Summary:

- The arguments that the watchdog uses regarding the cloud gaming market look unsupported, which means it would be easier to appeal this ruling that blocks the Microsoft-Activision deal.

- The deal is far from being dead though.

- Microsoft would benefit greatly from the deal with Activision as it seeks to take a larger share of the pie in gaming.

- Activision is facing falling MAU and operating margin, while the valuation is excessive. The deal fail would likely collapse the stock.

FeelPic/iStock via Getty Images

Main thesis

UK’s Competition and Markets Authority (CMA) said that it would prevent Microsoft (NASDAQ:MSFT) from acquiring Activision Blizzard (NASDAQ:ATVI) for $69 billion dollars. Following the announcement, ATVI stock fell 10%. Many analysts, including Microsoft’s, were expecting the deal to be approved and therefore were surprised by the news.

The problem with CMA is it’s too hard to challenge their decision as the regulator gets the final word either way. Thus, the deal is on the verge of collapse, and the plans of the companies to complete the process by June 30 are simply unrealistic now. At the same time, I think the arguments that UK’s watchdog uses can easily be challenged

What happened & Why no one expected it

In March, the CMA released a document where they said it no longer expected the deal to result in SLC (Substantial Lessening of Competition) in the console gaming services market. Thus, they almost completely abandoned the theses that were presented in February. Many expected it to be approved.

We have, therefore, provisionally concluded that the Merger may not be expected to result in an SLC in the market for the supply of console gaming services in the UK.

CMA

However, just a month later, they publish this. A 418-page report full of analysis of the potential merger based on which, it was concluded that the merger would result in SLC of the cloud gaming market.

There are many interesting points made in this report that I would like to discuss.

Arguments look unfounded, Microsoft will have a clear advantage in legal battles

We consider, however, that the popularity of Activision’s games on consoles and gaming PCs is indicative of its importance for cloud gaming services now and in the near future. On consoles, we found that CoD is an important game and that alternatives with similar levels of gametime, revenue, and engagement are limited. On PC, the evidence indicates that CoD and WoW are among the most played games in the UK, and Overwatch is also reasonably popular.

CMA’s report (page 284)

The ‘no alternative’ position for CoD and WoW statement looks strange as they basically acknowledged that there is nothing special about these games in the console market in their previous report. So why will those games suddenly become special in the cloud?

Based on the available evidence, we consider that Activision’s games — particularly CoD, WoW, and to a lesser extent Overwatch — would be an important input to cloud gaming services absent the Merger.

CMA’s report (page 283)

Here Activision’s position is actually what matters. The company said they have taken a clear stance not to provide their games to cloud streaming services. So who is going to make this input if the studio doesn’t want its games in the cloud? There is no evidence that ActiBlizz will change its mind anytime soon. It turns out that the watchdog itself put at risk the presence of CoD and WoW in the cloud streaming market because Microsoft has already entered into 10-year agreements with Nvidia (NVDA), Boosteroid, Ubitus and Nware.

For the reasons set out above, we do not consider that the NVIDIA, Boosteroid or Ubitus agreements have any material impact on the overall assessment of the Merged Entity’s ability to foreclose cloud gaming service rivals.

CMA’s report (page 285)

What other behavioral remedies are possible in this situation? This market hasn’t been attractive for new big players. This is well illustrated by the situation with Google Stadia, which had to be closed since the idea did not find a response from consumers. Microsoft has an agreement with almost all the major players in this market, but the CMA does not believe that this is enough.

The estimates for the UK show that Microsoft’s share [in the cloud gaming market] increased from [30- 40]% in 2021 to [60-70]% in 2022. In 2022 it had over [REDACTED] as many average MAUs as the next biggest service, PlayStation Cloud Gaming.

