Summary:

- Following AT&T’s Q1 2023 reporting, investors doubt that the telco giant can achieve $16 billion FCF for 2023.

- But AT&T management has stressed that the target remains reasonable, which opens a very unfavorable risk/reward set-up for equity investors.

- If AT&T meets the target, few will likely applaud; if the target is missed, many will probably share their disappointment through stock sale.

- The ability to generate strong FCF is crucial to maintain the dividend and to decrease gross leverage to the targeted 2.5x by the beginning.

- Personally, I continue to be bearish on the FCF outlook for equity holders; and I reiterate a ‘Sell/Underperform’ rating.

Ronald Martinez

AT&T (NYSE:T) stock fell sharply (almost like a speculative tech company missing on growth projections) after the telco giant reported Q1 2023 results, disappointing against estimates on almost every key metric. But the major concern that investors needed to digest was anchored on doubts whether the company will be able to meet its Free Cash Flow target of $16 billion for the year. While I am neutral on AT&T’s ability to hit the target, I advocate a ‘wait and see’ approach until at least Q3 FY 2023, given that the risk for growth/ capex revisions could be skewed to the downside, potentially raising doubts on the sustainability of AT&T’s >6% dividend.

Although I now believe that AT&T may manage its net debt position better than expected, as compared to my previous assessment, I continue to be bearish on the FCF outlook for equity holders; and I reiterate a ‘Sell/ Underperform’ rating.

For reference, T stock has clearly underperformed the broader market YTD. Since the start of 2023, AT&T shares are down close to 6%, versus a gain of almost 10% for the S&P 500 (SP500).

AT&T’s Q1 2023 Results

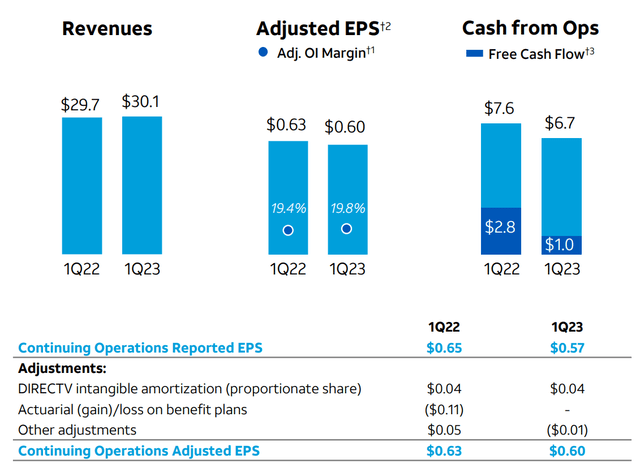

On April 20th, AT&T reported results for Q1 2023, missing analyst estimates with regards to both topline and FCF projections. During the period from January to end of March, the US’ largest telco conglomerate recorded about $30.1 billion of revenues, up from $29.7 billion for the same period one year earlier (only about 1% YoY growth), and about $120 million below analyst consensus estimates according to data collected by Refinitv.

With regards to profitability, AT&T’s operating income was reported at $6.3 billion, up 10.2% YoY (30.5% margin); AT&T’s post-tax GAAP net income came in at around $ 4.18 billion ($0.58/ share), down ~12% YoY versus $4.75 billion ($0.66/ share) for the same period in FY 2022.

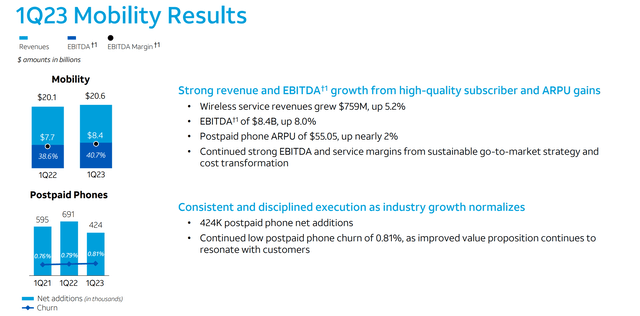

In the Mobility segment, AT&T’s performance was supported by healthy growth in service revenue, up 5.2% YoY, while postpaid phone additions crashed to 424k, almost 40% below net adds for the same period in FY 2022. Reporting about $8.4 billion of EBITDA, AT&T missed consensus expectations by close to $300 million.

