Summary:

- Microsoft Corporation reported its fiscal Q3 results on April 25 and blew away the consensus as both revenue and EPS came in much better than anticipated.

- Driving the outperformance were higher cloud revenues, better performance in More Personal Computing, and continued high demand for productivity products and enterprise software.

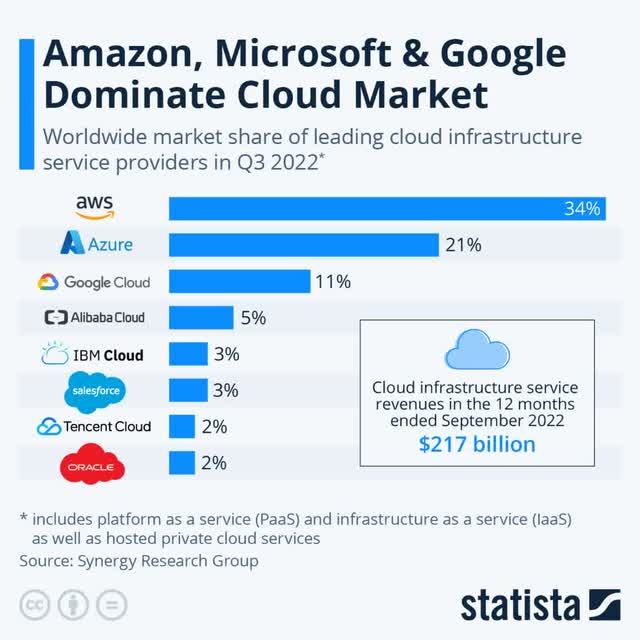

- Microsoft is outperforming its cloud peers, and this has enabled it to take away market share in the cloud industry, going from 21% in December to 23% today.

- Microsoft looks very well positioned for long-term financial growth, driven by its exposure to multiple high-growth areas and an impressive business moat with its products being irreplaceable.

- AI is the latest catalyst for Microsoft and has already caused much enthusiasm among investors. While I believe it will drive significant revenue growth, I do not see this materializing anytime soon.

lcva2

Investment Thesis

I maintain my buy rating on Microsoft Corporation (NASDAQ:MSFT) and update my revenue and EPS estimates following the company’s 3Q23 results which beat its previous guidance and that of Wall Street analysts. Microsoft delivered an outstanding quarter with impressive growth across most of its segments and initiated a similarly strong outlook for the final quarter of its fiscal FY23.

Microsoft shares have shown an impressive performance over the last several months, with the shares up close to 30% YTD, primarily driven by the enthusiasm around AI and the position of Microsoft within this industry. Yet, Microsoft is not just up because of the hype around AI as it delivered excellent financial results last week, which caused a 10% share price appreciation since. Microsoft showed impressive growth across most of its business segments, with especially strong growth in Microsoft Cloud. The company is outpacing most of its peers on this front and has been gaining market share at a rapid pace over the last several quarters as it strengthens its position in the cloud industry.

Overall, Microsoft is looking in excellent shape, with a fortress balance sheet, exposure to multiple high-growth areas, and an impressive business moat with its products being irreplaceable. And AI is the latest catalyst causing investor enthusiasm toward the shares, with Microsoft heavily investing in the new technology. As a result, it seems to have taken a head start versus its competitors, positioning it well to benefit from the massive growth in the AI market (expected CAGR of 37.3% until 2030) and demand worldwide. As a result of this and its excellent position in gaming, cloud, and productivity, I believe Microsoft is very well positioned for sustained excellent growth over the remainder of the decade.

In this article, I will take you through the latest developments and financial results and update my estimates and view on the company accordingly.

Microsoft Delivered Stellar Q1 Results

Microsoft reported its fiscal third-quarter earnings on April 25 and, as illustrated by the almost 10% increase in share price since this release, the results did not disappoint. Moreover, I think Microsoft did exceptionally well in the latest quarter, achieving growth rates ranging from high single digits to low double digits in most areas, despite significant economic headwinds and an overall slowdown in IT spending. Microsoft simply keeps on performing and delivering top-notch financial results, outpacing its big tech peers.

The result of these superior quarterly results from Microsoft compared to many of its peers and competitors, is Microsoft taking share in many different business segments including Azure, Dynamics, Teams, Edge, and Bing. With Microsoft delivering operating excellence in a challenging environment where many of its peers are struggling, the company is positioning itself well for when the economy recovers, and this should drive additional performance going forward. Simply put, the Microsoft offering delivers better value to customers, and in times when they are cutting back on spending, it is the best value product that they keep investing in. As a result, commercial booking increased by 11% YoY, despite a strong comparable quarter last year. Moreover, commercial RPO increased by 26% to a staggering $196 billion, illustrating strong demand for Microsoft products.

