Summary:

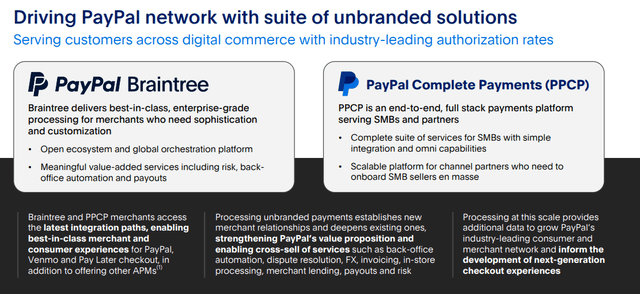

- PayPal Holdings, Inc. is prioritizing on expanding its unbranded processing business, which could result in margin compression, but is expected to drive more profitable volumes in the long term.

- Despite the stock has largely discounted slowdown in payment volume and weak forward guidance, the negative sentiment around the CEO’s retirement continues to weigh on PayPal stock.

- The company’s low valuations are justified by the street’s pessimism toward its earnings outlook.

- I’m bullish on PayPal Holdings, Inc.’s long-term prospects, given that its current valuation provides a solid floor for the stock.

Sundry Photography/iStock Editorial via Getty Images

Investment Thesis

PayPal Holdings, Inc. (NASDAQ:PYPL), as one of the “pandemic darlings,” surged 230% from its 2020 low in less than a year due to the belief that the pandemic had accelerated the global e-commerce adoption. Investors were optimistic about the company’s transaction volume outlook, believing the pandemic had caused a structural shift that would continue into the post-pandemic era.

However, this secular tailwind also created tremendous pull-forward demand, which caused the spend trend to exceed the long-term trajectory. Additionally, investors underestimated the disastrous impact of high inflation on the company’s margins, and the stock price quickly reversed course, falling 75% within a year and currently trading 18% below the pandemic low.

Although the near-term sentiment remains under pressure due to the CEO retiring and macro headwinds, I’m bullish on PayPal Holdings, Inc. in the long-term due to its high relative exposure to e-commerce, strong brand recognition, and global scale. Furthermore, the company’s strong free cash flow (“FCF”) profile and cheap valuation provide a floor for further downside.

Fintech Outlook

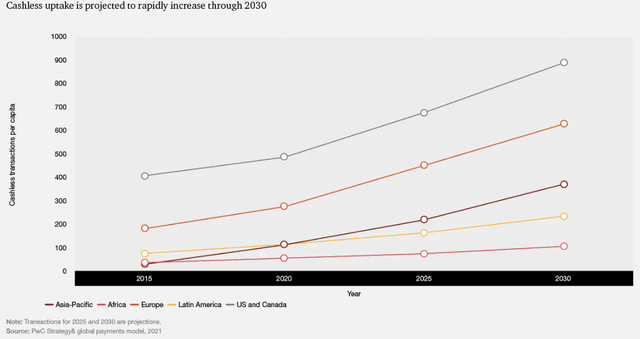

The pandemic has led to an acceleration in the adoption of digital behaviors, which has resulted in the rise of digital economies and a decrease in the importance of cash in daily life. As a result, electronic payments have become increasingly important, and digital transactions have become a top priority for most goods and services providers. According to PWC analysis, global cashless payment volumes are expected to increase by over 80% from 2020 to 2025, from about 1 trillion transactions to nearly 1.9 trillion, and almost triple by 2030.

As an early player in online B2C payments, PYPL has become a preferred payment choice for digital commerce worldwide. The company has consistently generated a substantial portion of its net revenues from international customers. In 2020, 2021, and 2022, approximately 49%, 46%, and 43% of the company’s net revenues came from customers domiciled outside of the U.S., respectively.

Q1 2023 Takeaway

Despite a better-than-expected 1Q earnings results, PayPal Holdings, Inc.’s disappointing 2Q guidance resulted in a 5% stock decline after hours. Although TPV growth for 1Q FY2023 did show a 10% YoY increase, it continued to decelerate from 13% YoY in 1Q FY2022, indicating a weak trend in payment volume. While FY 2023 non-GAAP diluted EPS being raised to $4.95 from the previous $4.87 due to cost-cutting initiatives, the lackluster revenue growth outlook for 2Q 2023, at 6.5%-7% YoY, is below the consensus. The growth on active accounts continued to decelerate to only 1% YoY and the transaction margin has been compressing in the last 5 quarters.

