As the earnings season gains momentum, the upcoming week is set to deliver one of the most closely watched stretches of earnings season, with heavyweight reporters spanning technology, autos, consumer goods, defense, financials, energy, real estate, and travel.

The Magnificent 7 will be in focus, with results due out from the likes of Apple (AAPL), Tesla (TSLA), Microsoft (MSFT), and Meta Platforms (META).

Beyond Big Tech, key reports from ASML (ASML), Texas Instruments (TXN), ServiceNow (NOW), Lam Research (LRCX), IBM (IBM), Western Digital (WDC), Seagate Technology (STX), and Corning (GLW) will also headline a packed slate.

General Motors (GM) will offer key updates on the auto landscape, while UPS (UPS), Comcast (CMCSA), and Union Pacific (UNP) will provide insights into logistics and communications demand.

The consumer and retail space brings major names, including Starbucks (SBUX), Kimberly-Clark (KMB), and Royal Caribbean (RCL). UnitedHealth Group (UNH), Thermo Fisher Scientific (TMO), Regeneron Pharmaceuticals (REGN), and Teva Pharmaceutical Industries (TEVA) will represent healthcare and biotech.

A strong showing from the defense sector is also expected, with Boeing (BA), Lockheed Martin (LMT), RTX (RTX), General Dynamics (GD), and Northrop Grumman (NOC) set to report. Energy giants Exxon Mobil (XOM), Chevron (CVX), and Valero Energy (VLO) join industrial leaders Caterpillar (CAT) and Honeywell (HON) on the docket.

The financial universe features Mastercard (MA), Visa (V), American Express (AXP), Blackstone (BX), Annaly Capital (NLY), AGNC Investment (AGNC), NextEra Energy (NEE), and SoFi Technologies (SOFI), offering a broad read on consumer spending, credit trends, and capital markets.

Meanwhile, telecom players AT&T (T) and Verizon (VZ) will provide visibility into wireless demand.

Rounding out the busy lineup, Altria (MO), American Airlines (AAL), Southwest Airlines (LUV), Dow (DOW), Celestica (CLS), and ServiceNow parent names add further depth to a week that spans nearly every major segment of the economy.

Below is a rundown of major quarterly updates anticipated in the week of January 26 to January 30:

Monday, January 26

AGNC Investment (AGNC)

AGNC Investment (AGNC) is scheduled to report its Q4 results on Monday after the market closes, with analysts expecting revenue to surge by roughly 212% Y/Y.

Both Seeking Alpha analysts and Wall Street analysts rate the stock as a Buy, supported by its more than 26% rally over the past six months.

Seeking Alpha contributor Jeremy LaKosh, who maintains a Hold rating, notes that AGNC’s preferred shares offer yields above 9%, making them an appealing income option compared to the riskier common stock. He highlights that net interest income has stabilized following rate hikes, supported by effective hedging strategies, though recent reductions in hedges could raise risks if interest rates move unexpectedly. Meanwhile, the common shares face pressure from inconsistent dividends and a declining tangible book value, making the preferred shares a more compelling choice for income-focused investors.

- Consensus EPS Estimates: $0.37

- Consensus Revenue Estimates: $358.75M

- Earnings Insight: AGNC has missed revenue expectations in 8 straight quarters and EPS expectations in 6 of the past 8 quarters.

Also reporting: Nucor (NUE), Baker Hughes (BKR), Dynex Capital (DX), Steel Dynamics (STLD), Alexandria Real Estate Equities (ARE), Ryanair Holdings (RYAAY), W.R. Berkley (WRB), Brown & Brown (BRO), and more.

Tuesday, January 27

Boeing (BA)

Boeing (BA) is set to report its Q4 results after the market closes on Tuesday, with analysts expecting profits to improve by 93% on 49% Y/Y revenue growth.

Shares have climbed about 44% over the past year as the industrial and defense giant, now based in Virginia, continues its recovery. Despite the stock’s strong run, Seeking Alpha’s Quant Rating system remains cautious with a Hold, citing profitability concerns, while Wall Street analysts maintain a Buy rating.

Operational momentum has picked up: Boeing delivered 63 jetliners in December, its strongest monthly performance since 2023, bringing full-year deliveries to 600, the highest in seven years. However, the total still trails Airbus (EADSF) (EADSY), which delivered 793 aircraft last year. Boeing logged 174 net orders in December, driven by Alaska Airlines’ major purchase of 105 737 MAX jets and five 787 Dreamliners. For 2025, the company delivered 440 737 MAX aircraft and 88 Dreamliners, the latter marking a six-year high. Boeing’s total backlog now stands at 6,130 planes.

