Summary:

- Home Depot has benefitted significantly from a strong housing market and pent-up demand for home improvement, but there are growing signs of slowdown in the housing market.

- There were several warning signs in the company’s most recent earnings report that demand for home improvement and do-it-yourself work is slowing, recent demand was at unsustainable levels.

- The company’s earnings are likely peaking, the stock looks overvalued using several metrics.

jetcityimage

Few ideas in life are black and white. While some notions trend in specific direction, most concepts have nuance as well. One of the most talked about ideas during the Pandemic was pent-up demand, or the concept that once the Pandemic ended there would be activity that would make-up for how slow parts of the economy grew during 2020 and the immediate aftermath. Many industries, such as the housing market, saw historically high levels of demand as the Covid restrictions were eased in 2021 and 2022. Still, while the buying and consumption in some industries reached historically high levels after 2021, we are also seeing that the demand seen coming out of Covid was also unsustainable in many cases.

One company that benefitted significantly from pent-up demand was The Home Depot (NYSE:HD). With new house construction starts reaching high levels, historically high numbers of do-it-yourself projects, and a strong overall housing market, the operating environment has been very favorable for Home Depot since 2021.

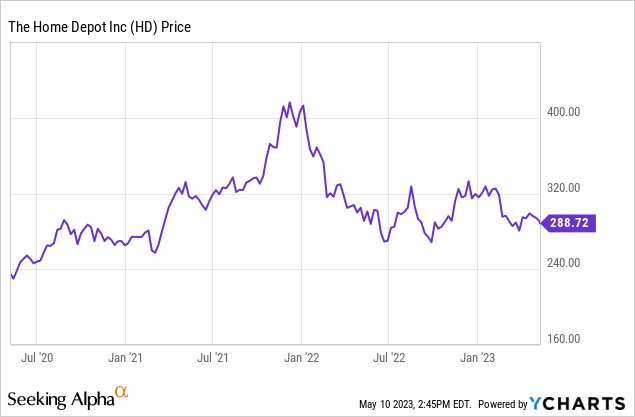

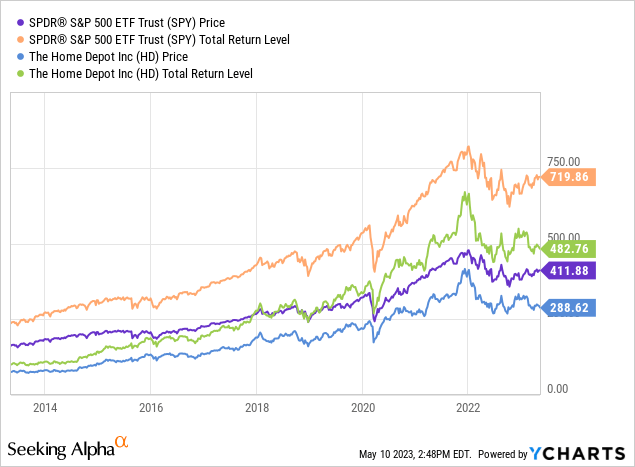

Still, while Home Depot performed very well in 2021, but the stock is only up 22% over the last 3 years. The S&P 500 is up 40.95% percent during the same time period.

Home Depot had consistently and significantly outperformed the S&P 500 and other broader indexes over the last decade.

Home Depot is up 275% over the last decade, while the S&P 500 is up 144.48% during this same timeframe. Still, this leading retailer’s stock has gone nowhere for nearly 2 years now.

Today, I rate Home Depot a strong sell. The company’s strong earnings coming out of the pandemic created unrealistic expectations, and the stock is likely pricing in unrealistic growth expectations. Home Depot trades at 18.42x expected forward earnings even though analysts are only forecasting this leading retailer to grow profits at 5-7% over the next 5 years. There are also multiple signs that the housing market continues to slow, and the company’s recent earnings reports show some concerning signs that demand numbers for DIY projects are weakening. These earnings estimates are likely to be revised down in coming months.

Home Depot reported record earnings for the fiscal years of 2021 and 2022. Management stated the company’s net earnings for fiscal year 2022 were $17.1 billion, and $16.69 a share. This compared to fiscal year 2021 net earnings of $16.4 billion and $15.53 a share. The company saw 7.5% growth in earnings per share on a year-to-year basis. However, Home Depot’s revenue growth in 2022 was unimpressive, and the earnings per share numbers were misleading because the company bought back more just over $9 billion in shares in 2022 alone. The company is expected to be more conservative with share buybacks moving forward.

Home Depot’s recent earning reports also showed some key weakness in important parts of the company’s core home improvement business, and management has stated that net margins should decline this year as the company will be payout out an additional $1 billion wages in 2023. Home Depot recently saw weakness in big ticket sales of over $1,000 in the laundry, roofing, and soft flooring areas. The company also saw sales drop .3% for the quarter on a year-to-year basis, and management is guiding toward flat sales comps in 2023, specifically citing a moderation in demand for home improvement. The cost to finance housing construction has also increased with rates going up and fewer people are working remotely from their homes. These factors should lower demand for home improvement and DIY work as well.

There is also increasing evidence of a slowdown in the housing and construction markets, as well as the broader economy. The National Association of Homebuilders is expecting housing prices to fall by as much as 15% this year primarily because of how rising rates have priced most families and individuals out of the market. The NAHB discussed how even a 3% rise in interest rates can mean increased monthly payments of $700. New construction of homes is expected to hit a multi-year low in the middle of this year as well. The NAHB also stated that just 42% of homes are affordable to most families and individuals, and any reading below 50 signals a weak housing market.

The consensus amongst economists and the NAHB is also for a 2 consecutive quarter of negative growth in 2023, meaning a recession is expected. Several major companies, including Disney (DIS) and Alphabet, have recently announced significant layoffs, and manufacturing and consumer confidence numbers also show the economy is likely to continue to slow in the coming months. The Fed has also remained committed to raising interest rates, with Powel recently reiterating that his goal remains 2% inflation.

This is why Home Depot’s shares look significantly overvalued at 18.42x forecasted forward earnings, 14.98x projected forward cash flow, and 13.42x likely forward EBITDA. The sector median valuation is 14.51x likely forward earnings, 8.96x projected forward cash flow, and 9.12x forecasted forward EBITDA. Analysts are only expecting this leading retailer to grow earnings at 5-7% a year over the next 5 years, and there are also multiple signs that those earnings projections will likely be unrealistic as the housing market and the broader economy both signs of significant slowing. While Home Depot trades at discount to the company’s 5-year average valuation of 21.23x forward earnings, this leading retailer has reported record profits both of the last 2 years, and management is expected to be more conservative buying back shares moving forward.

Home Depot benefitted significantly from pent-up demand over the last 3 years, but the stock has still gone nowhere in the last 2 years since recent earnings reports have created what are likely unrealistic expectations. Even though this has reported record profits for 2 straight years, a slowing housing market and likely recession should put further pressure on this leading retailer’s stock as well. While Home Depot has been one of the best performing stocks in the market for some time, this company’s best days are likely in the past.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.