Summary:

- Apple has heaped significant pressure on the leading Android smartphone vendors and chipset makers. It’s taking them on with relative success in their dominant markets.

- Apple’s ability to chart new growth vectors in under-represented markets/product categories is highly formidable. Apple bears could have underestimated its prowess.

- We believe our sell thesis on AAPL has been dismantled, with dip buyers in January 2023 proving their point as AAPL outperformed the market.

- With AAPL’s momentum likely topping out, investors shouldn’t rush into the momentum surge and wait patiently for a pullback into more attractive zones.

Wachiwit

Apple Inc. (NASDAQ:AAPL) bulls continue to defy gravity, driving AAPL toward the highest levels since it topped out in August 2022. AAPL has also outperformed the S&P 500 (SPX) (SPY) and the Nasdaq (NDX) (QQQ) since its January 2023 lows as investors look past its H1FY2023 struggles.

Apple bulls contend that the iPhone maker has outperformed its leading Android peers. Qualcomm’s (QCOM) guidance in its recent quarter was highly disappointing, coming well below the previous Wall Street estimates.

As such, while the premier Android chipset maker continued to suffer from downstream inventory digestion and macroeconomic headwinds, the impact on Apple has been much less significant.

Accordingly, Qualcomm guided for revenue of $8.5B at the midpoint for the quarter ending June 2023, down more than 22% YoY. It’s also down more than 8% QoQ, suggesting Qualcomm’s recovery has been pushed further out.

Apple’s guidance for the quarter ending June 2023 indicates why the Cupertino company could continue outperforming its leading Android peers. Accordingly, Apple expects “year-over-year revenue performance to be similar to the March quarter.”

Apple reported a 2.5% revenue decline in FQ2’23. Hence, the expected fall in revenue is much less than what Qualcomm promulgated. Wall Street analysts have raised the bar, as they penciled in a YoY revenue decline of 0.9%, expecting CEO Tim Cook and his team to outperform their guidance.

We believe market operators who had expected Apple to perform relatively against its peers likely bought the dips in early January. That has proved to be an astute move, as AAPL has outperformed the market since then, heaping more pressure on its Android peers.

Apple’s gains in emerging markets were impressive, “driven by increasing market shares of iPhones in emerging markets such as India, Indonesia, and Turkey.”

We believe DIGITIMES correctly pointed out that Apple’s ability to gain share against the Android players could be detrimental. The Android peers could find it difficult to “regain market share from Apple,” as Apple’s share remains under-represented in these regions.

For instance, StatCounter estimates that iOS has a global mobile OS market share of about 30.4%, below Android’s 68.8%. However, iOS only has a 4.2% market share in India, compared to Android’s 95% share.

Management also highlighted at its earnings call that Apple’s momentum and growth opportunities in emerging markets have gained through “adding switchers and increasing the installed base,” bolstered by “the low market share in those areas.”

As such, we reassessed our thesis on Apple and believe that we have underestimated the prowess of Cook & his team’s ability to take on the Android players in their dominant markets.

Apple sees significant opportunities in the emerging market, leveraging its growth momentum in refurbished phones to further grow its installed base for monetization. Therefore, Apple’s ability to gain share cannot be underestimated unless the leading Android players engage in detrimental price competition to try and persuade their users to stay with them.

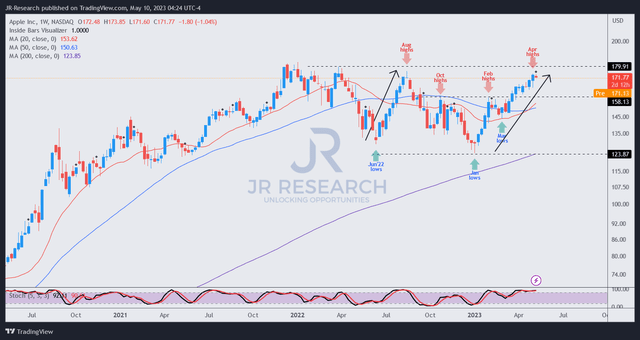

AAPL price chart (weekly) (TradingView)

With that in mind, we think we have gotten our sell calls on AAPL wrong. AAPL dip buyers who defended its January lows were spot on, expecting Apple to gain more ground through its remarkable ecosystem.

Apple has proved to be a highly formidable competitor in markets/product categories that it has chosen to enter, with emerging markets in the cross-hair for the next leg of growth for Apple products.

Bolstered by a significant network effect of more than 2B active installed devices, Apple’s competitive moat will likely widen as it garners more share from Android competitors.

However, we also assessed that AAPL had risen too quickly through its outperformance, with its price action similar to the one that led to its August top.

As such, investors looking to add more shares should remain patient, anticipating the next steep pullback, and join the dip buyers instead of chasing momentum.

Rating: Hold (Revised from Sell).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!