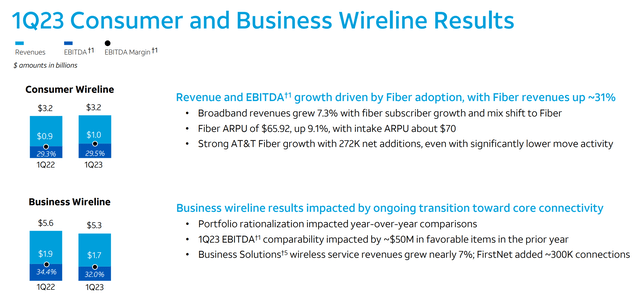

AT&T’s performance in the wireline segment was somewhat disappointing, adding only about 272k new customers, versus street expectations of close to 300k. Accordingly, healthy Average Revenue Per User (ARPU) growth of 9% YoY growth, bringing ARPU to about $66/ month, failed to offset the customer churn, and segment topline remained flattish versus the same period in 2022.

In the business wireline market, AT&T continues to feel pressures from competition, as highlighted by a 5.5% YoY decline in revenues, and a 12% YoY drop in EBITDA.

A Deep Dive On Cash Flow

Most notably, AT&T’s FCF was reported at $1 billion, materially below the street consensus projection in the $2.6 to $3 billion, as about $2.7 billion of ‘unexpected’ working capital pressure weighed on the company’s liquidity.

Although AT&T management has reiterated FCF of $16 billion for 2023, the surprisingly thin Q1 FCF performance fueled the debate whether the company will be able to meet its target. Admittedly, AT&T had previously stated that it anticipated free cash flow generation to be concentrated in the second half of the year, as capex intensity was guided to be high in the first half. However, investors should note carefully that the Q1 cash flow miss was not attributed to CAPEX being higher than expected, but the working capital investment. In fact, AT&T’s Q1 CAPEX was below expectations.

With CAPEX shifting into the March quarter, I anticipate that FCF for 2Q23 will likely be somewhere ~$3.0 billion, which would require AT&T to generate about $12 billion of FCF in the second half of 2023. For reference, AT&T’s FY 2022 FCF was split according to $4 billion in 1H22 and $10 billion in 2H22. Accordingly, AT&T may need to generate ~20% more cash flow in 2H 2023 than in 2H 2022, which may be quite a stretch given a potentially weaker macro backdrop.

Markets are not stupid: I assume investors have likely reflected on the above calculation and concluded that there is little reason to maintain risk exposure while waiting for AT&T to hit or miss the FY 2023 $16 billion FCF target, because the risk/ reward on a miss versus hit is most definitely skewed unfavorably.

Moreover, investors are certainly not ignorant to the fact that ever since 2019 AT&T has maintained a track-record to shrink its cash flow pool, with FY 2022 operating cash flow contracting to $33 billion, versus $48.7 billion for FY 2019.

Conclusion

For a value (trap) company like AT&T Investors are right to focus on FCF: The ability to generate strong and sustainable cash flow is crucial in order to maintain the current dividend and to decrease gross leverage to the targeted 2.5x by the beginning of 2025. With that frame of reference, investors doubt that the telco giant can achieve $16 billion FCF for 2023. But AT&T management has stressed that the target remains reasonable, which opens a very unfavorable risk/ reward set-up for equity investors: if AT&T meets the target, nobody will likely applaud; if the target is missed, many will probably share their disappointment through stock sale. Personally, I continue to be bearish on the FCF outlook for equity holders; and I reiterate a ‘Sell/ Underperform’ rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.