Microsoft: Azure Cloud Poised To Surpass AWS

Summary:

- Microsoft beat both its revenue and earnings growth estimates as of Q3 FY23.

- Its “Azure and other cloud services” revenue grew at a rapid 27% YoY growth rate, which was faster than AWS at 16%.

- Microsoft has a strong chance of surpassing AWS as the market leader in the cloud and Microsoft is poised to become the largest company on the planet (by market capitalization).

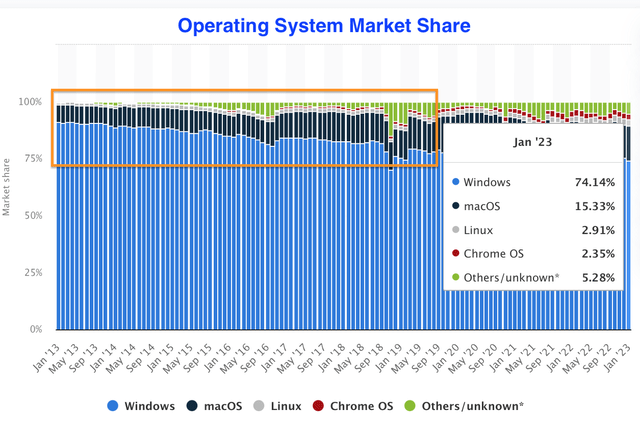

- Over 90% of the Fortune 500 have installed Windows 11 or are trialing the software and Microsoft still has ~74% market share in the OS industry.

- Microsoft has integrated AI with a multitude of its apps with 36,000 organizations already using AI in its Power Platform.

Jean-Luc Ichard

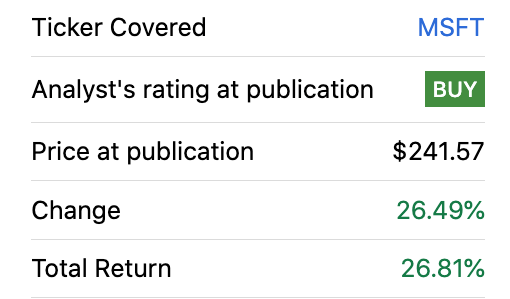

Microsoft (NASDAQ:MSFT) is a company that I believe could become the largest company in the world (by market capitalization) within the next few years, given my “best case” scenario outlined in my valuation model. The company has a staggering number of dominant businesses and tailwinds including its Windows OS (~74% market share) and Microsoft Azure, which I believe has a good chance of surpassing AWS due to its faster growth rate and AI focus (50% owner of Open AI). In addition, Microsoft owns the world’s most popular professional network LinkedIn, which reported record engagement and a staggering 930 million members in the recent quarter. In Q3,FY23, the company beat for both its top and bottom line estimates and has continued to integrate AI into many of its products exceptionally well. I called the bottom of Microsoft’s stock price in early 2023 and it has since increased by over 26%, due to the aforementioned tailwinds and excitement around AI. In this post I’m going to break down its Q3,FY23 report, and cloud segment, before revealing my valuation model and forecasts for the stock, let’s dive in.

Microsoft (Q1 FY23)

Solid But Cyclical Financials

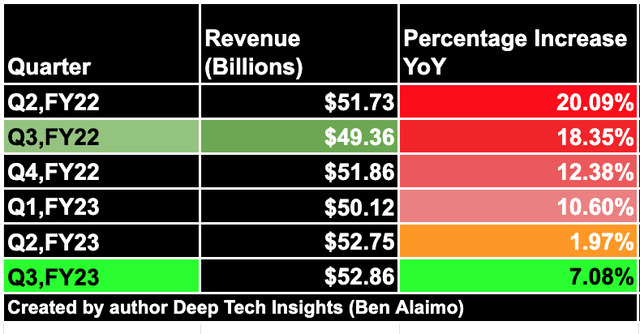

Microsoft reported solid financial results for the third quarter of the fiscal year 2023. Its revenue was $52.86 billion, which beat analyst forecasts by $1.83 billion and rose by 7.08% year over year or 10% on a constant currency basis. The standard growth rate has slowed down substantially from 20.09% YoY reported in Q2,FY22. However, I have created a color-coded table below which shows the slowing growth trend looks to have troughed in Q2,FY23 at 1.97% YoY. Therefore this quarter it has started to turn around, which could be a sign of a new growth trend.