…

Whilst it is not possible to determine how many users xCloud would have as a standalone service, the evidence described above indicates that cloud gaming attracts users to XGPU and that a significant proportion of users would be willing to pay extra for it

CMA’s report (page 217)

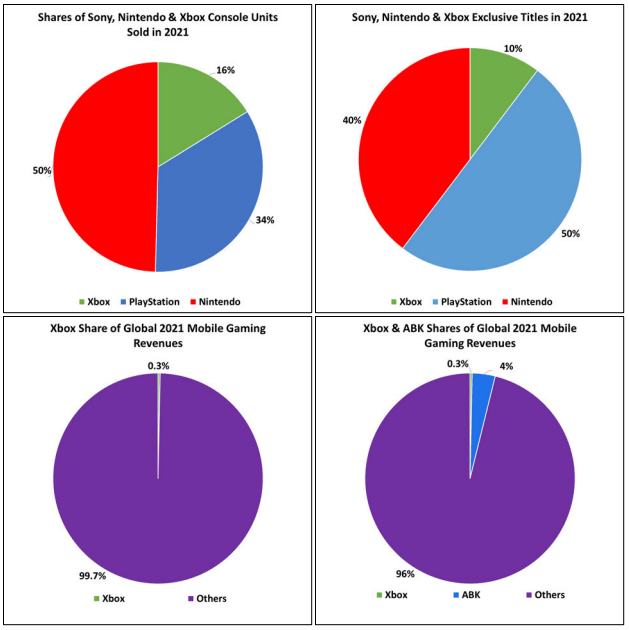

Well, Xbox Gaming Cloud (xCloud) is part of the Xbox Game Pass Ultimate (XGPU) subscription. The regulator considered that it is the factor of having a cloud service in the subscription that makes users pay for it. This cannot be substantiated as it is impossible to determine how many users are using xCloud. XGPU is mostly popular due to the price factor (because it includes Xbox Game Pass and PC Game Pass at the same time), EA Play is added at no extra cost, a great mix of games, and huge discounts. xCloud is more of a nice addition. But apparently, CMA just included all XGPU users without disassembly. That is, Microsoft doesn’t have such a strong position (60-70%) in this market.

But there are other claims that are not related to the streaming services market.

absent the Merger, Activision would seek to maximise the value that it can derive from these games, which would have involved considering making non-Windows PC versions of its games.

CMA’s report (page 20)

CoD games can’t work on Linux though and why would they even think of moving their products outside of the Windows system? Linux accounts for 2.91% of global desktop PCs, while computers with other systems (macOS & Chrome OS) are just not designed for gaming. What are the prerequisites for changing this situation? That’s unclear.

At the same time, other very important points are being ignored.

as for Microsoft’s plans to enter the mobile gaming market, we found that these plans were far from certain, especially in current circumstances where the largest mobile OS—Google’s Android and Apple’s iOS—either currently prohibit rival mobile gaming app stores or impose strict limits on their ability to monetise content.

CMA’s report (page 284)

Well, Apple and Google will eventually allow 3rd party app stores in the European region because of strict regional requirements. Similar requirements will likely spread around the world. Thus, the mobile market can get a very strong player to challenge this oligopoly. Microsoft will be more interested in building its own mobile platform than anyone else. Another big tech company in the market will certainly tip the scales: Apple (AAPL) and Google (GOOG)(GOOGL) can make all the game studios kowtow, but will the second largest corporation be fine with it? And yes, this market is very big, way bigger than cloud gaming will ever get.

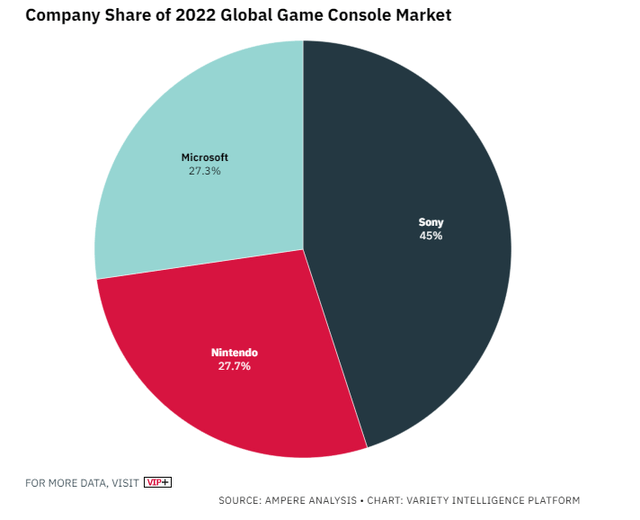

Also, the CMA should recognize not only that merger will not lead to an increase in SLC in the console market, but will also contribute to more fierce competition. There is nothing so special about Activision games, we’ve been there already. However, it would allow Sony’s biggest competitor to challenge its market leadership.

