U.S. financial firms dominated last week’s earnings calendar, with major banks and capital-markets companies largely topping profit expectations, supported by resilient trading activity, higher fees and steady loan demand.

Large lenders including JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C) and Wells Fargo (WFC) all reported stronger year-on-year earnings, reflecting improved net interest income and solid consumer activity. JPMorgan and Bank of America also posted notable revenue growth, while Citigroup and Wells Fargo delivered mixed top-line results.

Outside financials, results from the transport sector were mixed. Delta Air Lines (DAL) met earnings expectations but posted lower profits than a year earlier, while J.B. Hunt Transport (JBHT) topped profit forecasts even as it missed revenue estimates.

Earnings Roundup:

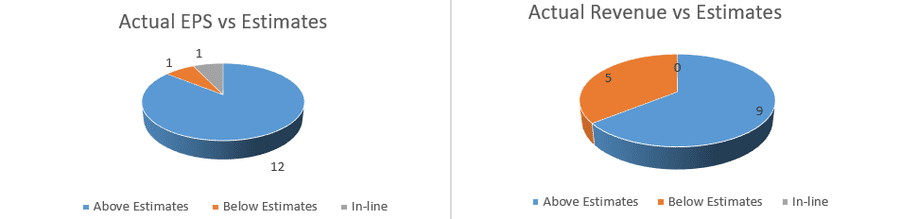

Of the 14 S&P 500 companies that reported earnings this week, 12 beat EPS expectations, 1 missed and 1 came in line. On a year-over-year basis, 12 companies posted higher earnings.

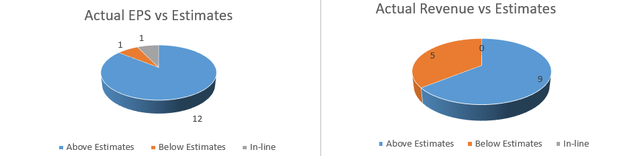

On the top line, 9 companies topped revenue estimates, while 5 fell short. Year over year, 13 companies reported revenue growth.

Source: Seeking Alpha

Let’s take a look at some of the companies that reported earnings this week:

Bank of America (BAC) reported EPS of $0.98, beating estimates by $0.03, as revenue of $28.37B rose $3.02B from a year earlier and topped expectations.

JPMorgan Chase (JPM) posted EPS of $5.23, exceeding forecasts by $0.37, with revenue up $4.01B year over year to $46.78B, beating consensus by $520M.

Citigroup (C) earned $1.81 per share, beating estimates by $0.19, while revenue edged up from a year earlier to $19.87B but missed expectations.

Wells Fargo (WFC) reported EPS of $1.76, topping estimates by $0.07, as revenue rose $910M from a year earlier to $21.29B, though it fell short of forecasts.

Goldman Sachs (GS) posted EPS of $14.01, beating estimates by $2.36, but revenue slipped $420M year over year to $13.45B and missed expectations.

Delta Air Lines (DAL) reported EPS of $1.55, in line with estimates but down from a year earlier, while revenue increased $440M to $16.00B.

Despite beating earnings estimates, all four large-cap banks ended the week lower, led by Wells Fargo, which fell 7.9%, followed by Bank of America down 5.2%, JPMorgan off 5.1%, and Citigroup sliding 2.7% over the week.

Earnings next week:

Earnings next week will be led by a diverse group of S&P 500 companies across technology, industrials, health care and consumer sectors, with Intel (INTC), General Electric (GE), Johnson & Johnson (JNJ) and Netflix (NFLX) among the most closely watched reporters. Overall, next week’s earnings are expected to provide a broad read on corporate margins, demand conditions and sector-specific trends as investors assess the outlook for 2026.