Summary:

- We remain buy-rated on Intel, focusing on long-term gains.

- We believe INTC is well-positioned to outperform the market and peer group in the mid-to-long term as it executes its process roadmap plan in the next two years.

- We believe the stock multiples will expand as INTC stamps share loss in its PC client and Server CPU businesses and expand its TAM into the foundry market.

- While we continue to see PC and Server TAM contraction year-over-year, we believe the major supply chain correction is now behind us.

- We believe the risk-reward remains favorable for the stock and recommend longer-term investors continue to look for entry points on pullbacks.

JHVEPhoto

We continue to be buy-rated on Intel (NASDAQ:INTC) post-1Q23 earning results. INTC suffered its largest-ever quarterly loss this quarter, but we recommend investors focus on the long-term gains rather than getting overwhelmed with near-term losses. INTC’s 1Q23 earnings results generated a wave of sell-ratings on Seeking Alpha, despite beating bottom and top growth line estimates. The company reported a 133% annual reduction in EPS and a revenue drop of 36% Y/Y and 16% sequentially to $11.7B. We believe the declines were primarily due to inventory digestion in the PC and Server markets. Our bullish sentiment on the stock is driven by our belief that INTC is well-positioned to outperform the market and peer group in the mid-to-long term as it executes its process roadmap plan over the next two years.

INTC stock is down 33% over the past year, significantly underperforming the S&P 500, up roughly 1% during the same period. The stock price has performed in line with the S&P 500 since our upgrade in November of last year.

We’ve been covering INTC closely to highlight possible entry points in the pullback for longer-term investors; we believe INTC is on the verge of a turnaround. We recommend longer-term investors take advantage of pullbacks and begin exploring entry points into the stock at current levels as INTC’s risk-reward profile is becoming increasingly favorable.

The following outlines our rating history on INTC.

PC & server contraction

We expect some near-term pressure due to the year-over-year contraction of PC and Server markets. However, we expect the second half of the year to be better than the first due to strong inventory digestion.

1. PC Front

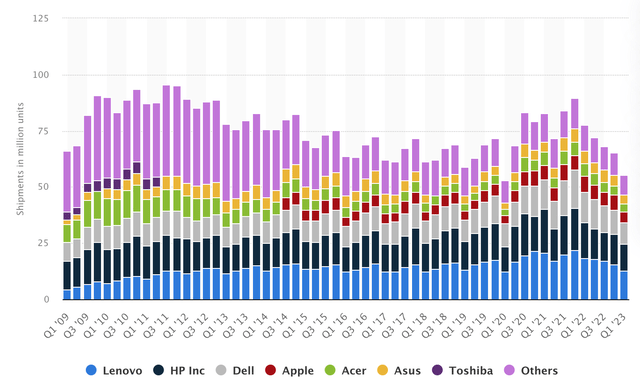

INTC expects PC usage to remain strong long-term with TAM 300M. The company’s Client Computing Group revenue dropped 38% Y/Y to $2.7B from $9.3B a year ago. We’re not too alarmed about the Y/Y decline as we forecast PC TAM to shrink 14-18% this year compared to last year, from 292M in 2022 to around 240M to 250M this year. We’re more constructive on PC inventory correction cycles nearing their end toward 1H24. We’re seeing shipments by the largest PC vendors decline in 1Q23 to work through excess inventory built up from pandemic-led demand levels. The following graph highlights PC vendor shipments worldwide from 2009 to 2023 by quarter.

We expect the near-term PC slump to pressure INTC and Advanced Micro Devices (AMD) toward the end of the year. AMD will report later this week, and we expect to see the weaker PC demand reflected on AMD’s 1Q23 earning results. For reference, in 4Q22, AMD’s PC Client revenue dropped 51% Y/Y with an operating income reporting a loss of $152M. INTC is expected to continue under shipping demand next quarter to allow the PC market to go through an inventory burn. We believe INTC can grow its quarterly top-line sales sequentially into 2H23.

2. Server Front

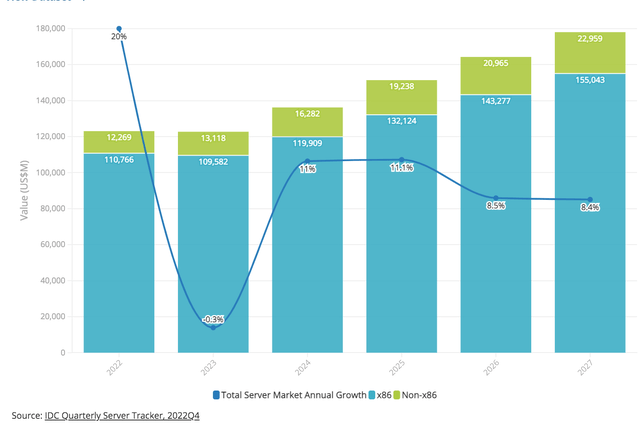

INTC’s Data Center and AI Group suffered a 39% Y/Y decline to $3.7B from $6.1B a year ago. IDC estimates the worldwide Server market spending to decline slightly this year but continues to expect the Server market to grow at a CAGR of 7.7% in a five-year period. The following graph outlines the worldwide Server market forecast for 2022-2027.

