Summary:

- ADBE is looking for AI to help drive growth as it introduces generative AI models.

- Its deal for Figma could be a nice driver, but looks unlikely to gain approval.

- With a near monopoly on creative software, the stock looks attractively priced.

SeanShot

Trading at a valuation below its large software peers with a near monopoly on creative software, Adobe (NASDAQ:ADBE) looks attractive at current levels.

Company Profile

ADBE is a software firm whose products are aimed at creative professionals including photographers, graphic designers, video editors, marketers, content creators, and others. Its products are delivered through several different models, including software as service (SaaS), managed services, term subscriptions, and pay per use. The company has two product portfolios.

Its Digital Media offering are designed to help create, publish, and promote content. This includes products in its Adobe Creative Cloud, such as Photoshop, Lightroom, InDesign and Illustrator, among others. It also houses the Adobe Document Cloud, which includes offerings such as Acrobat, Acrobat Reader, Acrobat Scan, and Acrobat Sign, among others.

ADBE’s Digital Experience Offerings, meanwhile, are products designed to help manage the customer experience. It includes the Adobe Experience Platform; Data, Insights and Audiences; Content and Commerce; Customer Journeys; Marketing Workflow; and Digital Enrollment and Onboarding.

Opportunities and Risks

ADBE likes to tout much of its success over the past decade to its demand driven operating model (DDOM), in which any decision about the customer experience is made with informed insights and not guesswork. The company has really been focused the last few years on getting customer feedback to help them become successful, and having customers help grow the products and become part of the flywheel experience. Since ADBE went through its own digital transformation moving to a SaaS model from a perpetual software model, it believes it can help its customers through their own digital journeys.

Discussing its DDOM strategy at a Bernstein conference, Chief Product Officer Scott Belsky said:

“What’s interesting though about DDOM and Shantanu always loves to talk about what we call Adobe on Adobe, building Adobe on our own tools and building our own customer and when you are your own customer, you have the ultimate level of empathy and how to help customers get value out of your products and how to drive the road map going forward. And so DDOM really drove our transformation as a company over the last 10 years. And so as we’re thinking about other companies and other brands that are going under digital transformation of their own, one of the amazing thing to say, hey, we were customer zero. We learned and really built this for our own transformation. And we’re not selling something without empathy because we know exactly what it takes to implement this and to benefit from the DDOM model that is now sold through our products.”

Continual product innovation has been another driver of growth for ADBE. On the product innovation front, the company is really embracing AI and announced Firefly, a group of creative generative AI models, in March. The product will be part of a series of new Adobe Sensei generative AI services and be initially focused on the generation of images and text effects. Firefly will be directly integrated into its tools and services.

Discussing generative AI and Firefly at its Adobe Summit, President of Digital Media David Wadhwani said:

“So we think that generative AI is the foundation that is going to really inflect this business, not just what people can do with it. And as we look at the business, we look at it in terms of 3 ways we’ve always talked about. First is top of funnel, right? How are we — how do we bring more people into Adobe? Express has already started us down that road and is doing a great job. But when we start to be able to tell people come to adobe.com, Firefly and all you have to do is type in a prompt of what you want and you start that process. It increases creative confidence in those who don’t have it, and it brings people into the funnel. So top of funnel is massively benefited by, I think, what we can do with generative technology.

“The second thing is we’ve said we already have very good retention rates. But what’s the — what are the things that are going to drive that — those retention rates even higher? It’s the ability to be more productive in the product. So generative AI integrated into our creative flagship applications I think has the potential to drive more engagement than we already have, which is already high. And then the third piece is the ability to also offer new upgrade opportunities, upgrade SKUs to take people who are using our problem — sorry, our products and are able to sort of upgrade into more capabilities. So every step along the way, we have built Firefly in a way that’s embeddable with the community in mind, with usability and value in mind and with the business model in mind.”

