Summary:

- MSFT has been well-supported by the AI boom, while further boosted by the stellar FQ3’23 results and optimistic FQ4’23 forward guidance.

- With FY2023 potentially bringing forth a top and bottom-line expansion of +6.7% and +5.4%, respectively, it is not surprising that the rally has been this aggressive.

- With $10B pledged to OpenAI and a new partnership with AMD, Nadella has envisioned the company’s (likely) successful transition toward the next generational platform, AI.

- However, this is where we prefer to exercise prudence, due to the minimal margin of safety to our price target of $321.13.

- Due to the uncertain macroeconomic outlook and increased likelihood of recession by H2’23, investors may want to avoid joining the rally now.

anyaberkut/iStock via Getty Images

We had previously covered Microsoft (NASDAQ:MSFT) in April 2023 here, with the software company going on the offensive, integrating GPT-4 capabilities in most of its product offerings. As such, it was unsurprising that Mr. Market had awarded MSFT’s stock with an AI premium, widening the gap between its valuations/stock prices to GOOG’s, prompting “the 800-pound gorilla,” and Mr. Market to “dance.”

In this article, we will be covering MSFT’s FQ3’23 results, one that has further boosted its stock prices, despite the potentially blocked ATVI deal. Perhaps the optimism has to do with the bottoming PC demand destruction, with H2’23 bringing forth further tailwinds in its top and bottom-line expansion. We shall discuss this further.

The Tech Giant Continues To Deliver And Expand Aggressively – Deserving The Rally

MSFT has had a smashing FQ3’23 earnings call, with a double beat in its top and bottom lines. Notably, it records revenues of $52.85B (inline QoQ/ +7.1% YoY) and EPS of $2.45 (+5.6% QoQ/ +10.3% YoY).

Much of the success is attributed to the growth in MSFT’s Intelligent Cloud/ Azure segment, contributing revenues of $22.08B (+2.6% QoQ/ +16.3% YoY) in the latest quarter, comprising 41.7% of its total revenues (+1 points QoQ/ +3.3 YoY).

With Azure delivering operating margins of 42.8% (+1.5 points QoQ/ -1.4 YoY) in FQ3’23, it appears that the company’s cloud segment remains unaffected by the uncertain macroeconomic outlook.

While Q1’23 numbers may not be reported yet, MSFT has also been eating Amazon’s (AMZN) share in the global cloud market, growing to 23% by Q4’22 (+2 points QoQ/ +5 YoY), with the latter declining to 33% (-1 point QoQ/ inline YoY), while Alphabet’s (GOOG) remains stable.

In addition, it appears that the software company’s headwinds from the PC demand destruction have lifted moderately, attributed to the highly promising profitability in More Personal Computing by the latest quarter. The segment reported operating incomes of $4.23B (+27.4% QoQ/ -11.5% YoY) and operating margins of 31.9% (+8.6 points QoQ/ -0.8 YoY), despite the stagnant revenues of $13.26B (-6.8% QoQ/ -9% YoY).

If we are to dig further, MSFT’s More Personal Computing segment’s performance has been significantly lifted by the Windows Commercial products/ cloud services in FQ3’23, expanding by +14% YoY, as with Xbox content/ services at 3% YoY and Search/ news advertising revenue at +10% YoY.

Furthermore, the Window segment is showing signs of recovery, with revenues of $5.32B by the latest quarter (+10.8% QoQ/ -12.2% YoY), naturally being much improved from pre-pandemic levels of $4.94B in FQ3’20 and $5.22B in FQ3’21. This cadence further underscores its winning strategy of offering a “consolidated playbook” to corporate/ retail consumers, across Azure, Dynamics, Teams, Security, Edge, and Bing.

While the integrated strategy may have forced MSFT to “unbundle” Microsoft Teams with Office products in the EU, to avoid a “formal antitrust investigation by regulators,” we believe that market demand may be more than healthy. By the end of 2022, over 1.4B (+7.6% YoY) of people /businesses use its offerings globally.

With Intel (INTC) similarly suggesting the bottoming of the PC downturn by Q2’23, we suppose MSFT may have further tailwinds for top and bottom-line expansion by H2’23, significantly aided by the aggressive AI strategy.

The software company has integrated AI across its first-party product offerings, most notably in Azure, driving performance while improving efficiency in resource usage. Particularly, it records optimized “cost footprint” QoQ, driving COGS down while expanding cloud margins, as witnessed in FQ3’23 results.

As a result, it is unsurprising that MSFT’s Research & Development has also drastically expanded to $6.98B in FQ3’23 (+2% QoQ/ +10.7% YoY), comprising 13.2% of its revenues, compared to FY2022 cadence of 12%.

This is on top of the supposed $10B pledged to OpenAI and a new partnership with Advanced Micro Devices (AMD) for the development of next-gen AI chips, as Satya Nadella, the CEO of MSFT, envisions the company’s (likely) successful transition toward the next generational platform, AI:

As we look towards a future where chat becomes a new way for people to seek information, consumers have real choice in business model and modalities with Azure-powered chat entry points across Bing, Edge, Windows, and OpenAI’s ChatGPT. We look forward to continuing this journey in what is a generational shift in the largest software category, search. (Seeking Alpha)

So, Is MSFT Stock A Buy, Sell, or Hold?