INTC has been pressured by competition with AMD on the Server front; in 2022, INTC remained the market leader but had a lower share than it once commanded in 2018. AMD successfully expanded its market share in 2022, driven by the adoption of its EPYC processor Milan and its x86-based CPU for data centers. We believe INTC and AMD will continue to experience near-term headwinds due to the harsh macro environment. The silver lining in 1H23 is INTC’s moderating share loss to AMD; we expect INTC’s share loss in PC and Server markets to moderate meaningfully. INTC’s Sapphire Rapid Server CPU and new process roadmap will help stamp the share loss.

INTC’s data center business has been in murky waters over the past year, but if executed correctly, the company’s Xeon roadmap can turn things around. We see the best days ahead for the company and recommend longer-term investors don’t fret about declines over the past year and maintain a forward-looking outlook on the stock.

New TAM opportunities in the foundry business

INTC’s Foundry Services (IFS) reported a revenue drop of 24% Y/Y to $118M. The company is pushing an operating loss due to increased spending to incite future growth. It’ll take time for INTC to establish its status as a leading foundry player, but we believe it’s a matter of when not if. We expect INTC’s foundry business to provide new TAM opportunities to drive the next leg of growth toward 2026 as INTC becomes a credible foundry for top fabless companies, including Qualcomm (QCOM) and Amazon’s (AMZN) AWS.

Valuation

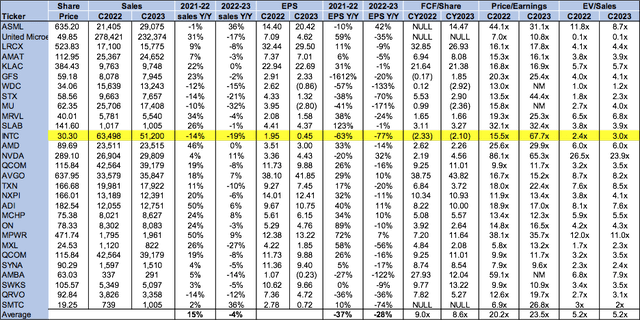

INTC is relatively expensive, trading at 67.7x C2023 EPS $0.45 on a P/E basis compared to the peer group average of 23.5x. The stock is trading at 3.0x EV/C2023 Sales versus the peer group average of 5.2x.

The following table outlines INTC’s valuation compared to the peer group.

Word on Wall Street

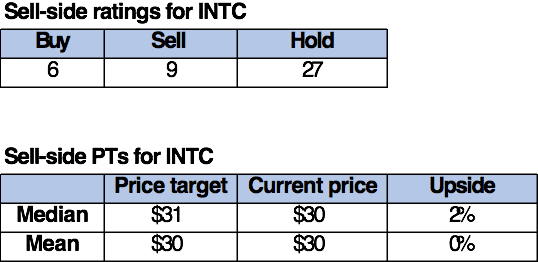

Wall Street is bearish on the stock. Of the 42 analysts covering the stock, six are buy-rated, twenty-seven are hold-rated, and the remaining are sell-rated. The following table outlines INTC’s sell-side ratings.

TechStockPros

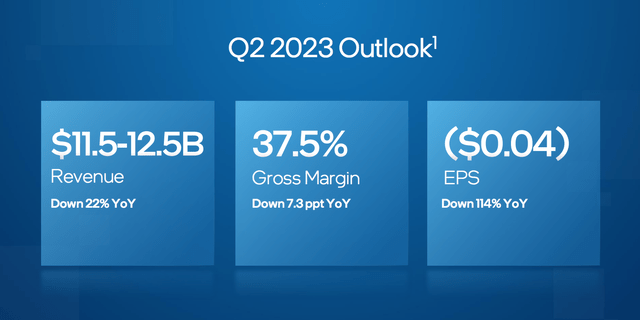

It’s not too surprising that Wall Street is leaning toward a bearish sentiment on the stock given the near-term outlook for the stock post-1Q23 earning results and the guidance for 2Q23 of revenue between $11.5B and $12.5B, down 22% Y/Y and EPS of $0.04, down 114% Y/Y. Still, cutting through near-term noise, the company is extremely well-positioned to grow in the mid-to-long run, driven by a combination of PC inventory correction cycles ending, the process roadmap toward 2025, and its foundry business. We may be early to the party, but we expect INTC to outperform in 2024. The following table outlines INTC’s 2Q23 outlook.

INTC 1Q23 earnings presentation

What to do with the stock

We maintain our buy-rating on INTC for long-term investors. We continue to see near-term pain for INTC but believe the company is on the right track to recover toward 2025 and warn that ambitions this big won’t be realized overnight. INTC, alongside the broader semi-peer group, is maneuvering a harsh macro backdrop with weaker consumer spending on PCs and softer enterprise spending on Servers. Still, we see the end of the tunnel and expect INTC to be well-positioned to hit the ground running as it executes its process roadmap. We also believe the stock will re-rate higher as more news of its 20A and 18A process nodes come to light. We believe investors buying the stock at current levels will be well-rewarded in the longer term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.