Summary:

- The Walt Disney Company missed earnings estimates slightly.

- The company generates attractive business growth, but profits are declining, which is far from great.

- The Walt Disney Company’s valuation has come down a lot but is not especially low.

Wirestock

Article Thesis

The Walt Disney Company (NYSE:DIS) reported its most recent quarterly results on Wednesday. The company missed profit estimates and showed a Disney+ subscription decline, which isn’t good news. While the valuation has come down a lot over the last two years, shares aren’t looking overly attractive as profitability remains an issue.

What Happened?

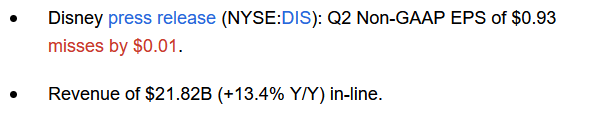

The Walt Disney Company’s earnings results for its fiscal second quarter were released on Wednesday afternoon, following the market’s closing. The headline numbers can be seen here:

Seeking Alpha

Disney generated revenues of close to $22 billion, which was in line with expectations. Relative to the previous year’s quarter, revenues were up by a sizeable 13%, which was largely the result of an easy comparison and a compelling 17% sales increase in the parks, experiences, and products unit – the waning of the pandemic naturally was a major tailwind for the parks business.

However, when it comes to profits, Disney’s results were far from strong, as the company missed the earnings per share forecast – in the past, Disney had been beating profit estimates relatively regularly. The market didn’t like the subscription number decline and the profit miss, sending Disney’s shares lower following the release of Disney’s results.

Disney’s Profitability Issues

The Walt Disney Company is a diversified entity that is active across many different industries. It owns traditional TV assets, is active in the streaming industry, operates theme parks and cruise ships, and has a widely-known and well-liked cinema business where it owns hit franchises such as Star Wars and the Marvel Universe.

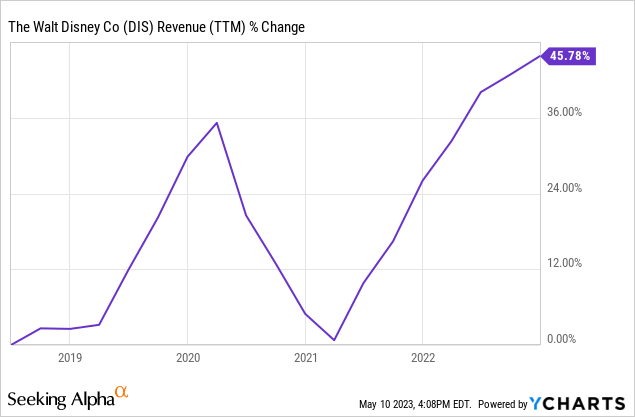

While business growth has been uneven across Disney’s different business units, sales growth has not been a problem for the company. The following chart shows Disney’s revenue performance over the last five years:

Revenue jumped by almost 50% in that time frame, which pencils out to an annual revenue growth rate of around 8%. For a large and established company like Disney, that’s a strong result. There were some ups and downs in this data, which can largely be attributed to the impact of the pandemic, which hurt businesses such as Disney’s theme parks, while M&A had a positive impact on Disney’s revenue growth.

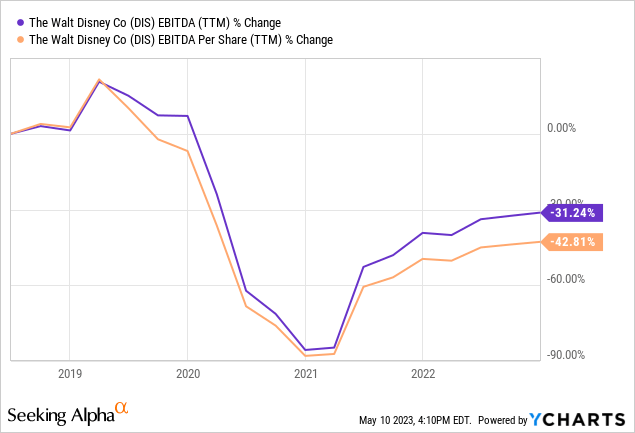

When it comes to profitability, however, things look a lot less rosy, as we can see in the following chart:

Disney’s EBITDA dropped by around one-third over the last five years, while an increase in Disney’s share count made its EBITDA per share drop by an even wider 43%. Since profits and cash flows (on a per-share basis) ultimately drive the value of a company’s shares, Disney has not been generating shareholder value very efficiently over the last couple of years. That also is underlined by the fact that the company’s dividend has been cut over that time frame, while its share price is flat over the last five years.

