Summary:

- Meta Platforms reported solid first quarter results with revenue growing again and the company beating expectations for revenue as well as earnings per share.

- With monetization of Reels improving, business messaging continuing to improve and DAUs and MAUs still growing in the mid-single digits, the overall picture seems to improve again.

- Despite the rally occurring since November 2022, META stock is most likely still trading below its intrinsic value. But I would not rule out setbacks at this point.

Justin Sullivan

When reading comments under articles and news stories published in the last few days more and more people seem to get be bullish and now everybody knows that Meta Platforms (NASDAQ:META) was way too cheap when it traded for under $100 – and of course, everybody bought Meta Platforms for $90. I want to be honest – I didn’t buy Meta Platforms for $90 as I already bought Meta Platforms twice on the way down and didn’t want to increase my position further (maybe that was a mistake).

But while I did not buy Meta Platforms for $90, I have proof for calling Meta Platforms an incredible bargain at that price and identifying it as a potential rare buying opportunity. Since that article was published at the beginning of November, the stock increased 165% in value and since my last article, Meta Platforms could add about 30% in value (clearly outperforming the S&P 500, which increased only 1.5%). And I remain rather bullish about Meta Platforms, but let’s not get ahead of ourselves and start by looking at the last quarterly results.

Solid First Quarter Results

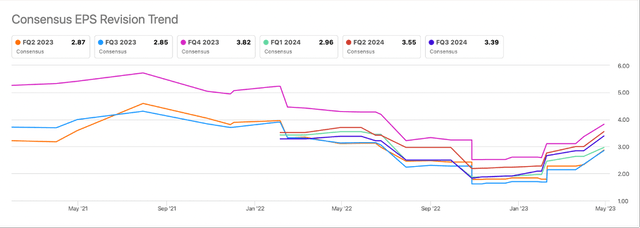

For starters, Meta Platforms beat expectations for revenue (by $990 million) and earnings per share (by $0.23 on GAAP basis). But we also must point out that estimates were lowered constantly in the last two years and that trend was only recently reversed. And of course, with lower estimates it is easier for a company to exceed expectations.

Meta Platforms EPS Expectations over time (Seeking Alpha)

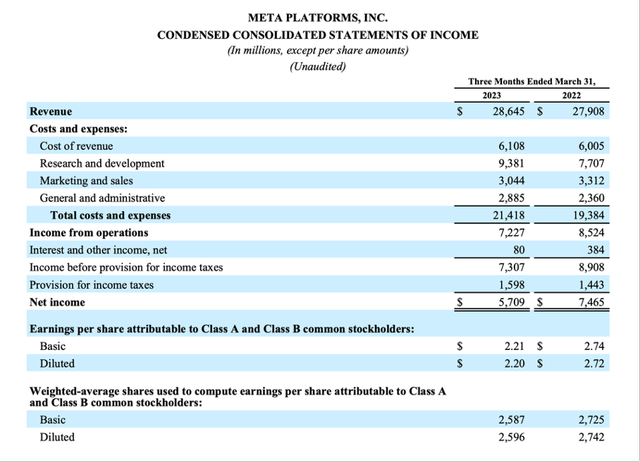

In the first quarter of fiscal 2023, revenue increased 2.6% year-over-year from $27,908 million in the same quarter last year to $28,645 million this quarter. On a constant currency basis, revenue increased 6% for Meta Platforms. But while Meta Platforms saw increase in revenue again, income from operations declined from $8,524 million in Q1/22 to $7,227 million in Q1/23 – resulting in a 15.2% YoY decline. And diluted earnings per share declined from $2.72 in the same quarter last year to $2.20 this quarter – resulting in 19.1% YoY decline.

Meta Platforms Q1/23 Earnings Release

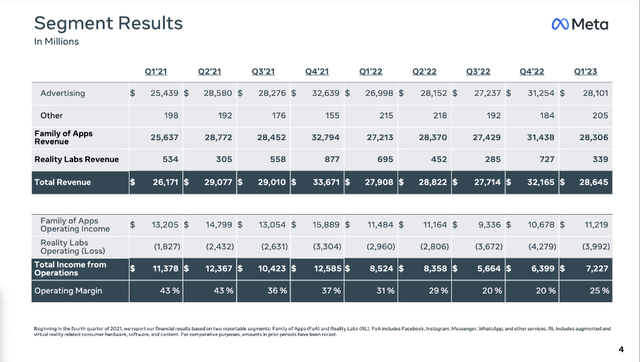

Meta Platform is still generating most of its revenue by advertising and its “Family of Apps”. The “Family of Apps” generated $28,306 million in revenue (an increase of 4.0% YoY) and within that segment, $28,101 million in revenue stemmed from advertising. On the other hand, revenue from Reality Labs declined from $695 million in Q1/22 to $339 million in Q1/23 – a decline of 51%. The reason for the declining sales is lower Quest 2 sales. And due to higher Reality Labs expenses, the segment had to report an operating loss of $3,992 million.

