Key to Expertise

Many of the projects, such as NEOM or the California High-Speed Rail project, are successfully bid for by AECOM due to a high degree of technical expertise. While AECOM provides industry-leading employment programs, these are costly, and an inability to retain these senior employees can limit AECOM’s future success.

Conclusion

In the short term, AECOM will continue to rally alongside the rest of the industry, thanks to leadership across flagship projects in the Americas and beyond.

In the long term, the company’s continued leadership in technical expertise across megatrends will continue to enable successful projects, with a capital allocation strategy which emphasizes value return to shareholders.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.