Summary:

- Google is an advertising company.

- The advertising market is slow growing, but the margins are high.

- GOOGL is a growth company in the higher-than-average online advertising niche, within the broader advertising market.

- GOOGL trades at a premium due to this growth more than the high margins, and the “recipe” of success remains intact.

- GOOGL is currently a Hold but is very close to my personal Buy zone.

Rouzes

How’d We Get Here?

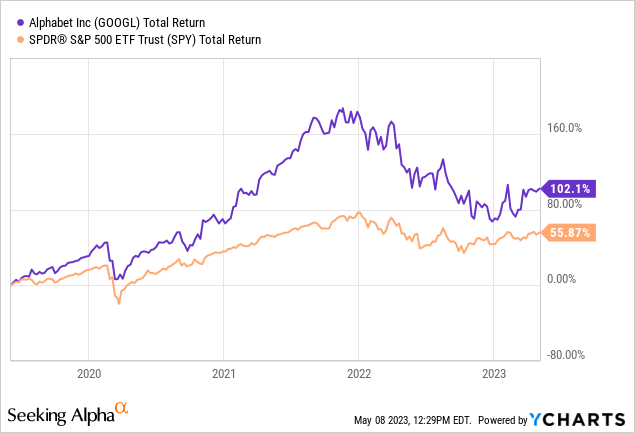

I’ve only been invested in Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG) since June 2019. If I bought a single batch back then I would have a cost basis around $53-55 and I’d be happy with this performance vs. the S&P 500 (SPY):

However, my cost basis is about $93 so I’m up about 15% at this point. How did this happen? Well, I set up a small initial position. Then I added along the way up, and the way down. Therefore, I haven’t hit the jackpot. Such is the nature of dollar cost averaging.

In any event, there’s a lot of fear in the air right now about inflation and recessions, and that sort of thing. This is nothing new. In terms of macroeconomics, there’s always something to worry about. Always.

So, generally speaking, I try not to predict how the winds are blowing. Roughly speaking, I follow Warren Buffett’s approach:

“Well, think about it. You have all these economists with 160 IQs that spend their life studying it, can you name me one super-wealthy economist that’s ever made money out of securities? No.”

Instead, I usually work hard on the fundamentals. I don’t spend too much time at all with charting, or technicals, although those tools can help a little. Usually my focus is on the basics, and I try to keep it really simple.

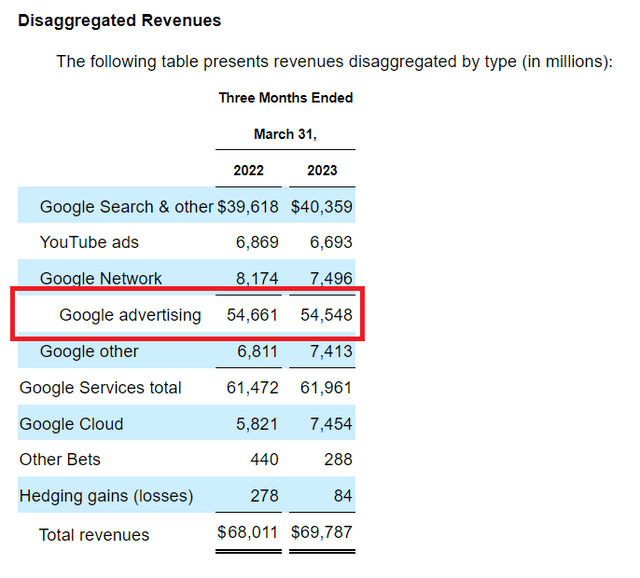

Today, in this article, I’m going to do something a wee bit different. I’m merely going to look at GOOGL as an advertising company. Because, frankly, that’s what it is, no matter anyone else says. The numbers show it:

78% of Alphabet’s Revenue is Advertising (Alphabet Inc. (GOOGL) – FORM 10-Q | Quarterly Report)

Yes, I did some quick math for you. GOOGL revenue is 78% advertising. I’m not going to spend any time on the balance sheet, or cash holdings, or even any of the normal metrics. We are going to do something a bit different.