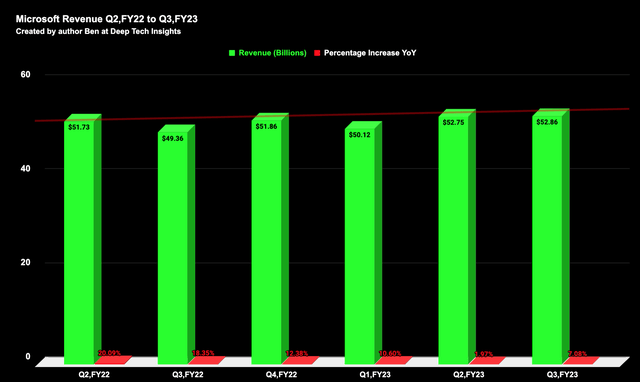

The same trend can be seen on the chart I have created below, the red trendline indicates a slight uptrend which is a positive. The company also reported solid profitability with $22.4 billion in operating income up 9.76% year over year. This was despite a 7% increase in operating expenses to $14.4 billion, and thus indicates strong operating leverage.

MS Cloud will Surpass AWS

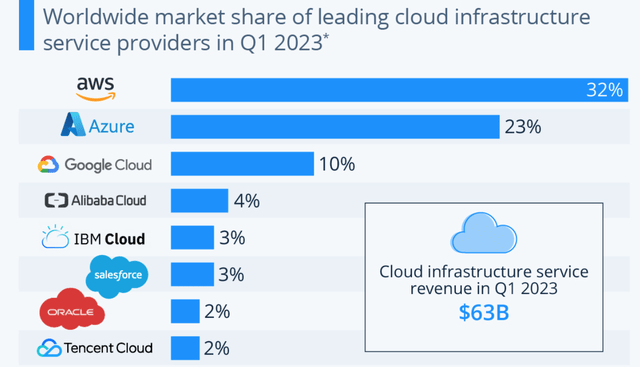

Microsoft’s Intelligent Cloud segment has been the main growth driver with a staggering 17% revenue growth reported or 21% on a constant currency basis. In order to work out market share, I will use two methods. In the first method, I will use data from Statista which indicates MS Azure has a 23% market share of the cloud market, just behind AWS which has a 32% market share. These two giants are rapidly owning the market as Google Cloud captures just 10% market share.

Cloud market share Q1,23 (Statista)

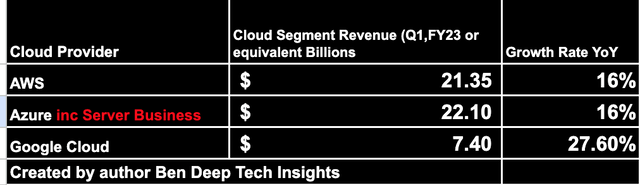

I also prefer to go direct to the source in order to track the true health of the cloud business relative to competitors. Unfortunately, Microsoft doesn’t break out its “Intelligent Cloud” segment into pure Azure revenue on a dollar basis. Instead, the company provides data on its Azure segment including the legacy server business. In this case, Microsoft’s “Intelligent Cloud” looks to be actually slightly larger than AWS, although this is not a direct comparison due to the aforementioned reasons. At a high level, both businesses look to be growing at a similar 16% growth rate. However, when after delving deeper I did discover Microsoft reports its “Cloud” growth rate (but not raw revenue figure) which was up a rapid 22% for Q3, FY23. While its “Azure and Other cloud services” revenue grew at an even faster 27% clip YoY. Therefore, Microsoft’s cloud business is growing at a much faster rate than Amazon’s and I therefore predict the business to surpass or at least match AWS within the next few years assuming the current trends sustain. The growth in the artificial intelligence [AI] industry could also help to accelerate Microsoft’s cloud growth, after its $10 billion investment into Open AI (ChatGPT and GPT-4). ChatGPT has become the fastest-growing application of all time and I believe its “share of mind” with the average person could help to accelerate Microsoft’s position, even with the enterprise, as ultimately decisions are made by people in a buying committee. Microsoft reported over 2,500 customers for its Azure OpenAI Service up 10x compared to the prior quarter.

The observant among you will say but isn’t Google Cloud growing at a faster 27.6% growth rate? Yes, this is correct, but given the starting figure is much smaller for Google, it is not a true comparison to compare the growth rate. Whereas between AWS and Microsoft the figures are much closer and thus a pure growth rate comparison works well.

