Summary:

- Lucid dramatically misses Q1 revenue estimates.

- Full-year production forecast updated in a challenging way.

- Cash position continues to decline.

jetcityimage

After the bell on Monday, we received first quarter results from Lucid (NASDAQ:LCID). The luxury electric vehicle maker has struggled recently to ramp production of its Air sedan as well as sell what it has actually made. Unfortunately, the numbers and guidance were again rather poor, sending shares another leg lower in the after-hours session.

For the March ending period, the company produced 2,314 vehicles during Q1 at its facility in Arizona and delivered 1,406 vehicles during the same period. Unfortunately, this was a bit disappointing, as the delivery print was barely above Q3 2022 levels. Just a year ago, the street was expecting $755 million in revenues for the March 2023 period, but that number was down to just $211.5 million going into the report.

As it turned out, Lucid didn’t come anywhere close to these expectations. Revenue for the period came in just under $150 million. While this is tremendous growth in percentage terms over the prior-year period, the number was down over $108 million on a sequential basis. Worse yet, the company reported a cost of goods sold of more than half a billion dollars, with the operating loss surging by about $175 million above Q1 2022 levels. Lucid’s net loss was almost $780 million, more than five times the revenue number, a situation that is not sustainable. On a per-share basis, Lucid lost 43 cents, which was 2 cents worse than the street was expecting.

Last year, Lucid twice cut its production forecast for the year, going from 20,000 units to just 7,000 units. While it hit that figure in the end, deliveries did not even reach 4,400 vehicles. Back at the company’s Q4 report, management announced 2023 annual production guidance of 10,000 to 14,000 vehicles. That was seen as a disappointment, especially since the top end didn’t even match the original target for 2022. However, management essentially cut guidance on Monday, now just calling for 2023 production of more than 10,000 vehicles, eliminating any overall guidance range.

With EV giant Tesla (TSLA) significantly reducing prices on its luxury Model S and X vehicles in the last few months, Lucid’s demand path has gotten much shakier so far this year. Tesla peaked around 100,000-unit sales of its two luxury vehicles per year, but they’re now running around half of that. Lucid is struggling to sell just a small fraction of that currently. This doesn’t even include the growing high-end competition from the likes of Mercedes, Polestar (PSNY), and others.

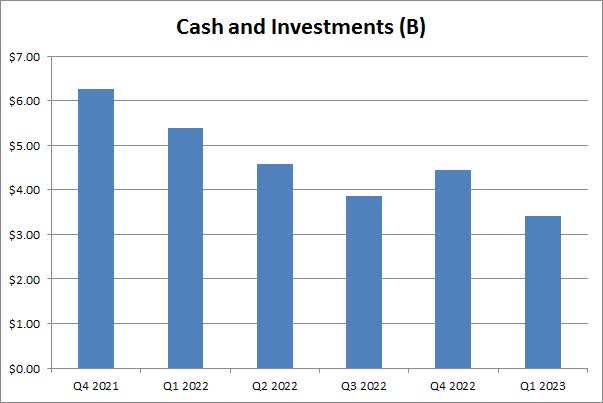

In terms of the balance sheet, Lucid continues to burn a ton of cash each quarter, primarily thanks to its large ongoing losses. As the chart below shows, the cash balance has come down quite a bit since then end of 2021, and that includes a major capital raise that came late last year. With Lucid getting ready to launch its next vehicle in the coming quarters, it seems that investors are preparing for more funds to be raised. Management believes it has enough liquidity to get to Q2, 2024, but they don’t have a great track record when it comes to guidance. Lucid burned over $1.04 billion in cash in Q1, 2023.

Lucid Cash Position (Company Earnings Reports)

Going into Monday’s report, the average price target on the street was just over $10, implying more than 30% upside from the day’s close. However, that average has dropped by more than $7 alone so far in 2023 and is down from nearly $37 just a year ago. Analysts have continued to cut their targets almost as fast as the stock has fallen, with overall results continuing to disappoint, and I’m guessing we’ll see more target cuts after this Q1 report. The stock’s 50-day moving average was at $7.88 as of Monday, which will be a key technical level to watch going forward. In the after-hours session, shares were down about 8%, looking to drop below $7 yet again, so I expect the 50-day to start heading lower again.

In the end, Lucid reported another awful set of results on Monday afternoon. The company fell dramatically short of street revenue estimates, while large losses continued to pile up. Guidance for the year has been adjusted and no longer features a range for production, essentially meaning the forecast has been cut. With cash burn continuing at alarming levels, shares are dropping after the report and are putting their all-time trading low back in play moving forward if results don’t improve dramatically and quickly.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.