Revenues are growing nicely, while Disney’s profit performance is weak, which can be explained by significant margin compression over the last couple of years. This is, at least partially, explained by the company’s investments in its streaming business. Whether one creates content for 10 million users or 100 million users, the expenses are largely the same – when a streaming service has not hit sufficient scale yet, it is thus bound to be unprofitable. That was relatively clear from the start when Disney decided to enter the streaming industry. Nevertheless, the profit performance is weaker than what some investors had been hoping for, which explains why Disney’s share price has dropped so much from the highs that were hit in early 2021 when Disney was trading at around $200 per share on the back of a lot of streaming enthusiasm. Sentiment on other streaming companies has soured as well, as Netflix, Inc. (NFLX), for example, currently trades at less than half its all-time high. Two years ago, investors were enamored by “business growth,” but since then, they realized that profit growth – or lack thereof – should not be neglected.

Disney’s segment operating profit came in at $3.3 billion for the quarter, which was down 11% year over year – while the parks business was ramping up again, and while revenues were growing nicely, Disney saw its profits decline. Operating leverage isn’t working in Disney’s favor, which obviously is negative for investors.

There were some items impacting Disney’s profits that aren’t really telling when it comes to the profits that can be expected in the long run, such as one-time charges. Excluding those, Disney’s earnings per share were significantly higher than the reported EPS result of $0.69, and yet, adjusted earnings per share were down compared to the previous year’s quarter. The profitability issues can be attributed to Disney’s media & entertainment business, where operating income was almost cut in half. In contrast, Disney’s parks business saw its profits rise by more than 20% – in the current environment, it’s a profit driver for Disney, but not large enough to offset the headwinds in the media and entertainment franchise.

This is not a new trend, as the same held true during the previous quarter, Disney’s Q1, as well – parks profits were up, but the media and entertainment business generated lower profits.

Looking at the underlying business growth in the media and entertainment unit, we see that Disney’s streaming subscriptions have fallen during the second quarter – which had also been the case in the first quarter. Of course, for a presumed growth business that is not profitable and that needs growth to eventually become profitable, that’s pretty bad. The macro-environment likely plays a role, as consumers are cutting back on discretionary spending due to persistent inflation that hurts their spending power and due to uncertainties about a potential recession. Getting rid of non-needed subscription services can make sense in these uncertain times.

When the macro-environment improves, it’s very much possible that Disney’s subscriber count starts to climb again, while this might also be the case when/if Disney is able to create more content that attracts new subscribers – at least over the last two quarters, that seemingly wasn’t the case, otherwise subscriber numbers would have gone up instead of down. The good news, here, is that Disney was at least able to increase the revenue contribution on a per-subscriber basis, as Disney+ monthly revenue per subscriber rose from a measly $5.95 to a little more than $7.

Disney is making moves in order to improve the profitability of the streaming business – Chief Financial Officer, Christine McCarthy stated the following during the earnings call: “Going forward we intend to produce lower volumes of content in alignment with our strategic shift.” While this should improve Disney’s cost profile, all else equal, it remains to be seen how lower content volumes will impact Disney’s subscriber count – it is possible that some subscribers bail. Hopefully, Disney has thought this through, and as long as they cut volumes of shows that aren’t overly important to subscribers while keeping the more attractive ones, such as the Mandalorian series, the move might not impact subscription numbers – but there is the possibility that it does, which introduces additional uncertainties for the highly important but struggling business unit. I believe that this doesn’t increase the attractiveness of Disney as an investment.

Today, Disney’s enterprise value is $240 billion, which is around 20x Disney’s trailing EBITDA, and around 15x Disney’s forward EBITDA. However, estimates might be reduced over the coming weeks, as Disney missed profit estimates for the quarter. Taking the estimate for the current fiscal year at face value, Disney does neither look especially expensive, nor especially cheap. Netflix trades at a higher EBITDA multiple of around 20, while Fox Corporation (FOX) and Warner Bros. Discovery (WBD) trade at substantially lower EBITDA multiples in the single-digit range.

While The Walt Disney Company undoubtedly was too expensive at the peak of the streaming euphoria, it is way more reasonably valued right now – but not overly attractive. At least for now, the business continues to have profitability issues, despite solid business growth, while shareholder returns are weak at the same time. Since The Walt Disney Company is neither overly expensive nor a bargain, I’d call it a hold right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!