Summary:

- How much an investor can expect from an investment here depends very much on the future P/E ratio of the share.

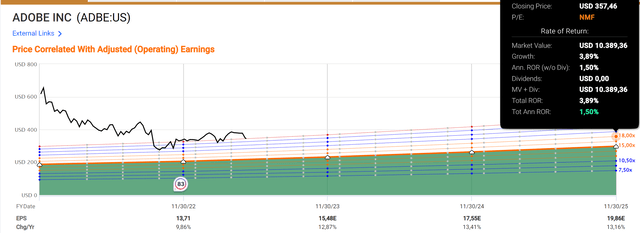

- According to Fastgraphs, if the P/E ratio were 18 in 2025, the expected return would be only 1.5%. If it were 23, about 13% annually could be expected.

- GAAP earnings are 30% lower than non-GAAP.

- SBCs are very high, and if they continue to rise relative to revenue, it would be a red flag for investors.

visualspace/E+ via Getty Images

Investment Thesis

Adobe (NASDAQ:ADBE) is dominant in the rapidly growing digital marketing software market. It offers a relatively safe and stable investment opportunity due to its monopoly-like position, global presence, and interconnected product ecosystem. However, investors should be cautious of potential technological disruption, competition from user-friendly alternatives, and the company’s high SBCs. Overall, positive returns are very likely for investors this decade but will depend heavily on whether the market will continue to grant the company a premium valuation. However, virtually all realistic scenarios indicate a positive return by 2025.

Market Outlook

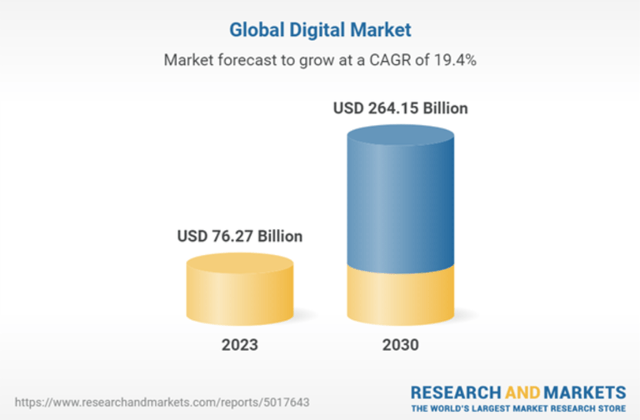

The global digital marketing software market has already experienced explosive growth, but the end seems far from being reached. Researchandmarkets.com predicts that the market will grow by 19.1% annually until 2030. Of course, digital marketing is a broad term and includes various software solutions. Adobe, however, is at the very beginning of this chain with its high-quality and complex programs. Adobe is used to create everything that reaches the end consumer via advertising, social media post, or PDF file.

One reason that growth can continue for a long time is the growing importance of developing countries in Latin America, Africa, and Asia.

Asia Pacific is anticipated to register the highest growth rate over the forecast period, owing to the increasing popularity of social media and the rising preference for e-commerce and m-commerce, particularly in emerging economies, such as India, Indonesia, and Thailand, among others.

About Adobe´s moat

Adobe has achieved a monopoly-like market position. Competing products can only replace many Adobe products with considerable effort, as it takes months to learn how to use them. Since the applications are aimed primarily at creative professionals and designers, they have virtually become a “must-have.” Jobs in this segment would be difficult to obtain without knowledge of Adobe products. And even when companies exchange data with each other, it is virtually expected that they use Photoshop.

Here are some statements Adobe makes about itself:

- Over 90% of the world’s creative professionals use Adobe Photoshop.

- More than 8 billion electronic and digital signature transactions were processed through Adobe Document Cloud in the past year. The majority of Fortune 100 companies rely on Adobe Sign for fast, secure e-signatures.

- Adobe Stock offers 320+ million assets, including including 195+ million photos, 98 million vectors and illustrations, 24 million videos, 70,000 music tracks, 5.1 million Premium assets, and 850,000+ free photos, vectors, videos, templates, illustrations, and 3D assets.

It isn’t easy to verify if these statements are precisely accurate. Some of my thoughts on the possibility that Adobe’s moat may even be in danger can be found below in the risks section.

Worldwide diversified

I like companies that are globally positioned. Local recessions and currency fluctuations are smoothed out in this way. In addition, the population in some regions of the world is stagnating while it continues to grow in others. So for a company like Adobe, which benefits from increasing Internet usage and digital advertising, it’s a great advantage when countries become more prosperous, i.e., the middle and upper classes grow. More startups will emerge, and in general, the budget for advertising is increasing.