I believe such a decision should be easy to challenge at the legislative level.

Is the deal dead though?

Of course not. Now Microsoft is set to file an appellation to the CAT (Competition Appeal Tribunal), which, according to the UK’s Enterprise Act can only make the CMA review the case one more time while changing some of the processes. Now the European Commission’s decision is also important since its approval (with or without behavioral remedies) would leave the FTC and the CMA practically alone. Microsoft will be able to use the decision of this strong regulator as an evidence base for the wrong actions of watchdogs from the US and the UK.

The deal, if regulators would give the green light, is likely to be closed only in 2024/2025 given how long such cases can take in the UK.

What does it mean for Microsoft?

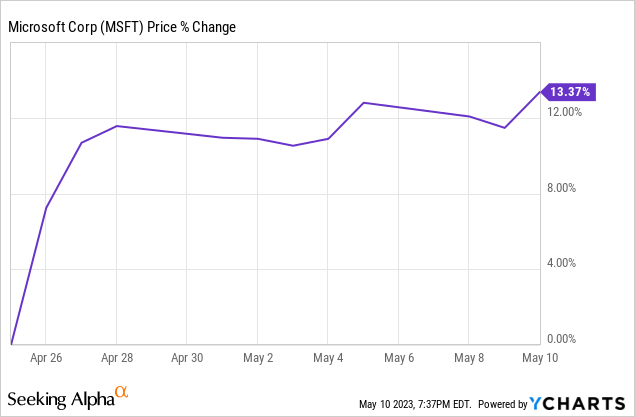

It may seem that investors appreciated the decision of the British regulator, as MSFT shares have risen by 13% since the publication of the report. However, in my view, this was mainly due to a strong quarterly report published by the corporation on the same day.

I think this is a very good deal for Microsoft, and it’s important for investors to be reminded of that. For $69 billion Microsoft would get:

- Nearly 400 million monthly active players around the world

- Easy access to a $100 billion mobile gaming market with at least $2.6 billion in revenue

- Call of Duty and other games on Xbox Game Pass, which will further increase the popularity of games, as well as increase the attractiveness of Xbox over PlayStation, which will help to grow market share faster and more aggressively

All in all, ABK, as part of the gaming division of the corporation, will allow not only to compete on equal terms with the main competitor in the console market but also to work on a scale and occupy every niche in the gaming market as a whole. The collapse of the deal means that Microsoft will likely remain in a weak position in the gaming market. Xbox only accounted for 16% of console units sold in 2021 and only for 10% of exclusive titles. Essentially, the CMA decision means that Microsoft will be mired in legal battles for at least another year.

Microsoft

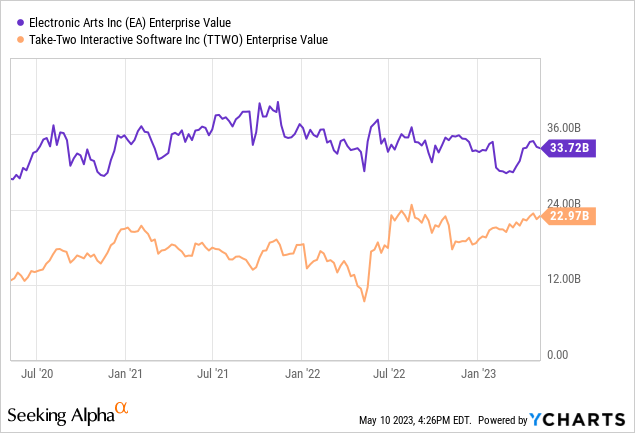

At the same time, Microsoft would still walk away with approximately $64 billion in cash (initial offer minus breakup fee) if the deal gets blocked. It would be possible to buy both the 2nd and the 3rd Take-Two Interactive (TTWO) and Electronic Arts (EA), for example.

However, exactly the same regulatory arguments can be applied to these two companies, so such a deal would also not be approved. So in essence, if the regulators win in this case, then the path to expanding the Microsoft gaming segment through M&A will be closed.

