Summary:

- After reporting outstanding revenue and EPS numbers, Amazon’s stock sky-rocketed in post-market trade.

- However, the optimism faded quickly as the discussion about a slowdown in AWS sank Amazon’s stock.

- Nevertheless, AWS remains the top cloud business globally, experiencing a transitory slowdown due to macroeconomic factors.

- Amazon remains undervalued relative to its intermediate and long-term growth and profitability potential.

- I added to my Amazon position recently and will add more if Amazon’s stock goes lower, as the company’s shares should be worth substantially more in several years.

Sundry Photography

Amazon (NASDAQ:AMZN) reported a solid quarter for Q1 2023, beating top and bottom line estimates by considerable margins. Initially, the stock surged by about 12% due to the outstanding numbers, but then came the earnings call. Here’s where the optimism faded, as Amazon reported a stronger-than-anticipated slowdown in its AWS segment. However, the deceleration is predominantly due to a challenging macroeconomic landscape, a widespread phenomenon not necessarily Amazon-specific.

Moreover, AWS remains the top cloud business globally and should continue expanding in the coming years. Furthermore, Amazon’s better-than-expected EPS results and other profitability metrics indicate that it continues to optimize efficiency. This dynamic should enable Amazon to become increasingly profitable in future years. Amazon remains a strong buy, and I have a $150 price target on the stock for the end of 2023/early 2024, approximately 50% above current levels.

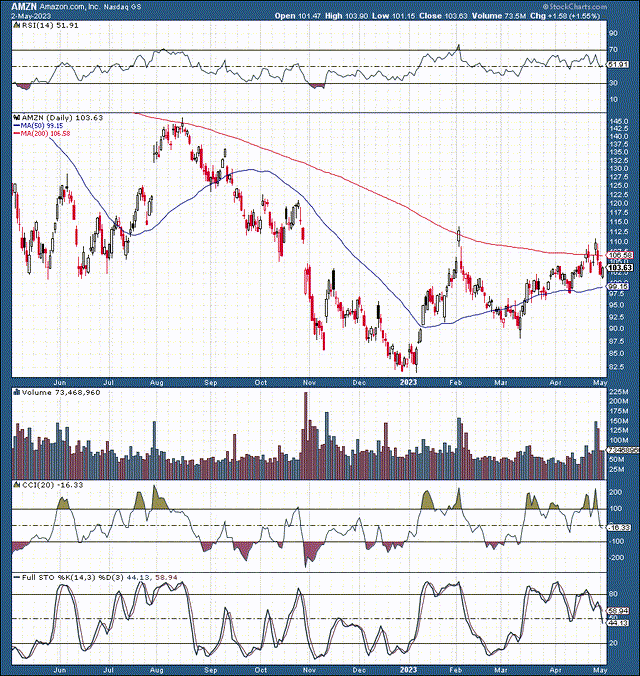

The Technical Image – Compelling and Bullish

We’ve seen relentless selling in Amazon shares during the recent bear market phase. At several points, the stock declined by more than 50% from its 2021 highs. Amazon made a significant low in November and a lower low, followed by a successful retest (late 2022/early 2023).

As it became apparent that its shares got significantly oversold, the stock quickly skyrocketed by about 40% in one month. Then we saw a correction and a substantial buying opportunity in March. Most recently, the stock topped around $110, providing another buying opportunity close to the $100 level.

What to Expect Now – We will probably see more volatility in the coming weeks/months. However, the bear market bottom may have already occurred, and Amazon’s stock is not likely to revisit the $85-80 level or lower. Also, if Amazon’s stock drops to $90-100, I’d consider this another significant buying opportunity.

Q1 Report – Excellent 2.3% Revenue Beat

Investors were disappointed due to the discussion about the AWS slowdown during Amazon’s earnings call. However, provided that the sharper-than-anticipated deceleration in AWS’s growth is likely due to challenging macroeconomic conditions and should be transitory, Amazon delivered excellent results for Q1 2023.

EPS – Roughly a 50% Beat

Amazon’s GAAP EPS came in at 31 cents, crushing the consensus estimate of just 20 cents. Furthermore, Amazon’s revenues came in at $127.4B, beating estimates by a staggering $2.85 billion, providing YoY revenue growth of 9.5%. North American sales increased by 11% to around $77B, and AWS sales increased to $21.4B, illustrating a YoY gain of approximately 16%. Amazon Guided to revenues of $127-133B for Q2, compared with around $130.3B in estimates.

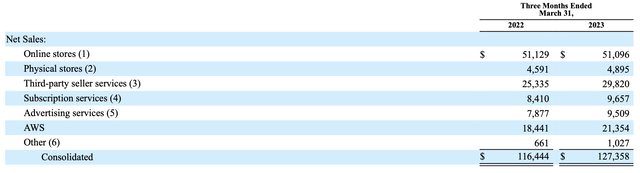

Net Sales by Group – Outstanding

- Amazon’s sales by group were solid, around $51 billion in Q1. While there is a slight YoY decline in online store sales, the figure is insignificant considering the broad economic slowdown. Furthermore, this segment’s revenues were essentially flat from a year ago, which is quite positive considering the challenging economic environment.

- Moreover, we saw growth in physical store sales from last year, implying that future physical store sales could expand faster than anticipated under normalized economic conditions.

- Amazon’s third-party seller services division revenues grew to nearly $30 billion, roughly 20% YoY.

- The company’s massive cloud segment increased revenues to $21 billion in the quarter, roughly a 16% YoY gain.