Another positive for Microsoft is its cloud development environment is often judged to be more user-friendly than AWS. I was recently hiring two software engineers for a project at my digital consultancy, and both had similar opinions regarding usability. Of course, this is just a couple of data points but I did find similar opinions online, which suggests AWS is known for “lots of documentation”. In addition, many developers are already familiar with Microsoft products such as Windows, Active Directory, SQL servers etc. Microsoft Azure also looks to be more friendly from a hybrid cloud standpoint, according to sources. Microsoft also owns GitHub the popular developer code repository and community, which the company acquired in 2018 for $7.5 billion. A staggering 76% of Fortune 500 companies use GitHub and Microsoft has enhanced this with its “Copilot” AI developer tool which is used by 10,000 organizations to improve developer productivity.

According to a survey by Google, the majority (83%) of “digital natives” list hybrid cloud support as a key consideration when choosing a cloud provider. This trend is especially true in the financial services industry and the company reported Rabobank and ING Bank as customers for its Azure Arc, which enables Azure to be on-premises or in a multi-cloud environment. Microsoft’s Azure Arc has over 15,000 customers and increased by a rapid 150% year over year. Azure also has built up a reputation as the go-to provider for the telecoms industry with AT&T, Deutsche Telecom and Telefonica reported as customers, therefore this offers a vertical expansion opportunity.

Productivity Segment is Solid

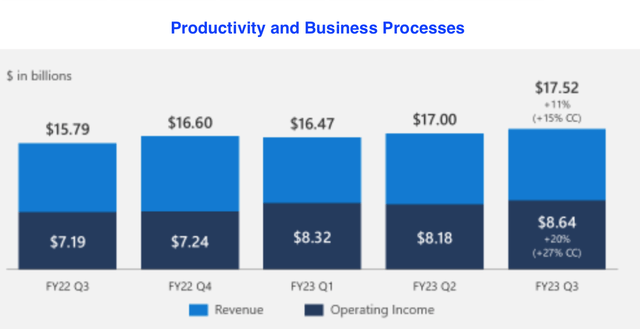

Microsoft’s productivity and business processes segment reported $17.52 billion in revenue which increased by 11% year over year or 15% on a constant currency basis for Q3,FY23. This was driven by solid Office 365 revenue growth which increased by 14% year over year or 18% on a constant currency basis. Given Office 365 contains many essential products (Excel, PowerPoint, Teams) that business is done on, I believe its retention will be solid, especially on the commercial side. However, for smaller organizations (less than $20 million in ARR) I have noticed an increased adoption of Google’s Office suite as it’s effectively free for anyone to get started, therefore this could disrupt Microsoft’s smaller company cohort.

Productivity Segment (Q3,FY23 data with author annotations)

I believe a continued slowdown of Microsoft’s core consumer office is also likely and just a 1% growth rate was reported in Q3,FY23. A positive is we are going through a cyclical downturn in the PC market and thus I believe the main impact is from the macroeconomic environment at this stage.

Teams also continue to expand its total addressable market with close to 60% of enterprise Teams purchasing a Teams Phone or Room setup. This has also been enhanced with AI thanks to new features such as Intelligent recap. Given the growth in hybrid working, I believe more companies will continue to adopt Teams and Teams rooms for its setup.

Microsoft has also continued to expand its Viva employee experience platform, which launched in 2021. This platform is great for aligning teams across goals, communications and also encourages learning via LinkedIn courses. This has also been enhanced with an AI copilot. I believe this platform will also continue to grow solid to the remote working environment.

LinkedIn still offers Huge Potential

LinkedIn is one of my favorite parts of Microsoft’s business as it has virtually no competition (name another business social network?) and is the category leader. I also believe this business is less prone to disruption when compared with personal-focused social media applications such as Facebook, Instagram, etc. I personally only started to use LinkedIn a couple of years back, but have found it valuable for business contacts as well as content consumption which is relevant to my industry. Microsoft’s data backs up my thesis with a revenue increase of 8% year over year and a session increase of 15% YoY with record engagement reported for Q3, FY23. I believe LinkedIn still has huge potential across recruiting (Talent Solutions) and has a strong position in the B2B sales and marketing cycle. In addition, the company reported record engagement with a 73% YoY in the Gen Z student cohort, which is a great sign for long-term growth.

