Summary:

- What will make or break Netflix’s price action will be next quarter’s earnings report as there will be one full quarter of the results from cutting off password sharing.

- The bottom line is surprisingly stable for this company and what the market will want to see is top line impact from the two pivots announced a year ago.

- Currently, our technical analysis points toward May 12 being the bottom for the stock. In other words, we do not believe the stock will dip below $200.

- Although our firm is long-term bullish on the stock, we don’t believe now is the time to build a long-term position.

hapabapa/iStock Editorial via Getty Images

In April 2022, Netflix (NASDAQ:NFLX) surprised the markets by reporting its first subscriber loss in nearly 10 years. The stock tumbled 35% the following day, as investors panicked. Famed hedge fund manager, Bill Ackman, immediately sold his entire stake in Netflix for a $400 million loss, only after holding it for just over three months.

Last April was a tough month for Netflix stock, yet fast forward — and in one brief year, Netflix is up 41% from where Ackman sold the stock and is up 84% since the low on May 12.

On the very day that Netflix lost one third of its value last year, management announced its intention to cut off password sharing and rollout a new ad tier. We deemed the stock a buy and executed in August and again in early September.

Tech Insider Network

What will make or break Netflix’s price action will be next quarter’s earnings report as there will be one full quarter of the results from cutting off password sharing. The bottom line is surprisingly stable for this company and what the market will want to see is top line impact from the two pivots announced a year ago.

Currently, our technical analysis points toward May 12 being the bottom for the stock. In other words, we do not believe the stock will dip below $200 before the macro environment clears up. This is rare, as our analysis points toward a few FAANGs retracing their lows in the coming quarters.

Although our firm is long-term bullish on the stock, we don’t believe now is the time to build a long-term position. Instead, we plan to further trim our position and build at lower levels. More details are below.

The Pivot of a Quarter-Century

At the same time that Netflix lost its growth status, the company made the biggest announcement in its history – which was to cut off password sharing for 100 million users and to roll out an ad tier that will monetize higher than the Basic and Standard subscription plans.

One could argue that moving from DVDs to over-the-top (OTT) was the biggest announcement in the company’s history, yet at the time Netflix had nothing to lose. Today, the company is the top streaming service in the world and has held this top position despite media titan Disney’s (DIS) attempt to reclaim the media throne. In other words, Netflix’s two pivots are high stakes. The good news is, investors won’t have to wait too much longer to find out if the pivots are successful.

Password Sharing:

In the most recent quarter, global paid adds of 1.75M came in slightly shy of analyst estimates of 1.8M.

For password sharing, the Latin America region was a test region and the Q1 results provided some clues as to how a broader rollout will perform. According to management there was a cancel reaction which later eased. The region reported a loss of net adds of (0.4M) compared to net adds of 1.76M in Latin American last quarter, yet the revenue was up 7% YoY (+13% on constant currency basis).

The company stated that other regions, such as Canada, were “directionally consistent with what we saw in Latin America.”

There was a similar pattern in the United States Canada (UCAN) region where there was low net adds yet higher revenue growth. The region reported 0.1 net additions with revenue up 8% YoY.

In the year ago quarter, these regions were flat or reported a decline. Notably, churn can be higher coming out of Q4 for Netflix since that quarter has high net adds.

Another observation is that LatAm and UCAN both had expanding ARM, or average revenue per membership, whereas the other two regions saw a lower ARM. This could be encouraging in terms of a broader rollout on password sharing driving more top line growth in the second half of the year.

- UCAN up +9% from $14.91 to $16.18

- LatAm up +3% from $8.37 to $8.60

- EMEA down (6%) at $10.89 this quarter compared to $11.56 in the year ago quarter

- APAC down (13%) at $8.03 this quarter compared to $9.21 a year ago

Notably, average paid membership increased in APAC, and was up 17%. This is clearly a large region but there’s been some attention on India specifically where Netflix has lowered prices. This would make sense to where net adds increased but ARM decreased.

Advertising Tier

Upfront season is coming for Netflix, which means Netflix will likely have to state the company’s expected scale for the ad tier come Q3/Q4. Right now, the company is not guiding for this but analysts believe it will be in the 13M range.

Per Forbes and Bloomberg:

After a slow start Netflix ad tier has been gaining traction with U.S. subscribers. After analyzing their internal data, Bloomberg reported in its first two months, Netflix had one million active users. Before its launch, Netflix had projected 1.1 million by year end 2022 increasing to 13.3 million by the third quarter 2023. Industry analysts project Netflix could eventually wind up with 30 million U.S. subscribers on its ad supported tier. The U.S. is one of the 12 markets where Netflix is now selling ads. At its most recent earnings report Netflix had 74 million total U.S. subscribers with 231 million worldwide.”

For our purposes as investors, the most important aspect of the ad tier is that it will be accretive to the bottom line as the ad tier will monetize at a higher rate than Netflix’s basic and standard plans. The ad tier will be $6.99 per month plus ad dollars. With that, management believes there will be “50% or more incremental profit contribution to the business.”