Valuation

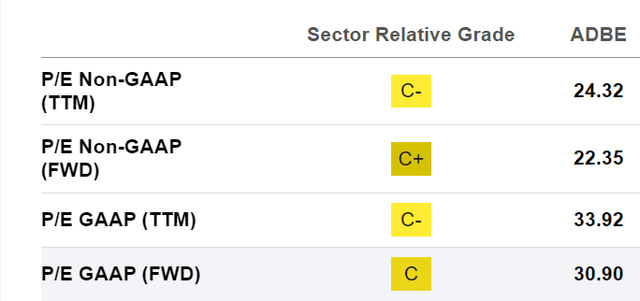

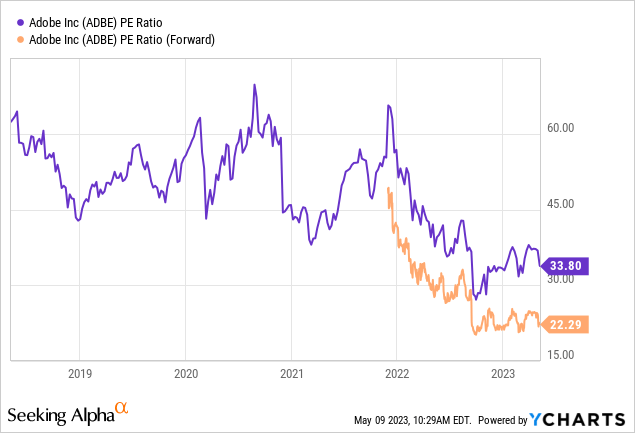

The company is currently valued at an enterprise value of $156B. The market cap is $157B, meaning there is more cash than debt. We will look at the company’s valuation from different angles. Let’s start with the most used non-GAAP P/E ratio.

Another way of looking at it is to take the PEG ratio = P/E / growth rate. According to Peter Lynch, a PEG ratio above 1.0 is considered overvalued, while a stock with a PEG of less than 1.0 is considered undervalued. So, for example, Adobe’s 5-year average revenue growth is 20%, but let’s calculate 20% less, so 16%, to exclude a Covid special effect. This would make the forward PEG ratio 22 / 16 = 1.375.

GAAP and non-GAAP

There are often significant differences between these two figures. And I want to remind you that the GAAP figures are required by law, and the non-GAAP figures are added by the companies. But there is more creative leeway here because, for example, stock-based compensations are excluded. GAAP metrics include the impact of SBC in the income statement.

So was for the full year 2022:

- Diluted earnings per share were $10.10 on a GAAP basis and $13.71 on a non-GAAP basis.

- GAAP net income $4.76 billion and non-GAAP net income $6.46 billion

For Q1 2023

- Diluted earnings per share were $2.71 on a GAAP basis and $3.80 on a non-GAAP basis.

- GAAP net income was $1.25 billion and non-GAAP net income was $1.75 billion.

These considerable differences of around 30% cannot be attributed to non-recurring effects. Incidentally, I am also bothered by these one-time effects because there are new so-called non-recurring effects every year. So I think investors should always look at the GAAP numbers as well. There is more on the amount of SBCs further down in the article. At Seeking Alpha, under Valuation, both figures are well laid out. If we look at GAAP numbers, the future P/E would be 31, which sounds much more expensive than 22.

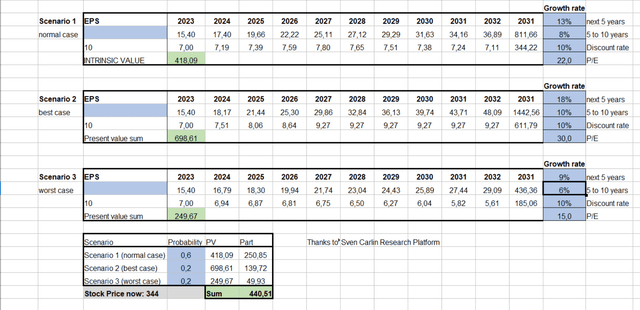

I have created a detailed analysis with three different scenarios to determine the current fair value with a DCF analysis. Each of the three cases have specific growth figures for the next five years and other growth figures for the 5 to 10 years period, and a given P/E ratio that is realized then. The normal scenario is indicated as the most probable variant and has 60% weight in the calculation; the best and worst cases have 20% each.

Of course, one has to estimate the growth figures roughly; the calculation is not exact. Nevertheless, I find this approach useful, as it allows us to at least approximate a fair value. In other words, this could be seen here if a share was strongly overvalued or undervalued.

According to this calculation, the current fair value would be $440.However, if you use the GAAP numbers, which are about 30% lower, the fair value would be around $300.

Risks

Many of the risks that other companies face does not exist here. The company has no debt, hardly any currency risk because it operates globally, and has no political risks. The most significant risk by far is technological disruption and catching up competition. In recent months, generative AI has made a lot of headlines. As a result, Adobe has also launched an AI image generation called Firefly.

But by disruption, I mean something else; take video editing, for example. I believe that we are only a few years away from being able to tell a virtual assistant to “take these raw files and cut them so that the main message is summarized and underlay the whole video with appropriate subtitles and B-roll.” Like this, video editing is done virtually by itself, and users control the whole thing simply by their voice commands. The same will work for image editing too, but here even sooner. For Adobe, this is an opportunity and a risk simultaneously because Adobe is in an advantageous position and has enough experience to take over the market leadership in all emerging technologies. For the existing top dog, however, it is always a risk when new technologies emerge.

