Summary:

- PayPal Holdings had a really solid quarter, but shares of the business moved lower after-hours because of weak near-term guidance.

- A reduction in the number of active accounts might also have been a factor, but management is optimistic about this year as a whole.

- Add in how shares are priced, and investors should give the company serious consideration.

JasonDoiy

Perhaps no company in the payment processing space is known better than industry giant PayPal Holdings (NASDAQ:PYPL). Year after year, the company continues to grow, with sales, profits, and cash flows usually coming in higher each year than the year prior. But this doesn’t mean that it has always been smooth sailing for the company or its shareholders. In the long run, the industry that the company plays in is quite appealing. And more likely than not, it will continue to expand. Though it has hit some bumps from time to time. The latest came after the company reported financial results for the first quarter of its 2023 fiscal year following the markets close on May 8th. Even though the company exceeded analysts’ expectations across the board, shares experienced a bit of a pullback on disappointing guidance for the second quarter of this year. Investors who are focused on long term investing should probably view this as a good opportunity to pick up a piece of the company on the cheap.

A great quarter, but a mixed outlook

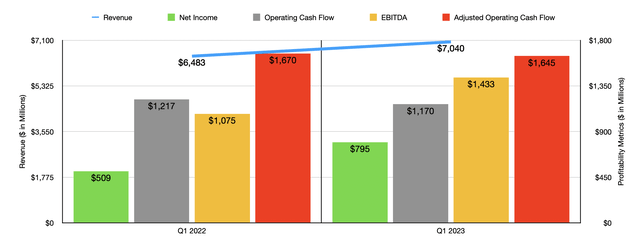

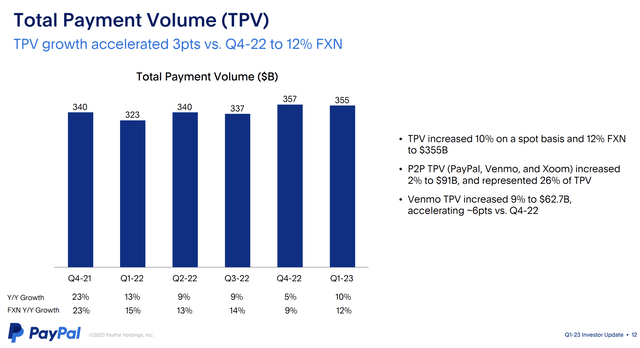

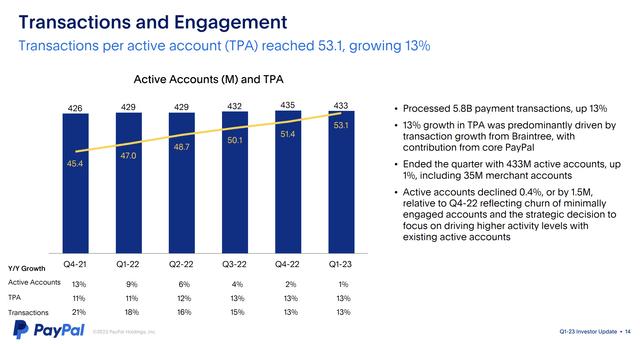

After the market closed on May 8th, the management team at PayPal announced financial results covering the first quarter of the company’s 2023 fiscal year. Revenue for this time came in at $7.04 billion. That’s 8.6% above the $6.48 billion the company reported the same time one year earlier. In addition to this, it also exceeded the $6.99 billion that analysts expected sales to come in at. This growth was driven by a couple of key factors. For starters, the number of active accounts on the firm’s platform grew from 429 million to 433 million. The number of transactions per account expanded from 47 to 53.1, indicating that those who are using the platform are using it more now than ever. A total of $354.51 billion spread across 5.84 billion transactions, beat out the $322.98 billion spread across 5.16 billion transactions, reported one year earlier.

Author – SEC EDGAR Data

The company also beat expectations on the bottom line. Earnings per share came in at $0.70. That’s well above the $0.43 per share reported one year earlier. Analysts, meanwhile, were forecasting profits per share of $0.67. On an adjusted basis, profits per share of $1.17 beat out the $1.10 the analysts thought the company would report. These results translated to total net profits for the quarter of $795 million. That’s well above the $509 million reported one year earlier. This is not to say that everything was great. Operating cash flow for the company actually declined, dropping from $1.22 billion to $1.17 billion. Even if we adjust for changes in working capital, we would have seen a dip from $1.67 billion to $1.65 billion. Fortunately, this was offset to some degree by an increase in EBITDA from $1.08 billion to $1.43 billion.