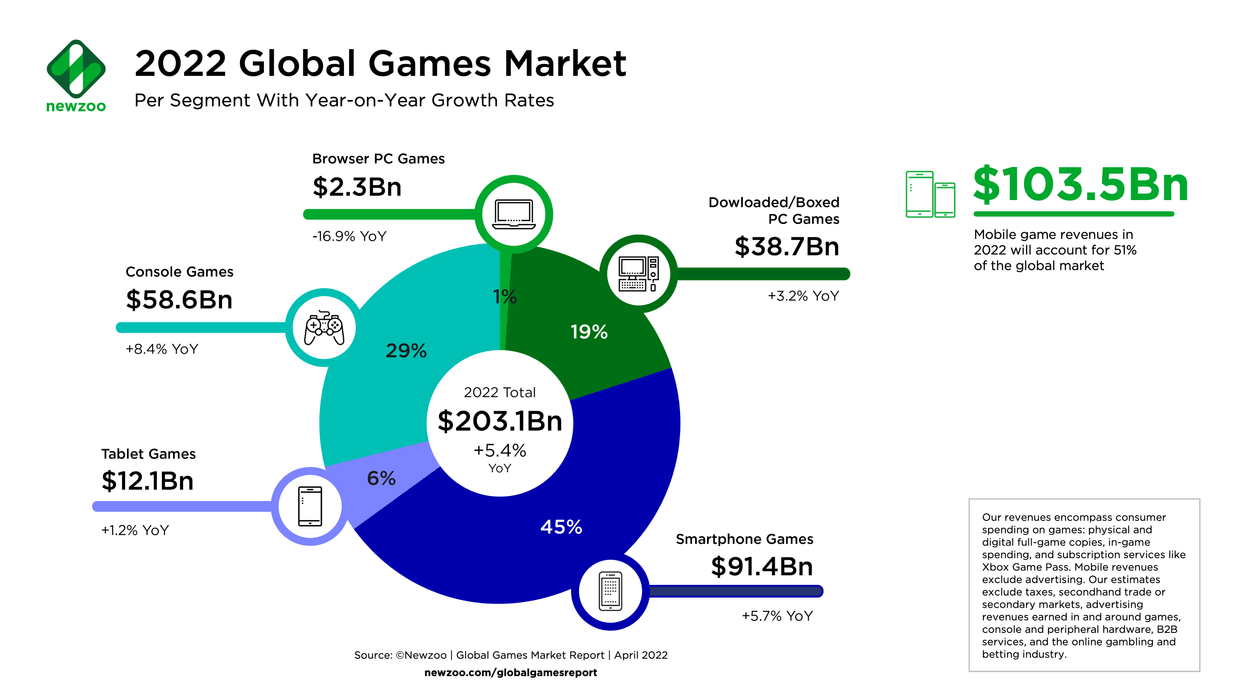

At the same time, the gaming segment is really important for Microsoft. One thing the corporation lacks is the user experience among everyday users. Activision alone has around 100 million active users. A large consumer base will be a great opportunity to integrate ads into the gameplay. It is especially important when the company tries to go to the metaverse. The gaming market was valued at $200 billion in 2022. Microsoft would only occupy 2.5% if the deal closes.

Newzoo

At the same time, if Microsoft would be able to at least catch up with the PlayStation share, it would mean 32% revenue increase in $58.6 billion console market alone.

What does it mean for Activision?

