Summary:

- Google beat the low expectations set by the market as it proved that its business fundamentals are not as bad as feared.

- The resilience from Google Search & YouTube results suggest stabilizing advertising trends.

- While Google Cloud growth decelerated, it became profitable for the first time and adoption continues to grow.

- A $70 billion stock repurchase and improving profitability as efficiency improves brings additional upside to Google stock.

- Assuming 20x 2024 P/E, which reflects the pessimistic scenario for Google, my 1-year price target is $168, implying 28% upside from current levels.

Prykhodov

Google (NASDAQ:GOOG) earnings date for its first quarter 2023 was on 25th April. I think that after its earnings release, we saw that Search was looking resilient, Google Cloud adoption grew although growth continued to decelerate, and profitability improved as well.

This article looks deeper into whether Google stock is a buy after its first quarter earnings and whether there is a buying opportunity for investors today.

Did Google beat earnings?

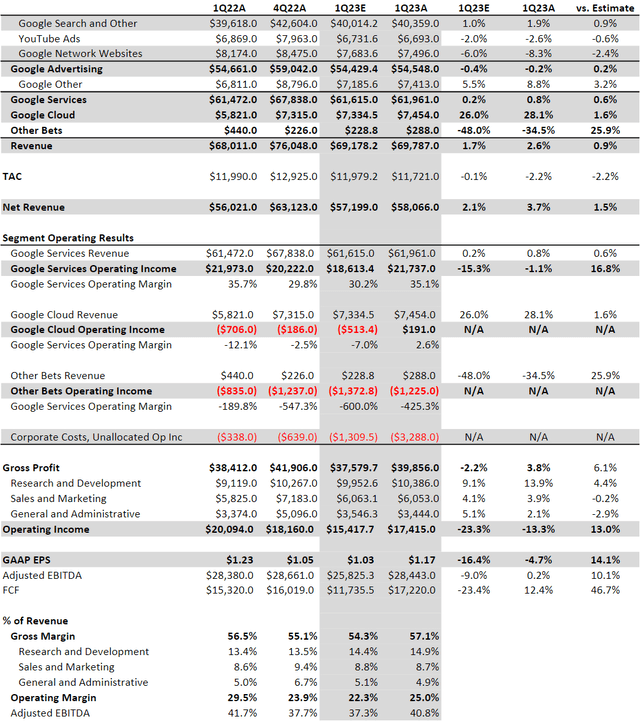

Google released 1Q23 earnings results that beat expectations, particularly because of the better than expected Search revenue and EPS highlighting the benefits of improvement in efficiencies.

In the first quarter of 2023, Google generated $69.8 billion in revenues, 1% above consensus and growing at a rate of 6% year on year excluding the effects of FX.

Search, YouTube, and Cloud results came in 2%, 1%, and 2% above consensus expectations.

By region, EMEA reported revenue grew 3% Y/Y ex-FX while APAC revenue grew 1% Y/Y ex-FX.

Total operating income of $17.4 billion, which implies a 25.0% margin, came in 6% above consensus and GAAP EPS of $1.17 was above consensus of $1.08, though GAAP EPS includes a $0.06 benefit from the extension of server & equipment useful life.

Google earnings result (Author generated)

Google Search & YouTube results suggest stabilizing advertising trends

Search & Other revenues was up 2% in 1Q23 to $40.4 billion. This came in 2% better than consensus. YouTube advertising revenue declined 3% Y/Y to $6.7 billion, which was still 1% above consensus.

Overall, Google Services gross revenue was still above consensus.

More importantly, gross margins expanded, resulting in Google Services GAAP Operating Income coming in 7% above consensus expectations.

I think that the results from Search highlight core resiliency.

While growth only grew 2% year on year and mid single digits ex-FX, I am amazed by the strength from Travel and Retail verticals, which was among Google’s strongest verticals. This comes as Performance Max adoption increases as it was expanded to the Travel vertical in March and a 18% higher conversion on average, up from the 13% disclosed 14 months ago as a result of improvements in the underlying AI.

This was offset by softness in Financials and Media & Entertainment.

Where will Search and YouTube go from here?

I expect search and YouTube growth to accelerate throughout 2023.

In particular, we are seeing YouTube Shorts and Subscriptions gain scale in the quarter.

Shorts content continued to grow in 1Q23 as the number of Shorts that were uploaded daily increased by 80% in 2022.

Shorts also accounted for most of the new subscribers for channels as it helps to engage users better. Music subscriptions and YouTube TV reached 80 million subscribers combined as of the fourth quarter of 2022.

Together, these led to Google Services “Other revenue” grow 9% year on year.

These two segments should accelerate through 2023 as Search continues to be resilient and YouTube continues to gain traction as compares get easier. For YouTube, the focus areas going forward continues to be Shorts, engagement on CTV, subscription and making YouTube more shoppable.

What are the prospects for Google Cloud?

Google Cloud revenue grew 28% year on year to $7.4 billion, further decelerating by 400 basis points when compared on a quarter on quarter basis. The results of Google Cloud came in as expected in the quarter when compared with consensus and 2% above my own estimates.