PayPal

At first glance, everything here looks pretty solid. It would have been nice for the cash flow data to be more robust and in-line with the other profitability metrics. But outside of that, the situation for shareholders looks quite nice. The problem, then, involved guidance for the second quarter of this fiscal year. Revenue for the company during that time should be between 6.5% and 7% higher than it was last year, with this range moving up to between 7.5% and 8% when you factor in foreign currency fluctuations. Meanwhile, earnings per share should be between $0.81 and $0.83. On an adjusted basis, this number should come in at between $1.15 and $1.17. A portion of the disparity between official earnings and adjusted earnings will be roughly $0.45 per share of a negative impact associated with the company’s investment portfolio. For context, analysts were expecting adjusted earnings per share for the second quarter to be around $1.17.

PayPal

Although not discussed as much, another factor that probably has investors spooked is the decrease in active accounts that the company reported. At the end of the 2022 fiscal year, it boasted 435 million active accounts. That number dropped to 433 million by the end of the first quarter. I looked back to see if a decrease in the number of active accounts took place from the final quarter of 2021 to the first quarter of 2022. It did not. During that time, the company saw an increase of roughly 3 million active accounts.

I can understand why investors might be a bit skittish based on these results. However, I think any pessimism is definitely overdramatic. I say this because, for the 2023 fiscal year as a whole, management remains very optimistic. They are currently forecasting earnings per share of $3.42. That’s up from the $2.09 reported for 2022. Adjusted earnings, meanwhile, should be $4.95 compared to the $4.13 reported one year earlier. This all represents an upward revision and guidance for the year. When management reported financial results for the final quarter of 2022, they said that earnings per share for 2023 would be $3.27, while adjusted earnings would be $4.87.

Author – SEC EDGAR Data

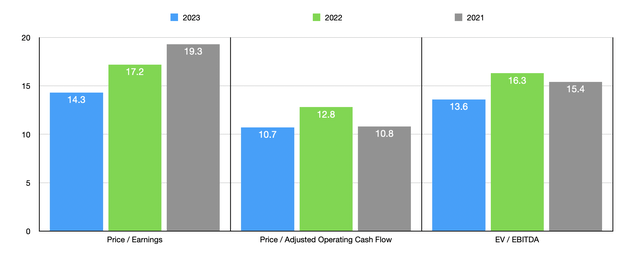

Factoring in the roughly 5% decline in price that the company experienced after the market closed, I was able to value the company. For context, I assumed that both adjusted operating cash flow and the EBITDA of the company would rise this year at the same rate that earnings are forecasted to. In the chart above, you can see the results of my analysis, with the trading multiples of the company compared to the trading multiples if we were to use data from 2021 or 2022. Meanwhile, in the table below, I compared the company, focusing on its 2022 results to be conservative, to five similar companies. On a price to earnings basis, our prospect was the cheapest of the group. Using the price to operating cash flow approach, one of the firms was cheaper, while another was tied with it. And finally, using the EV to EBITDA approach, I found that two of the five companies were cheaper than it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| PayPal | 17.2 | 12.8 | 16.3 |

| Automatic Data Processing (ADP) | 27.4 | 22.7 | 18.2 |

| Fiserv (FISV) | 31.5 | 15.5 | 13.9 |

| Fidelity National Information Services (FIS) | 44.4 | 9.1 | 10.5 |

| Global Payments (GPN) | 234.5 | 12.8 | 22.2 |

| Paychex (PAYX) | 25.6 | 23.7 | 17.4 |

Takeaway

After looking through all the data that management provided, I must say that PayPal is doing quite well for itself. Although the company may have disappointed its shareholders to some degree, the overall trajectory of the enterprise is positive and investors should be happy about the upward guidance and profitability. Shares are not exactly the cheapest thing on the market. But for a high-quality industry leader I would make the case that they are cheap enough to warrant optimism. So because of this, I have no problem rating the company a ‘buy’ to reflect my view that PYPL stock should outperform the broader market moving forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!