Summary:

- Home Depot is the world’s largest home improvement retailer with a moat that should protect its earnings.

- They are also very shareholder friendly and one of the best capital allocators in North America.

- As such, their prospects are excellent and should reward patient, long-term investors with market-beating returns.

Justin Sullivan

Thesis

Home Depot (NYSE:HD) is a company with an excellent management team that really knows how to allocate capital efficiently. As a result, shareholders have been handsomely rewarded over the past few decades. And I expect Home Depot to beat the S&P Total Return over the next 10 years.

Furthermore, Home Depot offers the opportunity for strong outperformance if it can continue the strong business performance of the past few decades. Even 15%+ annual returns could be possible if the company performs very well. But even under conservative assumptions, they should outperform the index over the long term.

Analysis

As the world’s largest home improvement retailer, Home Depot has significant competitive advantages due to its economies of scale. They can buy volumes that almost all of their competitors cannot and therefore get a better price. I would also add that they have certain advantages because of their excellent supply chain management.

Author

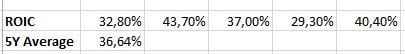

But I think the most important measure of a quality company is ROIC. And this is where Home Depot really excels. They have a 5-year average of 36.64% per year, which really speaks for itself. Home Depot is a master of capital allocation and I see no sign of that changing in the near future.

As Home Depot is a strong company with competitive advantages, I would argue that they will be able to protect their earnings in the future and therefore a valuation with historical figures minus a little discount makes sense for a 10-year outlook.

In terms of valuation, I will apply a multiple to earnings and also include dividends and share count reduction to arrive at my 10-year figure and annual return. To make this a little safer, I will use one case where I will use more conservative numbers and one case where I think I will use numbers that are likely to happen.

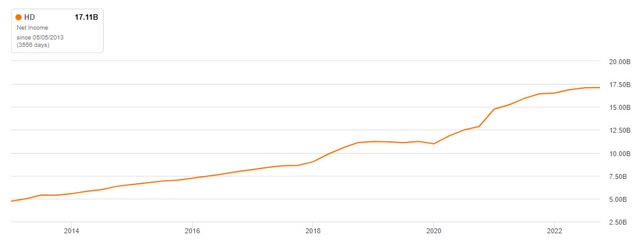

Net Income

To see how earnings might develop over the next 10 years, we can look at the historical development of net income over the last 10 years and over this period it has improved by ~13% per annum. To have a margin of safety, I would use a figure of 7% per annum over the next 10 years, which would give a multiple of 1.97x over that period.

For people who want to understand these figures, you can use this compound interest calculator. $1 at 7% per year becomes $1.97 in 10 years. I have rounded the results up or down to the nearest two decimal places in each case.

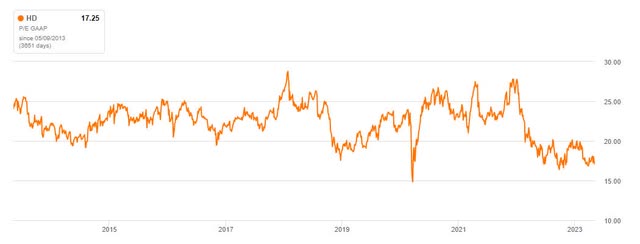

Multiple

At the moment, the P/E multiple is below the average of the last 10 years, but I believe that this period is not an ideal guide for the future, as higher interest rates could lead to much lower multiples over the next 10 years. So I will use a 0.8x multiple for the conservative approach, which would be a multiple contraction, and a 1x multiple for the normal case where the multiple will be the same in 10 years.

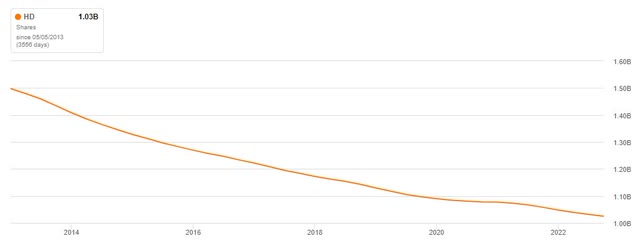

Shares Outstanding

Buying back shares at attractive multiples has been one of Home Depot’s success factors over the past few decades. Share cannibals with rising earnings and rising multiples have been among the best performers in the S&P 500. In the last earnings call, management also reiterated that after investing in the business and paying a dividend, share buybacks are intended to return cash to shareholders. And they also set up a new $15bn buyback program last year. So that will make the program relatively secure going forward.

The historical CAGR of shares outstanding is -3.88%, so I think 3% per year for the next 10 years is a good estimate. This would give a multiple of 1.34x over 10 years.

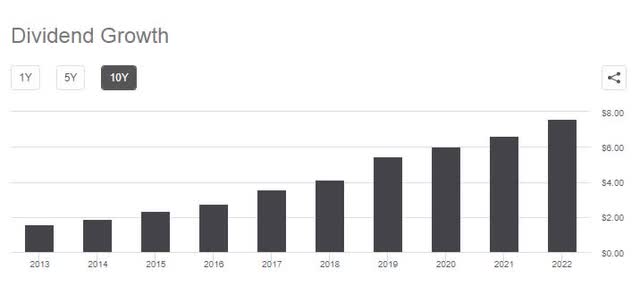

Dividends

The dividend yield is currently 2.88% and the 5-year growth rate is 16.06%. So it is safe to assume that Home Depot is a relatively safe dividend payer that has a high probability of increasing the dividend over the next 10 years. The last dividend was the 144th dividend in a row, which also reinforces my belief that they will continue to pay a dividend, barring some unforeseen black swan event.

So I would use two assumptions and the first is that the dividend will add 2.5% per year which is a 1.28x multiple and for the other case that the dividend will add 3% per year which is a 1.34x multiple.

Valuation

The first assumption, which is the more conservative one, is for:

- Earnings: 1.97

- Multiple: 0.8

- Shares Outstanding: 1.34

- Dividends: 1.28

1.97 x 0.8 x 1.34 x 1.28 = 2.70x over 10 years, or 10.44% per year.

In the more normal scenario we have the following figures:

- Earnings: 1.97

- Multiple: 1

- Shares Outstanding: 1.34

- Dividends: 1.34

1.97 x 1 x 1.34 x 1.34 = 3.54x over 10 years, or 13.48% per year.

So if we assume that the total return for the S&P 500 will be around 10% a year, which is the historical average, we can see that even the conservative assumption will beat that return. And it could be argued that Home Depot’s earnings will exceed 7% annually, so the outperformance could be even greater. And dividends and share buybacks could add even more to returns, so returns in excess of 15% per annum could be possible. On the other hand, I am relatively confident that the multiple will not expand in the future.

Conclusion

If Home Depot continues to allocate capital as efficiently as it has in the past and earnings continue to grow, I think there is a good chance that the stock will outperform the index over the long term. As always, persistent investors will be rewarded for investing in quality companies with competitive advantages, and Home Depot is one of them.

Increased share buybacks or higher dividend growth could also surprise investors positively, as they would add to potential future returns. So higher earnings and/or higher dividends/buybacks could even push the total return over that period to 15%+.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in HD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.