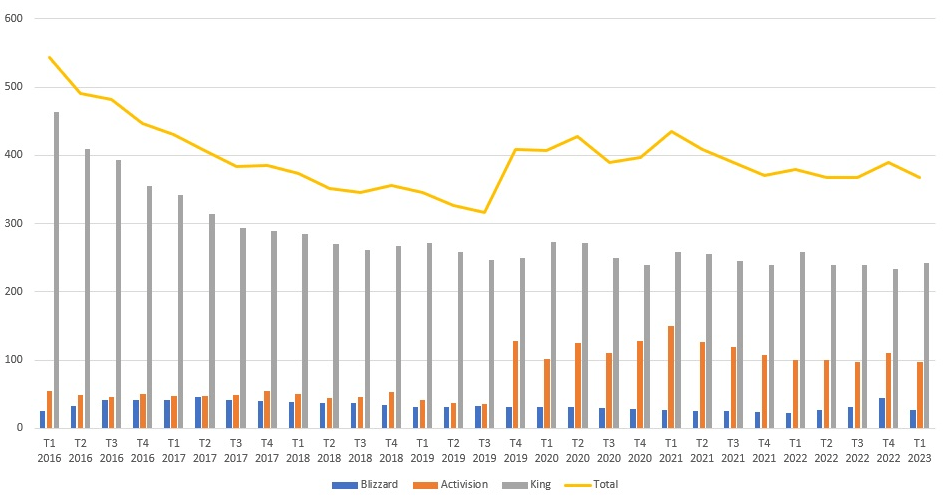

The deal itself is also incredibly important for Activision, as it’s an opportunity to start over with a clean slate under stronger leadership, as a scandal-driven reorganization will be difficult. The CMA decision puts this all at huge risk. At the same time, holding’s MAU metric is almost at pre-covid levels as the consumer cuts expenses on entertainment while the competition is heating up.

noob-club.ru

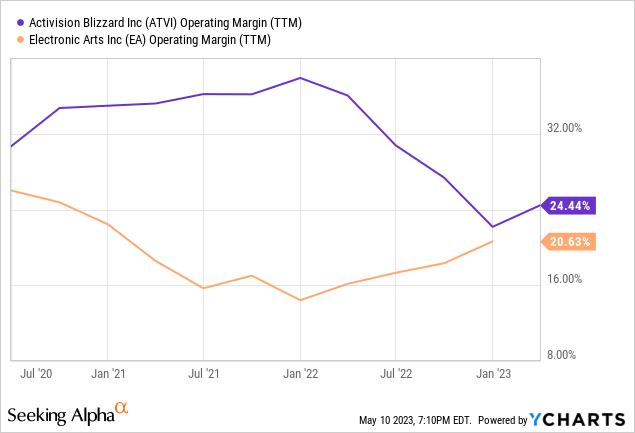

At the same time, operating margin is falling short. There is currently no incentive for management to invest in development due to a pending deal. However, if regulators still block it, then Activision will have to rethink its own business model. It is unlikely that the company will be able to stop the decline in the number of users during the recession.

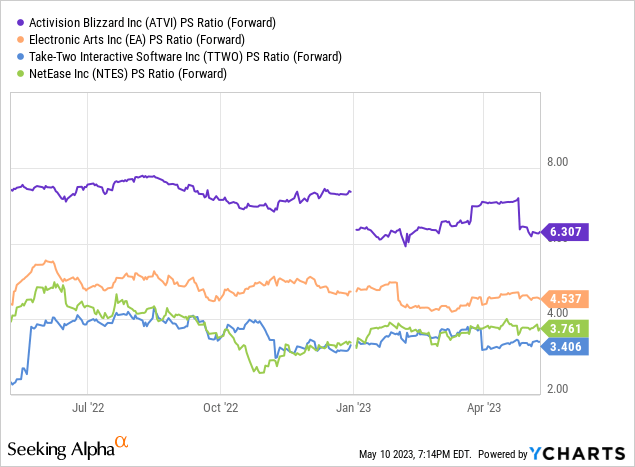

The company’s valuation is excessively high due to the premium that Microsoft is willing to pay. If the merger collapses, I think Activision’s forward P/S should approximate that of its competitors’, which is very far from current levels.

After the deadline of FY2023 (which ends in June), Activision shareholders will have a right to abandon the deal (not likely), increase the breakup fee and the value of the merger. I think it is possible to negotiate at least $5 billion in breakup fee. That would be great news for investors as the company will have $18 billion in cash on hand that it can use to buy back shares, which can help ATVI stock to hold somewhere at $60 level.

The problem is ATVI is not an attractive Risk/Reward like it used to be since not only did the risk part rise massively, but the likely closing time went far away from summer 2023.

Conclusion

The CMA dramatically decreased the chances of a successful closing of the deal. Activision Blizzard games look important for Microsoft to get a stronger foothold in the gaming market in the long run. At the same time, Activision is experiencing short-term problems that, in my opinion, will only exacerbate the fall if Microsoft backs out of the deal.

Due to a spark in uncertainty about the fate of the deal, ATVI and Microsoft are both Holds.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.