Now, getting into the quarterly financials, revenue increased by 7% (10% in constant currency) and came in at $52.9 billion. Important to highlight here is that this growth rate is much better compared to its reported growth in its second fiscal quarter, which saw revenue growth of just 2% YoY and could illustrate strong renewed demand for Microsoft products.

In constant currency, commercial business revenue increased by an impressive 19% as Microsoft saw better-than-expected renewal strength across its offering. I must say this is somewhat surprising when considering the reports that surfaced over the last couple of months discussing a slowdown in IT spending among enterprises. Yet, Microsoft seems not to be impacted as much. Of course, as I have discussed in my previous articles on Microsoft, the offering is incredibly sticky and crucial in the functioning of many businesses. I bet most of you work with either Word, PowerPoint, Excel, or any of the other applications included in the Microsoft 365 package on a daily basis. I do, and I could not think of a world where these would not be available. And this is precisely the strength of this Microsoft offering and part of the reason why Microsoft is less impacted by a slowdown compared to many enterprise software peers. Its moat is hugely impressive.

Another factor that drove the earnings beat was better-than-expected PC demand, which benefited Windows OEM and Surface products, despite elevated inventory levels. In addition, advertising revenue was on par with management expectations. Yet, probably the most impressive factor driving the earnings beat was a more resilient performance in Microsoft Cloud which increased by 22% YoY and accounted for over half of total revenues. I will dive into this further later in this article.

Moving to the bottom line, the gross margin increased slightly YoY to 69%, but accounting for the change in accounting estimate, this actually showed a minor decrease due to a lower mix of OEM revenue. Still, considering the current macroeconomic challenges and high inflation, this is not something to worry about at all.

Operating expenses grew 7% YoY, in line with revenue growth and $300 million below expectations. This increase was driven by the integrations of Xandr and Nuance, as well as continued investments in cloud engineering and LinkedIn. Overall, I am happy to see Microsoft continuing its investments in high-growth areas as this allows them to take market share from competitors which are forced to cut back on investments to drive profitability. Despite some layoffs, this effort is also reflected in its growing headcount, which was up 9% YoY. So again, I do not mind Microsoft investing in the future at the cost of some minor profitability today.

Driven by solid revenue growth and efficiencies, operating income grew at a slightly faster 10% YoY (15% in constant currency) as margins increased ever so slightly to 42%, which is still truly impressive. As a result, EPS came in at $2.45, up 10% (14% in constant currency), and beat the consensus by $0.22. Finally, free cash flow (“FCF”) came in at $17.8 billion, down 11% YoY. Yet, excluding the impact of a tax payment, this would have been down only 5% YoY. Still, despite this decline, a FCF margin of above 33% is absolutely nothing to complain about, and Microsoft continues to be a real FCF machine.

On that, let’s dive a bit deeper into the individual business segments and important developments.

Productivity And Business Processes – Microsoft Productivity Products Remain In High Demand

The Productivity and Business Processes segment saw revenue increase by a very resilient 11% YoY to $17.5 billion. This was primarily driven by a better performance in Office commercial and Dynamic products. Office commercial revenue increased by 13% YoY as Office 365 commercial revenue grew 14% YoY. This was due to an 11% increase in commercial customers totaling 382 million. This increase in commercial customers was driven by increased penetration in small and medium businesses on which Microsoft is increasingly focusing its offering. Dynamics products revenue increased by 17% YoY as Dynamics 365 revenue increased by 25%. This strength in Dynamics 365 shows that this cloud-based suite of enterprise resource planning (ERP) and customer relationship management (CRM) applications are still in high demand among businesses as these try to optimize processes and deliver higher ROI. Dynamics 365 allows organizations to unify their data and processes across different departments and functions, providing them with a 360-degree view of their business operations, which drives the potential for cost efficiencies.

At the same time, office consumer saw some weakness and decreased 1% YoY, with subscribers now totaling 65.4 million. Only very few consumers will be willing or able to cancel their Microsoft 365 subscription due to the necessity for the products as explained earlier. Also, on constant currency, revenue from office consumer was up 4%.