Dhierin Bechai, leader of an SA investing group with a bullish stance, highlights that Boeing ended 2025 with strong order activity and its highest annual deliveries since 2018, supporting a meaningful production recovery. He notes that December orders reached 175 units, pushing full-year net orders to 1,075 units valued at $114.6B. According to him, rising 737 MAX and 787 production rates support a path toward 700 annual deliveries in 2026, making production execution, not valuation, the key metric to watch as Boeing works to strengthen cash flow and its balance sheet.

Offering a more cautious view, SA author Kenio Fontes argues that while Boeing remains structurally critical to commercial aviation and defense, the recovery is not fully de-risked. He notes that defense and services are showing margin stability, but the commercial segment still faces execution challenges and legacy contract issues. Even under optimistic 2028 operating income assumptions, the stock trades at a high EV-to-OI multiple of ~23x, suggesting limited upside relative to the risks. Fontes maintains a Hold rating, preferring clearer evidence of a sustained turnaround and a more attractive valuation.

- Consensus EPS Estimates: -$0.41

- Consensus Revenue Estimates: $22.72B

- Earnings Insight: Boeing has beaten EPS and revenue expectations 50% of the time in the past 8 quarters.

Also reporting: General Motors (GM), RTX Corporation (RTX), American Airlines Group (AAL), UnitedHealth Group (UNH), United Parcel Service (UPS), NextEra Energy (NEE), Texas Instruments (TXN), Union Pacific (UNP), Kimberly-Clark (KMB), Qorvo (QRVO), Northrop Grumman (NOC), Seagate Technology (STX), JetBlue Airways (JBLU), SYSCO (SYY), Synchrony Financial (SYF), PPG Industries (PPG), Polaris (PII), HCA Healthcare (HCA), Logitech International S.A. (LOGI), F5 Networks (FFIV), Invesco (IVZ), Roper Technologies (ROP), PACCAR (PCAR), and more.

Wednesday, January 28

Microsoft Corporation (MSFT), Meta Platforms (META), and Tesla (TSLA)

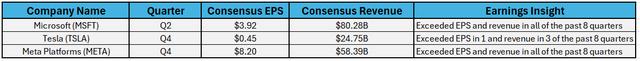

Wednesday is shaping up to be a pivotal day for the tech sector, with three members of the “Magnificent 7” set to report results. Microsoft (MSFT), Meta Platforms (META), and Tesla (TSLA) will all release their quarterly earnings, drawing intense market attention.

Wall Street analysts hold a Strong Buy view on Microsoft and Meta, while maintaining a more cautious Hold rating on Tesla. Seeking Alpha’s Quant Rating system, meanwhile, assigns a Hold rating to all three stocks.

Here’s a preview of the key information ahead of the reports:

Also reporting: AT&T (T), International Business Machines (IBM), Starbucks (SBUX), Annaly Capital Management (NLY), Teva Pharmaceutical Industries (TEVA), ASML Holding (ASML), Lam Research (LRCX), ServiceNow (NOW), Corning (GLW), WM (WM), General Dynamics (GD), Otis Worldwide (OTIS), Las Vegas Sands (LVS), Danaher (DHR), Automatic Data Processing (ADP), VF (VFC), Canadian Pacific Kansas City (CP), United Microelectronics (UMC), GE Vernova (GEV), and more.

Thursday, January 29

Apple (AAPL)

California-based Apple (AAPL), another core member of the “Magnificent Seven,” will report its FQ1 results on Thursday after the market close, with analysts expecting ~11% Y/Y growth in both EPS and revenue.

According to Counterpoint Research, Apple led China’s smartphone market in Q4 with a 21.8% share, supported by strong demand for the iPhone 17 lineup and a faster supply ramp. Overall shipments rose 28% Y/Y, with the Pro and base models outperforming; the iPhone Air, which launched later in China, captured only a low single-digit share.

Apple shares are down about 9% YTD and have fallen for seven straight weeks, a pullback Goldman Sachs views as a “buying opportunity” ahead of earnings. Analyst Michael Ng expects EPS of $2.66 for the quarter, forecasting 13% Y/Y growth in iPhone revenue and a 5% increase in shipments, including 26% growth in China. He maintains a Buy rating and a $320 price target.

Despite the bullish Wall Street view, Seeking Alpha’s Quant Rating assigns Apple a Hold due to valuation and growth concerns.

SA Investing Group Leader Envision Research also rates the stock a Hold, noting that while consensus expects double-digit revenue and EPS growth, investors should closely watch Apple’s rising R&D and SBC expenses, both essential for sustaining the company’s silicon leadership.