The Takeaway – Amazon’s revenues are far more resilient than the market anticipated. Furthermore, the company’s profitability potential is significantly underrated. Amazon should continue cutting costs and increasing efficacy, becoming increasingly profitable in the coming years.

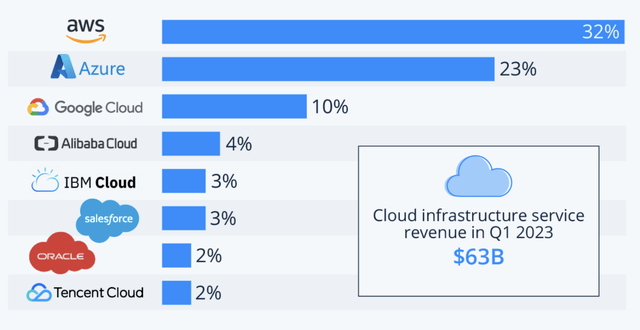

AWS – Transitory Clouds On The Horizon

AWS’s revenues expanded by 16% YoY in Q1. However, the company warned that April’s sales were about 5% below Q1. The company indicated that customers continue optimizing their cloud computing costs, leading to a transitory lower-than-anticipated growth environment. It is not just AWS experiencing a challenging phase, as many companies are going through similar deceleration processes. Furthermore, AWS should use the current time frame to optimize operations, and cut costs, to become more profitable as we advance. Also, AWS remains the number one cloud service globally and is unlikely to relinquish its lead.

World Market Share Cloud Infrastructure

Cloud market share (Statista.com )

Despite AWS’s temporary faster-than-anticipated deceleration, it commands a significant lead over rivals, with the big three now controlling about 65% of the cloud market globally. AWS’s Q1 revenues of approximately $21.3B could grow into about $90-100 billion for the year and about $100-120 billion next year. I believe AWS (as a stand-alone company) could command a 5-6 forward P/S multiple valuations, implying that Amazon’s cloud division could be worth approximately $500-700 billion. Also, my valuation could be modest here, as other analysts indicate that AWS alone should be valued at more than $1T.

Why Amazon is Cheap Here

Amazon’s market cap is roughly $1T, implying that if AWS became a separate company, the rest of Amazon is only worth $300-500 billion. However, that’s silly because AWS accounted for only about 17% of Amazon’s total sales last quarter. I know AWS is Amazon’s highly profitable, driving the company’s growth and long-term profitability potential. However, as Amazon continues expanding operations and improving efficiency, its core business should become more profitable as it advances. Furthermore, Amazon has a highly valuable supply chain and logistics system, along with other secondary businesses that are worth much more than Amazon’s current valuation implies.

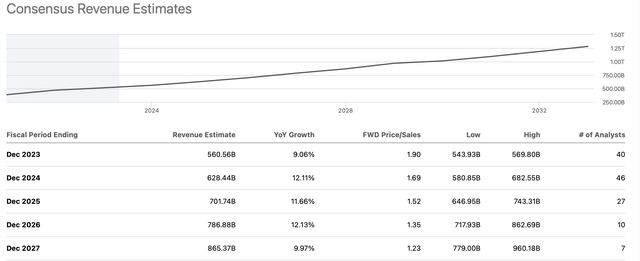

Revenues – Continue Rising

Amazon’s revenues should continue expanding, with the company likely reaching about $1T in sales in 2027/2028, roughly double from current levels. Moreover, we should continue seeing steady double-digit growth in the coming years. Furthermore, as Amazon continues optimizing operations, cutting costs, and implementing other measures to improve efficiency and increase profitability, Amazon’s share price should go much higher in the coming years.

Here’s what Amazon’s financials may look like in future years:

| Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $570 | $656 | $741 | $838 | $938 | $1.05T | $1.17T | $1.28T |

| Revenue growth | 11% | 15% | 13% | 13% | 12% | 12% | 11% | 10% |

| EPS | $1.85 | $3.70 | $5.25 | $7.20 | $9.72 | $12.73 | $16.17 | $20 |

| EPS growth | N/A | 100% | 54% | 37% | 35% | 31% | 27% | 25% |

| Forward P/E | 27 | 28 | 29 | 28 | 27 | 25 | 23 | 20 |

| Stock price | $100 | $147 | $209 | $272 | $343 | $404 | $460 | $500 |

Source: The Financial Prophet

Amazon’s growth should accelerate after the transitory deceleration process concludes. Also, Amazon’s EPS could increase significantly as the tech giant focuses on cost-cutting, optimization, and other strategies that should boost efficiency, improving Amazon’s bottom line. I’m also using a modest forward P/E ratio of below 30 as we move on. Nevertheless, we see a high probability of significant appreciation in the long term for Amazon’s stock.

Therefore, I am keeping my Amazon year-end price target at $120-150. Furthermore, there is likely minimal downside risk and significant upside potential in the intermediate and long term. Thus, Amazon remains on my list of top stocks to buy and hold for the next ten years.

Amazon – There are Risks

Investing in Amazon is not without risk. However, the most significant risk could be the worsening economy. Of course, the AWS slowdown is a concern that could materialize into a problem. Also, there’s the risk of increased competition, where other companies could take more market share from the e-commerce giant. There’s the risk of growth being slower than expected. Furthermore, Amazon may not become as profitable as estimated, and it may take the company longer to achieve significant ($10 or higher) EPS. Please consider these and other risks carefully before investing in Amazon stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!