Meta Platforms Q1/23 Presentation

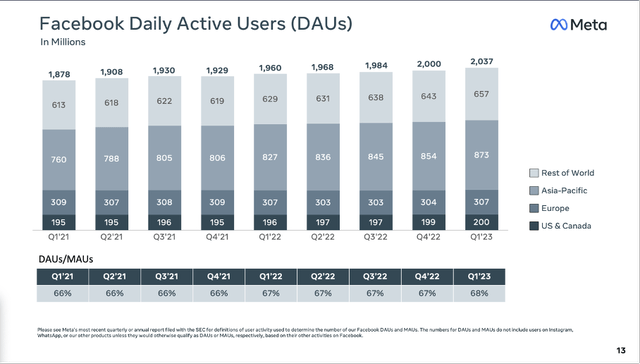

Additionally, Facebook increased the number of daily active users from 1,960 million in Q1/22 to 2,037 million in Q1/23 – an increase of 3.9% YoY which was mostly driven by Asia-Pacific and “Rest of World”.

Meta Platforms Q1/23 Presentation

And when looking at the “Family of Apps”, the daily active users increased from 2.87 billion to 3.02 billion – resulting in 5.2% YoY growth. And while ad impressions delivered across the Family of Apps increased by 26% year-over-year, the average price per ad decreased by 17% year-over-year.

Year of Efficiency

One of the most important ways to grow for any business is top line (organic) growth, but Mark Zuckerberg called 2023 the “Year of Efficiency” and is trying to increase the bottom line by cutting costs and making Meta Platforms more efficient. During the last earnings call, Zuckerberg commented on the process:

So far, we’ve gone through two of the three waves of restructuring and layoffs that we have planned for this year, in our recruiting and our technical groups. In May, we’re going to carry out our third wave across our business groups. And this has been a difficult process. But after this is done, I think we’re going to have a much more stable environment for our employees. And then for the rest of the year, I expect us to focus on improving our distributed work model, delivering AI tools to improve productivity and removing unnecessary processes across the company.

But research and development expenses increased 22% and this was primarily driven by restructuring charges related to facilities consolidation, severance expenses and headcount-related costs. However, we can expect these costs to decrease again in the coming quarters and therefore contributing to a growing bottom line. And headcount was lowered from around 86,500 at the end of December 2022 to about 77,100 at the end of March.

AI and Metaverse

When looking at top line growth, the two main contributors to growth will be the continued use of artificial intelligence as well as the Metaverse – and during the last earnings call, Mark Zuckerberg made it clear that Meta Platforms will continue to focus on both (and pushed back on any narratives that the company gave up on its Metaverse vision).

We start by looking at the Metaverse. And keeping in mind that this is probably a decade-long project, it is not looking good right now. At least when looking at the results from “Reality Labs”: Meta Platforms had to report a declining revenue third quarter in a row for the segment and – as mentioned above – revenue in this quarter declined even 51% year-over-year. And management is also expecting operating losses for the segment to increase year-over-year in 2023.

When looking for positive news one can mention more than 1 billion Meta Avatars that have been created and the number of titles in the Quest store with at least $25 million in revenue has doubled. The next milestone will be the launch of the next-generation consumer virtual and mixed reality device later in 2023.

And while it will probably take years before the Metaverse projects will have a real impact on the top and bottom line, pushing artificial intelligence further already has a measurable impact on the business. Right now, Meta Platforms is using AI mainly in two areas – the massive recommendations and ranking infrastructure power all Meta products and the new generative foundation models that are enabling entirely new classes of products and experiences. The building of an AI infrastructure was also a main driver of the increased capital expenditures in the last few years, but Meta Platforms should now be in a good position (and having the necessary infrastructure) for major new AI-based products as well.

Reels

Using AI already has a measurable effect on the business. AI recommendations have driven a more than 24% increase in time spent on Instagram and consequently Reels monetization efficiency is up over 30% on Instagram and over 40% on Facebook quarter-over-quarter. Overall, Reels continue to grow quickly on Facebook and Instagram with people sharing Reels more than 2 billion times every day (number doubling over the last six months).

And Meta Platforms is expecting Reels to become neutral to overall revenue by end of this year or early next year – after Reels was rather a drag in the last few quarters as Meta Platforms was not able to monetize Reels as well as Feeds and Stories.

Business Messaging

Another pillar of potential growth in the coming years is business messaging and Zuckerberg also provided an update during the last earnings call:

Our work to build out business messaging as the next pillar of our business is making progress too. I shared last quarter that click to message ads reached a $10 billion revenue run rate. And since then, the number of businesses using our other business messaging service paid messaging on WhatsApp has grown by 40% quarter-over-quarter. Our success here depends on delivering results for other businesses, and at our scale that can have macroeconomic effects.

