Summary:

- Historically, Amazon has leaned heavily on its cloud computing unit AWS to generate substantial operating profits to offset sizable operating losses elsewhere.

- In recent years, Amazon’s digital advertising business has become sizable.

- Using the performance of Meta Platforms and Alphabet as a benchmark, Amazon’s digital advertising unit should soon become the company’s second major profit generator.

- Amazon’s digital advertising business continued to grow like a weed during the first quarter of 2023.

- The recent rebound in Amazon’s share price is likely due to investors factoring in the upside its digital advertising business could generate in the medium term.

FinkAvenue

Shares of Amazon (NASDAQ:AMZN) have bounced meaningfully off their January 2023 lows as of early May 2023. Part of that is likely due to the market factoring in the prospect of the Federal Reserve’s cycle of interest rate increases coming to an end sooner rather than later, though there is more to the story here, in my view. Historically, Amazon has leaned heavily on its lucrative cloud computing operations to offset sizable operating losses elsewhere, but more recently it has become clear that Amazon will soon have another major profit generator at its disposal in the form of its lucrative and rapidly growing digital advertising business. I’m keeping shares of Amazon on my radar for this reason. Let’s dig in.

Digital Advertising Still Booming

In Amazon’s 2021 Annual Report, the company broke down the annual performance of its advertising business for the first time. Previously, the performance of this unit had been lumped together with the performance of its other operations.

Amazon’s ‘advertising services’ business reporting unit is built around digital advertising which carries high operating margins by providing services in the realm of video advertising, sponsored ads, and display ads. These services are provided to vendors, sellers, authors, publishers, and other entities. Before covering the performance of Amazon’s digital advertising operations, some background information on why this is an attractive space to operate in is warranted here.

Meta Platforms Inc (META), the company behind Facebook, Instagram, and WhatsApp, generates almost all of its revenues from digital advertising services. This makes Meta Platforms a useful benchmark for gauging the potential profitability of Amazon’s digital advertising operations. In 2021, Meta Platforms had an GAAP operating margin of 39.6% which fell down to 24.8% in 2022. Please note that any GAAP operating margin north of 15% is impressive. Meta Platforms’ GAAP operating margin declined from 2021 to 2022 primarily due to an aggressive increase its headcount to fund its metaverse ambitions (its total operating expenses rose by 23% from 2021 to 2022 as its headcount rose by 20%), but the underlying profitability of its core digital advertising business remained rock-solid.

The firm behind Google and Android which also generates the bulk of its revenues from digital advertising services, Alphabet Inc (GOOG) (GOOGL), had a GAAP operating margin of 30.6% in 2021 and 26.5% in 2022. As was the case with Meta Platforms, sharp increases in Alphabet’s operating expenses as a result of headcount growth represented the main reason for the decline in its operating margin. Both Meta Platforms and Alphabet are now trimming their headcount to improve their profitability levels.

Beyond the lucrative nature of providing digital advertising services, it’s worth noting that this remains a high-growth market. Secular tailwinds such as the pivot away from advertising on linear TV, radio, and newspapers in favor of digital advertising activities supports the promising growth outlook of total digital advertising spending levels. According to market research firm Insider Intelligence (formerly eMarketer), digital advertising represented 55.6% of total US media ad spending in 2019, a figure that jumped up to an estimated 71.8% in 2022. Insider Intelligence estimates that US digital advertising spend came in at $249 billion in 2022 and that by 2026, US digital advertising spend will reach $385 billion.

Globally, a similar story is playing out as Insider Intelligence expects digital advertising activities will continue to take market share from traditional advertising platforms through 2026. The market research service estimates that digital ad spend represented 63.1% of total media ad spend worldwide in 2021, a figure that Insider Intelligence forecasts will rise to 72.5% in 2026. From 2021 to 2026, Insider Intelligence forecasts that total worldwide media advertising spend will rise from $828 billion to over $1.15 trillion.

What matters the most here is that the overall shift towards digital advertising activities still has legs. A combination of market share gains and growth in total media advertising spend worldwide should result in a major tailwind for companies like Amazon, Meta Platforms, and Alphabet that provide digital advertising services.