Is Advertising a Good Business?

The short answer is that advertising is a good business but it’s not great. I’ll quickly show why. That is best done with some references and quotes.

IBIS World states (Updated January 2023):

The market size of the Advertising Agencies industry in the US has grown 3.6% per year on average between 2017 and 2022.

And…

Growth in total US advertising expenditure indicates that businesses are more willing to incur advertising expenses, which benefits advertising agencies. In 2023, total advertising expenditure is expected to increase, representing a potential opportunity for the industry.

So, this is before the recent bank crisis, and the rise of shadow banks. But, as I said above, there are always macro problems, year after year. The point is that the general advertising trend is up, but not up huge.

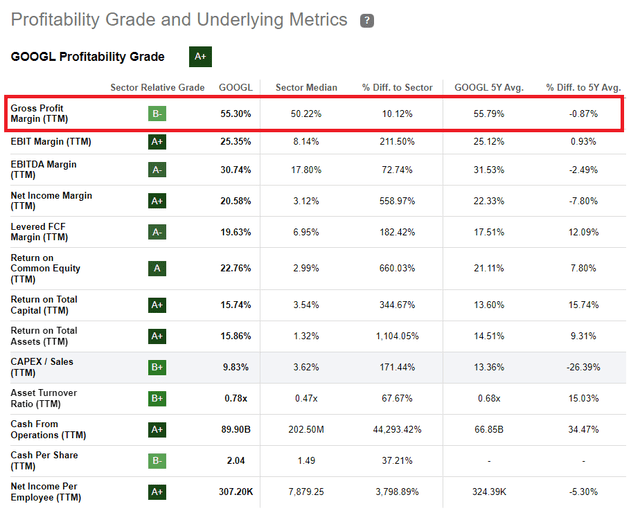

Moving on, we find that, generally speaking, profit margins in advertising are pretty good, even great. Here’s a quick view on GOOGL, at the top level, without specifically breaking out advertising. But I’m sure you get the point:

GOOGL Profit Margin (Seeking Alpha)

And, dialing things a bit, PwC indicates that the US Internet Advertising CAGR is expected to be 6.5%. So, we’re expecting overall market growth, and the profit margins are generally good in this market, perhaps even great.

We could spend a ton of time on this but the story is the same over and over. There’s growth in advertising, especially online and digital advertising, and margins are quite acceptable. GOOGL does especially well; see above.

Because It’s The Zeitgeist…

How about a recession? I think Albert Lin did a fine job explaining how I feel about this, in relation to GOOGL and advertising:

In a downturn, advertisers must also work harder to justify every marketing dollar spent, making ROAS (return on ad spend) a top priority. This means bottom-funnel digital ads driven by commercial intent such as Google Search and Amazon Advertising (AMZN) could be treated as relative safe havens from a budget perspective. In addition, online activities could actually increase in a recession as consumers cut travel plans and dine out less (much like during COVID), providing upside for time spent on services like YouTube and some cushion for digital ad budgets in general.

Of course I’m worried. But not that worried. Why? There is good news and bad news here, as Piotr Kasprzyk says. Hat tip!

The potential bad news coming in a recession:

- Decreased advertising spending

- Shifts in consumer behavior

- Disruption

But, the potential good news in a recession is:

- Increased demand for cost-effective solutions

- Increased search traffic

Throwing this all into a blender, it’s mixed. GOOGL will excel, or simply muddle along at worst. And, frankly, on the related topic and “Big Changes” coming, who knows what A.I. will do to GOOGL.

Bringing this full circle, I think it’s safe to say that advertising, especially digital advertising, is a fine business. Furthermore, there’s growth, and high margins.

Even with a recession, and even with A.I. screaming along, GOOGL should at least tread water. I think they’ll do far better. Pressing on.