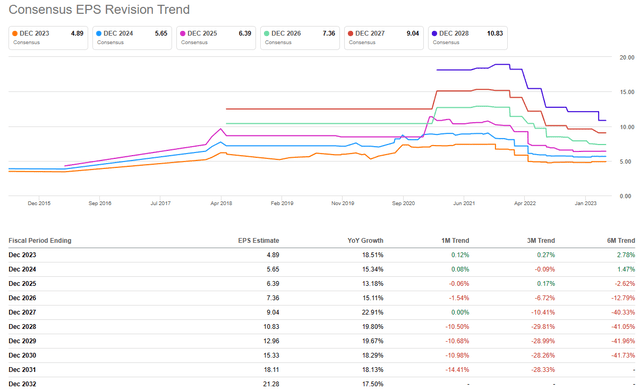

The trend in PayPal Holdings, Inc. earnings revisions shows that sell-side analysts have been consistently slashing their estimates since the start of FY 2022. The consensus for FY 2024 EPS, which was initially $9 as of 10/19/21, has been reduced to $5.65 as of now, indicating a decline of 37%. Therefore, I believe that the significant slowdown in earnings outlook can justify the company’s low valuations.

Pull-Forward Demand

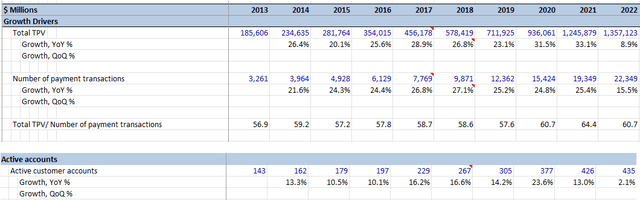

To understand why PayPal’s KPIs have been weakening in recent quarters, we need to consider two key factors. First, the company is facing increased competitions in the digital payments industry, with players like Block, Inc. (SQ) and Stripe challenging PayPal’s dominance. Second, the pandemic led to a surge in online payments, which boosted PayPal’s fundamentals in FY 2020 and FY 2021 but may have created a tough YoY comparison in FY 2022. The acceleration of digital behaviors during the pandemic created a pull-forward demand that resulted in a tripled price surge for PYPL.

This was supported by a robust total payment volume (TPV) CAGR of nearly 32% and active customer accounts CAGR of 18% from FY 2019 to FY 2021, compared to YoY growth of 8.9% and 2.1%, respectively, in FY 2022. Venmo TPV grew the fastest between 2018 and 2021, at a CAGR of 55%. However, in 1Q FY2023, Venmo TPV growth only increased by 8%, indicating a slowing of P2P.

This is a significant concern for the company, since P2P is a main source of inflows for the company to monetize. Despite the stock’s significant decline of almost 75% from the 2021 high, I believe that the headwind on pull-forward demand has largely been priced in. While a looming recession in the U.S might create weak payment volume in the near-term, the cyclical downturn is unlikely to structurally affect the multi-decade transformation of digital payments.

Margins Compression

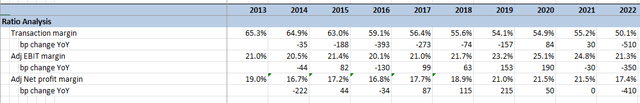

In addition to pull-forward demand, we need to take inflation into account. Despite the company’s claim of a continued operating margin expansion (EBIT) in its 1Q FY 2023 Investor Update, we should keep in mind that the numbers remain below the pre-pandemic level. Due to the negative impact of inflation on operating expenses, the company’s operational efficiency has suffered, despite efforts to reduce costs. In FY 2022, adjusted EBIT margin declined by 350 bps YoY to 21.3%, the lowest level since FY 2017, largely due to a compression of -510 bps on transaction margins. The transaction expense increased by $1.9 billion or 18% YoY in FY 2022.

In 2022 10-K, PayPal Holdings addressed that the funding mix and the macroeconomic environment may lead to shifts in consumer spending behavior, affecting the type of funding source they use. The company also explained:

“the increase in transaction expense rate in 2022 compared to 2021 was also attributable to unfavorable changes in product mix with a higher proportion of TPV from unbranded card processing volume, which generally has higher expense rates than other products and services.”