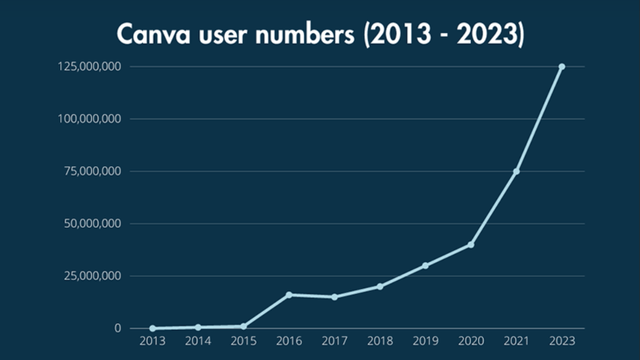

Another risk is that Adobe’s products will be replaced by better or more user-friendly products from the competition. For example, many home users now prefer Canva as a faster and easier alternative for creating social media posts.

I also have experience in video editing and started with Premiere Pro. But after some time and internet research, I switched to DaVinci Resolve. And on this topic, there are many YouTube videos where even famous YouTubers explain why they switch (mainly complaining about crashes and bugs). And from my research, I can say there are also many testimonials in the comments, and most people say that DaVinci Resolve is better and even free for home users. People like Peter McKinnon, with 6 million subscribers, should not be underestimated. They are real influencers for the next generation of editors.

Adobe’s biggest advantage is that they have programs for all sorts of areas and interact very well with each other in their ecosystem. From my point of view, this is their moat, but the individual products have numerous and strong competition.

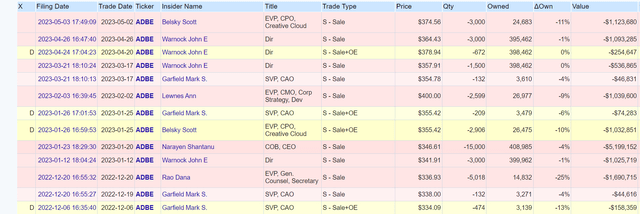

Share dilution and insider selling

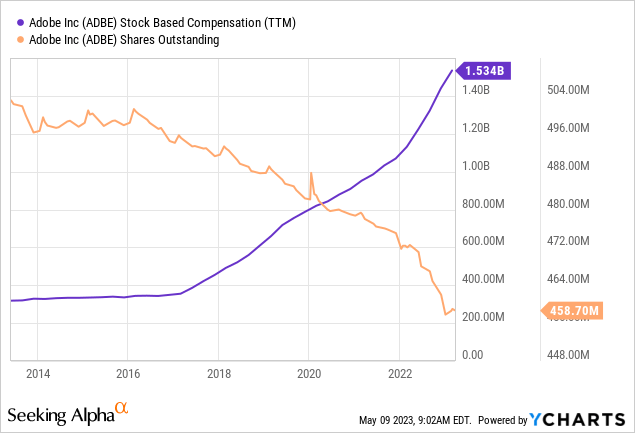

I always pay attention to share dilution and whether there is insider selling. In addition, it’s important to look at stock-based compensations. These are the insider trades since the beginning of December 2022.

The 10-year chart shows how the number of outstanding shares is decreasing but relatively slowly: they have repurchased about 9% of the shares in the last ten years. SBCs, on the other hand, continue to rise, adding up to $1.53B for the previous 12 months. To put that figure in perspective, that’s almost 10% of revenue, and with 29,000 employees, it’s about $52,700 per person per year. Since I look at the SBCs in each of my analyses, I can say that this number is relatively high.

Expected return

How much an investor can expect from an investment here depends very much on the future P/E ratio of the share. The market has attributed the company a high P/E ratio for years. If this remains as high as today, the investor can expect approximately the annual EPS growth figures as a return. According to Fastgraphs:

- if the P/E ratio were 18 in 2025, the expected return would be 1.5%.

- if the P/E ratio were 21 in 2025, the expected return would be 8%.

- if the P/E ratio were 23 in 2025, the expected return would be 13%.

Conclusion

I think Adobe stock is a safe and stable investment that should work well through all market phases. The worst case I have pointed out is a stagnant return for a few years, but there is hardly a scenario where you lose much money as an investor. Or in other words, in almost every scenario, you will continue to make money with this stock because a future P/E ratio of less than 15 is quite unlikely. As long as the company’s subscription numbers continue to grow, there is little cause for concern.

The shareholder gets a bit back via buybacks; we will see if the company pays dividends at some point. SBCs are very high, and if they continue to rise relative to revenue, it would be a red flag for investors. However, the management has been convincing for years, and there is not enough evidence that the business models will be disrupted soon.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.