Personal Computing Challenges

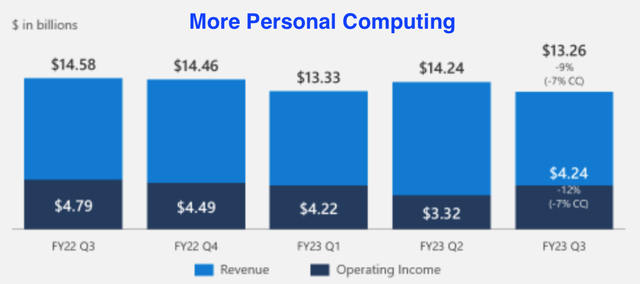

Microsoft’s “More Personal Computing” segment reported challenges with $13.26 billion in revenue, down 9% year over year. This was mainly driven by the aforementioned cyclical decline in the PC and gaming market, after a major boom in 2020. The good news is this is not specific to Microsoft and I believe the company still has strong relationships with OEMs. In addition, Microsoft’s Xbox reported a 3% year-over-year growth rate, which was an improvement over the negative 12% growth rate reported in Q2,FY23 and could indicate a possible turnaround in the gaming market. Its gaming subscription service surpassed $1 billion in revenue in Q3,FY23, and has over 500 million lifetime users across our first-party titles.

More Personal Computing (Q3,FY23)

Windows is still the most popular computing operating system in the world with a 74.14% share of the market as of January 2023. This is down from the 90% level reported in 2013 and the ~80% level reported in 2018. This was driven by MacOS which has doubled its market share over the past decade to 15.33% (as shown by the orange box). There is no doubt that many people prefer MacOS and Apple laptops (including myself). However, given the price differences in products and the range of OEM options with Windows (Dell, Lenovo, etc), then it seems unlikely that Apple will become the market leader. I believe this would be especially true given we are currently entering a “recessionary” environment and companies are thinking about cutting costs, as opposed to giving everyone more expensive MacBooks. New entrants such as Chrome OS for Chromebooks, are also not a major threat to Windows at this stage with a measly 2.35% market share. Alphabet or Google hasn’t really had a track record of major success with its hardware products (Google Glass etc) and thus I believe the company should stick to software.

Windows Market Share (Statista with author annotations)

Valuation and Forecasts

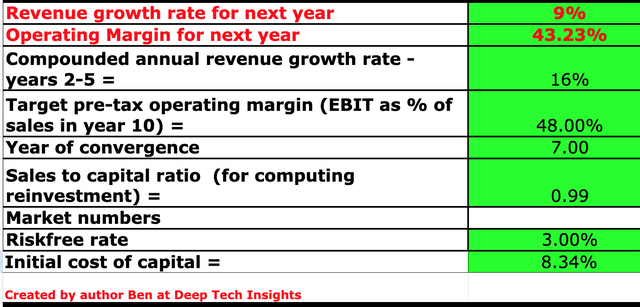

In order to value Microsoft I have plugged its latest financial data into my discounted cash flow model. I have forecast 9% revenue growth for “next year” or the next four quarters which is 2% higher than my prior forecast. I expect this to be driven by at least a 1% improvement from the 7% year-over-year growth rate reported in Q3,FY23. This should be driven by improved foreign exchange rate dynamics as the U.S dollar has continued to adjust down relative to most currencies. In addition, I expect at least a 1% boost from its Cloud AI as a service products, which is aligned with the CFO of Microsoft’s forecast for Q4,FY23 alone, which I have extrapolated out for the full year.

In years 2 to 5, I have forecast 16% revenue growth per year which is 1% higher than my prior forecast. I have increased this due to the incredible execution Microsoft has done in integrating AI into its products. For a large organization, the company is moving fast and not just talking about the potential. I expect its Cloud segment to continue to grow solid and benefit from a rebound in consumption spending as economic conditions improve. I also forecast a rebound in personal computing, gaming, and LinkedIn to continue its growth trajectory.

Microsoft stock valuation 1 (created by author Ben at Deep Tech Insights)

Microsoft reported an incredible 42.29% operating margin as of Q3,FY23 which I believe will be maintained over the next four quarters. When I capitalize Microsoft’s R&D expenses, this boosts that margin to 43.23% which is positive. Over the next 7 years, I have forecast a 48% operating margin. This may seem optimistic but assumes a return to the 44.66% operating margin reported in the quarter ending in September 2021, driven by a rebound in personal computing and gaming. In addition, I believe over 3.5% of extra margin can be captured due to improved economies of scale in its cloud business and crosselling related to AI over the long term.

