Summary:

- PayPal Holdings, Inc. beat Q1 2023 expectations easily yesterday.

- The payments company saw solid top line growth, but net new active account growth kept slowing.

- With $1B in Q1’23 free cash flow and a low 12X P/E ratio, I believe the risk profile for PayPal Holdings, Inc. is very attractive.

chameleonseye

The PayPal Holdings, Inc. (NASDAQ:PYPL) share price plunged 13% after the payments company submitted its earnings score card for the first-quarter yesterday. PayPal, which I last wrote about here, did beat earnings and top line estimates for Q1 ’23 and raised its EPS guidance for FY 2023, but investors are still worried about slowing net new active account growth and potential headwinds to the economy. I believe that the 13% drop in pricing is not justified. Considering that PayPal stock is now trading at a 12X P/E ratio, PayPal remains an attractive investment in the FinTech space!

PayPal didn’t deserve yesterday’s 13% price drop

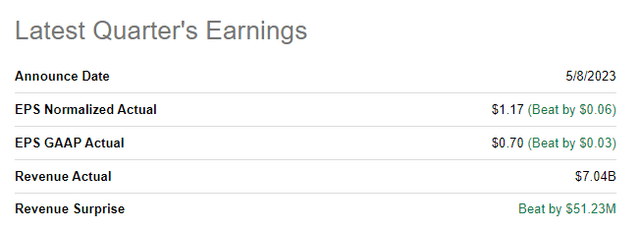

PayPal’s results for the first-quarter beat expectations on both the bottom and the top line: the payments company reported $1.17 per-share in adjusted EPS, beating the consensus estimate by $0.06 per-share. Revenues came in at $7.04B, showing 9% year-over-year growth, and beat the estimate by $51M.

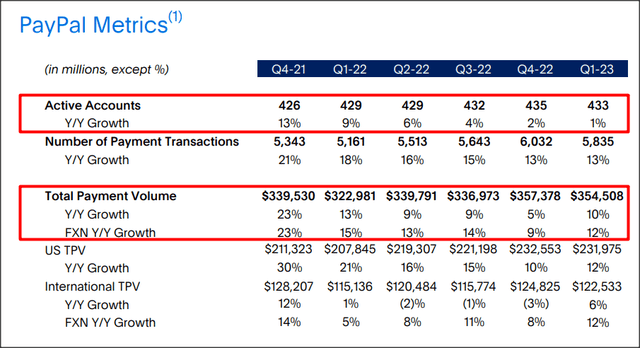

One metric I always look at is PayPal’s total payment volume… which increased 10% year-over-year to $354.5B as customers continue to use PayPal to purchase goods and services online. The firm’s total payment volume is a key indicator of PayPal’s platform strength as it indicates the amount of dollars that gets processed through the firm’s payments ecosystem. PayPal’s total payment volume growth also accelerated in the first-quarter and grew twice as fast as in the fourth-quarter, 10% vs. 5%, which is an encouraging sign that PayPal remains highly relevant for customers and merchants alike.

PayPal, however, did see a continual slowdown in net new active accounts. PayPal’s net new active account growth slowed to just 1% in Q1’23, which added to concerns that PayPal is having a harder time signing on new customers. PayPal’s account growth rates steadily declined in FY 2022 and now in Q1’23 as well. This is a major negative for PayPal’s stock, and I believe that unless the payments company turns this trajectory around, the firm may actually see a dip into negative territory here.

Free cash flow strength fundamentally supports an investment in PayPal

One of the key strengths of PayPal’s payments network is that it generates a considerable amount of free cash flow (“FCF”) each quarter. PayPal generated $1.0B in free cash flow in the first-quarter on revenues of $7.04B which calculates to a free cash flow margin of 14%. Although PayPal’s net new active account growth is slowing, PayPal has been able to maintain strong FCF margins consistently in the last year. The company also continued to guide for $5B in free cash flow in FY 2023, which implies that PayPal is set to see an average FCF of about $1.33B in the next three quarters.

|

PayPal |

Q1’22 |

Q2’22 |

Q3’22 |

Q4’22 |

Q1’23 |

Growth Y/Y |

|

Revenues ($M) |

$6,483 |

$6,806 |

$6,846 |

$7,383 |

$7,040 |

9% |

|

Free Cash Flow ($M) |

$1,051 |

$1,291 |

$1,766 |

$1,433 |

$1,000 |

-5% |

|

FCF Margin |

16% |

19% |

26% |

19% |

14% |

-2 PP |

(Source: PayPal.)

PayPal raises guidance for FY 2023

PayPal raised its non-GAAP EPS guidance for FY 2023 from $4.87 to $4.95 per-share, implying a 20% year over year growth rate. PayPal did not change its free cash flow guidance and continues to expect around $5B in free cash flow, 80% of which ($4B) is expected to be used for stock buybacks. Since shares of PayPal are cheap based off of earnings, I believe aggressive buybacks are the way to go here for management.

PayPal now has an even more attractive valuation, market likely overreacts

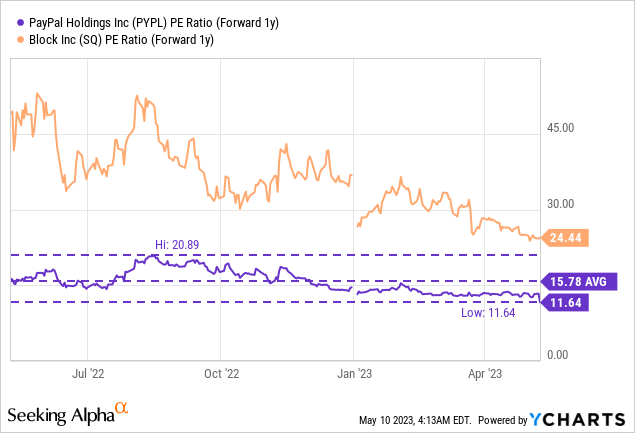

PayPal is very attractively valued based on forward earnings as the digital payments company currently has a P/E ratio of only 11.6X. Shares of PayPal are also cheap relative to rival payments company Block, Inc. (SQ) which has come under pressure lately from short seller Hindenburg Research. Block has a P/E ratio twice as high as PayPal’s, and PayPal is now trading 26% below its 1-year average P/E ratio.

Risks with PayPal

There are two big risks that I see for PayPal: (1) a continual slowdown in top line growth due to headwinds in the economy and cutbacks in consumer spending; and (2) a slowdown in net new active account growth which may actually result in negative growth in the short-term. Additionally, weaker total payment volume growth could hint at declining free cash flow strength for PayPal.

Final thoughts

Sometimes the market is hard to understand, and the 13% price drop yesterday seems not only exaggerated, but totally undeserved. PayPal Holdings, Inc. beat earnings and revenue expectations, total payment volume grew at double digits, the firm posted $1.0B in quarterly free cash flow, and it raised its EPS guidance for FY 2023. I believe PayPal submitted a solid earnings card although slowing account growth remains a challenge for the payments company in the short term. Considering the low valuation with a P/E ratio of 11.6X, I believe the PayPal Holdings, Inc. risk profile remains highly favorable for long term investors and the drop yesterday should be seen as a buying opportunity!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.