LinkedIn revenue increased by 8%, a slowdown from the 10% growth reported last quarter. Yet, the platform did see a record-high number of active members (930 million). Also, we can see a positive trend among Gen Z adoption as the number of student sign-ups increased by 73% YoY, which is a positive trend for the platform with an eye on the future. LinkedIn is unchallenged in the business x social media space, and this will drive future advertising revenues and premium subscriptions once macroeconomic issues ease off.

Microsoft Teams is also seeing solid continued growth, surpassing 300 million active users last quarter after some meaningful customer additions. With Microsoft continuously working on improving the videoconferencing platform and potentially integrating AI shortly, I believe Microsoft is a winner in this market as well. And with the videoconferencing industry poised for solid growth over the remainder of the decade with an 11.9% CAGR until 2030, this could be a solid revenue contributor for Microsoft.

Overall, we can see a resilient performance for this business segment, driven by continued demand for enterprise software solutions to drive business efficiencies. In addition, over the next couple of quarters, increased AI integration into these software offerings could drive additional growth. Also, driven by improvements in Office 365, operating income increased at a more rapid 20% YoY and has a strong contribution to the overall improvement in operating come.

Closing this chapter, I remain incredibly bullish on this business segment. I believe we should expect strong continued growth here for the next several years, possibly in the double digits, as Microsoft improves its offering and integrates more AI functionality. Overall, Microsoft is largely unchallenged in many parts of this segment and well-positioned to take more market share from competitors.

Intelligent Cloud – Microsoft Is Taking Market Share In The Cloud Industry

Next, revenue for the Intelligent cloud segment was $22.1 billion, up 16% YoY, slightly above expectations, and in line with the previous quarter’s performance. This was driven by a resilient performance in Azure which saw revenue increase by 27% YoY. Microsoft is seeing a somewhat cautionary approach among customers towards Azure, but growth for the segment was strong, nonetheless. Operating expenses for this segment increased by a rapid 19% YoY due to continued investments in cloud engineering, yet operating income still grew by 13% YoY.

The total cloud revenue across all segments for Microsoft was $28.5 billion, up 22% YoY and representing over half of the total revenues for Microsoft. This impressive growth illustrates the strength of Microsoft’s offering in the cloud space with growth rates coming in above Amazon.com, Inc. (AMZN) (16%) and only slightly below its smaller peer Alphabet Inc./Google (GOOG, GOOGL) (28%). As a result of these resilient growth rates for Microsoft compared to peers, it has increased its cloud market share from 21% at the end of 2022 to 23% today. Meanwhile, AWS has seen a 2% drop in market share to 32% and Google has remained stable at 10%. And I expect this trend to continue, with Amazon guiding for weaker AWS growth going forward.

In contrast, Microsoft Cloud is expected to remain much more resilient, supported in part by the AI integration which is attractive to customers, even when it is not fully operational yet.

During the Q3 earnings call, Microsoft pointed to three leading factors to drive cloud growth. First is helping customers make the best use of the Microsoft offering, which should result in more revenue for Microsoft as more customers start using more Microsoft cloud services. In addition to this, Microsoft works on expanding its total addressable market, or TAM, by introducing new cloud solutions and services. This also includes the integration of AI into its stack of cloud solutions, which has the potential to expand its cloud TAM massively.

AI is expected to drive additional growth with Microsoft leading the way in AI development and integration through its partnership with OpenAI. This will most definitely have given it a head start against its cloud peers and could attract customers to the Microsoft cloud platform. Microsoft has already seen impressive growth in AI through stellar demand for its Azure OpenAI service which brings together advanced AI models from GPT-4 and the enterprise capabilities of Azure. Microsoft has already seen impressive customer growth for this service, which is now above 2500, up 10x sequentially. Customers include large enterprises like Shell plc (SHEL) and Mercedes-Benz Group AG (OTCPK:MBGAF) and services like Grammarly. Of course, this is looking incredibly strong, and I believe Microsoft’s investments in AI should materialize rapidly and drive strong growth in cloud and productivity. Yet, I don’t expect these investments to drive revenue growth within the next couple of quarters meaningfully, and I believe investors will need to remain patient to see this making a real difference.

Finally, Microsoft is focused on driving improved operating leverage to ensure a more profitable business segment. On the note of margins, the gross margin for Microsoft Cloud (72%) increased roughly 2 points YoY, driven by cloud engineering efficiencies.

Overall, this quarter showed the real strength of the Microsoft cloud offering and I expect the cloud to remain a growth driver for Microsoft, driven by efficiency improvement, the integration of AI/an expanding TAM, and market share improvement due to the exceptional cloud platform and integrations with other Microsoft software offerings. There are simply not many weaknesses to be found here today.