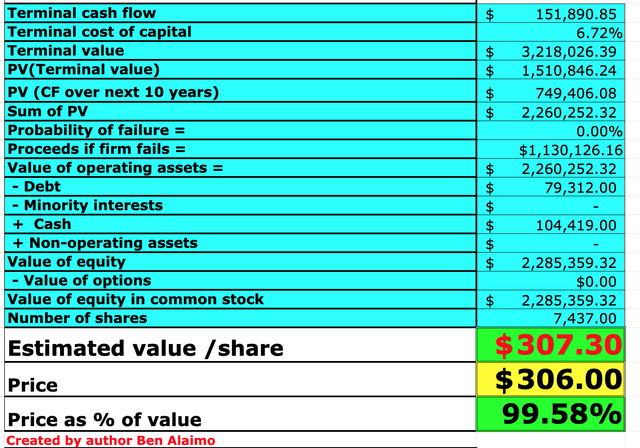

Microsoft has a fortress balance sheet to continue to invest with $104.4 billion in cash and short-term investments. In addition, the company does have total debt of a staggering $79.2 billion, but $41.97 billion is long-term debt which looks to be manageable.

Microsoft stock valuation 2 (Created by author Ben at Deep Tech Insights)

Given these factors I get a fair value of $307 per share, the stock is trading at ~$306 per share and thus is “fair value” at the time of writing.

It should be noted that in my “best case” scenario which assumes a 20% growth rate in years 2 to 5, (the same level achieved in Q2,FY22). Microsoft would be 20% undervalued. Given the largest company in the world, Apple’s market capitalization 2.68T is ~18% higher than Microsoft at 2.27T the time of writing, the company is primed to become the largest in the world. Of course this depends on how Apple’s business performs, but given the company reported declining growth of 5.48% in Q4,22, this estimate doesn’t seem impossible. I also personally see more new growth tailwinds (AI and the cloud) behind Microsoft, than Apple (legacy iPhone). Either way, this isn’t supposed to be a report about Apple (AAPL) and the companies aren’t competitors, but I just thought this would be an interesting forecast to make.

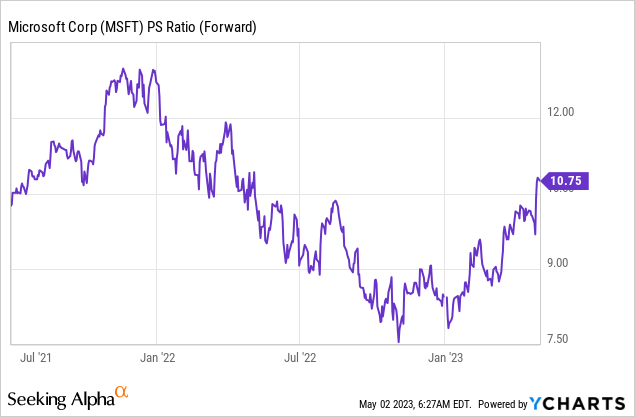

The stock also trades at a price-to-sales [P/S] ratio = 10.75 which is ~16% more expensive than its 5-year average.

Risks

AI Hype

I believe we are currently in a market where lots of “AI hype” is baked into Microsoft’s stock price. A lot of this is justified but the market can always take things too far as we saw in the “internet bubble” of the late 90s. The Internet did change the world, but that didn’t stop many companies from becoming egregiously overvalued. In the words of the legendary billionaire investor Howard Marks “success when investing doesn’t just come from buying great things but from buying things well”. In other words the stock price and its relation to value is a determining factor to success, unless you are using a momentum-based strategy.

Final Thoughts

Microsoft is in a strong market position both across its core operating system, cloud, and professional network businesses. I believe the company is gradually enhancing its ecosystem and building more pathways which should enable the business to benefit from cross-selling. The company is clearly the leader in AI, not just from a technology perspective (Azure supercomputer, Open AI) but from an executional perspective across its core products. The stock has rallied significantly but given it’s not egregiously overvalued at the time of writing I will still deem the stock to be a “Buy” or at least a hold for more prudent value investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.