Summary:

- Unity spins a tightly woven narrative of its plans to reach $1 billion of EBITDA in 2024.

- Unity is the master of EBE, Earnings Before Everything.

- In my opinion, Unity’s stock is expensive for what it offers.

Marko Geber

Investment Thesis

Unity Software (NYSE:U) saw its stock jump premarket by more than 10%. But as I analyze these results, I struggle to see much to get excited about.

The only consideration I could possibly consider is the fact that as we headed into this earnings report, the stock is down more than 80% from its highs. Aside from that, there’s really very little to get bullish about.

Unity has in the past made the assertion that it would be reporting non-GAAP operating profits breakeven in 2023. How much progress has Unity made on this front? Admittedly some progress, as Unity upwards revised its EBITDA line from $230 to $300 million, to $250 to $300 million, and once again reaffirmed that it will reach $1 billion of EBITDA in 2024.

However, I’m not enticed. And here’s why.

Why Unity Software? Why Now?

Unity is a real-time 3D platform used by creators to develop interactive experiences.

Unity’s platform holds many different assets. After several years as a serial acquirer, it’s difficult to get a clear understanding of how the individual business units are performing.

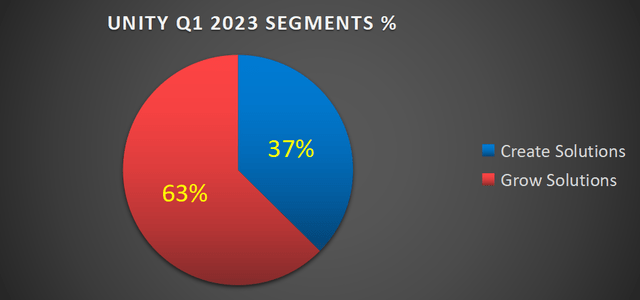

What we can see, though, is that Unity’s Grow Solution business unit makes up the bulk of its revenues. And we also know that Grow, which provides the tools to monetize creators’ content was down 9% y/y on an organic basis.

Meanwhile, its Create Solution, which provides tools and features to enable developers to design applications, was up 14% y/y.

Also, as one would by now expect given the tone of this earnings season, Unity jumps on the AI bandwagon as it mentions its AI capability 18 times in its shareholder letter, starting in the first paragraph, front and center, plus countless mentions to it throughout the earnings call too.

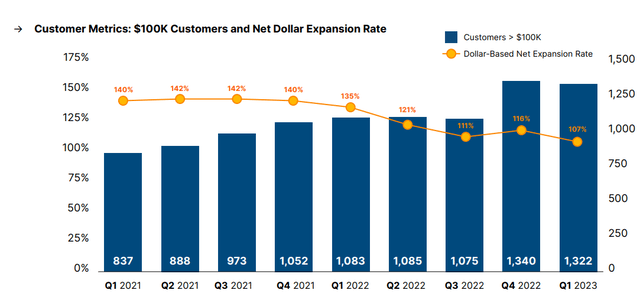

However, putting aside management’s excitement over AI, it appears that Unity’s dollar-based net expansion rate hit the lowest point in 9 quarters.

Revenue Growth Rates Are Going to Fizzle Out in 2024

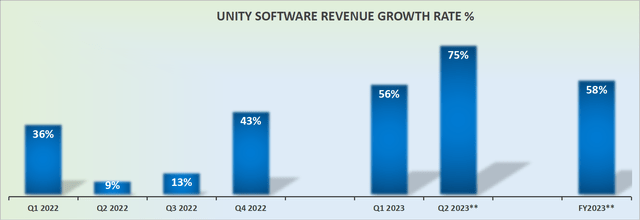

For now, investors are jumping for joy as Unity not only beat revenue consensus but also raised its full-year outlook. After being off to a strong start in 2023, combined with the stock trading at slightly over $30 compared with more than $150 per share several quarters ago, there’s broad contentment.

That being said, on a pro-forma basis, Unity is guiding for about 10% growth rates. Even if the ultimate figure in 2023 ends up at close to 12% CAGR, this is far from the secular hyper-growth business that we were all once led to believe.

Capital Allocation Priority?

Unity finished 2021 with 282 million shares outstanding. This figure then jumped to 474 million in Q4 2022 on the back of the ironSource acquisition.

Now, looking ahead to Q4 2023, 490 million shares outstanding are expected.

Put another way, since 2021, Unity’s total number of shares outstanding is up 74% y/y.

Furthermore, keep in mind that Unity also holds approximately $2.7 billion of convertibles, compared with about $1.6 billion of cash and equivalents.

Meaning that despite management having a share repurchase program in place, I don’t believe there’s any scope to slow down the growth in shares outstanding.

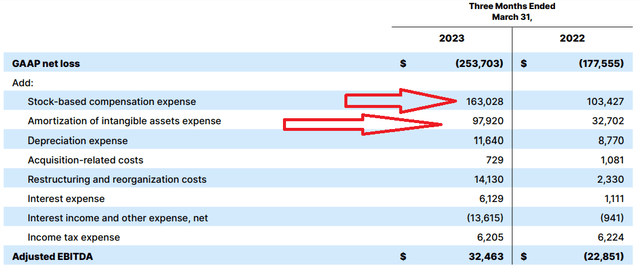

Warren Buffett used Berkshire Hathaway’s (BRK.A) (BRK.B) annual meeting this past week to teach investors a new investing term, EBE, Earnings Before Everything.

As Warren notes, depreciation and amortization are terrible add-backs to profitability. These are costs that go out the door first, only to deliver value to shareholders over time, with substantial assumptions being necessary as to the ultimate value to be delivered.

Then on top of that, SBC continues to rapidly climb y/y. Now, when Unity notes that in 2024 it’s likely to deliver $1 billion of EBITDA, I question what’s the ultimate value of that EBITDA?

And then, to further compound matters, can Unity truly go from about $300 million of expected EBITDA in 2023 to $1 billion of EBITDA next year? Can Unity seriously triple its EBITDA line in 12 months?

The Bottom Line

I struggle to find enough reasons to be bullish on Unity. I recognize that Unity’s management puts out such a compelling tale on the future prospects of the gaming industry and AI possibilities, but I believe that investors will in time see right through that.

I continue to believe, perhaps out of step with the investment community, that clean free cash flow is the lifeblood of a business. As an investor, I want to see the free cash flow per share increasing. But that’s not what I believe investors will find in the coming year from Unity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.