This compares to Amazon’s (AMZN) Azure growth in CY1Q23 of 31% year on year growth ex-FX, which is down 700 basis points on a quarter on quarter basis. Microsoft also guided to a further quarter on quarter deceleration of around 400 basis points to 500 basis points to 26% to 27% year on year growth ex-FX in the next quarter.

Google Cloud remaining performance obligations (“RPOs”) at the end of 1Q23 was $61.7 billion, with growth slowing to 22% year on year compared to the 26% year on year growth in 4Q22, and down from $64.3 billion we saw in 4Q22.

This could be viewed as negative by investors as Azure RPOs exit growth rate for the March quarter was 26% year on year growth which was stable compared to the prior quarter. In addition, Microsoft also noted that it was starting to lap optimization spend efforts in the June quarter of 2023, which implies that Microsoft is starting to see easier compares, indicating that the company might be seeing the light at the end of the tunnel.

Despite all that, Google did not provide any forward commentary during the 1Q23 earnings call but instead, it stated in the earnings call that:

In Q1, we continued to see slower growth of consumption as customers optimized GCP costs reflecting the macro backdrop, which remains uncertain.

Google Cloud operating profit came in at $191 million, implying a 2.6% margin compared to consensus of negative $513 million. As a result, this quarter marks a milestone for Google Cloud as it turns into a profitable business.

Google Cloud adoption continues to improve as 60% of Fortune 1000 use GCP and deal volume in the past three years was up 500% with larger deals worth more than $250 million grew more than 300%.

In addition, I think that the deceleration in 1Q23 cloud growth rate of 400 basis points show an improvement from the 4Q22’s 600 basis points deceleration. This might potentially suggest some stabilization in the optimizations amid continued demand.

Generative AI

While there was relatively limited commentary about Google’s initiatives into generative AI, management did highlight that the company will be bringing LLM experiences more natively into Search. Also, management also noted generative AI product advancements for advertising.

Within the enterprise space, Google Cloud’s while highlighting generative AI product advancements for advertising. From an enterprise perspective, Google Cloud’s PaLM API and MakerSuite could help accelerate the development of GenAI applications.

Lastly, Google is also using generative AI to identify cyber threats and automate security workflows.

As a result, I expect capital expenditures to increase modestly year on year in 2023, compared to the initial guidance of flat capital expenditures in 2023. This is because of management highlighting the need to increase significantly the technical infrastructure which is likely related to its investments into generative AI.

What to expect for Google after earnings

Firstly, I like that Google’s results were better than expected, suggesting that the company could beat on low expectations. Search proved to be resilient, while the increasing Google Cloud adoption is something to watch. While we could still see near-term optimization of spend, I think that the long-term picture for Google Cloud remains clear.

Secondly, the financial health of Google continues to improve, and this is particularly so for profitability. The improving cost efficiencies are showing and there is more room for improvement in the next few quarter to come. The slower operating expenses growth of 8.5% in 1Q23 compared to the 10% growth in operating expenses in 4Q22 makes me incrementally positive on the continued improving profitability of Google. I expect operating expenses to grow slower than revenue growth as Google has cut back on hiring meaningfully and improved spending efficiency and AI automation tools are helping to lead to increasing cost efficiencies.

On top of improving fundamentals, I like that the company announced that an additional $70 billion in stock repurchases were authorized post the recent earnings results. Based on the current market capitalization of $1.3 billion for Alphabet stock, this $70 billion in stock repurchases amounts to 5% of total current market capitalization.

Risks

Falling behind in generative AI race

As evident from the fall in Google’s valuation, the market is increasingly not confident about Google’s ability to stay ahead in its generative products and integration. Competition is rising from all fronts as players like Microsoft (MSFT) are increasingly looking to be a credible competitive threat and as a result, cause Google’s competitive moat to decrease.

Regulatory and legislative risks

There are also increasing regulatory and legislative risks as a result of the current and future potential anti-trust and DOJ investigations. Google is facing increasing regulations from the European Commission which could impact its future results. Google is among companies that are to be compliant with the European Union’s Digital Services Act. The Act requires Google to carry out regular assessments on its platforms to assess risks that its platform could pose to individuals and civic ideals like free expression. Google’s YouTube, Google Maps, Google Play and Google Shopping as well as Google Search was stated to fall under the purview of this regulation by the European Commission.

Is Google a good buy now?

Google stock is now trading at 17x 2024 P/E.

I think that we see better visibility on both revenue and earnings going forward despite the continued macroeconomic challenges.

I assume a 20x P/E on my estimate of Google’s 2024 EPS.

My 1-year price target for Google stock is $138, which implies 28% upside from current levels.

In the past five years, Google stock has traded at an average of 32x P/E. My 20x P/E assumption for Google in 2024 is almost a 40% discount to its 5-year average P/E.

As a result, I do think that Google stock is very attractively priced today, with a very attractive risk reward perspective.

My discounted valuation multiple acknowledges the difficult macroeconomic environment in which Google is operating in, as well as the decelerating growth at Google Cloud and limited visibility of integration of Bard into Search.

With so much discounted, I do think that Google stock is a good buy today as the risk reward is unbelievably attractive.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 51% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!