More Personal Computing – Better Than Anticipated

For the More Personal Computing segment, Microsoft reported revenue of $13.3 billion. Although this is down 9%, the performance was much better than anticipated. This beat was driven by continued strength in Windows commercial products due to a strong renewal execution and was far ahead of expectations. Also, despite a 28% decrease in Windows OEM revenue and a 30% decrease in devices revenue, both were better than anticipated as Microsoft saw better-than-expected PC demand.

Gaming revenues decreased by 4%, which was again above expectations. Still, Xbox content and services revenue increased by 3% YoY, driven by improvements in third-party and first-party content and growth in Xbox game pass subscriptions, which now total $1 billion in revenue.

Of course, we can’t mention gaming revenues without discussing the possible Activision acquisition, which seems less likely to be completed by the day. Last week, the U.K.’s regulator blocked Microsoft’s deal to buy Activision Blizzard (ATVI) for $69 billion as they are worried about cloud gaming competition. The Competition and Markets Authority stated that they believe Microsoft has substantial advantages in cloud gaming already through its ownership of Windows, Azure, and Xbox which according to them, brings its cloud gaming market share to 60-70% already. Adding a strong portfolio of games to this ecosystem would harm cloud gaming competitors as Microsoft could make blockbuster games a Microsoft exclusive.

And I must admit, I have mixed feelings about these objections from UK regulators. I understand their belief in Microsoft’s already strong market position in cloud gaming. Yet, in the overall gaming industry, even after the acquisition would be completed, it would still only be the third largest gaming company, behind Sony Group Corporation (SONY) and Tencent Holdings Limited (OTCPK:TCEHY). Overall, there is room for discussion there. Yet, their reasoning surrounding the withholding of Activision games by Microsoft seems unfair. Microsoft has already struck deals with the likes of Nintendo Co., Ltd. (OTCPK:NTDOY) and more gaming platforms to ensure these games will remain available on all platforms and will NOT be Microsoft exclusives. This is what Microsoft said about this a while ago:

Our commitment to grant long-term 100% equal access to Call of Duty to Sony, Nintendo, Steam and others preserves the deal’s benefits to gamers and developers and increases competition in the market

Microsoft will be fighting this decision from UK regulators, but the situation is getting trickier by the day and it’s hard to tell whether this deal will come through. I still favor this deal as gaming looks like a massive opportunity for Microsoft, yet I believe they might be overpaying. Therefore, I am also not overly worried if the deal falls through with Microsoft then saving a lot of cash for other investments. Also, I believe Microsoft already has a strong position in the gaming industry which should ensure strong growth going forward. For a more in-depth analysis of the gaming opportunity for Microsoft, I recommend reading my article specifically aimed at this.

Finally, revenue derived from Search and news advertising increased by 10%, of which 2 points came from the integration of Xandr. The YoY increase results from higher search volumes and market share gains for the Edge Browser and Bing following the enthusiasm among consumers worldwide for integrating ChatGPT-like features into the search engine and browser. And while I am not going to discuss how well this is working or not right now, there is definitely a lot of enthusiasm about this integration which has not been a bad thing for Microsoft as illustrated by the fact that Microsoft has seen daily installs of the Bing mobile app grow 4x since the launch of the AI-powered version. As a result, Bing now has over 100 million daily active users and is poised for further market share growth.

Putting this into further perspective, Microsoft’s Bing has actually seen a 15.8% YoY increase in page visits, comparing favorably with a 1% decline for Google. And I am definitely not saying that Bing will now take away market share from Google at a rapid pace going forward, but the battle between the two has become closer in terms of performance and value. Even when Bing can take away 1% or 2% of the market share from Google, this would bring in many billions in advertising revenue for Microsoft. So, it definitely looks promising, but I am not expecting to see a meaningful shift here anytime soon, and therefore do not see this as a meaningful revenue booster or reason for much enthusiasm yet. Time will tell how strong the Bing offering compares to Google over time and whether it will really be able to take away market share and drive solid advertising revenue for Microsoft.

Outlook & MSFT Stock Valuation

Driven by strong customer demand and consistent execution in Microsoft cloud, Microsoft guides for another quarter of healthy revenue growth. For total revenue, Microsoft is projecting growth to be relatively flat, indicating growth of mid to high-single digits. Assuming the same growth rate seen last quarter, this would result in revenue of approximately $55.5 billion.

Starting with the overall Microsoft cloud offering, margins are expected to be flat YoY as improvement in Office 365 will be offset by lower Azure margins and the impact of further investments in AI infrastructure. As a result of these investments, Capex is expected to see a meaningful sequential increase.