Business messaging is part of the “Family of Apps other revenue” and revenue for the segment decreased 5%. However – as mentioned during the earnings call – business messaging was driving growth for the segment and growth was offset by the other items, which declined. However, this segment is also generating only $205 million in quarterly revenue (less than 1% of total revenue).

Advertisement

It doesn’t matter if Meta Platforms is using AI, pushing business messaging forward or trying to better monetarize Reels – in the end, the company is still depending on advertisement as almost its entire revenue is generated from ads. And when looking at the overall advertisement spendings in the United States, Meta Platforms is doing quite well as the amount spent on ads declined during the second half of 2022 and in December 2022, the amount spent on advertisement declined 12% year-over-year in the United States. When looking at the numbers Amazon (AMZN) reported recently, the company generated $9,509 million in quarterly revenue from advertising services and compared to the same quarter last year this is an increase of 21%. And these are actually impressive numbers, especially when considering that Alphabet (GOOG) saw its Google advertising revenue (including Search, YouTube and Google Network) declining in the first quarter. Revenue declined only slightly from $54,661 million in the same quarter last year to $54,548 million in Q1/23, but it was a decline, nevertheless.

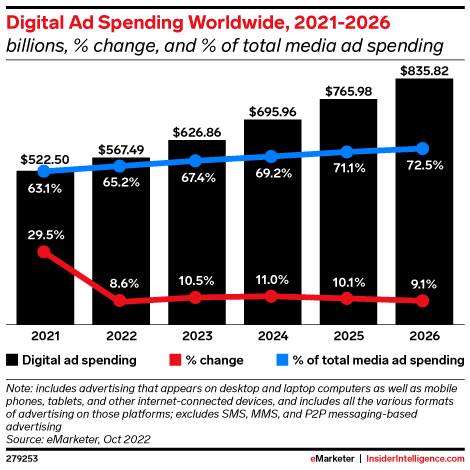

So far, U.S. ad spendings in 2023 are still expected to grow (according to these estimates from October 2022, the amount spent will be $279 billion). And digital ad spending worldwide is also expected to grow about 10% and reach an amount of almost $630 billion.

Insider Intelligence

In my opinion, it remains to be seen how high the ad spendings actually will be in 2023 and assuming a global recession (which might already have started) the probability of advertisement budgets being cut is rather high.

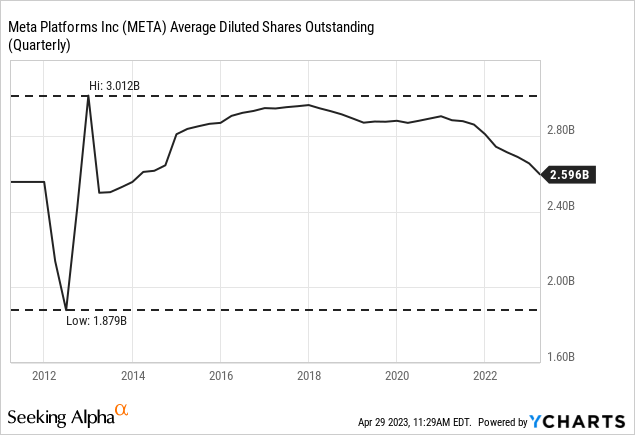

Share Buybacks

Meta Platforms also continues to repurchase shares and in the first quarter of fiscal 2023, the company spent almost $10 billion on share repurchases. And of course, $10 billion spent on share buybacks in a single quarter is still a high amount, but Meta Platforms lowered the pace of its share buybacks and in 2021 – when the stock price was much higher – the spendings on share buybacks were also higher. On the other hand, Meta Platforms still spent $31.5 billion on share repurchase in the last twelve months and in my opinion the stock was clearly undervalued most of the time during those twelve months.