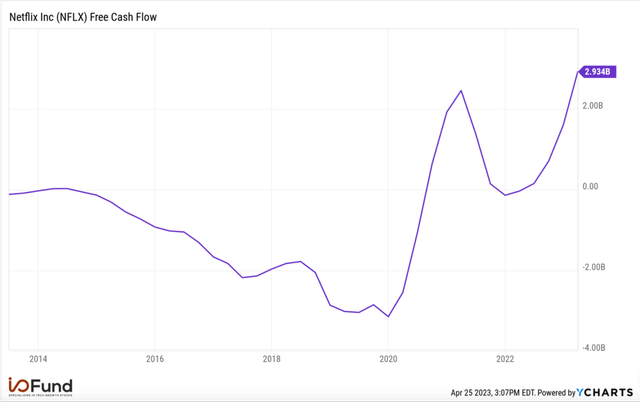

Strong Free Cash Flow

Netflix’s bottom line has stabilized. In the recent report, free cash flow came in at an impressive $2.17 Billion, with management raising full-year guidance to $3.5 billion. This is an improvement of ~$6.5 billion in free cash flow from five years ago when the company was losing $3 billion per year in 2019.

The free cash flow margin has more than doubled from last year at 25.9% compared to 10.19% in the year ago quarter.

YCHARTS

Gross debt is still high at $14.5 billion, which is inherent to the business model. However, net debt is improving at 1.1X compared to 1.3X last quarter with net debt of $6.7 billion compared to $8.37 billion last quarter.

Netflix still trails other FAANGs on its investment rating, yet it’s notable the company has seen an upgrade from Moody’s from junk to investment grade. Netflix has been the black sheep of the FAANGs in this regard, however, a large part of our thesis is based on the company’s change in profile in terms of bottom-line strength.

On another positive note, Moody’s stated the following regarding Netflix’s ad tier:

Moody’s anticipates that growth in subscribers from the recently launched ad supported service will be gradual but steady and provide a strong long-term opportunity for revenue growth.”

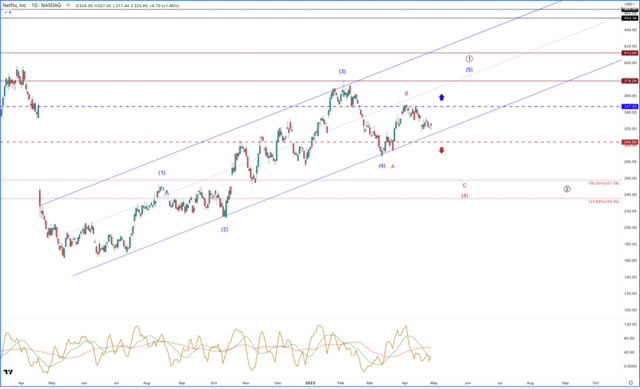

How to Position Now and Throughout 2023

We’re cautious when it comes to timing as tech can be volatile. We find the most success in matching quality stock ideas with technical analysis. This provides some insurance should a speculative bet not work out, for example, should Netflix’s management team not be able to execute. It also helps to increase gains as buying in April of 2022 would have produced 40% gains versus in May of 2022 at 80% gains. This is a substantial reward for only waiting one additional month.

Regarding the bigger technical picture, Netflix remains range bound between $304 and $347.

Tech Insider Network

We’ll start with the red count below. If we see a breach of the below trend channel, that will be the first warning. A break below $304 will open the door to our first target zone between $257 – $235.

On the other hand, if we see a breakout above $347, we would not consider this breakout a buy. The reason is because the bullish pattern that started on May 12 of 2022 is a 5 wave pattern. Any break above $378 would be considered a big warning, as it would be completing the 5 wave pattern and setting up for a rather deep retrace.

We do not believe a buy above $257 is worth the risk, considering both the macro environment and technical pattern in Netflix, right now. If we see favorable results regarding Netflix’s pivot, and yet pricing comes under pressure from the macro environment, we will be looking to aggressively accumulate at much lower levels.

Conclusion

Look for password sharing to contribute to results next quarter due to a broader roll-out including in the United States. This will be a line in the sand moment for Netflix’s new narrative.

If this hurdle is cleared, then look for the ad tier to contribute to earnings results by Q3 and Q4 of 2023 as the company will need time to grow the audience to a meaningful size for ads to have an initial impact. The target is in the range of 10 million to 15 million, if we assume 13 million is the midpoint.

Although some investors will become aggressive around these targets being hit early, it’s better to let management successfully pivot than to force exact timing. As long the top line bottoms in the June quarter, with evidence of an acceleration for the September guide on the top line, then that’s good enough for our position.

We believe our target buy level will set us up for gains in Netflix stock when the next bull cycle begins.

Recommended Reading:

- Netflix Stock Will Be A FAANG Again

- Netflix Stock Stronger Than It Seems Following Q2 Earnings

- Netflix Stock Could Rally With Ad-Supported Content

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Check out Tech Insider Network

Check out Tech Insider Network

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our audited 3-year results of 47% prove we are a top-performing tech portfolio. This compares to popular tech ETFs at negative 46% and the Nasdaq at 19%.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services includes an automated hedge, portfolio of 10+ positions, broad market analysis, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.