Meanwhile, SA contributor Income Generator upgrades the stock to a Strong Buy, arguing that the recent pullback provides an attractive entry point ahead of 2026. He highlights Apple’s robust gross margins (47.2%), 20% Y/Y net income growth, solid free cash flow yield (2.54%), and capital-light model that supports ongoing buybacks. Still, he cautions that valuation remains elevated, with high EV/EBITDA and PEG ratios implying Apple needs at least 10% EPS growth to avoid multiple compression.

- Consensus EPS Estimates: $2.67

- Consensus Revenue Estimates: $138.47B

- Earnings Insight: Apple has beaten EPS and revenue expectations in 8 straight quarters.

Also reporting: Visa (V), Altria Group (MO), Nokia (NOK), Mastercard (MA), Caterpillar (CAT), Lockheed Martin (LMT), Dow Chemical (DOW), Southwest Airlines (LUV), Blackstone (BX), Comcast (CMCSA), Honeywell International (HON), Valero Energy (VLO), Western Digital (WDC), Thermo Fisher Scientific (TMO), Brookfield Infrastructure Partners L.P (BIP), Sanofi (SNY), Royal Caribbean Cruises (RCL), SAP SE (SAP), Stryker (SYK), KLA Corporation (KLAC), Weyerhaeuser (WY), International Paper (IP), STMicroelectronics N.V. (STM), L3Harris Technologies (LHX), Sherwin-Williams (SHW), Tractor Supply Company (TSCO), and more.

Friday, January 30

Chevron (CVX) and Exxon Mobil (XOM)

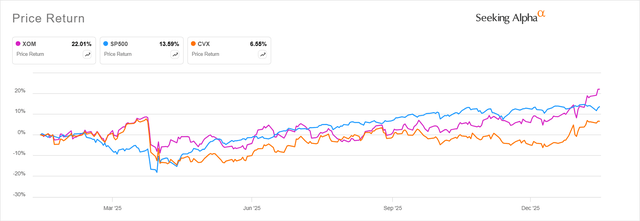

Oil majors Chevron (CVX) and Exxon Mobil (XOM) will report their Q4 results before the market opens on Friday, with analysts expecting a Y/Y decline in both earnings and revenue for CVX and a mixed performance for XOM.

While Exxon has outperformed both Chevron and the broader market over the past year, Seeking Alpha’s Quant Rating system assigns a Strong Buy to CVX and a Hold to XOM, citing concerns around growth and valuation. Wall Street, however, remains broadly constructive, with analysts maintaining Buy ratings on both stocks.

Exxon recently disclosed in an SEC filing that weaker crude prices could reduce its Q4 2025 upstream earnings by as much as $1.2B compared with Q3. Brent crude futures fell 19% in 2025, marking a third consecutive year of declines, while U.S. WTI crude dropped nearly 20% Y/Y.

XOM said changes in liquids pricing could cut upstream earnings by $800M–$1.2B, while natural gas price fluctuations may affect earnings by –$300M to +$100M. The company expects improved industry margins to add $300M–$700M to energy products earnings and up to $200M for specialty products. However, chemical product margins are projected to negatively impact earnings by $200M–$400M. Exxon also noted that asset sales will contribute $600M–$800M to Q4 earnings, while restructuring charges could weigh on results by up to $200M.

According to SA Investing Group Leader Daniel Jones, Exxon Mobil is the stronger long-term pick over Chevron. He highlights Exxon’s superior operational leverage and forward cash flow trajectory, with operating cash flow projected to rise from $58.46B in 2025 to $98.11B by 2030, generating an estimated $234.36B in excess cash flow. Chevron’s Hess acquisition should provide growth and synergies, but its anticipated annualized upside of 8.2% trails Exxon’s projected 17.6%.

Jones rates both stocks Buy but sees XOM’s higher expected returns and disciplined capital allocation as key reasons for a more bullish stance.

- Consensus EPS Estimates: XOM: $1.69; CVX: $1.48

- Consensus Revenue Estimates: XOM: $78.04B; CVX: $48.16B

- Earnings Insight: XOM has topped EPS expectations in 7 of the past 8 quarters, beating revenue estimates in 5 of those reports, whereas CVX has beaten EPS in 6 and revenue estimates in 4 of those reports.

Also reporting: Verizon Communications (VZ), SoFi (SOFI), American Express (AXP), Regeneron Pharmaceuticals (REGN), Colgate-Palmolive (CL), Brookfield Renewable Partners (BEP), Air Products & Chemicals (APD), LyondellBasell Industries (LYB), Canadian National Railway Company (CNI), Charter Communications (CHTR), Franklin Resources (BEN), Church & Dwight (CHD), and more.