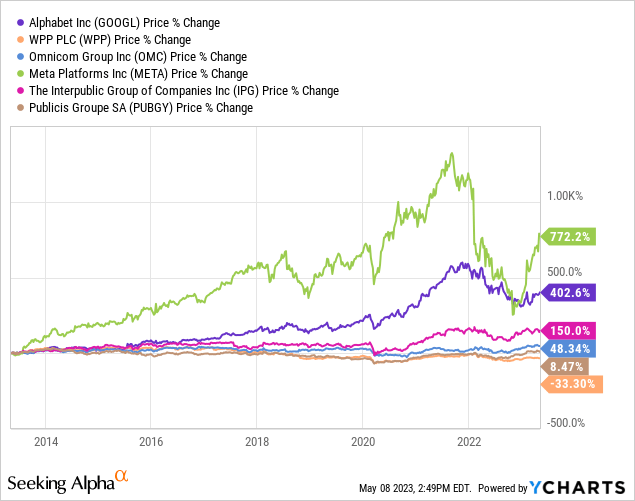

How Have Advertising Companies Done Over The Last 10 Years?

I like this question because it gives us an opportunity to compare GOOGL to other companies, in terms of performance.

As a sidebar, instead of comparing GOOGL to “typical peers” like Microsoft (MSFT), Amazon (AMZN), and Apple (AAPL), we’re going to get specific on more pure play advertisers. To be clear, I believe that GOOGL is very much like Meta Platforms (META). I’ve explained how META is really an ad company.

Let’s therefore focus on these advertising companies for perspective:

- WPP (WPP)

- Omnicom Group (OMC)

- Meta Platforms

- The Interpublic Group (IPG)

- Publicis Groupe S.A. (OTCQX:PUBGY)

Before moving on, please do not consider any of these as recommendations. I’m not talking about buying, selling or holding any of these companies. Instead, I’m providing color on GOOGL’s performance only. It’s all a matter of relativity here. This is market context to better understand GOOGL.

META has outperformed GOOGL. Yet, they’ve both crushed WPP, OMC, IPG and PUBGY. I suppose IPG has done fine. Nothing amazing. On the other hand, WPP, OMC, and PUBGY have been bad investments. This is especially true in light of SPY gains over the last 10 years.

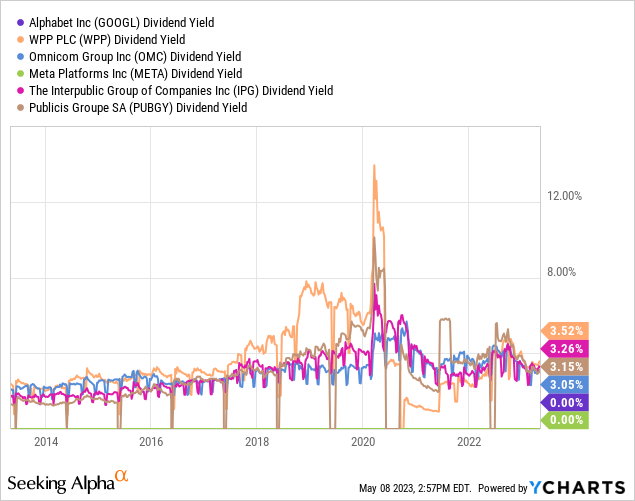

Well, how about this? What about dividends?

Sure, it’s ugly. But you can see that WPP, OMC, IPG and PUBGY have all paid out dividends for a long while. But, GOOGL and META have not. So, there’s at least a pinch of support via dividends. And, at-a-glance, the dividends have been rising over the last 10 years. Naturally, COVID smashed these dividend paying advertisers, but they’ve apparently regained their footing as a group.

Does this make these companies better? No, I don’t think so. These dividends are merely a consolation prize, especially considering the total returns. This is not a situation like the tobacco companies, where the dividends are awesome for income investors.

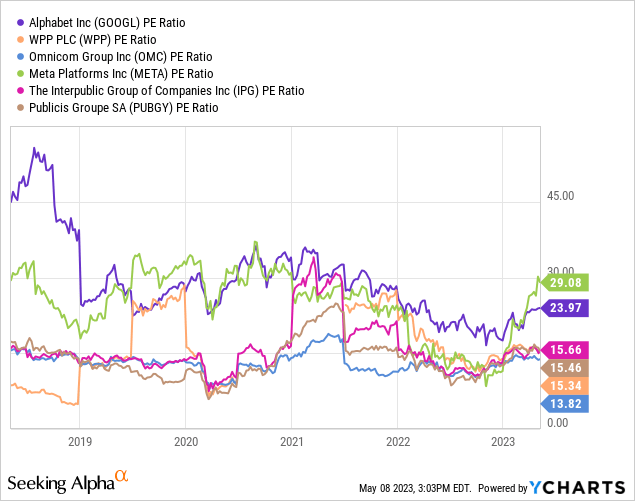

And, how about valuation?