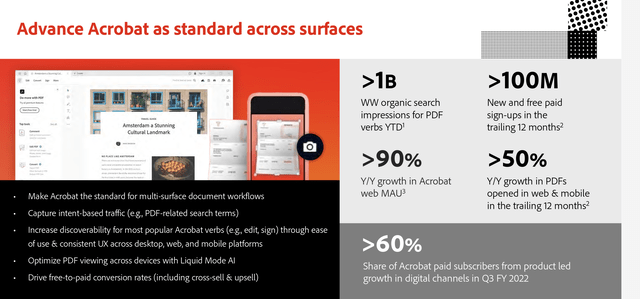

Driving its products to be multi-surface is another area of growth that ADBE is pushing. This includes getting Acrobat and PDFs to become the standard not just on computers, but also on derives like smartphones and tablets as well.

ADBE is also in the processing of buying Figma for $20 billion, which it thinks will be a big growth driver. Figma is a web-first collaborative design platform, which connects design teams with developers to help ensure a smooth handoff. Adobe has a somewhat similar product in XD, but it is generally behind Figma and has not capture much market share. ADBE believes there is a lot of low-hanging fruit synergies with the deal. It also notes that Figma has really just started to get into the enterprise space.

However, the deal is at risk of being rejected. The proposed acquisition is being heavily scrutinized by the DOJ as well as authorities in the UK and EU as well. The Figma acquisition would take out a potential upstart competitor in some areas, as well as help drive growth, so the deal getting blocked would be a clear negative.

When looking at other risks, the economy and layoffs are front and center. If companies pull back on their creative departments, it could certainly negatively impact ADBE. While ADBE’s products are often essential to creative workers, when companies and looking to cut costs and reduce workers, ADBE is not totally immune.

As with most tech companies, technological displacement is another risk. AI is the big buzz in tech currently, and while ADBE is adopting AI, there is a risk that it could replace some creative processes or that another company could better use AI and create a better product. Some of ADBE’s products aren’t the easiest to use for beginners, such as Photoshop, so there could be some room for disruption.

Valuation

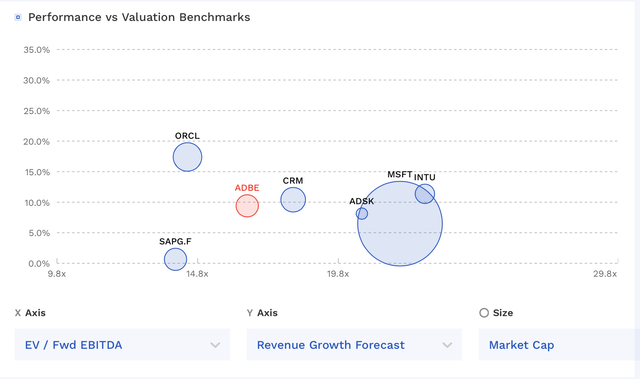

ADBE stock currently trades around 16.4x the FY2023 (ending November) consensus EBITDA of $9.5 billion and 14.7x the FY2024 consensus of $10.6 billion.

It trades at a forward PE of nearly 22x the FY23 consensus of $15.40, and 19.6x the FY24 consensus of $17.44.

Revenue growth is expected to be up over 9% this fiscal year and up nearly 12% fiscal year 2024.

The stock trades towards the lower end of where other large software firms trade.

ADBE Valuation Vs Peers (FinBox)

Conclusion

At present, ADBE is close to a monopoly in the creative software and document cloud spaces. Yes, there are competing products out there, but ADBE’s size and dominance make it very difficult for those products to be much more than niche products in many cases. For example, I’m big into photography and a lot of pro photographers prefer Capture One to Lightroom, but its share is still overall pretty small and the cost for an ADBE bundle is just much less expensive.

While there are some potential threats in terms of AI and technological displacement, I see the risk as minimal at current given how ingrained ADBE’s products are. Large software companies, including ADBE, have a history of adapting, and there is no reason to think that they won’t continue to do just that.

A this point I wouldn’t count on the Figma acquisition being completed, but would view it as a positive if it did occur. I think ADBE stock is a “Buy” with a $460 target, which is a 20x multiple on FY24 EBITDA.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.