Summary:

- Meta CEO Mark Zuckerberg has regained the narrative, as investors bought Meta’s improving performances, as he shifted from focusing on the metaverse to AI.

- Investors are likely not expecting Meta’s revenue recovery to turn south as Reels’ monetization continues to gain traction.

- Our previous bearish thesis was ruthlessly dismantled, as we underestimated Zuckerberg’s resolve to lift META’s previous collapse.

Drew Angerer

The recovery of Meta Platforms, Inc. (NASDAQ:META) has been nothing short of stunning. But, unfortunately, we underestimated the resolve of Mark Zuckerberg & his team as management set about reversing last year’s unprecedented decline in its stock.

We kept our bullish bias even as META fell toward its November lows. However, we turned bearish too early in late February as we looked for opportunities to cut exposure.

However, the bears never stood a fighting chance against the marauding bulls, as buyers absorbed momentary selling pressure to push META’s momentum higher.

As a result, META’s long-term trend has reversed from its downward bias above its critical long-term moving averages. With that in mind, bearish investors need to reconsider their bearish bias from here, as the flow has clearly returned to the bulls.

Zuckerberg demonstrated his ability to reverse the narrative on Meta’s metaverse spending last year to highlight the efficiencies since late 2022. As such, Meta has been able to win back the confidence of its investors, suggesting that the company could regain its operating leverage moving ahead.

META reported revenue growth of 2.6% in FQ1’23, reversing last quarter’s 4.5% slide. Moreover, the updated Wall Street estimates suggest that Meta is not expected to see a further decline in its topline growth. As such, the imminent threat from TikTok (BDNCE) and YouTube Shorts (GOOGL) (GOOG) seems to have fizzled out.

Analysts see Meta’s revenue growth to continue its upward recovery, reaching more than 12% by the end of 2023. Given Meta’s solid execution, as shown in its recent results, we assessed that buyers have likely positioned for a much better-performing Meta over the next three quarters.

Management highlighted that its AI investments have helped to mitigate signal losses as it lifted engagement. Notably, Meta expects Reels to be “neutral to overall revenue by the end of this year or early next year.”

However, management reminded investors of “structural supply constraints with the Reels format.” As such, investors should be cautious about expecting Instagram’s newest format to “close the monetization efficiency gap.”

In addition, Meta’s ability to reduce operating costs from its initial guidance at the end of 2022 further bolstered investors’ confidence. Accordingly, management’s updated expense guidance of $86B to $90B for FY23 is markedly lower than last year’s initial outlook of $96B to $101B.

The midpoint of Meta’s updated expense guidance of $88B is more than 10% lower than its initial update. Coupled with the recovery in Meta’s topline growth as it dealt with signaling headwinds and Reels’ monetization inefficiencies, investors are likely positioning for margins to steadily expand in 2024 and beyond.

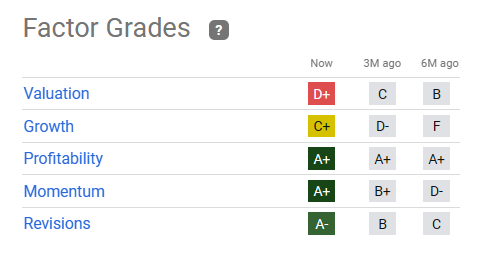

META quant factor ratings (Seeking Alpha)

With that in mind, META’s valuation rating has normalized rapidly. Seeking Alpha Quant reflected a “D+” grade for META’s valuation from the “B” grade it received six months ago.

However, its momentum, growth, and earnings revisions metrics are rated with the best possible “A+” grade, suggesting why investors have continued to pile into META.

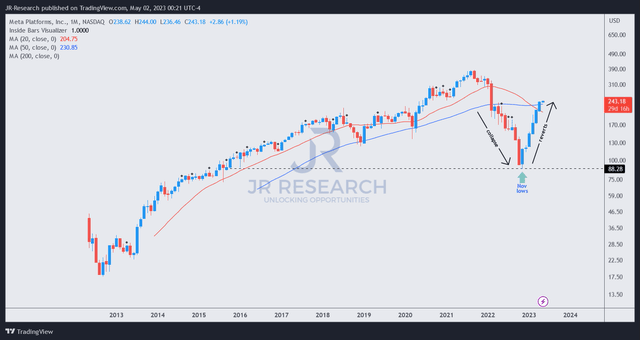

META price chart (monthly) (TradingView)

META’s unprecedented collapse toward its November lows was met with a remarkable resurgence in buying momentum that lifted META’s momentum back above its 50-month moving average or MA (blue line).

Investors who capitalized at its November lows have been well rewarded. META is up nearly 160% since our November update, marking its highly pessimistic lows, as discussed in our article then.

With the incredible surge, momentum investors are likely still chasing the recovery, overpowering the bears who lack conviction over META’s ability to recover.

Despite our bearish calls from February, META remains a core holding, but the bearish call is looking increasingly tenuous. While we remain cautious about chasing momentum, META’s risk/reward has shifted back toward “buying the dips” than “selling the rips.”

With that in mind, we upgrade our rating on META as we wait for the next meaningful dip to buy more.

Rating: Hold (Revised from Sell).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!