I’m only looking at five years here instead of 10 years, due to some charting issues with YCharts. Don’t worry about it. Instead, you can easily get the gist here over this shorter timeframe.

In essence, these companies are rarely “dirt cheap” and both GOOGL and META are often trading at high multiples, due to growth. I’m 0% surprised to see WPP, OMC, IPG and PUBGY trading around 15 P/E’s. As Chuck says:

…the 15 P/E ratio is a rational and normal valuation level for most (but not all) publicly traded companies. Consequently, I believe that investors can utilize it as a cogent benchmark valuation measurement. In other words, when they see P/E ratios above 15, the investor should automatically recognize that most stocks are expensive at those levels. Conversely, when they see P/E ratios below 15 they could logically assume that attractive valuation is present.

GOOGL and META are exceptional companies deserving higher than normal valuations, in most environments. The rest of these companies are simply mediocre, with lower growth rates, and no real strong additional earnings firepower. Let’s get specific. Here are the operating earnings growth rates over a 10-year period:

- GOOGL = 17%

- META = 22%

- WPP = 1%

- OMC = 7%

- IPG = 11%

- PUBGY = 5%

Interestingly, these growth rates line up fairly well to the stock price changes I showed you above. Scroll up to compare. You’ll see GOOGL, META then IPG, for example, all outshining. Then, look at WPP, at the bottom of the pile. To me, it’s pretty clear, at least from a high level.

Wrap Up

You know, it’s kind of easy when you take a step back. GOOGL is an excellent company in a pretty good market. They are still highly focused on online digital advertising. It’s a growth market inside a steadily growing market. That’s a tailwind.

Next, stock prices over time make it obvious that growth rates matter. GOOGL is doing just fine, even in the face of various macro headwinds. Is it really different this time? For example, does A.I. really destroy GOOGL? I doubt it. It’s more likely they take a hit or two, then adapt. They are big but I think nimble enough. Said another way, GOOGL’s huge pile of cash plus the relentless cash flow will solve a lot of problems.

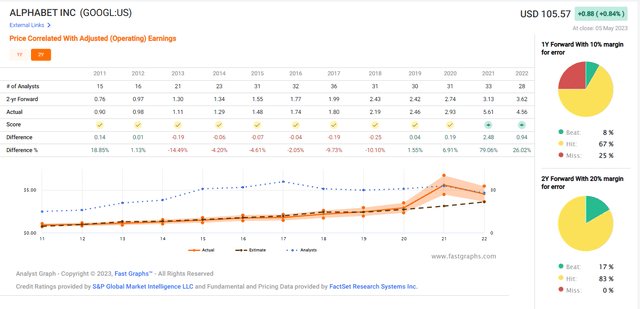

I need to also point out that the relatively accurate GOOGL analysts believe we’ll see these growth rates:

- 2023 = 17%

- 2024 = 19%

- 2025 = 17%

Take note, there are a whopping 50+ analysts tracking GOOGL. Over 2-year time periods, they have shown extraordinary success in their predictions:

GOOGL Earnings Estimates (FAST Graphs)

As my grandfather loved to say, put that in your pipe and smoke it. You might not like analysts, or you might think they are clowns, but they’ve been fairly accurate with their predictions. I find myself agreeing with them.

My long view is that GOOGL stock is at least a Hold. For a bit of fun, I will tell you that I am not buying hand over fist. However, GOOGL is a sleep well at night holding in my portfolio. I’ve added many, many times under $100 since September 2022. Now might be a time to nibble? Or, I think you could do just fine buying under $100, but that’ll depend on your goals and portfolio.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.