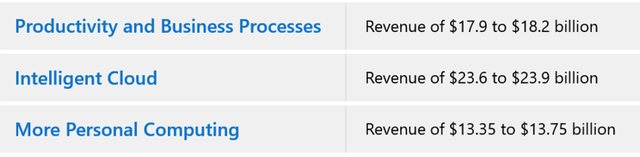

Looking at the guidance for each segment as can be seen above, we can see that Microsoft is guiding for the following growth rates:

Productivity and Business Processes to show 9% YoY growth at the midpoint of guidance. This will be driven by a 16% increase (on constant currency) in commercial Office 365 revenue as demand remains strong. Office consumer revenue and LinkedIn are both expected to report mid-single-digit growth, while Dynamics revenue once again shows impressive growth in the high teens.

Intelligent Cloud to show 14% YoY growth at the midpoint of guidance, driven by another quarter of impressive growth for Azure as this is expected to grow by 26-27% YoY. Yet, this growth will be partially offset by flat to slightly negative growth for Enterprise services and Server Products revenue.

More Personal Computing to show a 6% YoY decline at the midpoint of guidance, driven by another quarter of revenue declines in the low to mid-20s for both Windows OEM and devices. This will be offset by slightly stronger growth in gaming revenue compared to last quarter and continued strength in advertising.

In addition, operating expenses are expected to increase by only around 1-2%, and therefore, EPS will most likely again slightly outpace revenue growth.

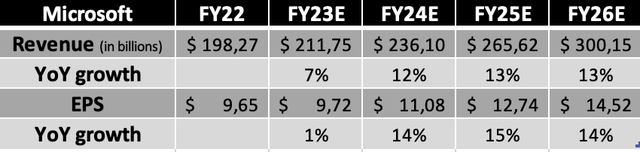

Following this guidance from management and the excellent financial results delivered by the company for its fiscal Q3, I am positively updating my outlook for the company and now project the following results for the years until fiscal FY26 (ending June 2026).

Shortly explaining these estimates, I now expect Microsoft to report revenue of $198.27 billion for the full year, based on Q4 revenue of approximately $55.7 billion. For FY24, I am guiding for a recovery in growth rates by the second half of 2023, or the first half of Microsoft’s fiscal 2024 which should boost growth rates for this year as I am expecting Microsoft to see solid cloud and Azure growth in the low-20s, low-teens growth for its productivity segment, and a recovery in More Personal Computing as the economy start to recover at the start of 2024. For the following couple of years, I expect Microsoft to keep executing and report strong growth across all segments, driven by market share gains and a growing TAM, primarily through the integration of AI. I project EPS to grow slightly faster compared to revenue as Microsoft will keep improving margins and lower its share count by buying back its shares.

Moving to the valuation, the recent strong share price performance has made shares quite expensive. Shares are currently valued at a forward FY24 P/E of 31.5x, which is about 8% above its 5-year average. This share price performance is primarily driven by the company’s solid results and the AI hype. Of course, I do get the enthusiasm here, but I still believe that we will first need to see these expectations materialize into real profits. Still, Microsoft does look exceptionally well positioned within the AI and cloud industry.

In addition, considering the sheer business strength and moat of Microsoft which it showed during the latest quarter by outperforming most of its peers and gaining market share across many product segments, combined with the stability and great growth prospects, I do believe this company deserves to be trading at a premium. With improved growth prospects and the company’s strong potential in the AI industry, as well as considering the possibility of a prolonged period of weak economic growth, I believe Microsoft deserves a P/E of 29x. Therefore, based on my FY24 EPS estimate and a P/E of 29x, I calculate a target price of $321 per share, leaving investors with an upside of approximately 5%. (Please note, this target price is solely based on its forward P/E and is only for indicative purposes.) For comparison, 50 Wall Street analysts currently maintain a price target of $328 per share combined with a strong buy rating.

Conclusion

I remain extremely bullish on Microsoft Corporation after the impressive quarterly results delivered by the company and the strong financial outlook. Microsoft looks poised for strong growth over the remainder of the decade in which AI can emerge as a serious growth driver, although this still remains to be seen.

Following the quarterly results and improved outlook, I upgrade my Microsoft price target from $280 to $321 per share, leaving only approximately a 5% upside for investors. And while this is not quite as much as I would prefer when buying shares, I maintain my buy rating on Microsoft Corporation, as I still see much room for outperformance and believe shares offer an attractive risk-reward profile due to the strong market position of the company.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.