However, in 1Q FY2023 earnings call, the CEO said the unbranded TPV growth accelerated from Q4 FY2022 to post 30% YoY growth and continue to focus on improving the margin structure of unbranded business. While the margins compression may persist in the near term, I believe the company may prioritize increasing approval and retention rates to benefit the shareholders in the long term.

Apple Pay Partnership

PayPal Holdings, Inc. needs to identify some catalysts to accelerate growth once again. I believe that the partnership with Apple Pay could be one of the silver linings for the growth turnaround. In 3Q FY2022, the company announced a multi-pronged omnichannel strategy with Apple Inc. (AAPL) to enhance the company’s offerings for PayPal and Venmo merchants and consumers. This strategy includes allowing PayPal merchants to use their iPhone as a mobile POS terminal without the need for a dongle or other accessory device in 2023.

The company also has been working with the Alphabet Inc. (GOOG, GOOGL) Google Pay for some time, and integrating PayPal with Google Pay has shown a 20% increase in branded checkout transactions in Germany. The CEO believed that adding Apple to PayPal’s unbranded flows will make the platform more competitive and position it as a complete payment solution for small and mid-sized merchants. Therefore, it’s possible that the margin compression due to the product mix headwind may be temporary, as the addition of unbranded flows, including Apple Pay and Google Pay, may help boost transaction volumes. This could position PayPal Holdings, Inc. as more competitive and potentially attract more business in the long run.

Valuation

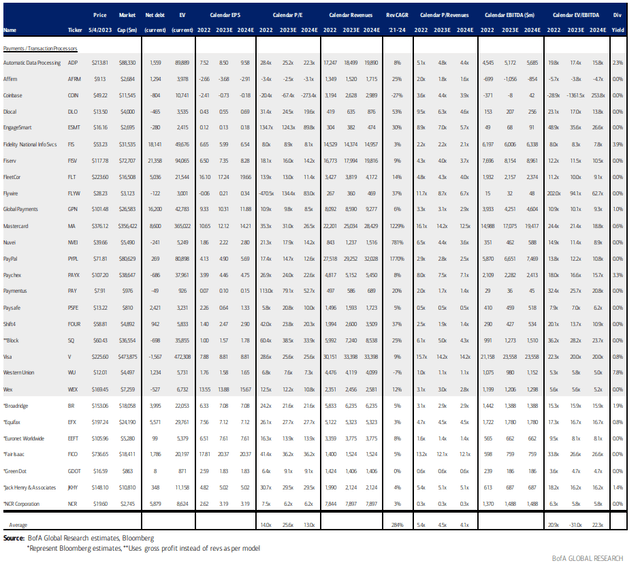

BofA Global Research estimates, Bloomberg

As a fintech company, PayPal Holdings, Inc. has historically been awarded a higher valuation multiple in a low interest rate environment, due to its growth potential. This was evidenced by a strong rally in 2021, when the fed fund rate was at the 0 lower bound. However, with U.S. inflation spiking up to 8% YoY in 2022, the Fed has signaled its intent to hike interest rates to bring it back down to the 2% target, which could pose significant challenges for high valuation growth stocks like PYPL if its fundamentals are also deteriorating.

Despite this, PYPL is still considered a value stock with strong long-term growth potential. As of 05/04/2023, the stock is trading at 2.9x P/S and 13.8x EV/EBITDA in CY 2022, significantly below the average of 5.4x and 20.9x, respectively. Taking the company’s FY 2023 guidance into account, the stock is trading at 14.8x PE CY 2023, which is also significantly below the average of 25.6x. However, If the company is unable to achieve a reacceleration in transaction revenue growth, PayPal may fall into a value trap, implying that the company should trade at a cheaper valuation.

Conclusion

In sum, PayPal Holdings, Inc. has demonstrated a strong growth momentum in the digital payment industry during the pandemic, supported by its diverse range of payment solutions and expanding customer base. However, the company has faced some headwinds, such as rising inflation and increased competition from other payment providers. While the current valuation of PayPal Holdings, Inc. is relatively cheap compared to historical averages, it’s important to note that the company needs to reaccelerate growth in transaction revenue to avoid falling into a value trap. Due to a 75% pullback from the recent high, I’m bullish on PayPal Holdings, Inc. stock as the long-term growth potential of PYPL remains intact.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.