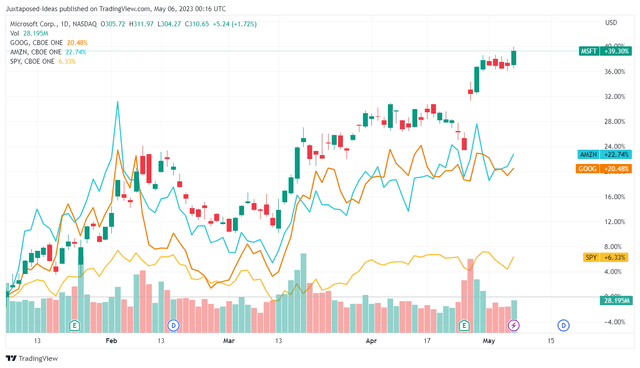

MSFT YTD Stock Price

Trading View

While we have scooped up more MSFT shares at the previous January 2023 bottom of $220, it appears that the rally has come relatively fast and furious, with the stock gaining +39.30% since then, compared to AMZN at +22.74%, GOOG at +20.48%, and SPY at +6.33%.

Its forward guidance demonstrated its highly optimistic outlook as well, with FQ4’23 revenues of up to $55.85B (+5.6% QoQ/ +7.6% YoY) and an operating income of up to $23.65B (+5.8% QoQ/ +15.1% YoY), suggesting improved operating margins of up to 42.3% (+0.1 points QoQ/ +2.8 YoY).

Therefore, it is unsurprising that the MSFT stock is highly buoyant, potentially retesting its March 2022 resistance levels of $315 ahead.

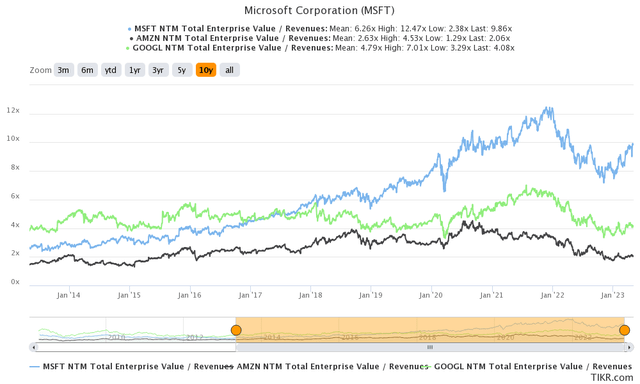

MSFT, GOOG, and AMZN 10Y EV/Revenue

S&P Capital IQ

However, this is where we have turned cautious, since the MSFT stock seems richly valued at the moment, trading at NTM EV/Revenue of 9.86x, compared to its 5Y mean of 8.66x and 1Y mean of 8.65x.

In addition, the stock is also trading way above its cloud provider peers, such as GOOG at NTM EV/Revenue of 4.08x and AMZN of 2.06x, with the two latter similarly trading below their 5Y mean of 4.87x/ 3.13x while in line with their 1Y mean of 4.14x/ 2.17x, respectively.

MSFT’s premium may not be warranted, since it is only expected to record a top-line CAGR of 10.1% through FY2025, compared to GOOG at 9.8% and AMZN at 10.9%. While the former may benefit from the AI boom, it is uncertain how things may develop ahead, due to the potential regulatory headwinds.

Then again, Palantir Technologies (PLTR) has been using AI as its data processing platform in multiple use cases, such as the military, tech companies, healthcare, and oil/gas industries, amongst others. Particularly, the US government comprised 71.2% (-5.9 points YoY) or $826M (+22% YoY) of its FY2022 revenues of $1.16B (+32% YoY).

With PLTR’s offerings also achieving the highest possible DoD Impact Level 6 (IL6) PA from the Defense Information Systems Agency in October 2022, along with MSFT and AMZN, we suppose regulatory approvals and widespread adoptions may come sooner than expected.

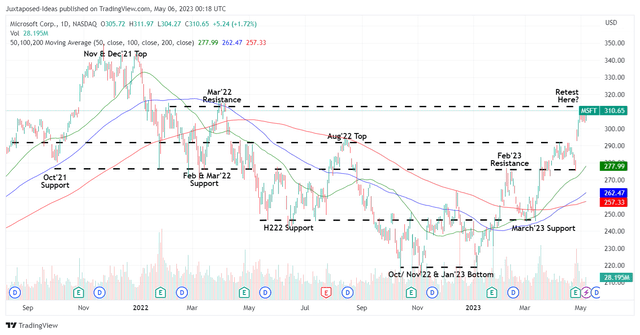

MSFT 2Y Stock Price

Trading View

It appears that the “rally still has legs,” with MSFT likely to retest its next resistance level at March 2022 of $315 over the next few days. Nonetheless, with the peak recessionary fears painting an uncertain macroeconomic outlook, we prefer to prudently rate the stock as a Hold here, due to the minimal upside potential to our price target of $321.64. This is based on its 1Y P/E mean of 25.67 and the market analyst’s projected FY2025 EPS of $12.53.

Interested investors may want to wait for moderate retracements ahead, for an improved margin of safety. Do not chase the rally here.

Furthermore, the software company faces further uncertainty from the Activision Blizzard (ATVI) deal, with the UK regulators blocking the acquisition. We are personally happy with the decision, attributed to the slight premium that the former planned to pay at $69B.

Given the Fed’s pessimistic outlook, it may be more prudent for MSFT to retain excess liquidity on the balance sheet, with it reporting FQ3’23 cash/ short-term investments of $104.41B (+4.9% QoQ/ inline YoY), while similarly paying down its long-term debts to $41.96B (-4.8% QoQ/ -12.8% YoY).

With the growing hype surrounding ChatGPT and AI-enabled technologies, we believe there are more than sufficient growth drivers for the company, implying the reduced need to rely on ATVI at these elevated valuations.

Then again, assuming that the appeal is successful, it will not be surprising to see the MSFT stock further rally, due to the massively accretive effect on its gaming ambitions, significantly boosted by ATVI’s $49.73B in Enterprise Value at the time of writing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, GOOG, AMZN, PLTR, INTC, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.