Significance for Amazon

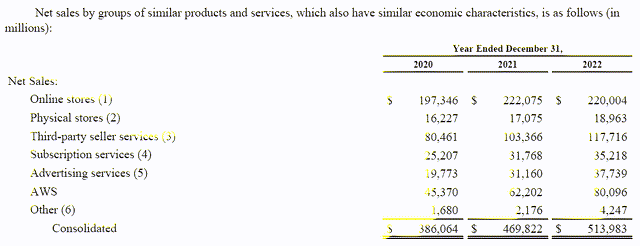

Pivoting back to Amazon. In 2019, the company generated $12.6 billion in revenue from its advertising services business reporting unit which represented 4.5% of its total revenue that year. By 2022, Amazon was generating $37.7 billion in revenue from its advertising services unit which represented 7.3% of its total revenue that year.

Amazon’s digital advertising revenues have grown at a robust pace in recent years. (Amazon – 2022 Annual Report)

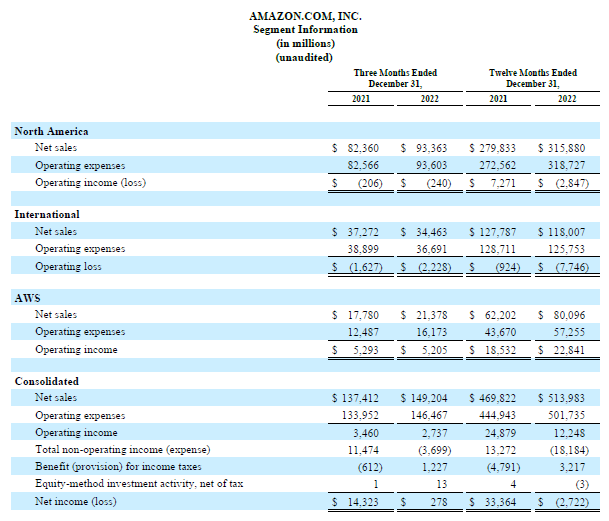

To put Amazon’s advertising services unit into perspective, its cloud computing unit Amazon Web Services (‘AWS’) generated $80.1 billion in revenues in 2022, up from $35.0 billion in 2019. AWS has historically been and continues to be the major profit generator for Amazon, as well as a major revenue growth driver. Last year, AWS generated $22.8 billion in operating income while Amazon on a consolidated basis generated $12.2 billion in GAAP operating income.

AWS has historically been Amazon’s main profit generator, offsetting losses elsewhere. (Amazon – Fourth Quarter of 2022 Earnings Press Release)

Put another way, AWS is effectively subsidizing Amazon’s other business operating units. Amazon continues to scale up its in-house logistical operations to speed up shipment deliveries (a process that involves spending billions on warehouses, aircraft, fleets of vans, and much more) while also spending heavily on its subscription service Amazon Prime through investments in original media content (such as new TV shows and movies, including a Lord of the Rings TV show) while acquiring the rights to major sporting events like the NFL’s Thursday Night Football.

Using the average GAAP operating margin of Meta Platforms and Alphabet in 2022 as a benchmark (~25.65%), Amazon’s advertising services unit could have generated around $9.7 billion in segment-level operating income last year (please note that this is just an estimate for illustrative purposes). As Amazon’s advertising services unit continues to grow the company should soon have another major profit generator on its hands.

Within Amazon’s 2022 Annual Report, the company highlights how it has a major advantage over its peers in the digital advertising market because it knows the shopping trends of its customers better than most. Amazon is sitting on a mountain of shopping data that most companies would never be able to replicate. Both Meta Platforms and Alphabet have for years tried to become bigger players in the e-commerce space with limited success. Amazon continues to dominate in this arena in the US and abroad, and that is unlikely to change anytime soon.

Investments in machine learning, in-depth knowledge of consumer trends and customer shopping habits (on both a micro and macro scale), and operations such as Amazon Marketing Cloud where advertisers can track the performance of advertising campaigns in great detail (digital advertising campaigns produce a treasure trove of data in real time that traditional advertising campaigns can’t match) represent some of the ways Amazon intends to stay ahead of the curve and continue growing its digital advertising revenues at a brisk pace over the long haul.

