Summary:

- Leading offshore driller Transocean Ltd. reported first quarter results ahead of management’s expectations and provided second quarter guidance essentially in line with consensus estimates.

- The company remains on track to deliver upon its full-year projections.

- On the conference call, management remained upbeat on the industry outlook with leading drillship dayrates expected to reach the $500,000 mark later this year.

- Admittedly, 2023 is unlikely to be a breakout year for the company, but 2024 should be a very different story with close to 25% revenue growth and substantial GAAP profitability which should pave the way for reducing the company’s substantial net debt position of approximately $6.5 billion to a more adequate amount over time.

- While I wouldn’t chase Transocean Ltd. shares at current levels, investors should consider adding on any major weakness.

Ion-Creations

Note: I have covered Transocean Ltd. (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

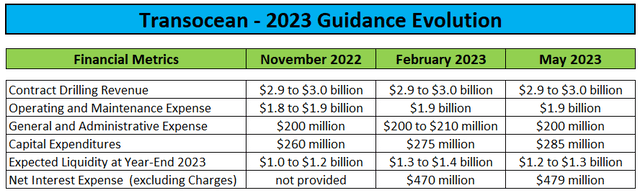

Last week, leading offshore driller Transocean reported first quarter results ahead of management’s expectations and provided second quarter guidance essentially in line with consensus estimates. In addition, the company largely reaffirmed full-year projections:

That said, the less-than-stellar terms of last year’s ill-advised convertible debt issuance continue to haunt Transocean, as the recent rally in the company’s shares resulted in the requirement to record another whopping $133 million non-cash charge in interest expense.

Undoubtedly, the unnecessary and substantially dilutive convertible debt issuance in September has been a major mistake, but investors need to remember that resulting charges are mostly accounting noise.

In fact, Transocean has become the victim of its own success, as the very strong performance of the company’s shares in recent months is the sole reason behind the charges.

In addition, the company recorded a $169 million impairment charge related to the recent contribution of the cold-stacked 6th generation drillship Ocean Rig Olympia to a new deep sea mining endeavor.

Assigning only scrap value to the rig, the charge would have actually exceeded $250 million but Transocean somehow managed to came up with an estimated fair value of $85 million for the drillship thus reducing the required impairment charge quite substantially.

On the conference call, management remained upbeat on the industry outlook with leading drillship dayrates expected to reach the $500,000 mark later this year.

On the flip side, I was surprised to see the high-specification ultra-deepwater drillship Deepwater Inspiration now sitting idle in the U.S. Gulf of Mexico. In addition, the current contract for the drillship Deepwater Invictus is scheduled to end in July with no follow-up work having been announced yet.

After being poked on the issue by an analyst on the call, management stated its expectations for securing new work for both rigs in the near term.

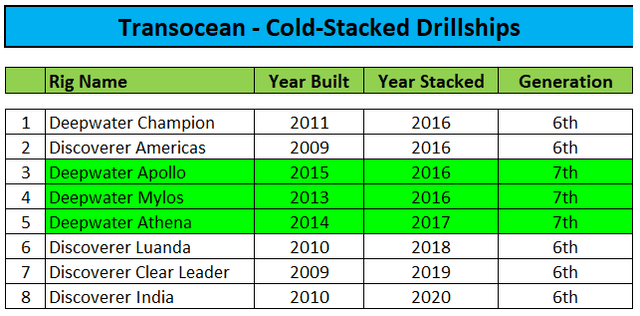

Not surprisingly, most of the discussion on the call centered around the potential reactivation of cold-stacked rigs, particularly after it has turned out that Transocean has offered three cold-stacked 7th generation drillships inherited from Ocean Rig in the recent Petrobras (PBR) pool tender.

On the call, management once again raised its estimates for the reactivation of a cold-stacked rig from an initial number of $25 million claimed at the time of the Ocean Rig acquisition to a range of $75 million to $125 million today with up to 18 months required for activating a drillship in the current market environment.

Please note that $75 million represents the amount estimated by competitor Valaris (VAL) for reactivating one of its remaining cold-stacked drillships but these rigs have been idled for considerably less time than Transocean’s. In addition, Valaris has accumulated plenty of experience in reactivating cold-stacked drillships in recent quarters which Transocean is lacking entirely.

In combination, it’s hard to envision Transocean being able to reactivate a cold-stacked 7th generation drillship for significantly less than $100 million and to be perfectly honest, I wouldn’t be surprised to see the company ultimately exceeding the upper end of the provided range.

Moreover, after listening to Noble Corporation Plc’s (NE) recent conference call, I was actually surprised to see Transocean bidding cold-stacked rigs into the latest Petrobras tender as Noble stated deep concerns regarding the time provided to perform reactivation work “before liquidated damages or termination rights might kick in” as the reason behind its decision to not offer the cold-stacked 7th generation drillship Pacific Meltem in this tender.

In sum, I remain concerned regarding Transocean’s ability to reactivate cold-stacked drillships in time and on budget.

Lastly, I was hoping for management to provide some color on the proposed offshore wind joint venture with Eneti Inc. (NETI) with Transocean expected to provide at least two cold-stacked drillships for conversion to offshore wind foundation installation vessels.

According to Transocean’s press release, the conversion would include the installation of a 5,200 ton crane, which would put these vessels well ahead of competitor Boskalis’ Bokalift 2, also a converted Transocean drillship formerly known as GSF Jack Ryan.

Boskalis

Unfortunately, both Transocean and Eneti are lacking the funds required to finance the equity portion of at least two multi-year crane vessel conversions. In aggregate, I would estimate conversion costs of up to $400 million for two 6th generation drillships.

As a result, the new joint venture would be required to secure a sizeable amount of third-party capital with Transocean and Eneti likely being left with minority stakes for contributing the drillships and managing the converted crane vessels, respectively.

Anyway, even if Transocean and Eneti decide to formally establish the proposed joint venture, with vessel conversion taking up to 36 months, there won’t be any financial benefits from this new endeavor anytime soon.

In fact, quite the opposite might actually be the case as depending on the drillships ultimately selected for contribution, Transocean might be facing estimated impairment charges of up to $1 billion.

Bottom Line

Transocean remains on track to deliver on its full-year projections but this doesn’t change the fact that 2023 won’t be a breakout year for the company as capex requirements and scheduled debt repayments are expected to result in liquidity decreasing further until the end of Q4.

That said, 2024 should be a very different story with analysts currently expecting almost 25% revenue growth and substantial GAAP profitability which should pave the way for reducing the company’s substantial net debt position of approximately $6.5 billion to a more adequate level over time.

While I wouldn’t chase the shares at current levels, investors should consider adding on any major weakness.

Despite recent volatility in oil prices and related stocks, I remain positive on the entire industry, including leading U.S. exchange-listed players Seadrill Limited (SDRL), Valaris, Noble Corp., Diamond Offshore Drilling, Inc. (DO), Borr Drilling Limited (BORR), Helix Energy Solutions Group, Inc. (HLX) and offshore drilling support providers like Tidewater Inc. (TDW) and SEACOR Marine Holdings Inc. (SMHI).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.