Intrinsic Value Calculation

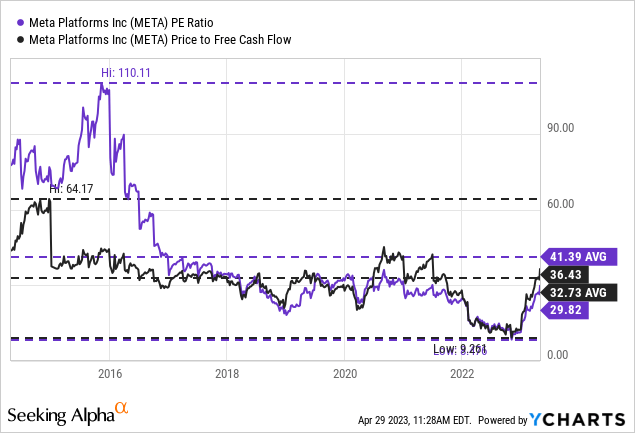

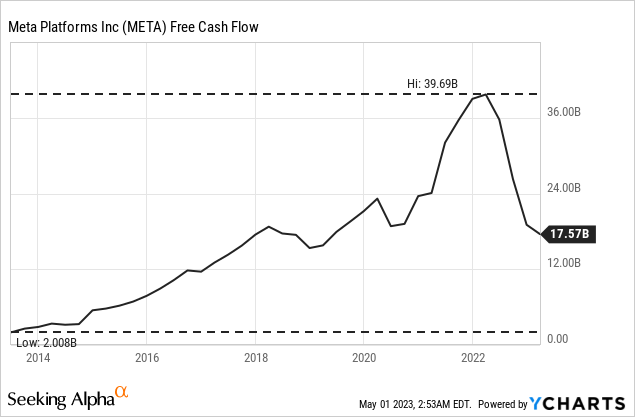

At the time of writing, Meta Platforms is trading for 30 times earnings and 36 times free cash flow. And usually, I would call valuation multiples above 30 only acceptable for high-quality and growing businesses – and even those businesses are not considered cheap for these valuation multiples.

But the valuation multiples right now might be a bit misleading. If we assume that Meta Platforms can manage the turnaround, the trailing twelve months earnings per share as well as free cash flow is probably one of the lowest numbers Meta Platforms reported in the last few years. And low results lead to high valuation multiples.

Right now, the trailing twelve months EPS is $8.08 while analysts are expecting $11.26 in earnings per share for fiscal 2023. And when using the expected EPS for fiscal 2023, Meta Platforms is trading only for 21 times forward earnings.

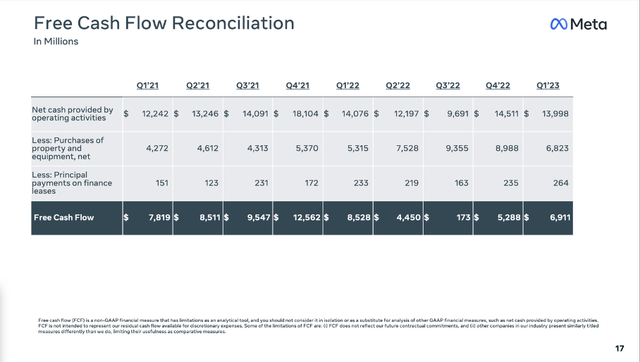

Meta Platforms Q1/23 Presentation

And the same is true for free cash flow. The trailing twelve months free cash flow is $16,822 million and when taking that number as basis and assuming growth rates starting from this amount, we would get a lower intrinsic value (compared to assuming higher free cash flow in the years to come). When assuming that amount as basis, Meta Platforms has to grow more than 11% in the next ten years followed by 6% growth till perpetuity for Meta Platforms to be fairly valued (assuming 10% discount rate and using 2,596 million outstanding shares).

When looking at the company’s expectations for fiscal 2023, we must assume that free cash flow might even be lower than in the last twelve months. Meta Platforms is expecting total expenses being in a range between $86 billion and $90 billion and capital expenditures are expected to be between $30 billion and $33 billion and considering that TTM revenue is $117.3 billion right now, the company must grow its top line significantly to generate a higher free cash flow.

Of course, I still expect a recession to hit the U.S. economy (and many other economies around the world) and most likely this will have a negative effect on Meta Platforms once again. And we should therefore assume that Meta Platforms will continue to struggle in 2024 before the top line (and especially free cash flow) might improve again. However, for the years following the recession, I expected Meta Platforms returning to its previous ability to generate high amounts of free cash flow.

Let’s make the following assumptions for Meta Platforms: For fiscal 2023 and fiscal 2024 we will assume that Meta Platforms is only able to generate a similar free cash flow as in the last twelve months before Meta Platforms will be able to return to “pre crisis” levels again and generate $40 billion in free cash flow. And in the years following 2025 let’s assume 6% growth till perpetuity as I still expect Meta Platforms to grow with a solid pace but want to account for the possibility that Meta Platforms might not be able to return to previous growth levels. When calculating with these assumptions, the intrinsic value for Meta Platforms would be $329.60.

Conclusion

In my opinion, Meta Platforms stock is still undervalued. It is not a screaming buy anymore, but I would still expect an investment to generate an annual return of at least 10%. Of course, these return expectations are over the long run. In the coming months and quarters we should not rule out a correction for two reasons. First, after a 165% increase within only six months a correction seems likely. Second, with the looming recession and bear market around the corner we should not make optimistic assumptions for the performance of any stock over the next few quarters (exceptions prove the rule).

Over the long run I still see Facebook’s business growing with a solid pace and the stock moving higher. Of course, this thesis is based on Meta Platforms being able to grow again with a solid pace (but it does not presume the Metaverse being a huge success).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.