In the first quarter of 2023, Amazon’s advertising services unit continued to grow like a weed. Revenues here were up 21% year-over-year, hitting $9.5 billion, and represented 7.5% of the company’s total sales. Amazon’s GAAP revenues were up 9% year-over-year last quarter, hitting $127.4 billion, while sales at its AWS unit were up 16% year-over-year, hitting $21.4 billion. The firm’s GAAP operating income rose by 30% year-over-year last quarter, hitting $4.8 billion. Like other tech giants, Amazon has begun to rationalize its headcount in certain areas, which should help improve its profitability levels going forward.

Downside Risks

Amazon has downside risks that investors should be aware of. The company is heavily exposed to the state of consumer spending levels in the US and abroad due to its enormous e-commerce operations (both as an online retailer and as a platform that supports third-party sellers). Its advertising business is indirectly exposed to the state of global consumer spending levels as companies are less willing, and in some instances able, to spend heavily on marketing campaigns when demand is likely to remain depressed regardless of how much is spent on digital ads, for instance when the global economy is in a deep recession. Amazon’s plan to build out a vast logistics operation is capital-intensive and requires billions upon billions of cash outlays each year, and this strategy could face hurdles should its net operating cash flows face sizable headwinds.

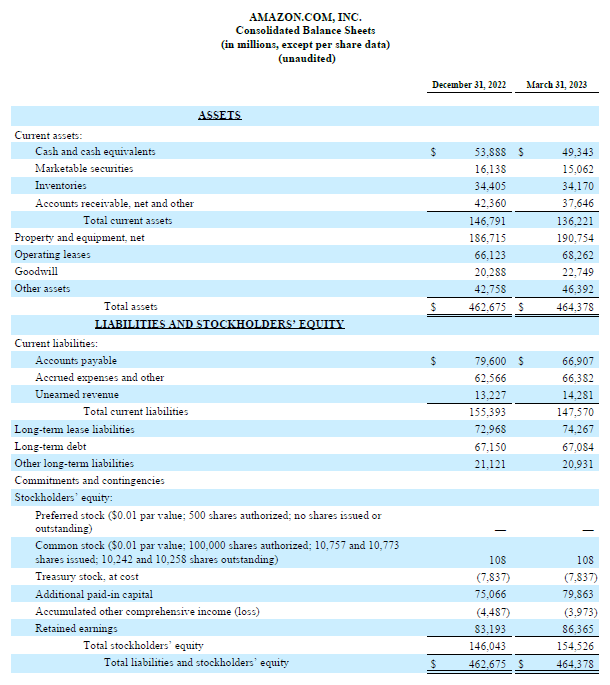

Keeping these risks in mind, Amazon should be able to navigate these hurdles with ease. At the end of March 2023, Amazon had $64.4 billion in cash, cash equivalents, and current marketable securities on hand with no short-term debt and $67.1 billion in long-term debt on the books. While Amazon had a relatively modest net debt load at the end of this period to be aware of, it has ample liquidity to meet its near-term funding needs. However, Amazon generated negative free cash flow (net operating cash flow less capital expenditures) in 2021 and 2022 due to its hefty capital expenditures (in part due to its desire to build out a vast logistics network), and its spending levels will need to be monitored going forward.

Amazon has ample cash on hand to meet its near-term financing needs. (Amazon – First Quarter of 2023 Earnings Press Release)

Concluding Thoughts

Amazon’s AWS unit has helped subsidize the company’s growth ambitions over the past decade or so. Now that its digital advertising operations are starting to become a meaningful part of its business, Amazon will soon have two fast-growing profit generators at its disposal. The rebound in Amazon’s share price seen since the start of this year is likely due, at least in part, to investors factoring in the upside Amazon’s digital advertising business could yield in the medium-term. I’m monitoring Amazon’s efforts to rationalize its headcount, spending levels, and the technical performance of its shares (which has been favorable of late) as the company represents a prime long-term capital appreciation opportunity under the right circumstances.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.